Well-known crypto analyst Egrag presented a compelling Elliott Wave analysis on the potential XRP price trajectory in a tweet today. Drawing attention to the inner workings of the Elliott Wave theory, he highlighted that XRP has entered Wave 3 in recent days, which notably plays a transformative role in determining asset price movements.

At Eggag words: “XRP Targets $27 – Wave 1 into Wave 3: Dive into Elliott Wave Theory as we explore the potential for XRP to reach $27! Wave 3 is typically a game changer in Elliott Wave theory.”

Elliott Wave Analysis: Wave 3

The crypto analyst further explained that Wave 3 is emerging as the dominant force of the trend, surpassing other waves in size and influence. This phase often witnesses positive news that prompts fundamental analysts to revise their outlooks, boosting upward momentum.

Notably, prices tend to rise quickly during this phase, with minimal corrections. Investors who try to enter the market during a pullback often miss out as the third wave gains momentum. Initially, pessimistic news could still dominate, with most market participants maintaining a bearish stance. However, as Wave 3 unfolds, a significant shift toward bullish sentiment is evident among the majority.

Egrag dives deep into XRP analysis and points out that the number of green waves reflects the Great Cycle that runs from 2014 to 2018. This cycle started with Wave 1 and was followed by a corrective Wave 2. the exciting currents of Wave 1 within Wave 3 of the Great Cycle. Prepare yourself for a fascinating journey ahead!” he noticed.

He further explained that XRP has adeptly navigated the early waves and is now heading towards the expected Wave 3, which he predicts will reach the Fibonacci mark of 1,618 at $6.5, followed by a short correction. The subsequent and concluding phase, Wave 5, will push the XRP price to a staggering $27, according to Egrag’s analysis.

A deep dive into Eggag’s XRP price chart

Egrag’s analysis outlines the complicated journey of the XRP price through the conceptual lenses of Elliott Wave theory. The chart begins its story in March 2020, when the minor Wave 1 began. In these early stages, XRP escalated to a prominent peak of $1.96, buoyed by a favorable outcome in Ripple’s legal battle with the US Securities and Exchange Commission (SEC).

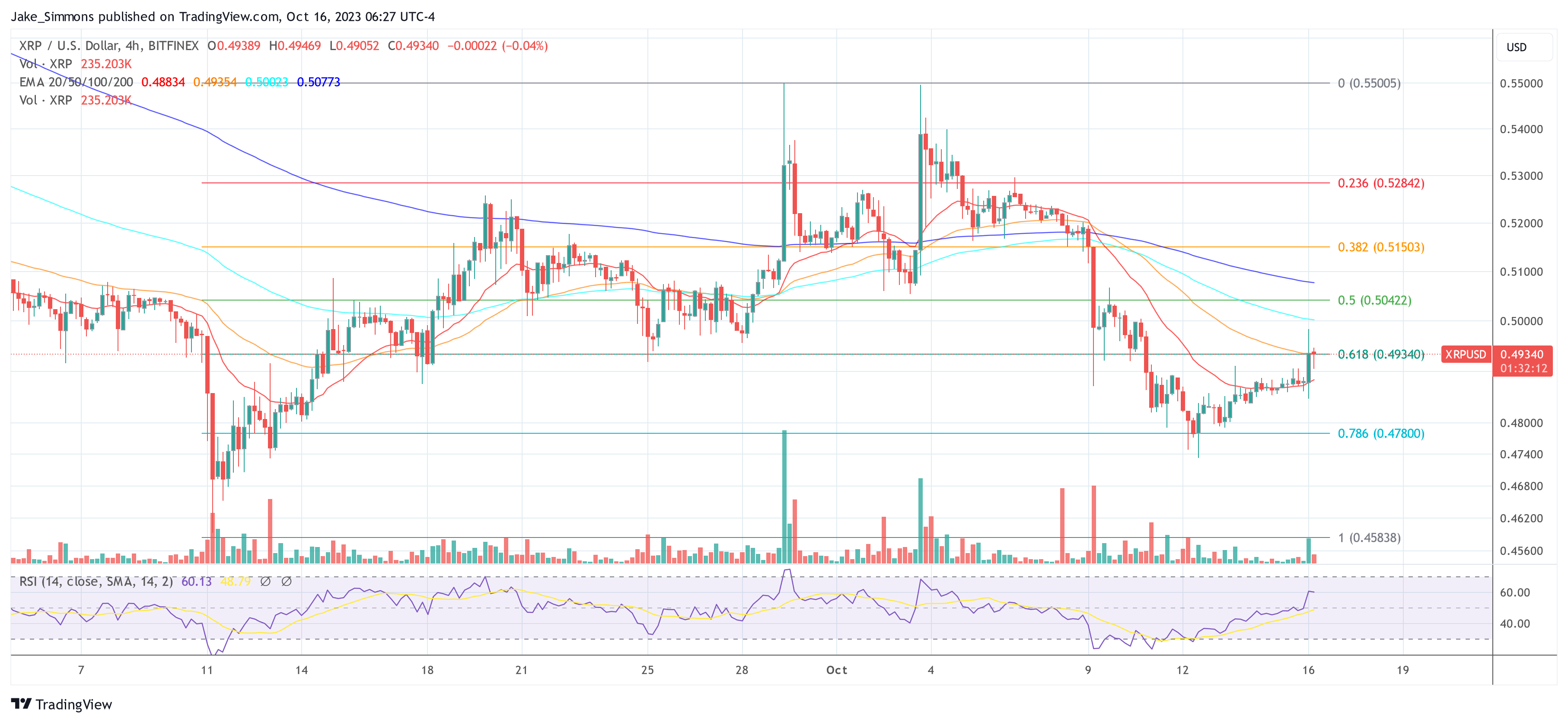

After the top of Wave 1, the chart navigates through an area marked by correction, which is called Wave 2. In this segment, XRP price experienced a pullback and fell to a low of $0.4313. This corrective phase, while drastic, respects the sanctity of the Elliott Wave standards by not falling below the initial Wave 1 point.

With the move into the Wave 3 area, bullish momentum is currently starting to build. Egrag, with a combination of analysis and foresight, expects the XRP price to rise past the Wave 1 high and target the Fibonacci extension of 1.618, valued at around $6.57. This positive effect, shown on Egrag’s graph, is expected to end sometime in 2024 or 2025.

Wave 4, as described by Egrag, provides a corrective move after the upswing of Wave 3. At this point, the XRP price is expected to fall heavily and find support at $1.96, which interestingly marks the peak of Wave 1 reflects.

In Egrag’s chart, Wave 5 emerges as the peak of the bull market. In this decisive phase, the analyst projects his boldest prediction for the XRP price trajectory. Anticipating a massive bull spike in 2025, he foresees XRP fluctuating between Fibonacci extension levels of 2,272 and 2,414, corresponding to price points of $23.63 and $31.20. Egrag, who averages the values, then predicts a $27 price target for XRP.

At the time of writing, XRP was trading at $0.4934.

Featured image from Figma, chart from TradingView.com