- Whale activity and important support levels suggested a possible price drop out on Ethereum.

- Exchange reserves decrease and liquidation points meant increased volatility, but also upward potential.

Ethereum [ETH] has recently experienced an important whale activity, with large recordings of large exchanges that arouse interest in the market. A new wallet withdrew 7,100 ETH, with a value of $ 14.27 million, from Gemini.

In addition, substantial ETH transfers took place of Binance, OKX and Kraken, which amounts to millions of value.

Some of these assets have been turned off or deposited in loan platforms such as Aave, which can indicate Bullish Intentions.

What does the price promotion about Ethereum say?

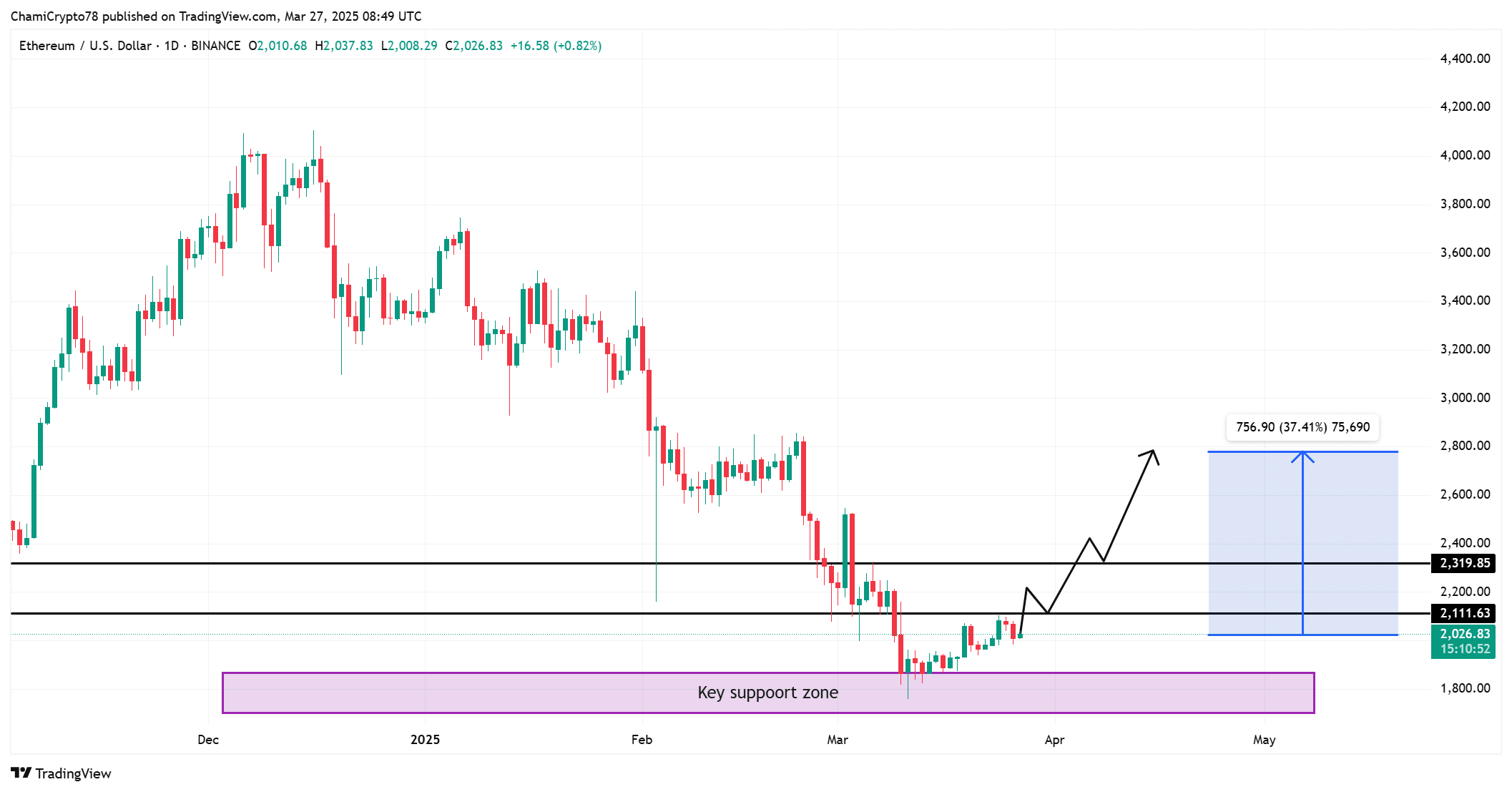

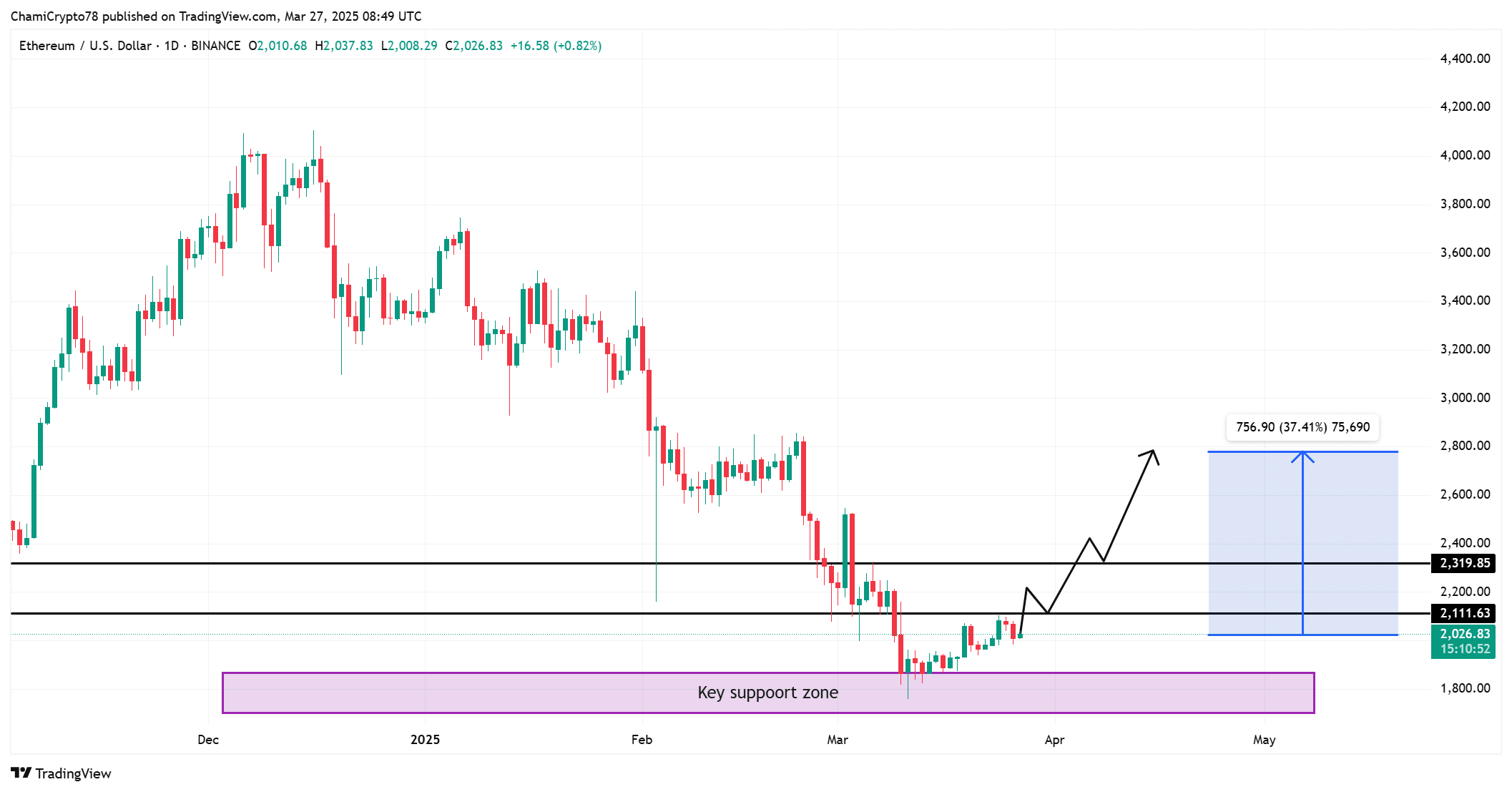

At the time of the pressure, Ethereum was priced at $ 2,030.76, which reflects a slight decrease of 1.21% in the last 24 hours.

Despite this small dip, Ethereum continues to float above important support levels, especially around $ 2,000. While whale activity absorbs, there is a strong possibility that Ethereum could experience a price change.

If the price remains above this support level, it can break past the $ 2,100 resistance, which may activate a rally.

That is why a movement above this threshold could further arouse, and the price could even rise by 37%and approach $ 2,800.

Source: TradingView

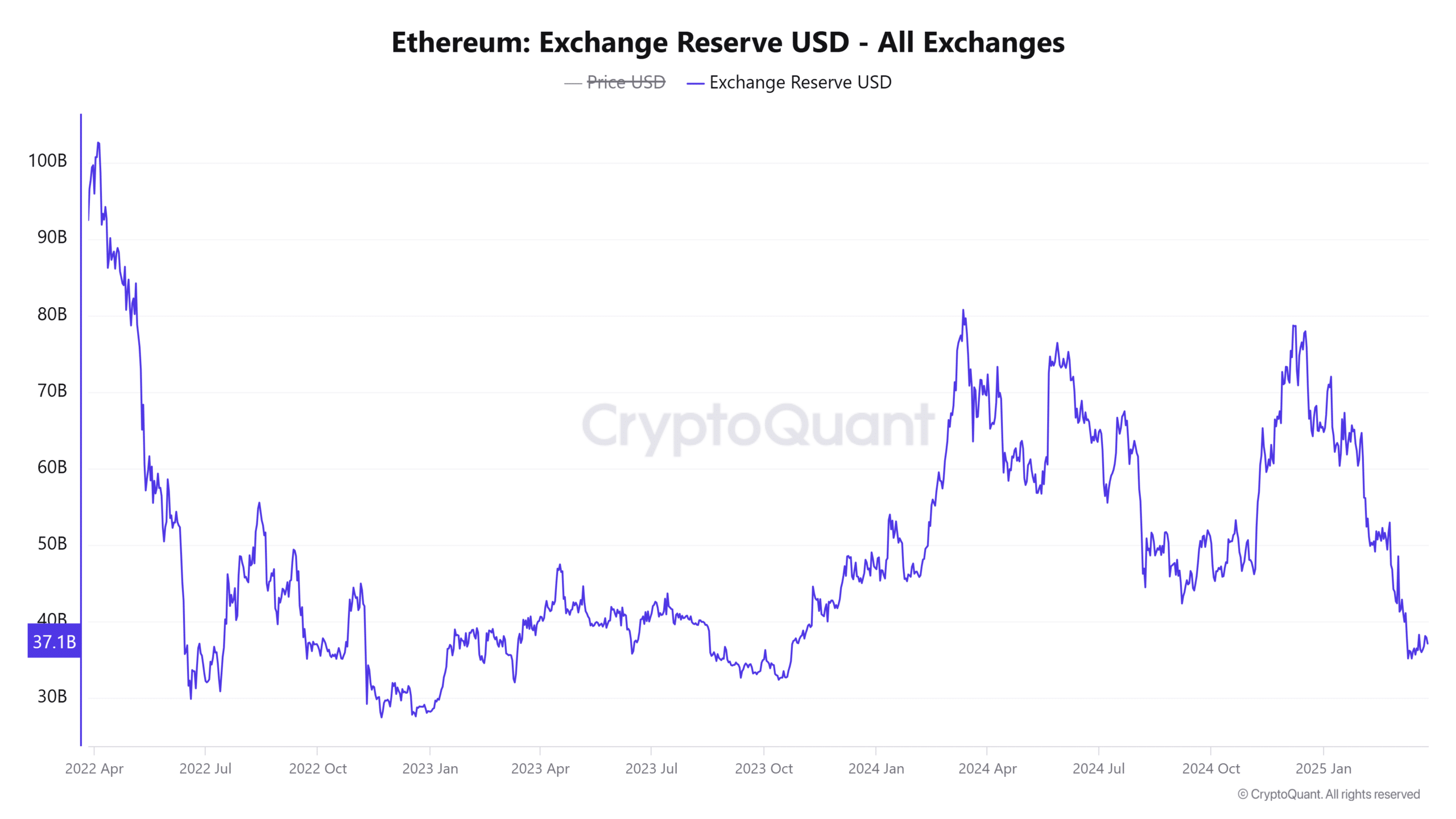

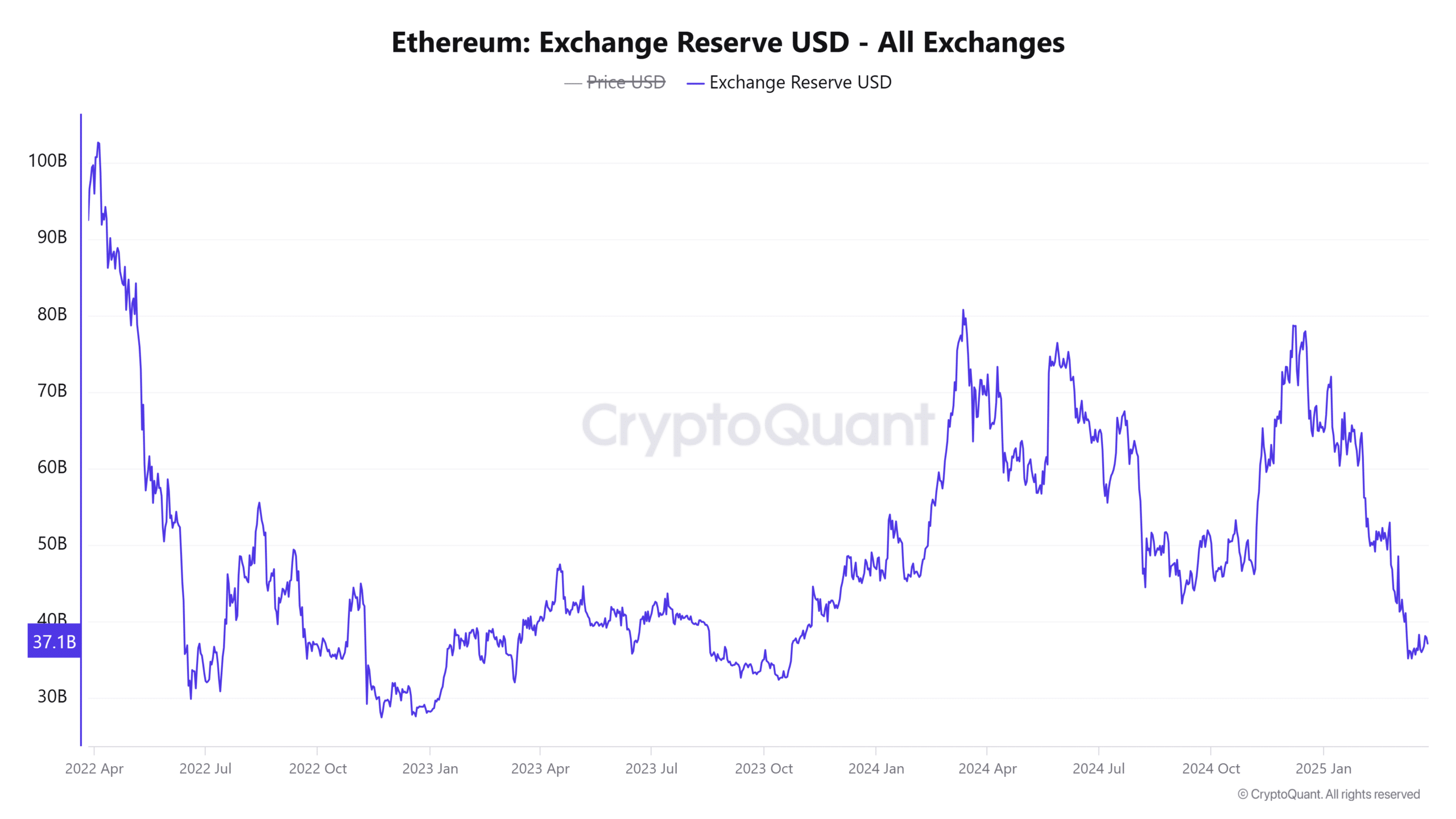

ETH ‘S Exchange Reserves: Liquuidity Dynamics at Play

At the time of writing, the Exchange Reserve of Ethereum was $ 37,1653 billion, which recently showed a decrease of 2.16%. This deterioration suggests that more ETH of stock markets moves, reducing the available liquidity for immediate transactions.

This shift may indicate that investors hold their positions or move assets to other platforms for setting or long -term investments.

With a stricter stock on exchanges, Ethereum can experience upward pressure in the coming days.

The drop in exchange reserves reflects evolving market dynamics and indicates reduced liquidity on the sales side, possibly increases in price increases.

Source: Cryptuquant

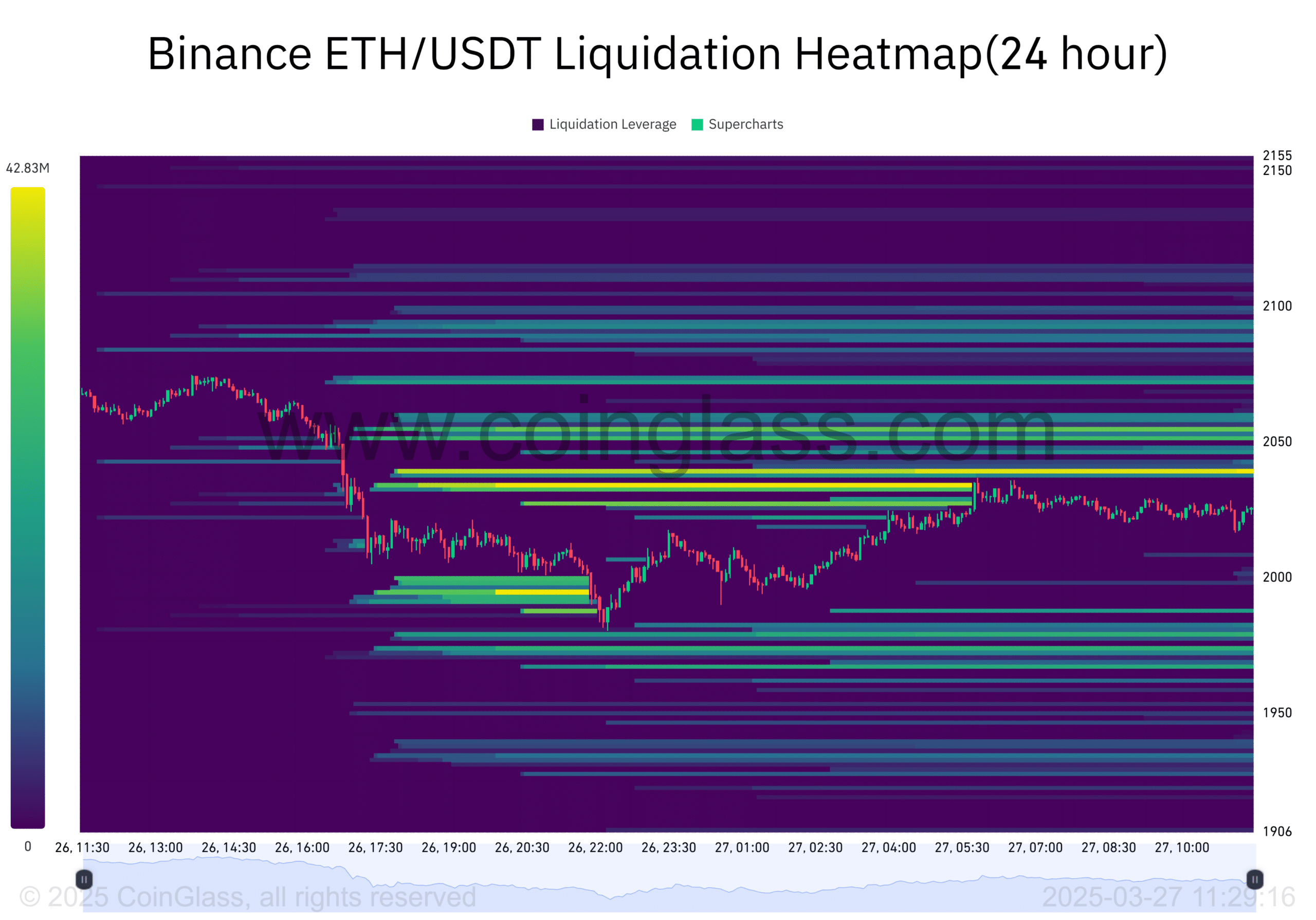

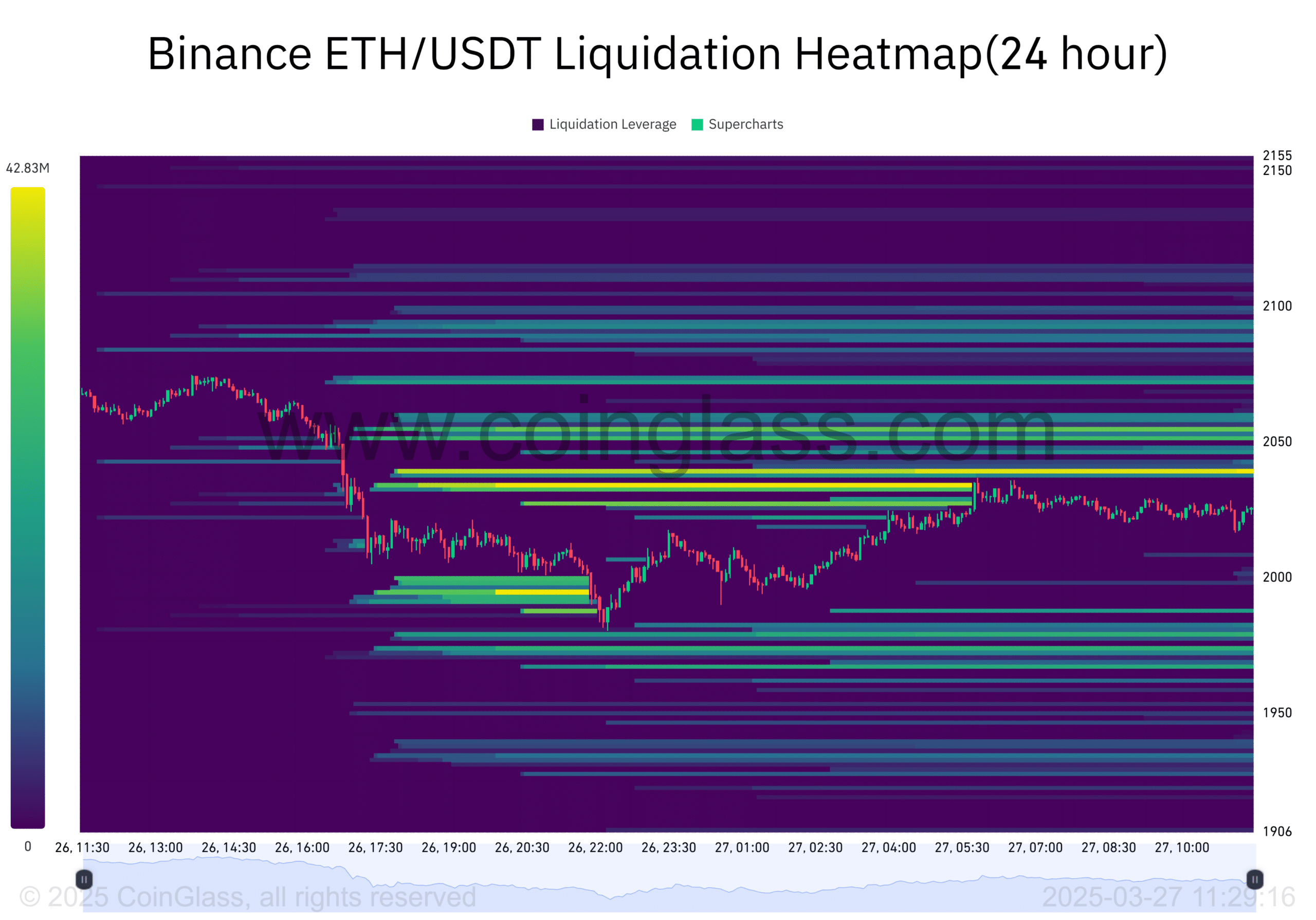

Liquidation Heatmap: How do the liquidation levels influence the price?

The breakdown of the liquidation of Ethereum of Binance reveals important support and resistance zones.

The card shows significant liquidation points between $ 2,000 and $ 2,100. As Ethereum approaches these levels, forced selling can occur, which increases market volatility.

This increased volatility can push the price of Ethereum through resistance levels or ensure that it is confronted downwards.

With the high number of liquidation points, the price of Ethereum is under pressure, but can also rise if the market effectively absorbs these liquidations.

Source: Coinglass

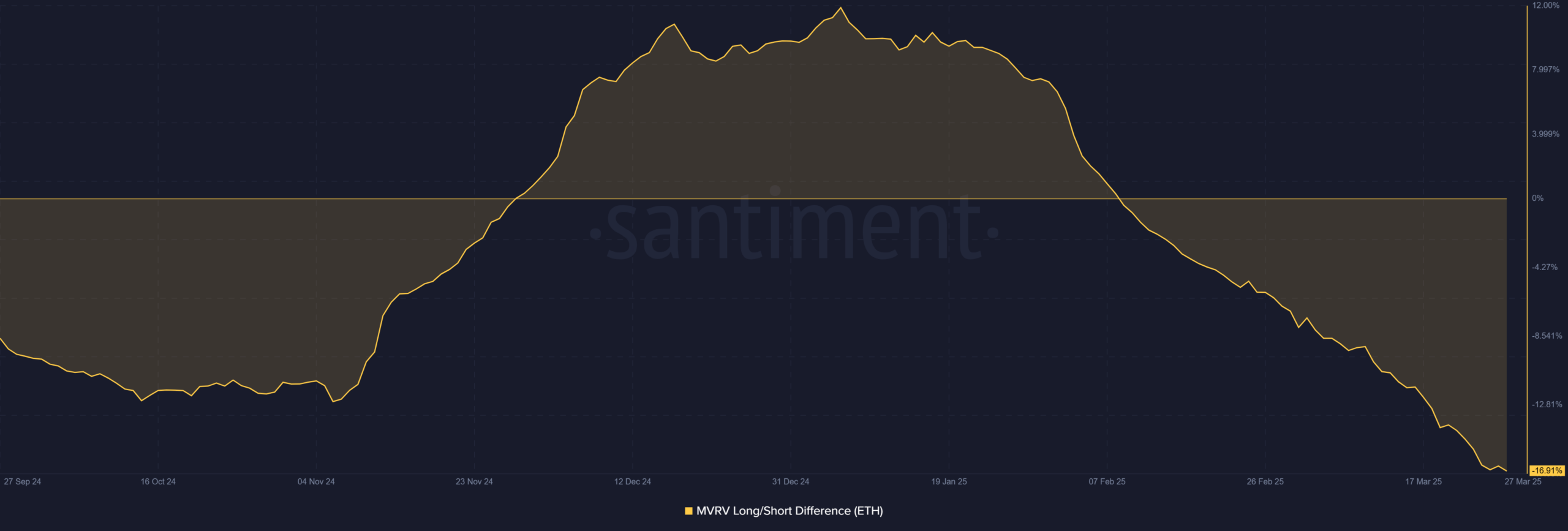

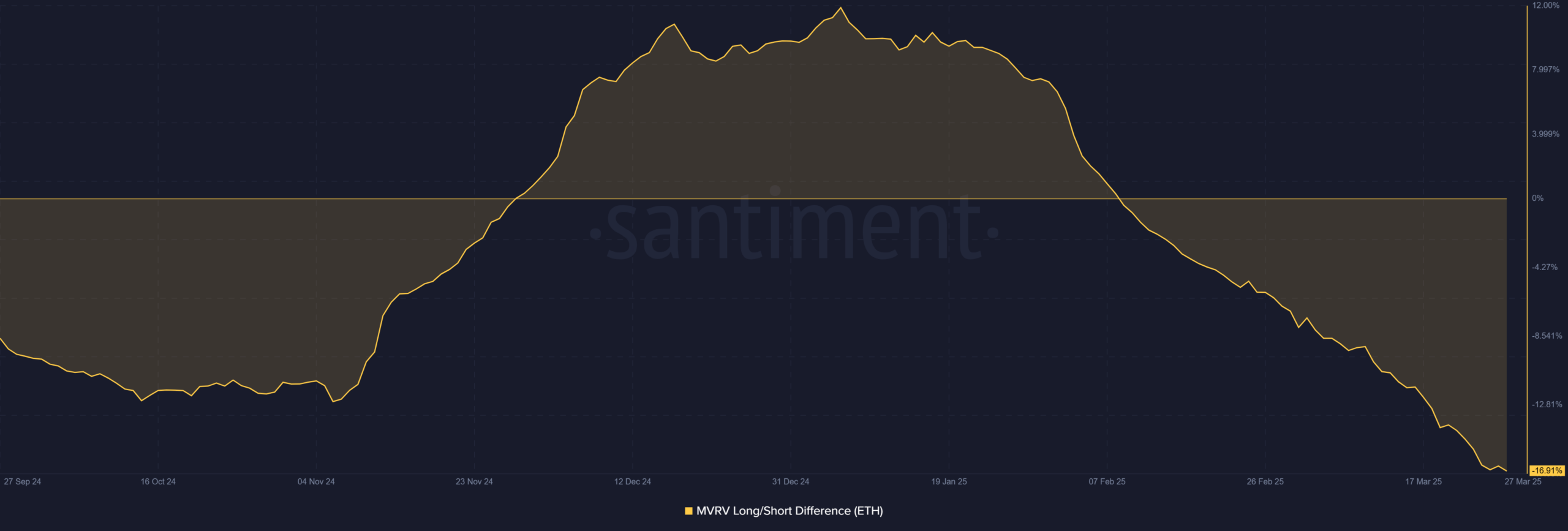

MVRV long/short difference: Analysis of market sentiment

The MVRV -long/short difference for ETH was -16.91 %. This negative value indicates a bearish sentiment at holders in the long term. However, such a significant divergence suggests that the market can be sold over.

If traders regard this as a buying option, ETH could see a price reverse.

As more market participants start to take advantage of the low levels, the price can recover quickly, adding fuel to a potential outbreak.

Source: Santiment

Has ETH been set for an outbreak?

Given the whale activity of Ethereum, important support levels and market sentiment, it seems likely that ETH is ready for an outbreak. The combination of reduced exchange reserves, rising whale activity and technical indicators suggests an upward price momentum.

That is why ETH can experience a considerable price increase if the resistance breaks through in the past, which may soon achieve $ 2,800.