- The fresh lows of ETH/BTC ratio have fueled a new debate about investing in ETH

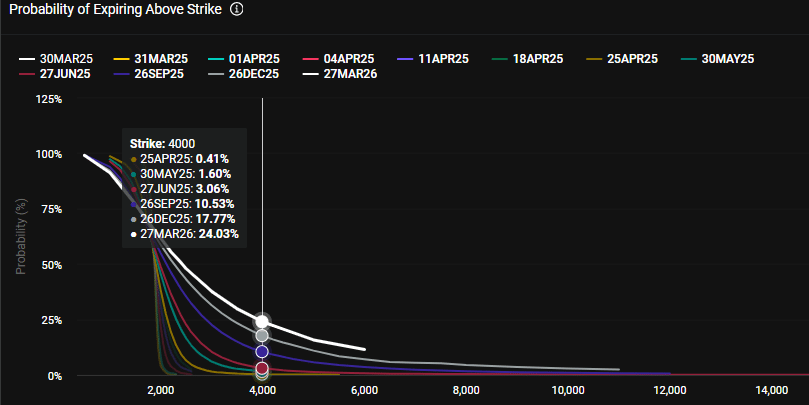

- Speculators still expect ETH to hit $ 4K in 2025

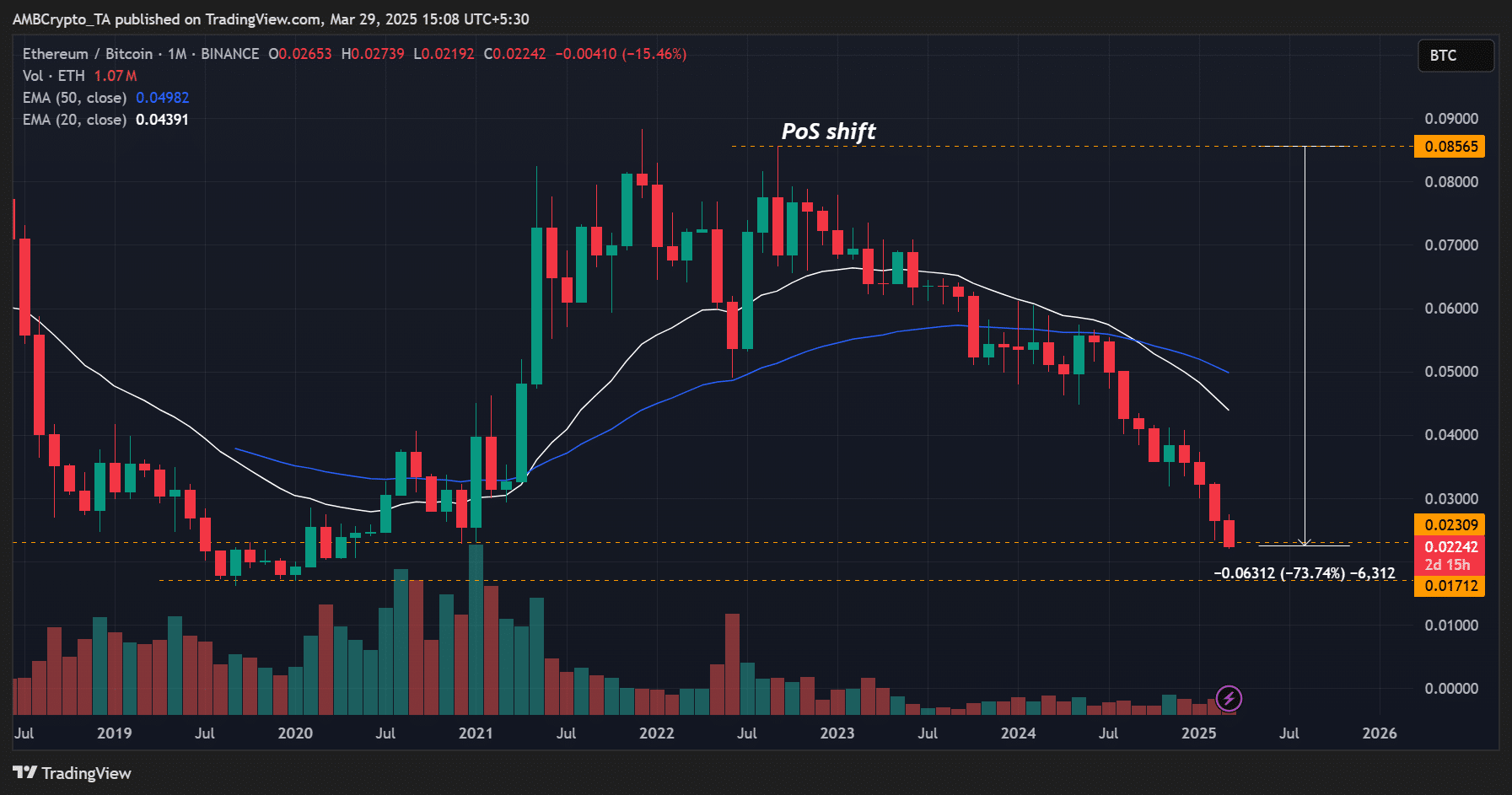

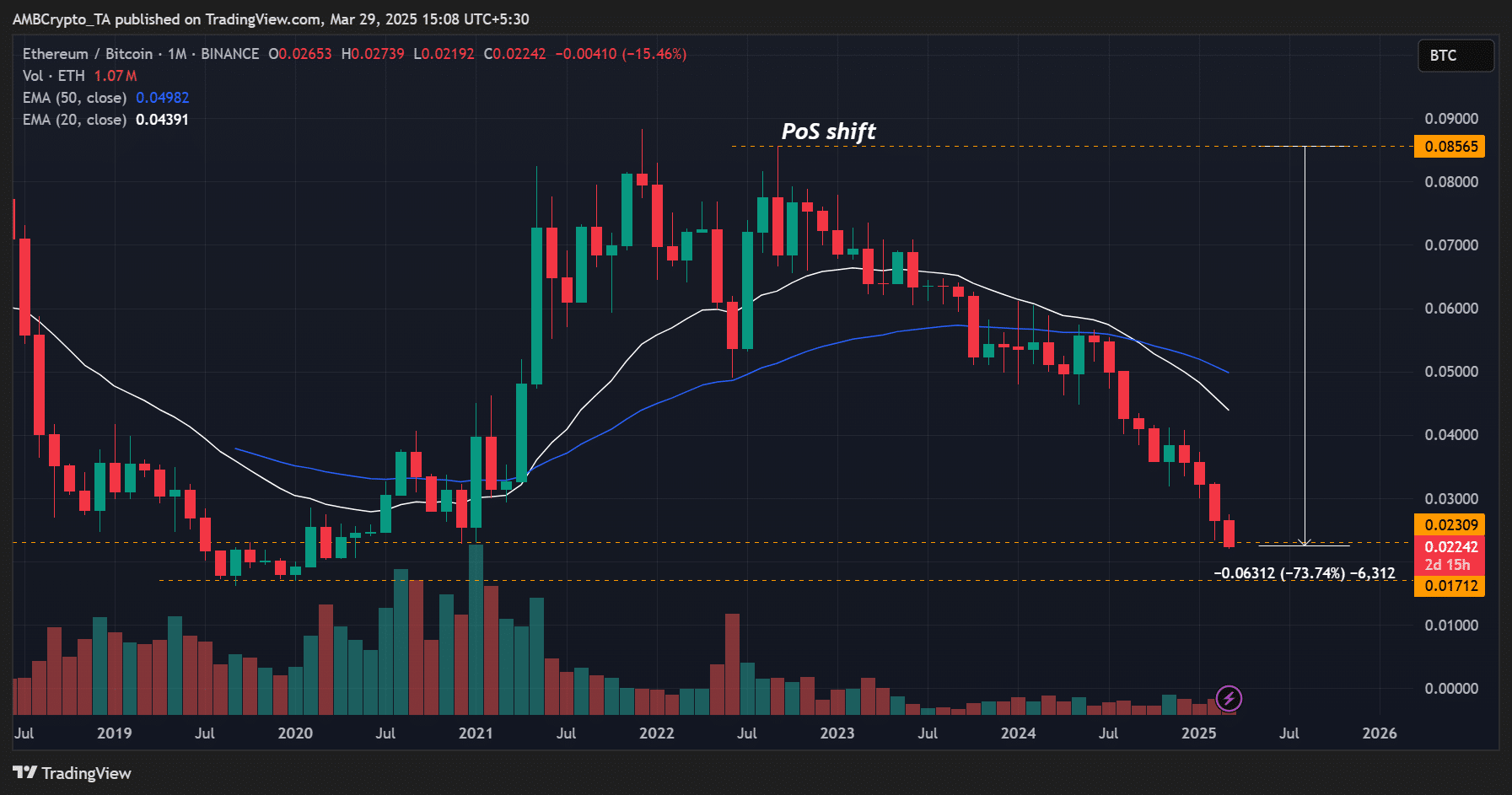

Ethereum [ETH] Has been weakened against Bitcoin for more than three years. This can best be proven by the ETH/BTC ratio, a metric that follows the relative price performance of ETH against BTC. It recently marked a new low of 0.022.

Alex Thorn, head of the Galaxy Digital’s head of research, stated“

“Ether has fallen by 74% compared to Bitcoin since the switch from proof of work to evidence is important.”

Source: ETH/BTC, TradingView

In fact, some members of the community even have called To return the network to POW (proof-of-work), such as BTC, assuming that the value of the Altcoin can be again supported.

Is ETH worth the bet?

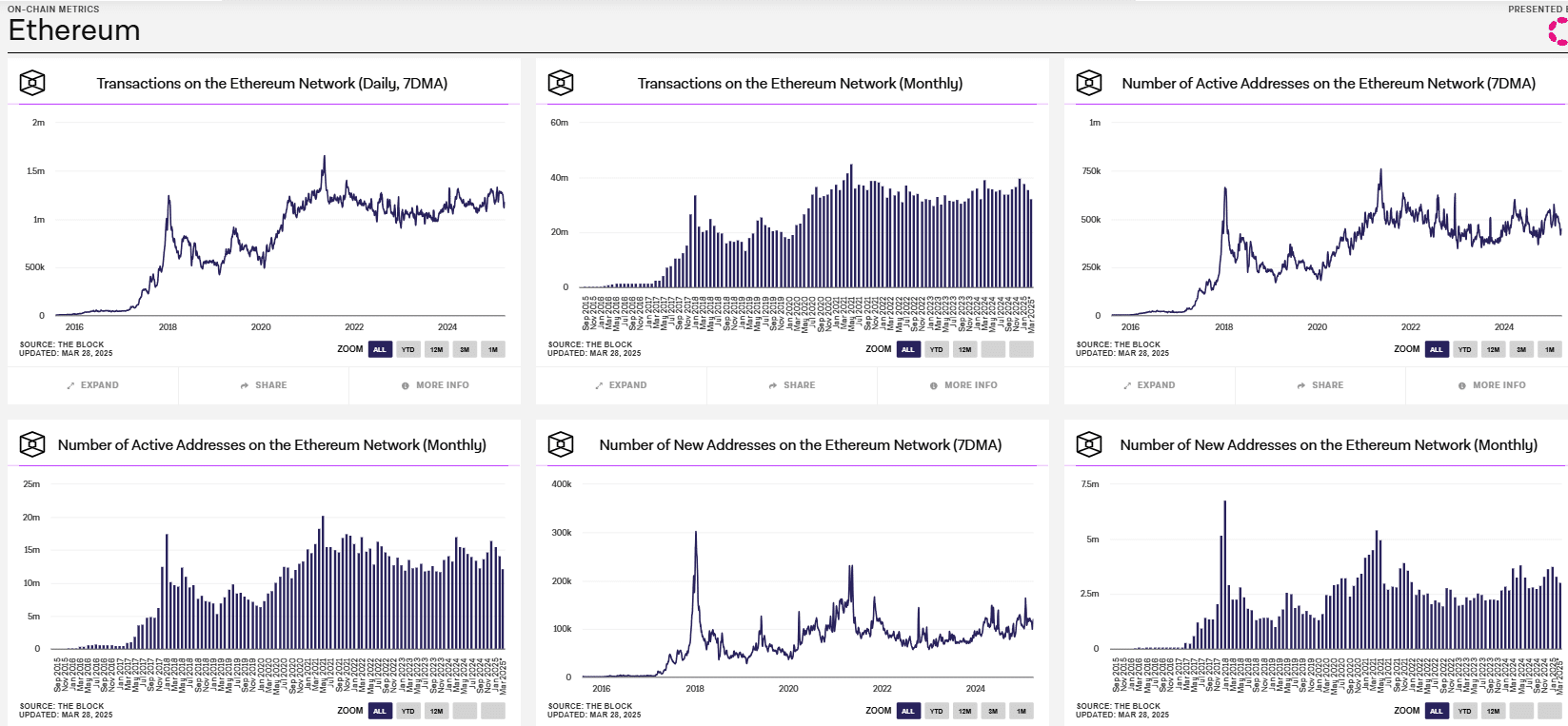

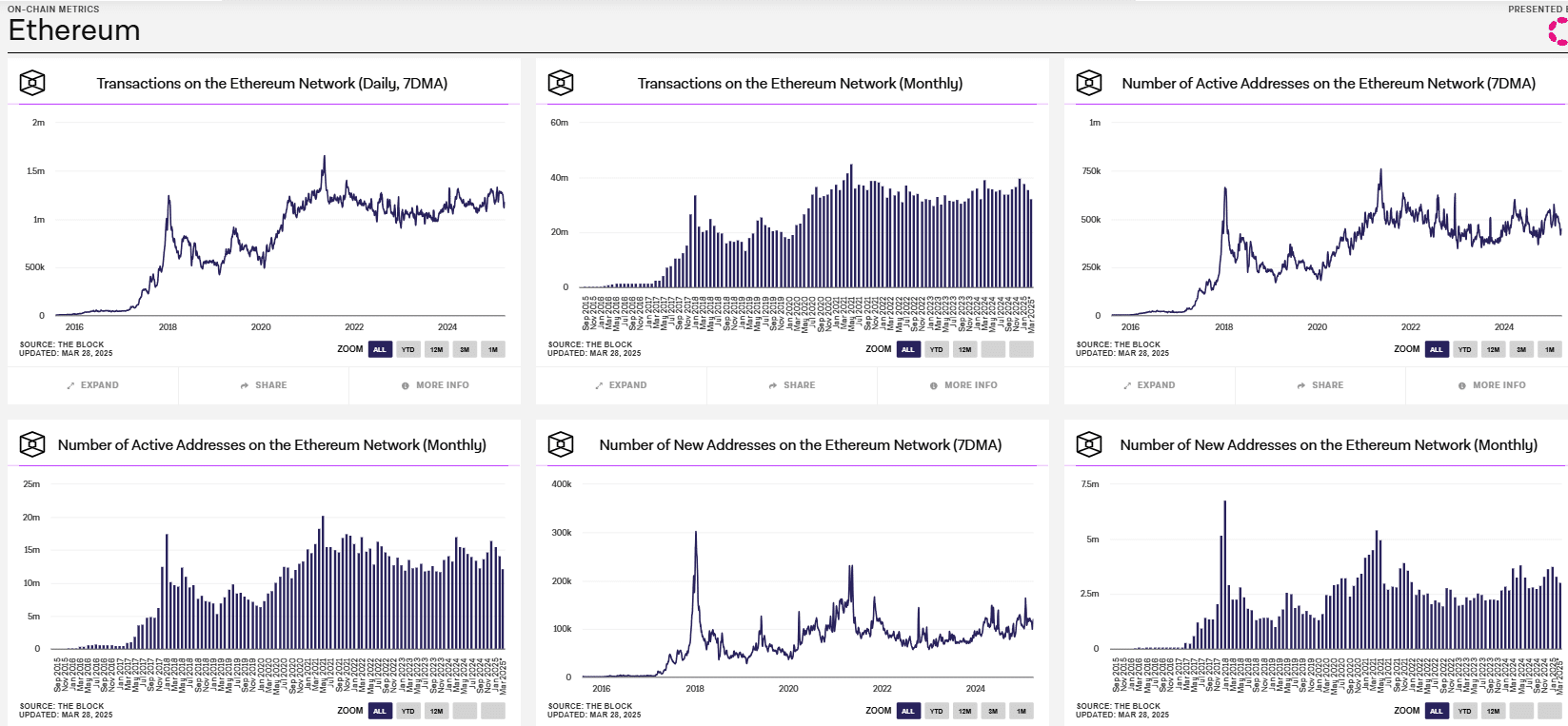

For his part, Quinn Thompson, founder of Macro-oriented Hedgefonds VC Lekker Fund, believe That ETH is ‘not worth the investment’. Among other things, he quoted the falling network activity.

“Make no mistake, $ ETH if an investment is completely dead. A market capital network of $ 225 billion that falls in transaction activity, user growth and reimbursements/income. There is no investment case here.”

Source: The Block

He added that the network has its advantages as an utility, but no investment. Nic Carter, partner at Castle Island Ventures and co-founder of data aggregator Coinmetrics, repeated this sentiment.

Carter actually blamed L2S for killing the value of ETH and stated”

“The #1 cause of this is greedy ETH L2S-Hevelwaarde of the L1 and the social consensus that surplus token creation was A-OK. Eth was buried in an avalanche of his own tokens. Die with his own hand.”

According to Thompson, the ETH/BTC ratio fell due to double digits during the bull cycle of 2023-2024 and it can be worse off during a bear cycle.

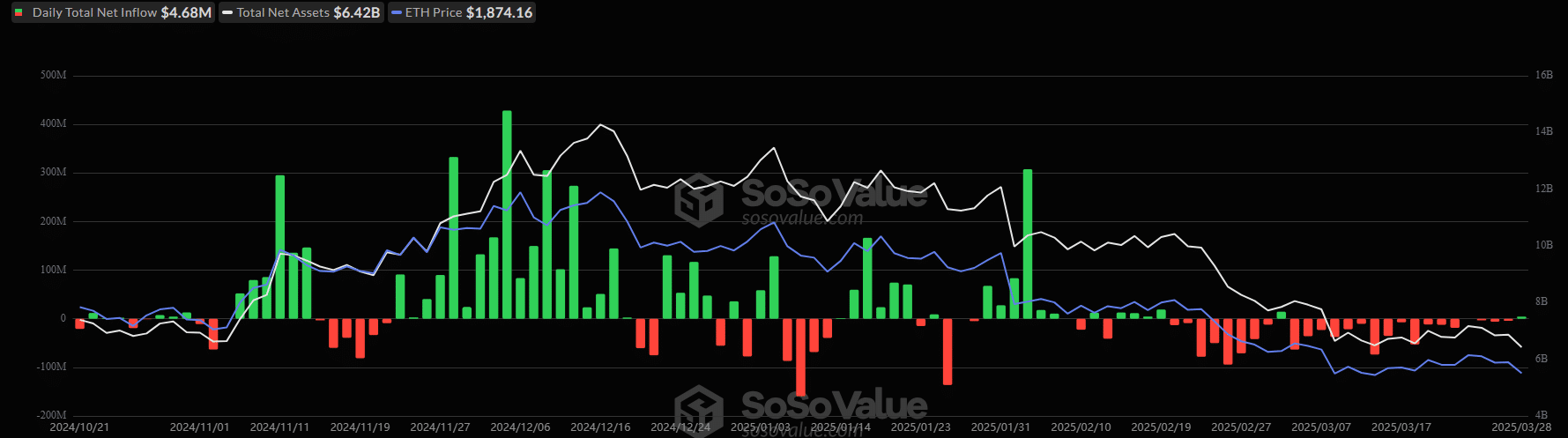

The recent ETF streams also showed dislocation between the two top crypto assets. For the US Spot BTC ETFs, the products have registered more than $ 1 billion in flow in 10 consecutive days (apart from last Friday, which saw $ 93 million outflowing).

US spot ETFs, on the other hand, have registered consistent outsource since 20 February, apart from just two days of inflow. In March they saw more than $ 400 million out.

Source: SOSO value

Simply put, the negative sentiment on social media seems to reflect the appetite of weak institutional investors for the Altcoin.

That said, the weak streams could not derail the chances of recovery from ETH. About the forecast site Polymarket, the ETH price objective of the gamblers for 2025 is $ 4K (with the highest volume of $ 710k). The second highest part is for $ 5K.

For option traders on Deribit, the goal of $ 4K is only expected in September (10% chance). At the time of writing, ETH was appreciated at $ 1.87k, with a 54% decrease compared to the Highs of December of $ 4K.