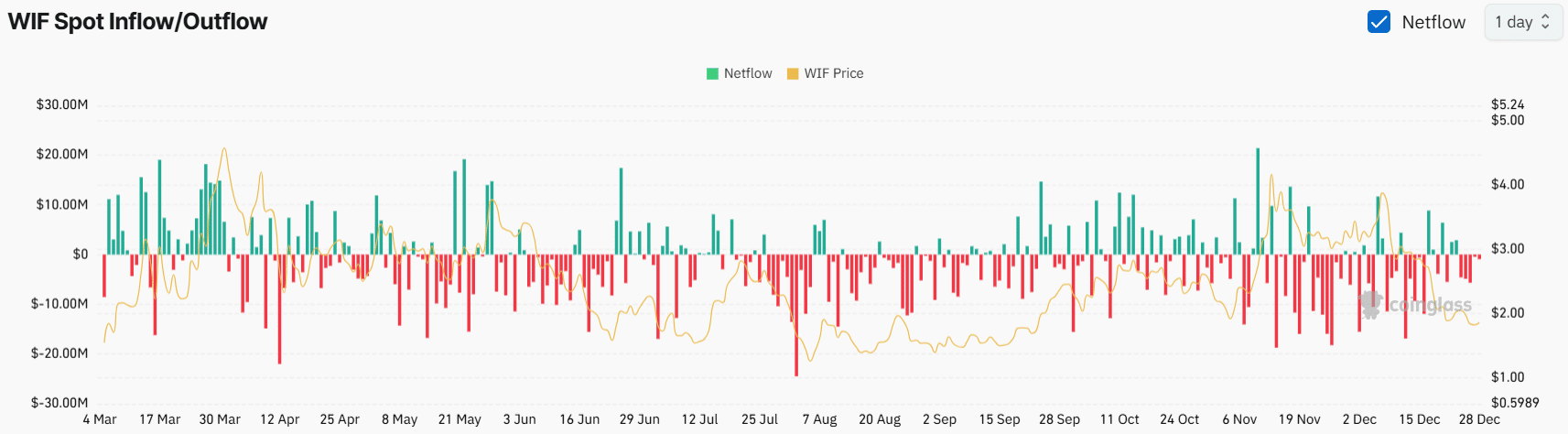

- On-chain statistics showed that crypto exchanges have seen an outflow of $15.9 million

- Despite interest from long-term holders, intraday traders seemed reluctant to build new positions

Dogwifhat (WIF), the popular Solana-based memecoin, is showing signs of potential recovery after a +32% price drop over the past week. Meanwhile, other major assets including Bitcoin (BTC), Ethereum (ETH) and XRP have struggled to gain any momentum, with each at risk of another price drop.

WIF’s price momentum

At the time of writing, WIF was trading around $1.85, having fallen more than 3.10% in the past 24 hours. However, in morning trading the decline was significant. And rising interest and confidence from traders helped the memecoin recover from $1.80 to $1.85.

However, despite this recovery, traders and investors remain cautious. This caution has actually resulted in a 16% drop in trading volume over the same period.

Dogwifhat (WIF) technical analysis and key levels

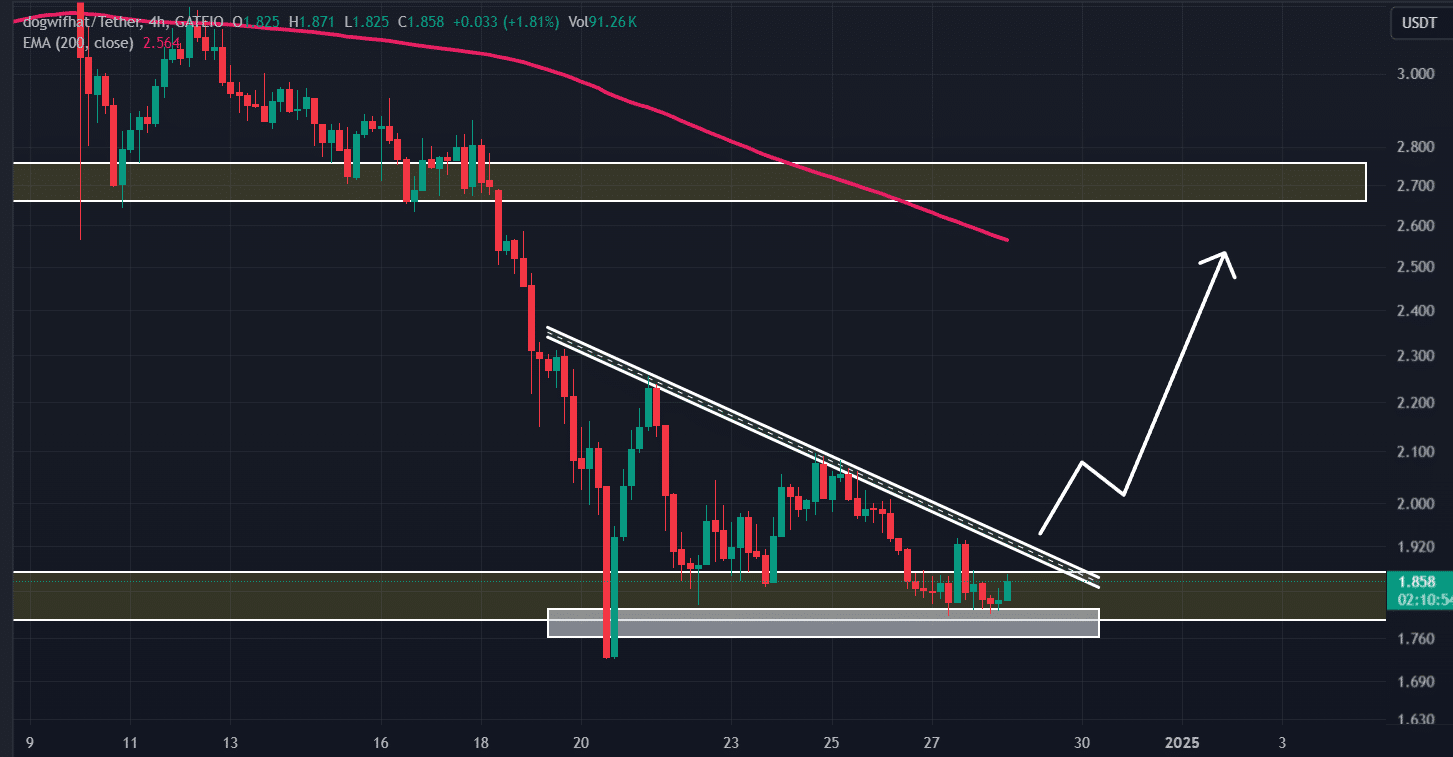

According to AMBCrypto’s technical analysis, WIF seemed bullish as it recently found crucial support around $1.80 and started moving in an upward direction. In addition to support, the memecoin formed a descending triangular price action pattern on the daily time frame and looked poised for a breakout.

Source: trading view

WIF price prediction

Based on the recent price action, WIF was trading within a narrow range of the pattern at the time of writing. If the price breaks a four-hour candle above the $1.945 mark and closes, there is a high chance that the price could rise by 20% and reach the $2.32 level in the near future.

On the upside, WIF’s Relative Strength Index (RSI) appeared to be below the overbought zone – a sign of a possible price recovery.

However, WIF’s bullish outlook will only hold if it breaks out of the pattern and closes a four-hour candle above $1,945. Otherwise, it may not be able to sustain its recovery on the charts. .

Statistics about the chain share mixed feelings

In addition to WIF’s bullish outlook, traders and investors have shown strong interest in the memecoin, as reported by on-chain analytics firm Coinglass.

Source: Coinglass

In fact, WIF spot inflow/outflow data showed that cryptocurrency exchanges have seen an outflow of a significant $15.9 million worth of WIF memecoins. This hinted at a potential upside rally and an ideal buying opportunity.

Despite long-term holders accumulating the memecoin, intraday traders may be hesitant to build new positions. This was evidenced by the fact that WIF’s Open Interest fell by 4% in 24 hours – indicative of the liquidation of traders’ positions.