Resume:

- Ethereum’s native asset ETH traded around $1900 on Tuesday ahead of the Shapella update that developers promise will unlock staked Ether.

- The update scheduled for April 12 at 23:00 UTC is Ethereum’s most significant technological upgrade since the Merge.

- Bitcoin surged above $30,000 for the first time since June 2022, making MicroStrategy’s BTC bet a profit.

ETH, crypto’s second largest token and largest altcoin in the market, had $2,000 ahead of the Ethereum upgrade that developers say will unlock more than 16 million staked ETH (stETH) held in a smart contract since December 2020 collected.

The token was trading around $1,900, data from CoinMarketCap showed on Tuesday. Should ETH break above the $2K level, it would be the first time Ethereum’s native coin has seen such prices since August 2022. ETH plunged along with the broader crypto market following the failure of digital asset giants like Terra and Three Arrows Capital for a little.

Ethereum’s latest update called Shapella, an acronym for Shanghai-Capella, is expected to allow withdrawals for staked ETH.

Core developers like Tim Beiko confirmed that Shapella will ship to ETH’s mainnet on April 12, months after the Merge transitioned the network from proof-of-work to proof-of-stake. As previously reported, Shapella will go live tomorrow at 23:00 UTC in epoch 194048.

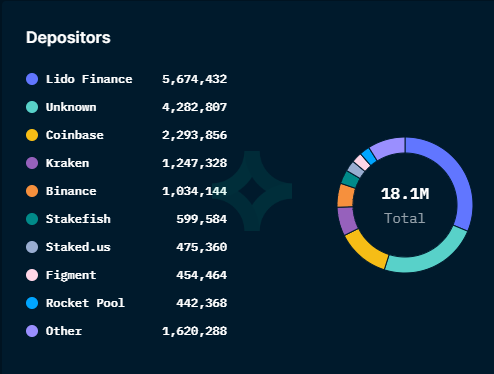

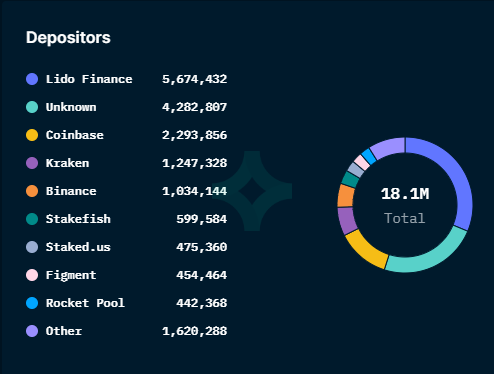

The upgrade will allow Ethereum validators and customers who have stored ETH supplies to withdraw their assets, an unlock that some believe could increase selling pressure on Ether’s market price.

Bitcoin Surpasses Ethereum to Push MicroStrategy to Small Profits

Bitcoin (BTC) pushed above $30,000 for the first time since June 2022. BTC’s dominance of the crypto market also rose to 45% after starting at 38% in January. In this case, dominance points to the size of BTC’s market cap relative to the total crypto market cap, which includes every altcoin in the market. It is the first time BTC dominance has reached this high since May 2021.

The price surge also pushed MicroStrategy’s Bitcoin bet to the green, albeit only a few hundred dollars in profit. MicroStrategy, the largest Bitcoin corporate holder, has an average purchase price of $29,803 per BTC for its massive 140,000 Bitcoin vault.