DWF Labs, a leading crypto trading and market maker company, is preparing to enter the booming stablecoin sector.

In an August 1 statement on social media platform X, Andrei Grachev, the firm’s managing partner, said: declared:

“Following our plans to be a global web3 financial institution, I am happy to announce that DWF Labs is working on a CeDeFi synthetic stablecoin that will allow users to receive nice returns without losing any flexibility in using their assets.”

Grachev did not reveal any further details about the stablecoin. However, this move signals increasing institutional interest in the stablecoin market. Over the past year, major financial institutions such as PayPal and Ripple have shown interest in the fast-growing sector.

Stablecoins have proven to be one of the most practical uses of crypto, offering a stable alternative to the volatility of digital assets like Bitcoin.

Stablecoin users in emerging economies such as Venezuela and Nigeria often rely on the asset to hedge against falling national currencies and for everyday transactions.

Crypto Slates Data shows that Tether’s USDT and Circle’s USDC dominate the $164 billion stablecoin industry, holding about 90% of the market share.

Stablecoin’s market capitalization is growing.

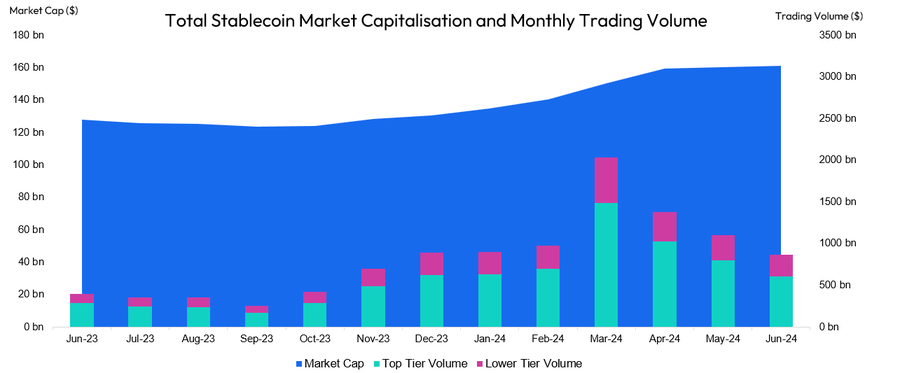

DWF Labs’ move comes amid the continued rise in the market capitalization of stablecoins.

CCData reported that the total market capitalization for the assets grew 2.11% in July to $164 billion, the highest since Terra’s ecosystem collapsed in May 2022.

This increase marks the tenth consecutive month of growth for the sector and is the highest monthly increase since April.

Market observers explained that the increase indicates that new capital is entering the market, which is reflected in the positive movement of digital asset prices in July.

Despite this rising supply, trading volume of stablecoins on centralized exchanges fell for a fourth month, falling 8.35% to $795 billion on July 25.

Conversely, on-chain transactions rose 18.3% to reach $999 billion in July, the highest level since April. This represents a 69.4% increase from the previous year, driven by the impact of spot ETFs in the US.