- Six accounts with 499 BTC have recently become active.

- The BTC is now worth over $47 million.

Between November 28 and December 1, six dormant Bitcoin wallets containing hundreds of BTC came to life, ending a nearly eleven-year period of inactivity.

Of these, the largest transaction came from a wallet containing 429 BTC, which is now worth more than $41 million at Bitcoin’s current price of around $95,900.

The sudden activity of these wallets has sparked curiosity about the motivations behind the moves and their implications for the market.

Dormant Bitcoin wallets resurface after a decade

The reactivation of six dormant Bitcoin wallets, each of which has been inactive since late 2013, marks a major event. The largest account contained 429 BTC, with a combined inactivity period of 10.9 years. When these wallets last moved money, Bitcoin was trading at around $700-$900.

At the time of writing, their assets were worth more than $41 million, reflecting an eye-watering 4,500% increase in value.

According to data from Whale alertThe last wake-up on December 1st showed an account with 11 BTC that had been inactive for 11.6 years.

The awakening of such wallets often indicates unique circumstances. Think of rediscovered keys, security problems or profit taking during a bull market.

Insights into the chain and whale activity

On-chain analysis shows that moves from long-dormant wallets are rare but impactful, often sparking speculation within the crypto community.

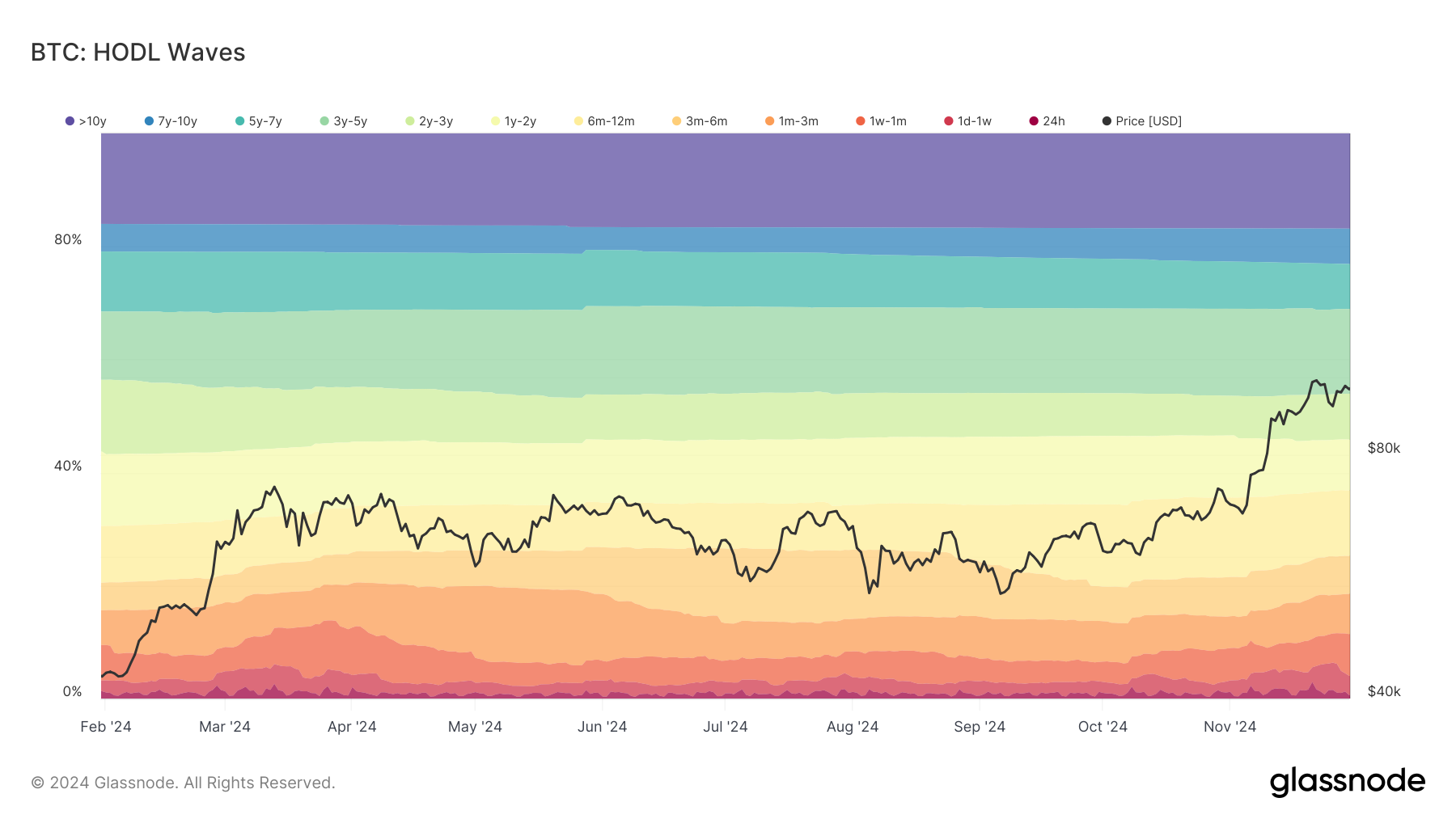

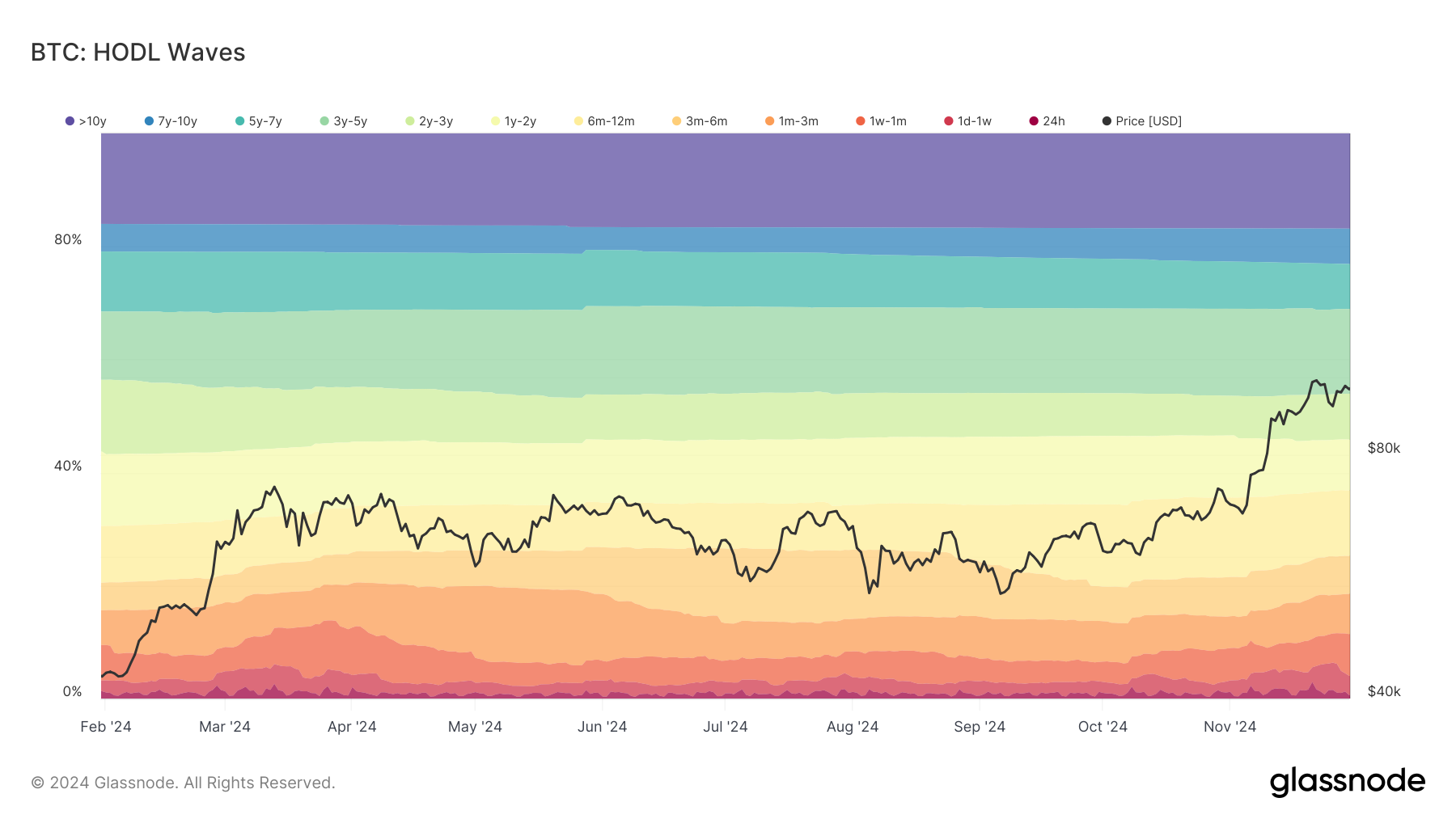

According to Glassnode’s HODL Waves, the percentage of Bitcoin that has been inactive in portfolios for more than 10 years remains high, highlighting the conviction of long-term holders.

However, moves from these portfolios can fuel fear, uncertainty and doubt (FUD) as market participants wonder whether such moves precede a sell-off.

Source: Glassnode

Adding to the market intrigue, significant whale activity was recorded, per Look at chain. In the last four hours, a giant whale has deposited 1,000 BTC ($97.5 million) into Binance.

This same whale had collected 11,657 BTC ($780.5 million) from Binance between March 14 and October 31, at an average price of $66,953 per BTC.

Despite these moves, Bitcoin’s price remains near $95,900, indicating strong demand and market confidence.

Such large inflows into the stock markets usually raise concerns about increased selling pressure, but the market is not yet showing signs of panic, underscoring its current strength.

Historical context: the value of Bitcoin then and now

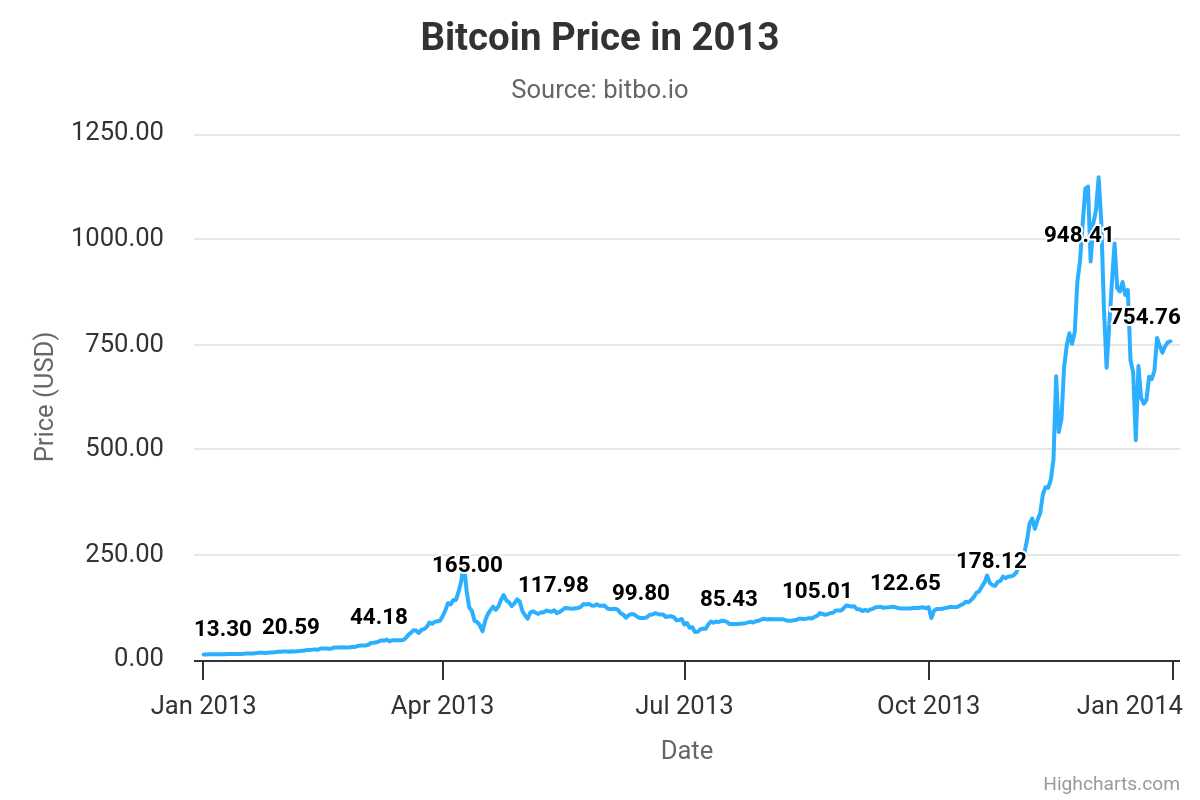

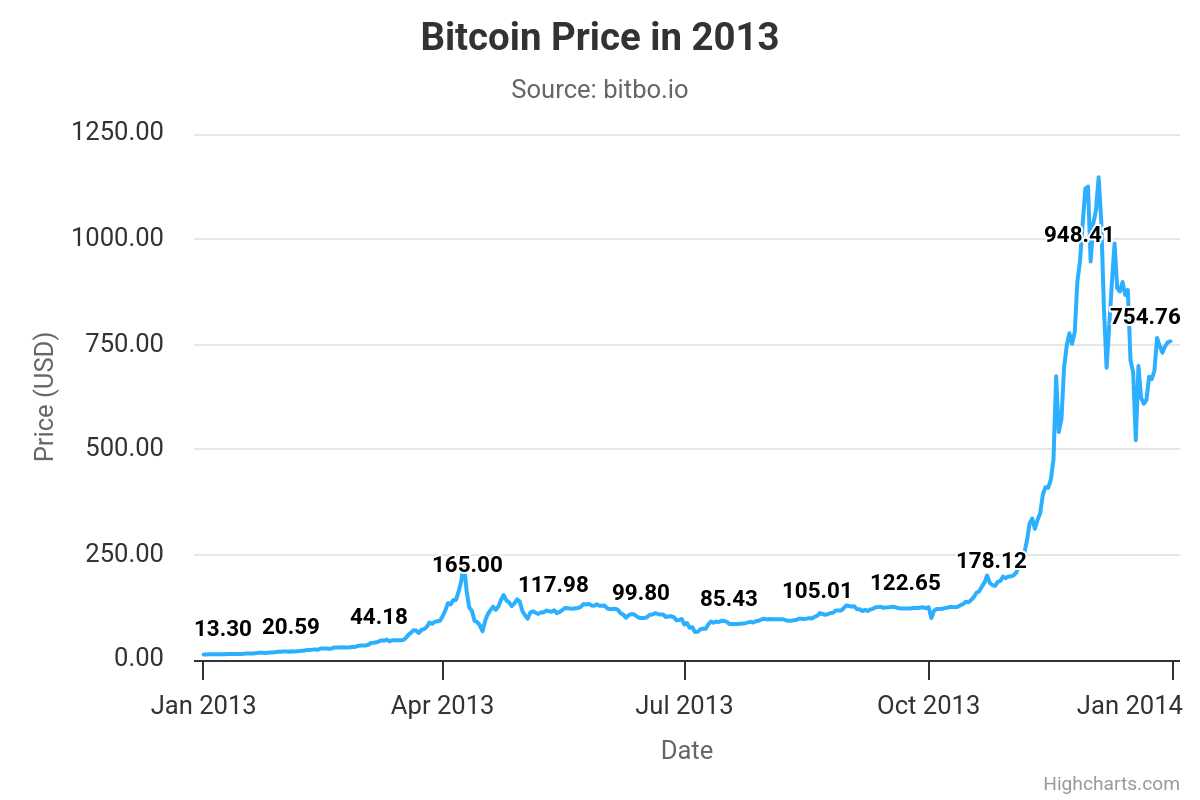

The reactivated wallets were last active during the first major Bitcoin crisis rally at the end of 2013 when the cryptocurrency rose from less than $100 to almost $1,200. This rapid rise was followed by a sharp correction, caused by the infamous Mount Gox collapse.

Source: Bitbo

Read Bitcoin (BTC) price prediction 2024-25

For these long-term holders, the growth in value is monumental. The 429 BTC from the largest wallet, which was worth less than $400,000 in 2013, is now valued at over $41 million.

As Bitcoin continues its climb and surpasses $95,900, more dormant wallets and strategic whale activity are likely to surface. Whether these moves will fuel the next rally or lead to a correction remains to be seen.