The past few weeks have been a rollercoaster ride for Ethereum. Supported by declining Bitcoin dominance and an influx of traders looking for greener pastures, Ethereum’s price rose to critical resistance levels around $2,500.

Yet there is a palpable fear in the air, fueled by questions about Ethereum’s long-term scalability and the increasing chorus of bearish whispers. Can the second-largest cryptocurrency walk this tightrope and reclaim its DeFi crown, or will it fall from grace?

Ethereum Rises: Growth, Innovations and Challenges

Beneath the surface of the rising price charts lies a complex story of intertwined strengths and weaknesses. Ethereum’s impressive 87% year-over-year increase in Ethereum’s market cap, which catapults the market cap from $140 billion to a hefty $267 billion, paints a picture of robust growth.

The Merge upgrade, a milestone that streamlines Ethereum’s blockchain, and the fast-growing DeFi ecosystem buzzing with innovative applications are major contributors to this rise.

However, beneath this facade lies a crucial bottleneck: Ethereum’s Layer 1 scalability limitations. The network’s notoriously high transaction fees and slow throughput have become a thorn in the side of DeFi’s expansion, frustrating both users and developers longing for a smoother experience.

At the time of writing, on December 26, The price of Ethereum fluctuates around $2,233, data from Coingecko makes the daily and weekly charts turn red with a dip of about 1.5%. This recent descent adds even more intrigue to the complex dance Ethereum is performing near the critical $2,500 resistance level.

This delicate dance between bullish aspiration and bearish pressure underlines the fragile balance in the market. On the one hand, optimism surrounding Ethereum’s future potential continues to attract traders.

On the other hand, the specter of high transaction costs and scalability issues, along with rumors of a potential bear market, is keeping selling pressure simmering just below the surface.

Ethereum at $2,300: Battle of Bulls, Threats of Bears

For Ethereum bulls, the $2,300 level is a crucial battleground. If they can gather enough strength on the buy side to sustain a climb above this level, it could pave the way for a rise towards the coveted $2,500 resistance level. This breakthrough would be a major psychological victory, injecting new confidence into the market and possibly ushering in a new uptrend phase.

However, the bears are not after the count. Their aim is to break the $2,200 support level, which would tighten their hold and potentially trigger a more substantial decline. Should this scenario play out, the $2,000 barrier could come into play, with further losses possible if selling pressure remains unchecked.

Adding to the intrigue is the exchange offer factor. A recent surge in Ethereum tokens on exchanges indicates that ETH is more readily available to sellers, potentially amplifying downward pressure. This highlights the delicate balance between market sentiment and technical factors in determining Ethereum’s future trajectory.

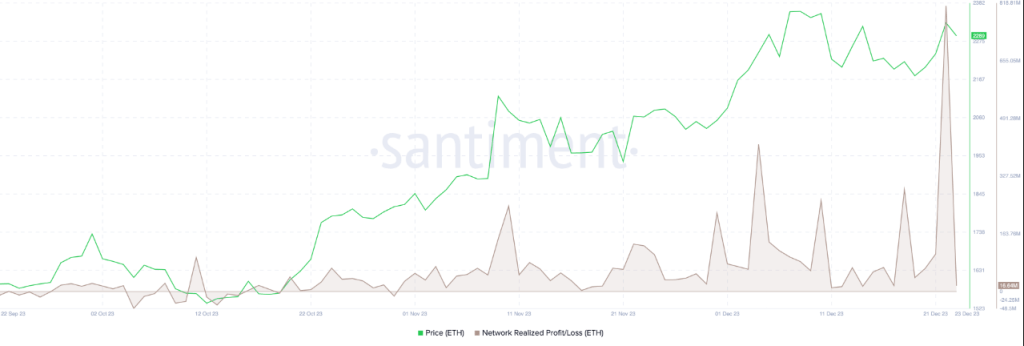

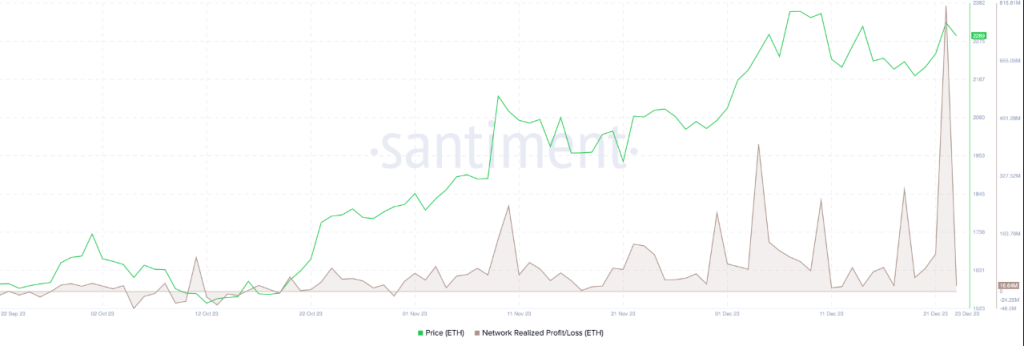

Meanwhile, ETH traders’ profit-taking is clearly visible in the Network realized profit/loss between October 31 and December 23. A significant amount of profit taking could cause the price of ETH to drop.

Ethereum’s Critical Crossroads Ahead

Looking ahead, Ethereum’s path depends on its ability to navigate this complex landscape. Addressing the scalability issues through Layer 2 solutions and potential future upgrades will be critical to maintaining and expanding DeFi dominance.

It is also paramount to rekindle developer and user trust by reducing transaction costs and improving network throughput. Only by addressing these internal challenges and adapting to the ever-evolving crypto sphere can Ethereum truly regain its throne as king of DeFi.

The coming weeks will likely be crucial for Ethereum. Will it scale the highs of $2,500 and cement its position as a leader in the crypto revolution? Or will internal constraints and external pressures force it to undergo a precipitous decline?

Featured image from Shutterstock