- Wif jumped 50.77%in a week.

- Dogwifhat is broken from a descending channel of one month, indicating the possibility of further profit.

Dogwifhat [WIF] broke from a falling triangle of several months after placing profits for three consecutive days. In the last 24 hours, WIF collected from $ 0.508 to a monthly high point of $ 0.612.

At the time of the press, the memecoin was traded at $ 0.6057 – which marked a daily increase of 17.74%. Wif rose from 50.77% per week, with an extension of 8.7% compared to its monthly profit.

The recent price pump shows a new interest rate and demand for WIF in the midst of a growing memecoin racing. With mass winnings, the question is whether Dogwifhat can support them to higher levels.

Can Dogwifhat be retained recent profits?

According to the analysis of Ambcrypto, Dogwifhat experienced a strong up -up momentum at the time of the press, while buyers dominated the market. The RSI of the Memecoin in particular rose to 70 to 70 within four days.

The increase from RSI to such extreme levels reflects mass purchasing pressure with buyers in total control over the market.

That said, while 70 signals overbought territory signals, RSI often climbs to 80 before markets are overheated enough for a correction.

Source: TradingView

In the midst of this buying activity, the upward momentum has been strengthened with the Direct Movement Index (DMI) that rises to be a 6 months high of 37.

With +di rising while -di stays low, it indicates at a strong up momentum, which confirms the potential that the current trend continues.

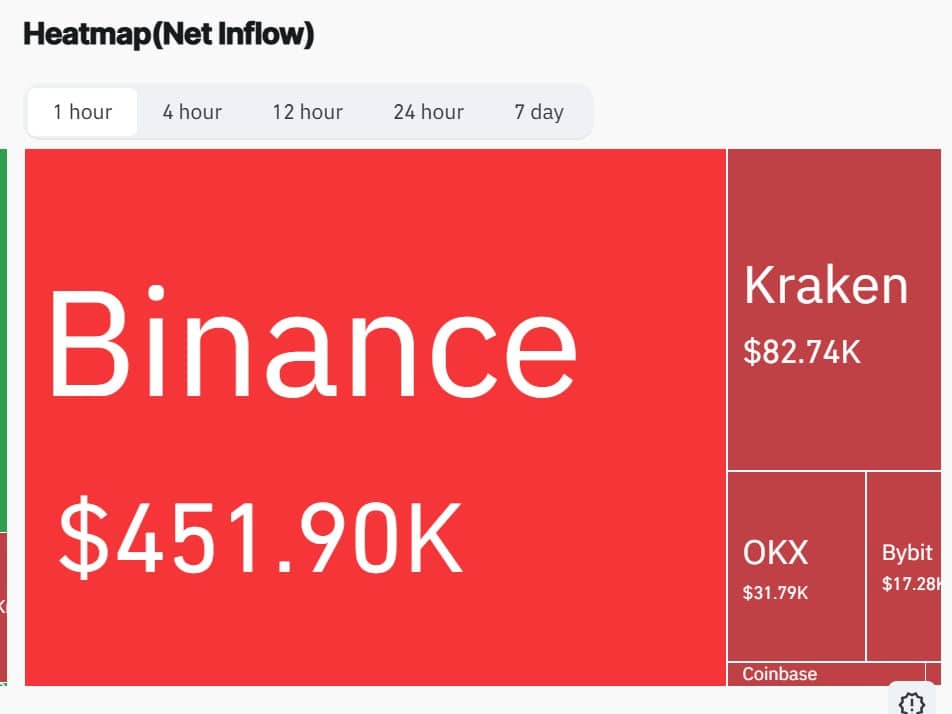

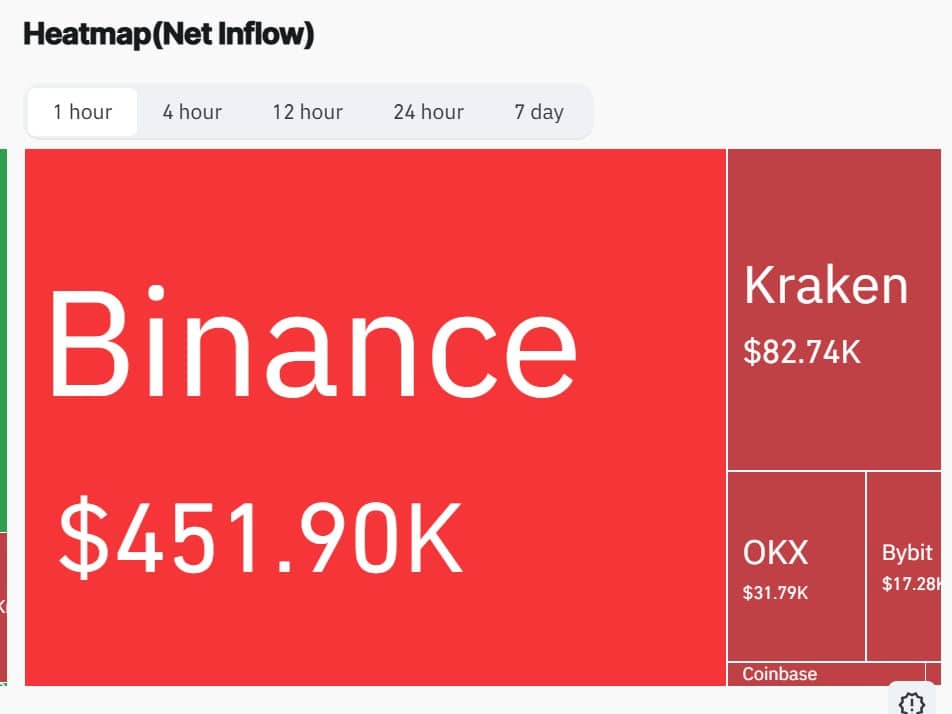

Source: Coinglass

Accumulation is about stock exchanges

Looking further, on short timetables, specifically on cards per hour, Dogwifhat experienced enormous accumulation. In fact, the Netflow Heatmap remained negative about all important stock markets under the aforementioned time frame.

At Binance, for example, Netflow has fallen to -451.9k, which indicates the rising purchasing pressure with more outflows than the inflow.

Source: Santiment

These buyers who enter the market usually take strategic positions, most of them go long.

Dogwifhat even sees a positive financing percentage that is collected by exchanges. This statistics has become positive again after he fell to negative territory the previous day.

A positive financing percentage points to a higher demand for long positions, which suggests that investors are bullish and expect more profit.

Simply put, the momentum of Dogwifhat remained firmly in favor of the bulls.

If buyers keep dominating, Wif could climb to $ 0.79. However, if the question fades as quickly as it seemed, a withdrawal remains to $ 0.54 on the cards.

![Dogwifhats [WIF] 3-day rally has glued eyes, but there is a hidden risk](https://free.cc/wp-content/uploads/2025/04/Gladys-8-1000x600.jpg)