- Ethereum recently broke the $3,000 price level.

- Over 2.8 million addresses purchased ETH at the current price level, making this a key level.

While Bitcoin[BTC] made headlines with its all-time high, Ethereum[ETH]often called the ‘digital silver’, also made a remarkable step.

The second-largest cryptocurrency by market capitalization broke above the $3,000 mark, a resistance level that has remained strong for months.

This breakout coincided with record-breaking positive flows in Ethereum’s spot ETF, marking a new phase of bullish momentum.

Can Ethereum sustain this rally as it enters new territory?

Record influx of spot ETFs fuels Ethereum’s breakout

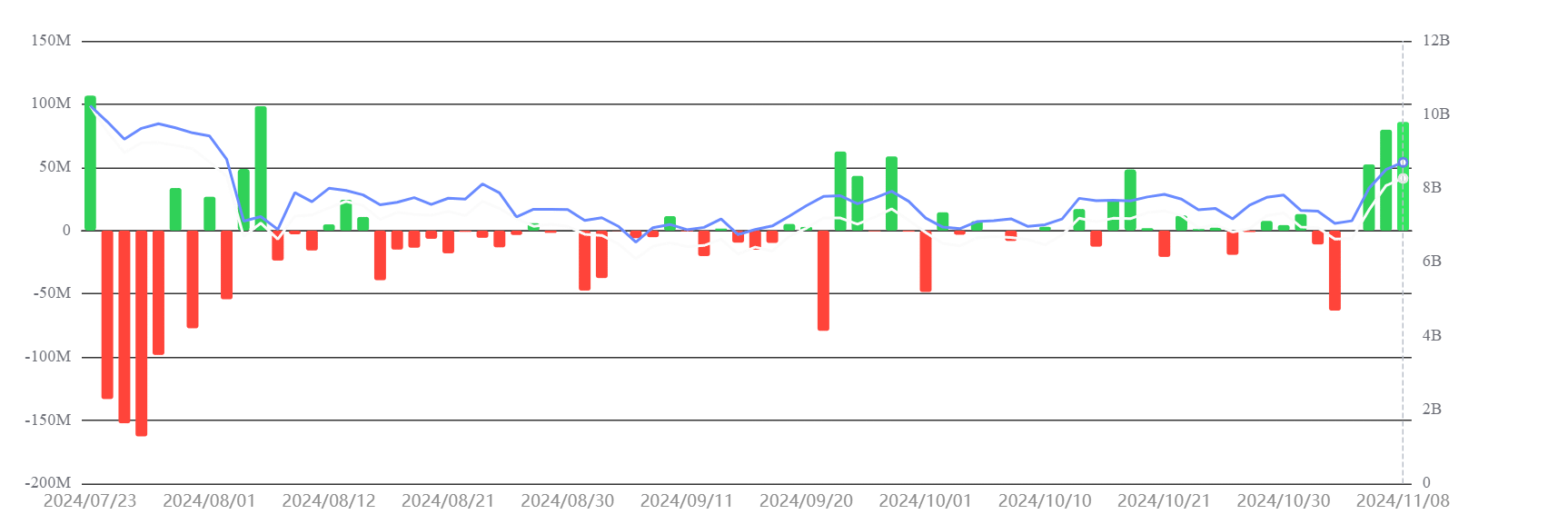

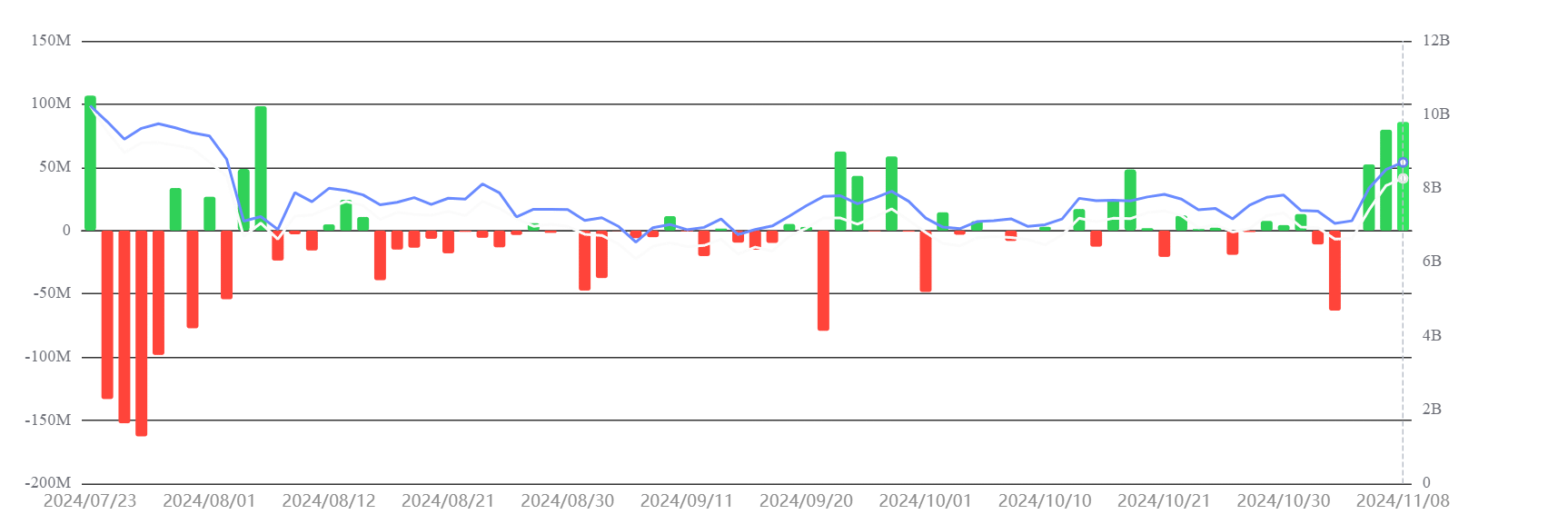

Ethereum’s ETF flow analysis over the past week revealed net inflows of $154.66 million. This set a new high for weekly positive flows.

Data from SosoValue showed that this is the second consecutive week of net inflows into Ethereum – a historic milestone for the ETF.

Source: SosoValue

The largest weekly net flow for the Ethereum ETF occurred during launch week, with negative flows of $341.35 million. Now the trend has definitively shifted into positive territory, with successive inflows supporting ETH’s price appreciation.

This surge in institutional support has pushed ETH past the $3,000 mark, reinforcing its upward momentum.

Ethereum moves to secure its position above $3k

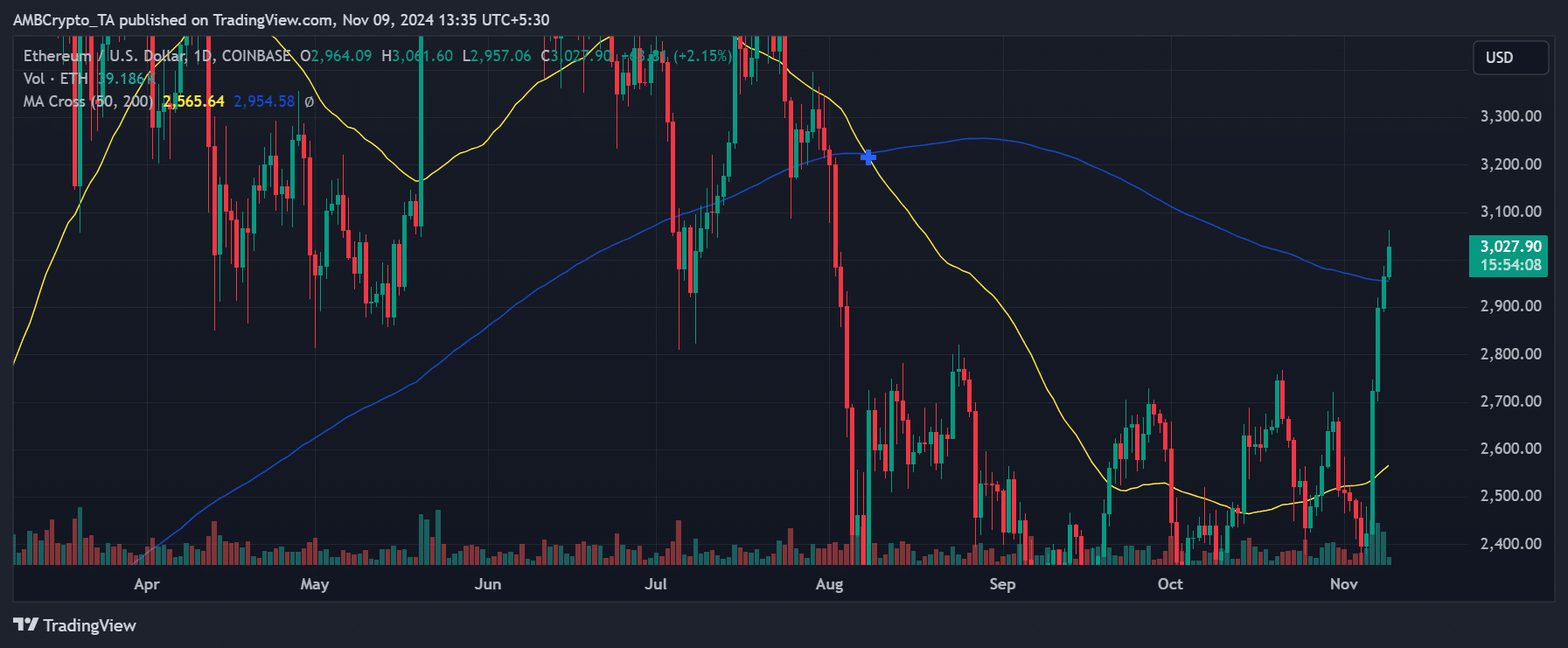

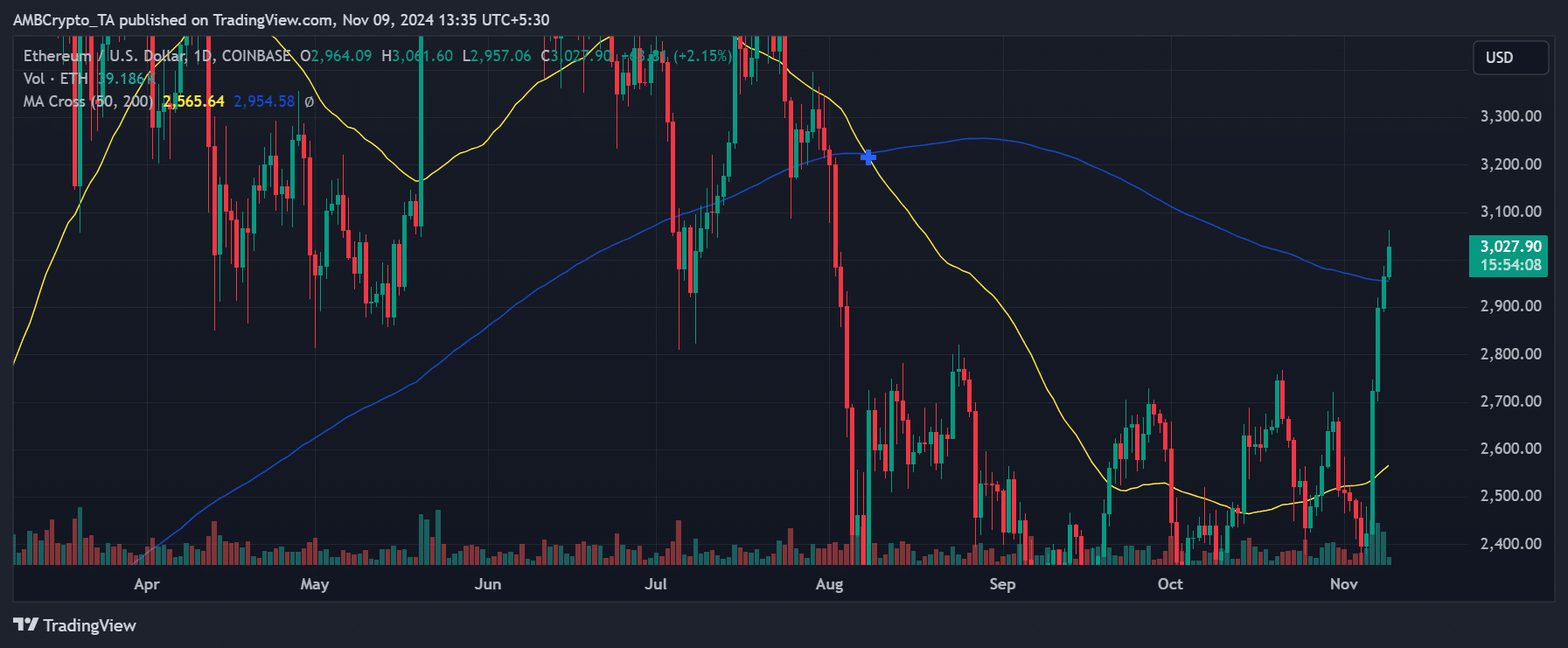

At the time of writing, Ethereum rose to $3,027.90 and experienced a strong bullish breakout. It has comfortably exceeded both its 50-day and 200-day moving averages (MA).

This move marked a significant rally as ETH surpassed the psychological resistance at $3,000. This indicates momentum indicating investor confidence in the asset.

Source: TradingView

The 50-day MA was positioned at $2,565.64 and the 200-day MA at $2,954.58, both serving as support levels for the current bullish run. Volume also increased, underscoring the strong purchasing interest.

Given this trend, ETH could target higher levels if it continues this bullish momentum, with the next resistance zones potentially around $3,200 or higher.

A pullback to test support at the 200-day MA could also be likely, which could be a potential entry point for traders keeping a close eye on this trend.

Ethereum’s break through the $3,000 resistance level is a major achievement, supported by record ETF inflows and strong technical indicators.

If this momentum continues, ETH could continue to rise, with $3,000 establishing itself as a new support level as the end of the year approaches.

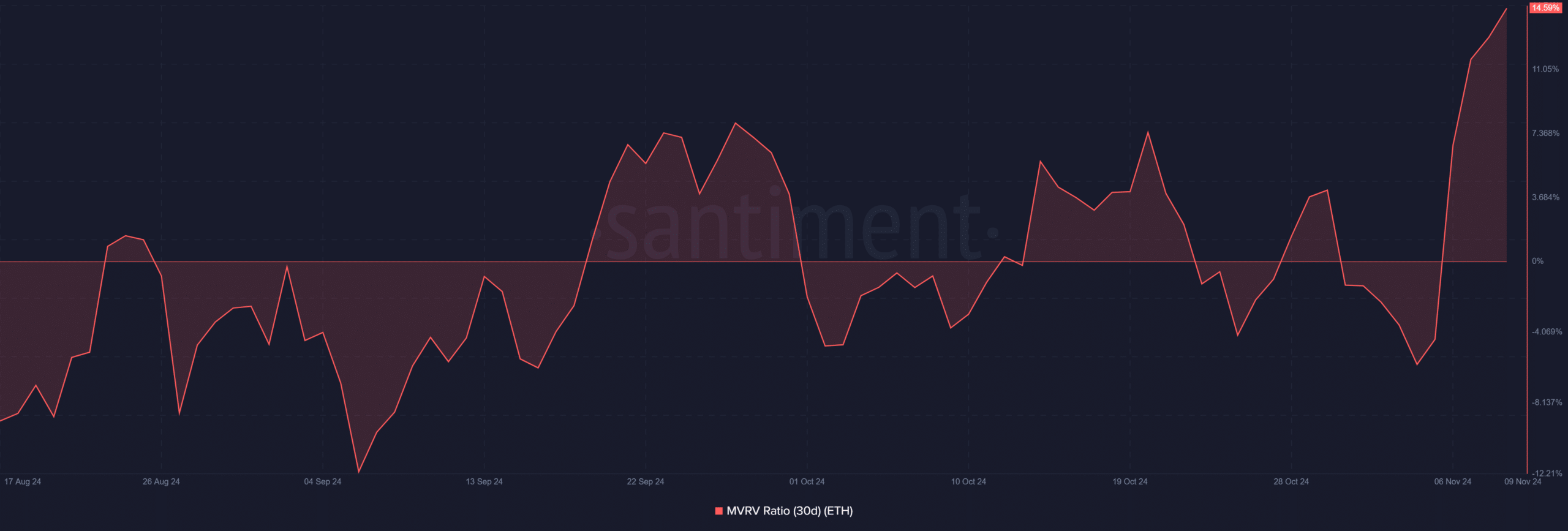

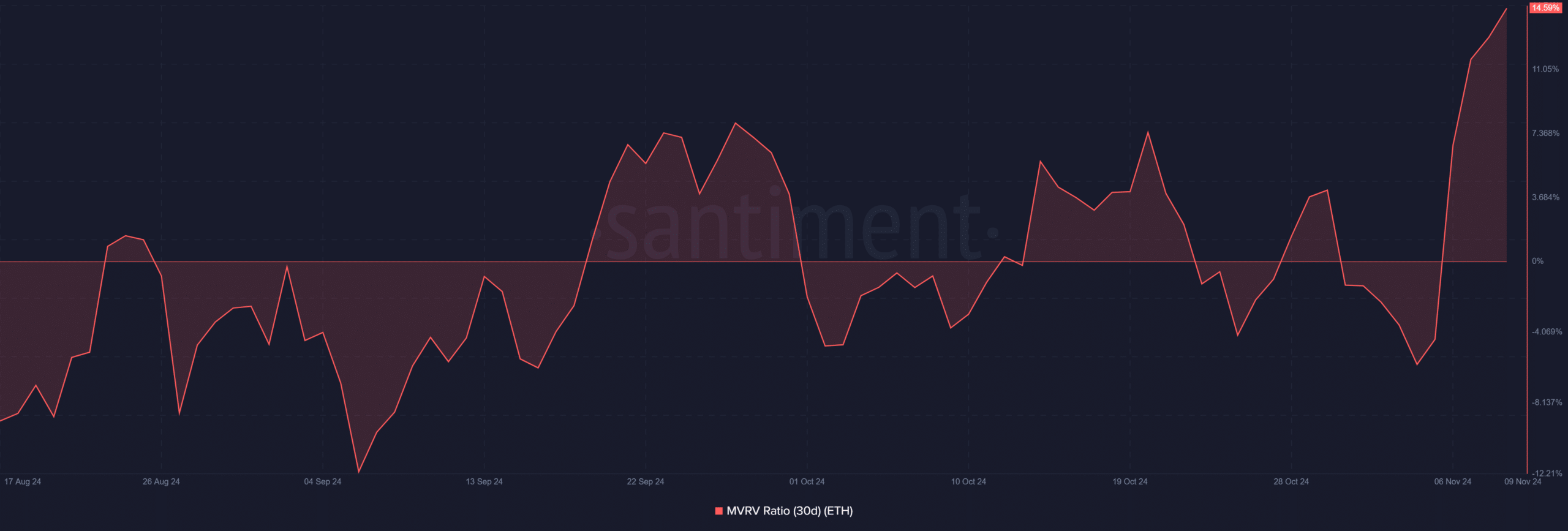

The MVRV ratio shows increasing profitability among holders

The 30-day market value to realized value (MVRV) ratio for Ethereum indicated that many holders are making profits as ETH trades above $3,000.

A rising MVRV ratio suggested that profit-taking could occur soon, which could trigger selling pressure.

At the time of writing, the MVRV was almost 15.6%, the highest since May.

Source: Santiment

Additionally, IntoTheBlock analysis found that 2.86 million addresses purchased ETH around the current price. This makes the current level very important, as a rise above it could cause an ATH.

– Is your portfolio green? Check out the Ethereum profit calculator

If the MVRV ratio continues to rise, more holders will find themselves in profitable positions and the market may undergo natural corrections.

With increasing institutional interest, Ethereum’s new support level could approach the $3,000 mark, reducing the impact of minor sell-offs.