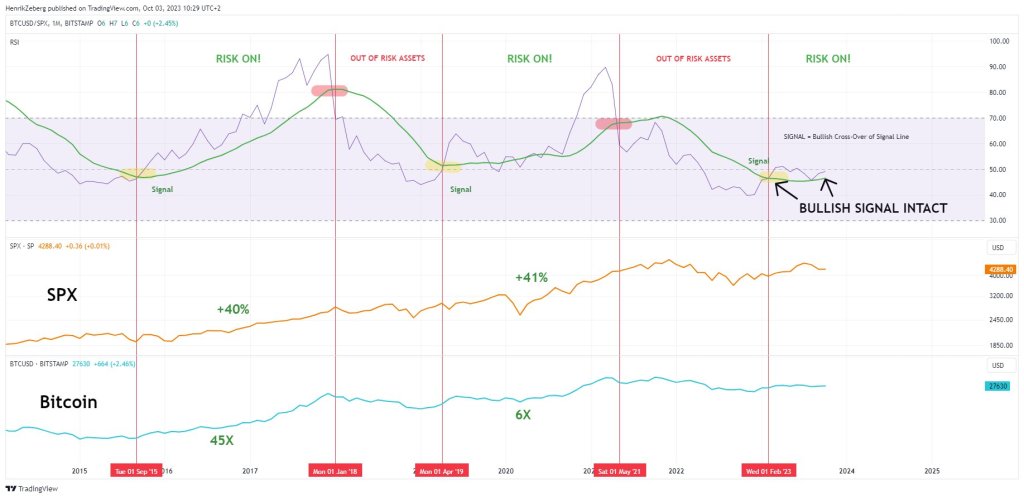

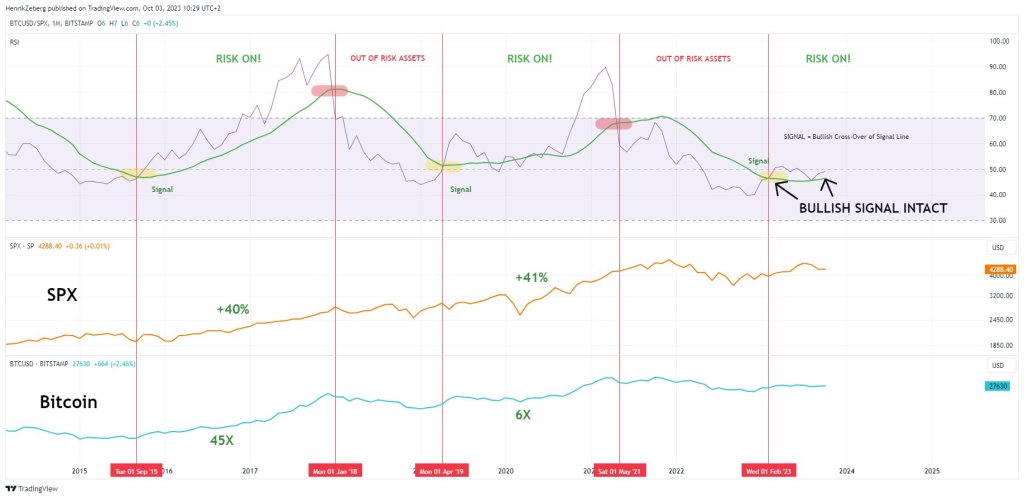

Macroeconomist Henrik Zeberg thinks Bitcoin (BTC) and other risk assets are gearing up for a “monstrous” move, with the trend still in its early stages. Zeberg’s predictions are based on the BTC/SPX ratio, an indicator that compares Bitcoin’s performance to the S&P 500 index (SPX).

The BTC/SPX ratio says a monster move is coming

Despite recent fluctuations and concerns about the sustainability of the crypto market, Zeberg remains optimistic about BTC. According to the analyst, the BTC/SPX ratio provides strong evidence that Bitcoin’s upward trend is “just beginning.” Based on price movements, the current September decline could provide traders with opportunities to accumulate.

The BTC/SPX ratio is an indicator that assesses the relative performance of Bitcoin and the stock market. The ratio is derived from the distribution of the spot prices of Bitcoin and the S&P 500 index (SPX). When the price rises, as is currently the case, it indicates that Bitcoin is outperforming the stock market. Conversely, a declining ratio indicates that Bitcoin is underperforming. In that case, banking on the stock market could yield better returns than HODLing BTC.

From the chart shared on October 3, Zeberg said a “bull” signal was triggered in February 2023, ahead of a substantial rally in Bitcoin’s price. By July 2023, Bitcoin had risen to around $32,000. Although there has been a cool-off since then, Bitcoin is above the February highs around $25,200, confirming the uptrend.

Between April 2019 and May 2021, when a similar bull signal was printed, BTC rose by a factor of six, while the S&P 500 saw a more modest 41% gain. Zeberg’s assessment, based on the BTC/SPX ratio, suggests that Bitcoin and other risk assets could post strong gains in the coming months.

Will Bitcoin soar to $200,000 this bull run?

Whether this will be printed or not can only be speculated. Looking at the BTC/SPX ratio, the indicator lags and does not accurately reflect the market peaks or bottoms.

For example, the last bear signal in May 2021 was months ahead of Bitcoin peaking and declining in November 2021. Therefore, although the bull signal was registered in early February 2023, it is unclear whether there will be another price drop before prices rise or the bears push through, pushing the coin back to the 2022 low.

If buyers take control and the BTC/SPX ratio indicator is correct, it is impossible to determine how high BTC will rise at current prices. If the latest bull run is something we can expect, BTC could rise by a factor of 6. In that case, BTC could rise above $200,000 in this bull cycle.