A Bloomberg crypto market analyst says Ethereum (ETH) and an XRP rival dominate institutional interest in real-world assets issued on public blockchains.

Jamie Coutts say on social media platform

“Growth is at a low level, but is rising steadily. Demand is also coming from emerging markets, which is not surprising given the adoption of stablecoins.”

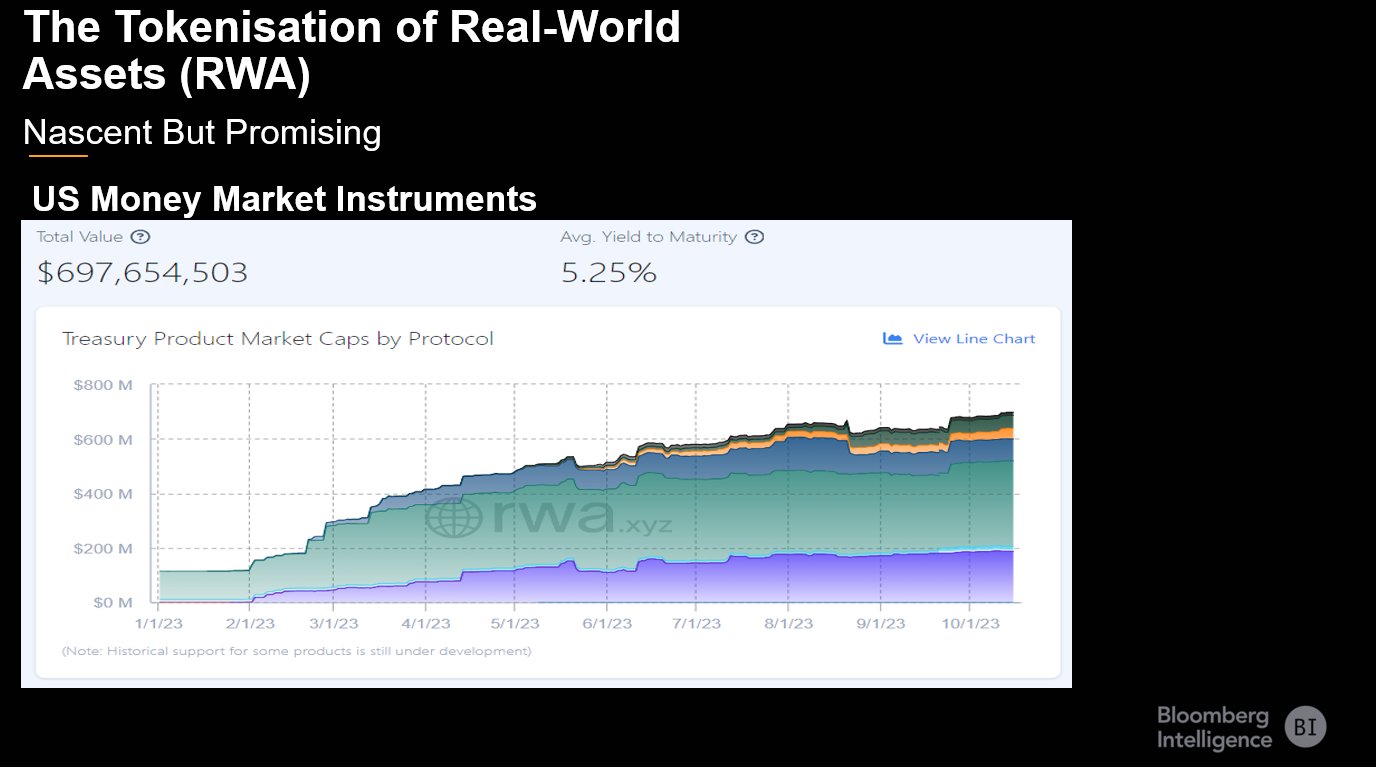

Coutts notes that the tokenization of US money market funds is now approaching a total value of $700 million, compared to $100 million at the beginning of the year.

A money market fund is a type of mutual fund that seeks returns by investing in highly liquid short-term debt instruments such as U.S. Treasury bonds, cash, and cash equivalent securities.

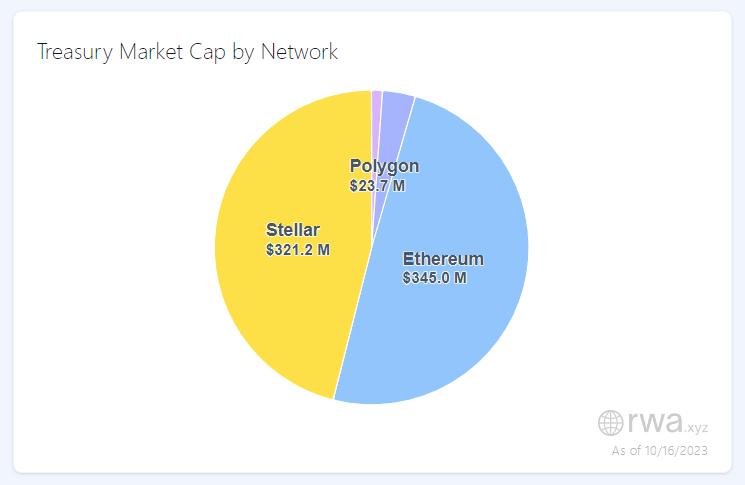

Ethereum is the top network choice for tokenized money market instruments in the US, valued at $345 million, although Stellar (XLM) follows closely with $321.2 million, according to Coutts. Blockchain scaling solution Polygon (MATIC) is in third place, with $23.7 million.

According to the Bloomberg analyst, RWA tokenization could be one of the biggest drivers for blockchain adoption.

“Thoughts: While stablecoins are likely the main driver of blockchain adoption, NFTs (non-fungible tokens), GameFi and now tokenization of real-world assets (RWA), while still nascent, offer enormous potential.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney