- Ethereum accumulation soared, signaling rising bullish sentiments.

- ETH has fallen 3.21% in 24 hours as the altcoin remained stuck in a consolidation range.

Since the beginning of 2025 Ethereum [ETH] is struggling to maintain upward momentum. During this period, the price has fallen below $3,000 while reaching a high of $3.7,000.

On the weekly charts, Ethereum continues to trade within a consolidation range between $3.5k and $3k.

In fact, at the time of writing, Ethereum was trading at $3,215. This marked a decline of 3.21% on the daily charts, extending this bearish outlook on the weekly charts by 4.57%.

On the plus side, investors have seen this decline as a buying opportunity. As such, most market participants are actively accumulating ETH in anticipation of a price recovery.

Ethereum accumulation is skyrocketing

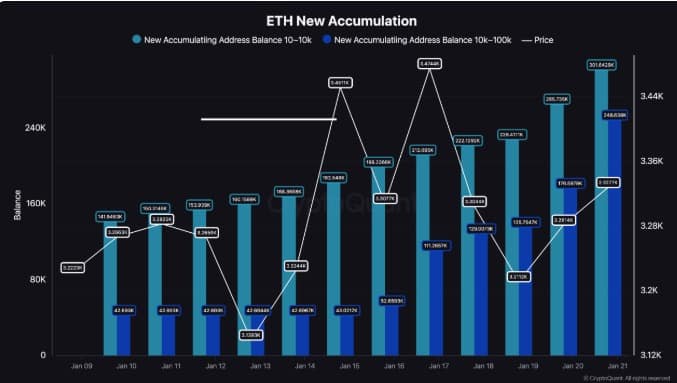

According to CryptoQuantEthereum accumulation has soared over the past two weeks. As such, investors have begun to focus on accumulating ETH, signaling growing confidence in Ethereum’s future prospects.

Source: CryptoQuant

Although ETH is currently experiencing strong market volatility, investors are optimistic and are taking this opportunity to HODL.

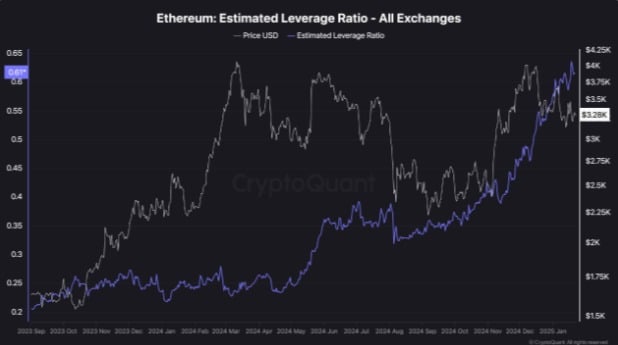

These market dynamics are more common among participants in the futures market. Thus, Ethereum’s leverage ratio has skyrocketed, reflecting the growing demand for highly leveraged positions in the derivatives markets.

With ETH still in a consolidation range, the increased leverage could lead to a breakout. A breakout driven by high leverage could in turn cause an impulsive price move.

Source: CryptoQuant

Therefore, current market conditions indicate a possible breakout to the upside. When investors accumulate while demand for leveraged positions remains high, this indicates bullish investor behavior.

Any impact on ETH charts?

In particular, when the accumulation rate increases, it indicates that investors are not only optimistic, but also view current market rates as undervalued and that the assets have more growth potential in the future.

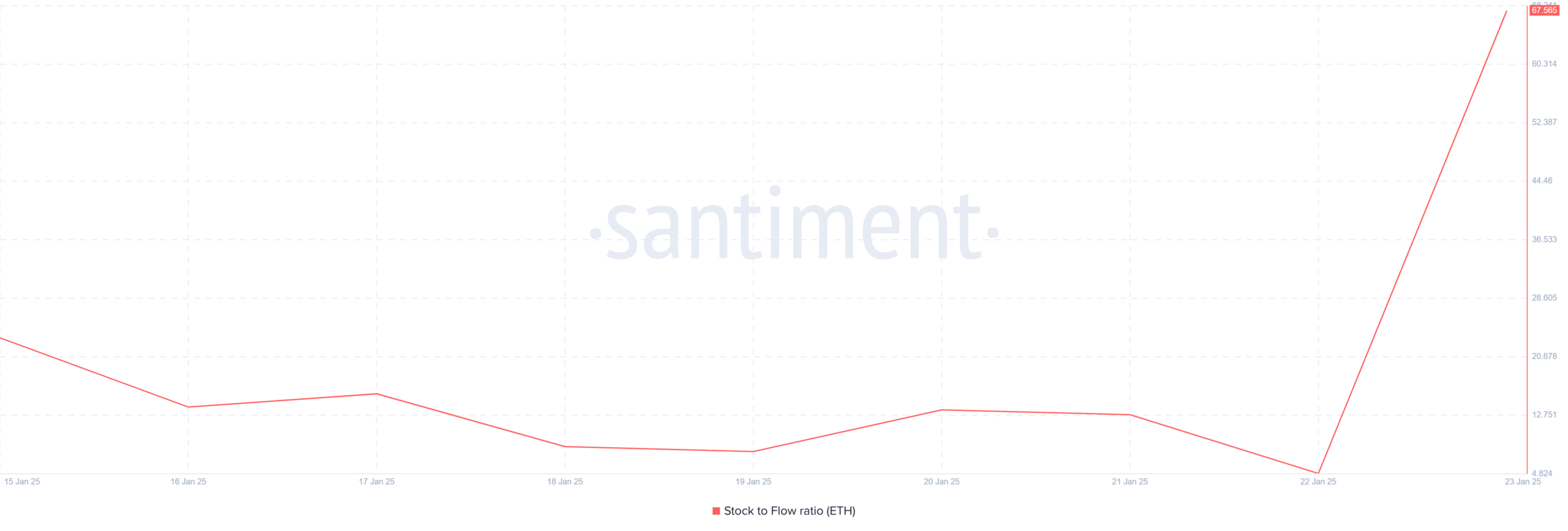

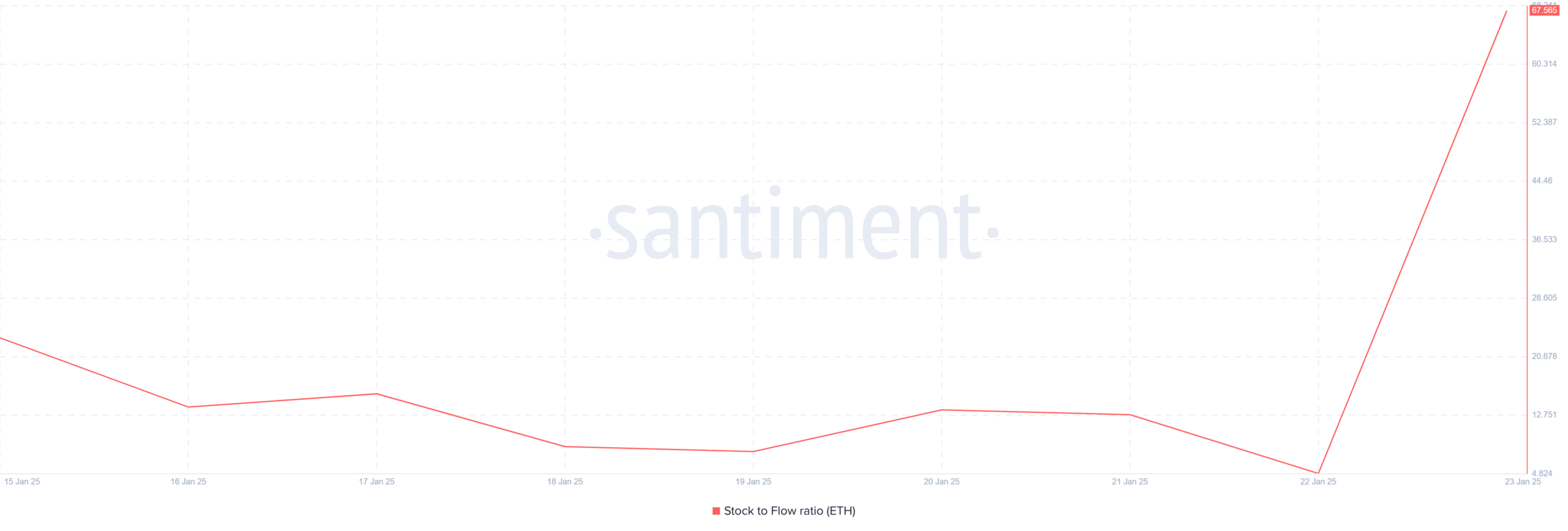

Source: Santiment

According to AMBCrypto’s analysis, Ethereum is seeing increasing positive sentiment. For starters, Ethereum’s stock-to-flow ratio has increased from 6.87 to 67.57, indicating increased scarcity.

When the SFR rises, it implies that ETH is becoming scarcer on exchanges as investors transfer their assets to private wallets or cold storage. Such market behavior implies greater accumulation.

Typically, severe scarcity results in higher prices if demand increases or remains constant.

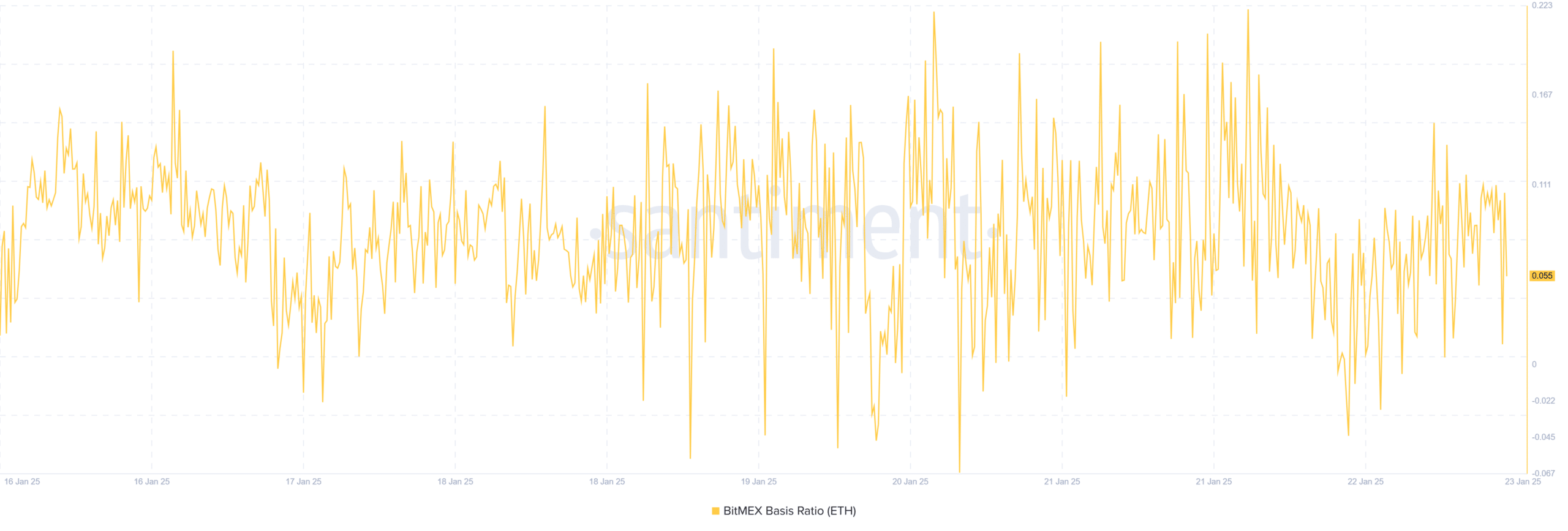

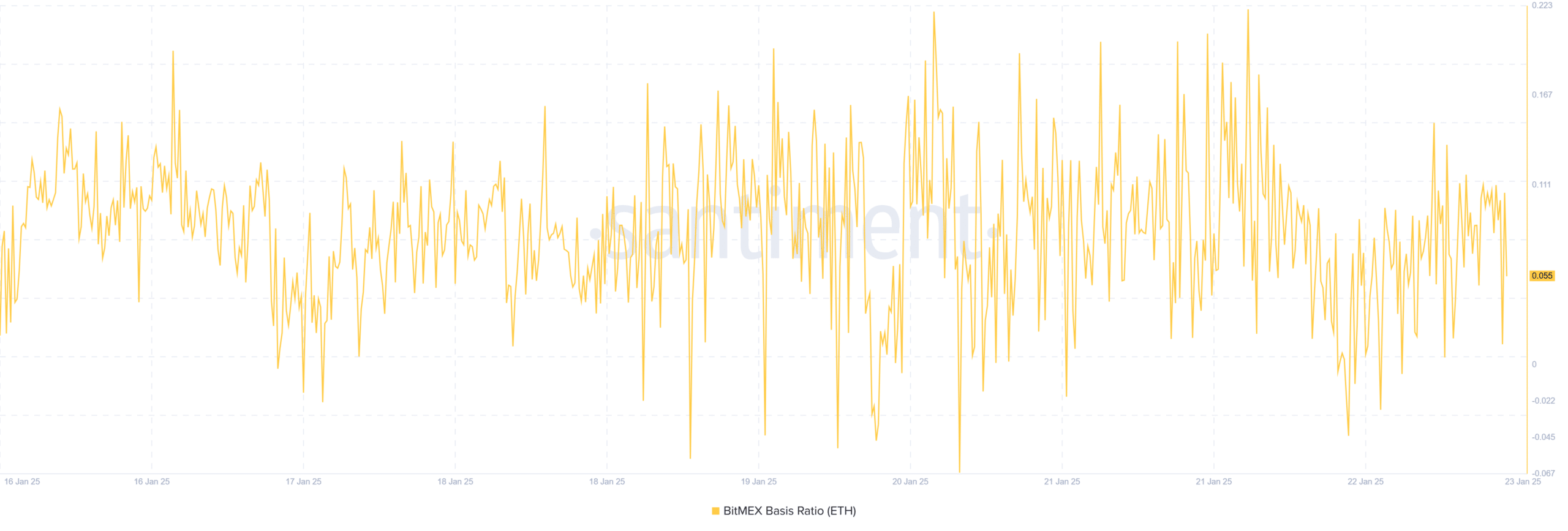

Source: Santiment

Finally, Ethereum’s Bitmex basis ratio has remained positive over the past seven days. This indicates that investors expect higher prices for ETH in the future, ultimately forcing them to pay a premium for future contracts.

Such a trend reflects bullishness as longs pay shorts to hold their positions.

Simply put, the increased accumulation signals a shift in sentiment as investors turn bullish. These market conditions position ETH for potential price recovery and a breakout from the consolidation loop.

Read Ethereum’s [ETH] Price forecast 2025–2026

If investors can maintain their recently observed appetite, ETH could reclaim $3450 and break the $3500 resistance.

However, if the bulls fail in this attempt, we could see the altcoin fall to $3,000 and break below this critical support level.