A huge amount of ETH has made its way to centralized exchanges, increasing the Ethereum balances of these exchanges. Considering the implications of the currency inflow, it could pose a barrier for the cryptocurrency when it comes to claiming the $2,000 resistance.

Investors send 13,000 ETH to exchanges

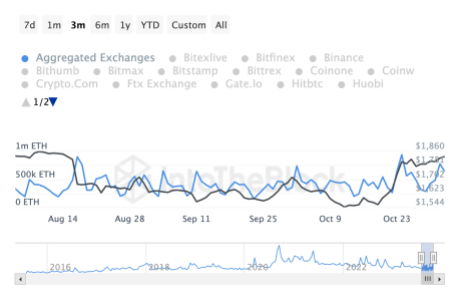

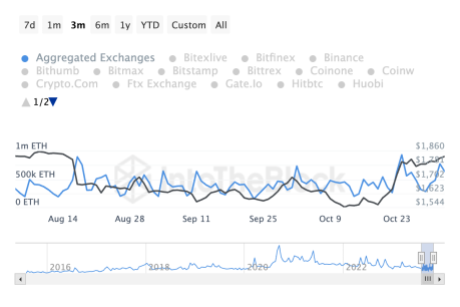

Data from IntoTheBlock shows that a huge amount of ETH went public as the price rose. The total inflow volume on October 31, when the price broke the $1,800 resistance for the first time, was 480,570. However, by early November this number had increased dramatically.

On November 1, total ETH flooded the exchanges to 774,890, by which time the bulls had established their dominance above the $1,800 level. With an outflow of only about 630,000 ETH, the mains currents This amounted to approximately 130,000 ETH flowing to the exchanges on November 1. This showed the willingness among investors to make a profit from their holdings.

Source: IntoTheBlock

As the data tracker shows, the majority of Ethereum investors had returned to profit after crossing $1,800. Even after the retracement, the total profit rate of ETH investors stands at 55.40% and it is no surprise that some of these investors would want to secure profits.

However, on November 2, there was a relaxation among investors when it came to inflows. Data shows that ETH inflows fell to 637,070 on Thursday, although this is still much higher than last week’s figures. Net exchange flow has now dropped to 31,040 ETH as of Thursday.

ETH price recovers above $1,800 | Source: ETHUSD on Tradingview.com

Major Ethereum holders are taking action

Ethereum has also seen a spike in the number of large transactions executed on the network, as well as the transaction volume of these large holders. The total number of large transactions was 1,900 on October 29. But on November 2, the number rose to 4,320, an increase of more than 100% in just four days.

The transaction volumes of these whales also showed an almost comparable increase to the number of large transactions. High transaction volumes amounted to 741,440 ETH on October 29. But on November 2, the volume reached 2.21 million ETH. In dollar terms, large transaction volumes went from $1.33 billion to $4.04 billion.

Looking at the bullish and bearish trades (i.e. those who buy versus those who sell), there is not a huge difference between bullish and bullish trades that still lead this asset. The 7-day total for bulls came to a total of 98 bulls compared to 87 boars. But the gap continues to shrink every day where IntoTheBlock shows 14 bulls and 12 bears.