- DOGS has recovered after a significant dip of 9%, with analysts predicting a 40% rally following a breakout from a falling wedge.

- Whale trades have declined, while Open Interest in DOGS has increased dramatically, indicating potential upside momentum.

Dogs [DOGS]a dog-themed memecoin built on The Open Network [TON] blockchain and inspired by the dog character ‘Spotty’, has been experiencing volatile market performance since its inception.

The coin, which has a total supply of 550 billion tokens of which more than 516 billion are already in circulation, is mainly distributed to Telegram users based on their activity.

Although DOGS has captured the attention of the crypto community, the price action has been a rollercoaster ride, with profits and losses fluctuating.

The memecoin reached an all-time high of $0.001633 on August 28, marking a remarkable achievement. However, shortly after reaching this peak, DOGS experienced a significant decline, down 32% from record levels.

In the last 11 hours, DOGS registered an all-time low, trading at $0.0009802.

Despite this sharp dip, DOGS showed signs of recovery, with a price increase of 9% over the past day, bringing the memecoin to a current trading price of $0.001094 at the time of writing.

DOGS: Technical outlook and forecast

Renowned crypto analyst Captain Faibik has shared a bullish forecast for DOGS, highlighting a potential near-term recovery. In a recent post on X (formerly Twitter), Captain Faibik noted,

“DOGS breaks out of a falling wedge on the hourly timeframe chart. A bullish rally of +40% is expected in the short term. Don’t miss the ride.”

Source: Captain Faibik

For context, a falling wedge is a technical chart pattern that is often seen as a bullish indicator. It typically occurs during a downtrend, where the price experiences lower highs and lower lows, creating a narrower range.

When the price breaks the upper trendline, it marks the end of the downtrend and the beginning of a bullish rally.

In the case of DOGS, Captain Faibik’s analysis suggested that a breakout from this pattern could lead to a 40% rally in the short term, providing optimism for the memecoin’s holders.

Whale transactions and open interest

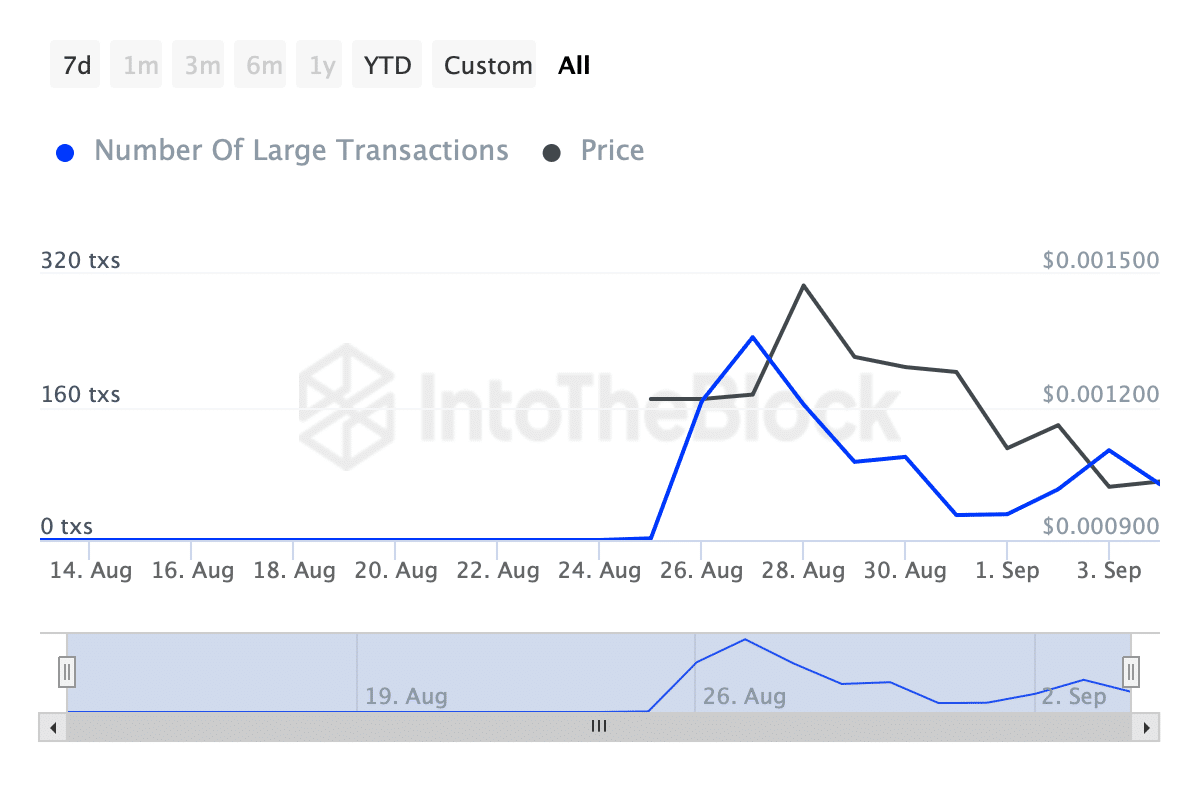

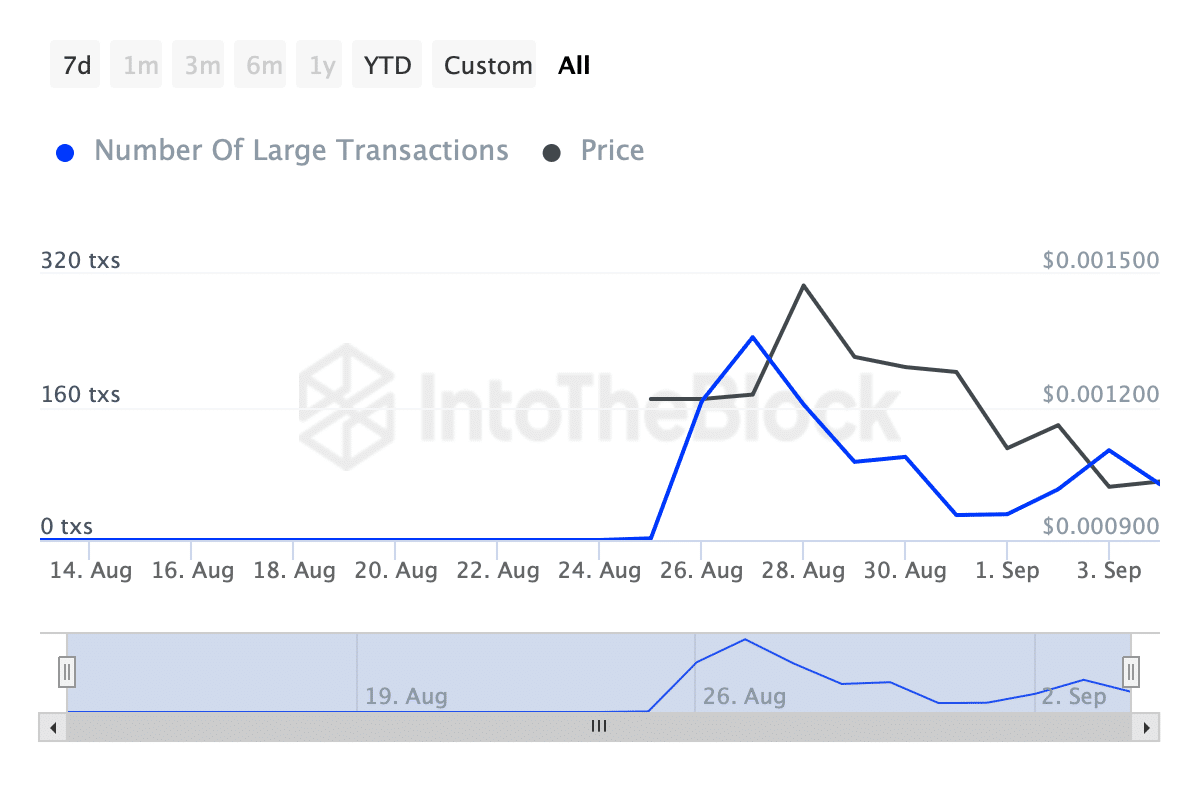

The basics of DOGS also offer some interesting insights. According to facts from IntoTheBlock, whale transactions (those above $100,000) have dropped noticeably in recent days.

Source: IntoTheBlock

After a peak of 244 transactions on August 27, the number of large transactions has now fallen to just 64 at the time of writing.

This decline in whale activity could indicate a cooling of interest from major investors, which could impact the currency’s price movement in the short term.

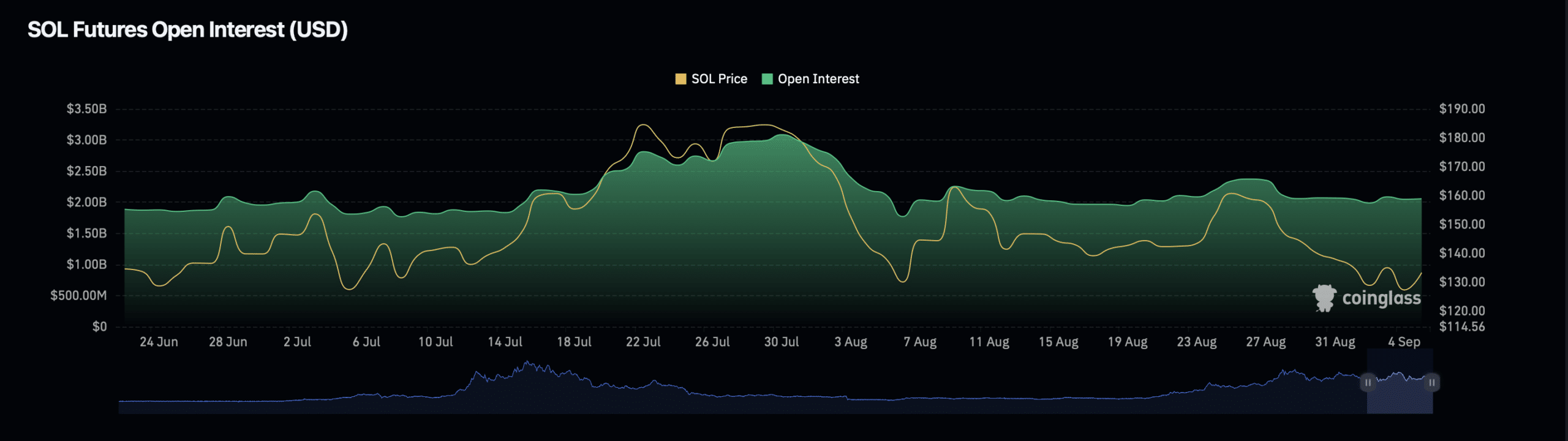

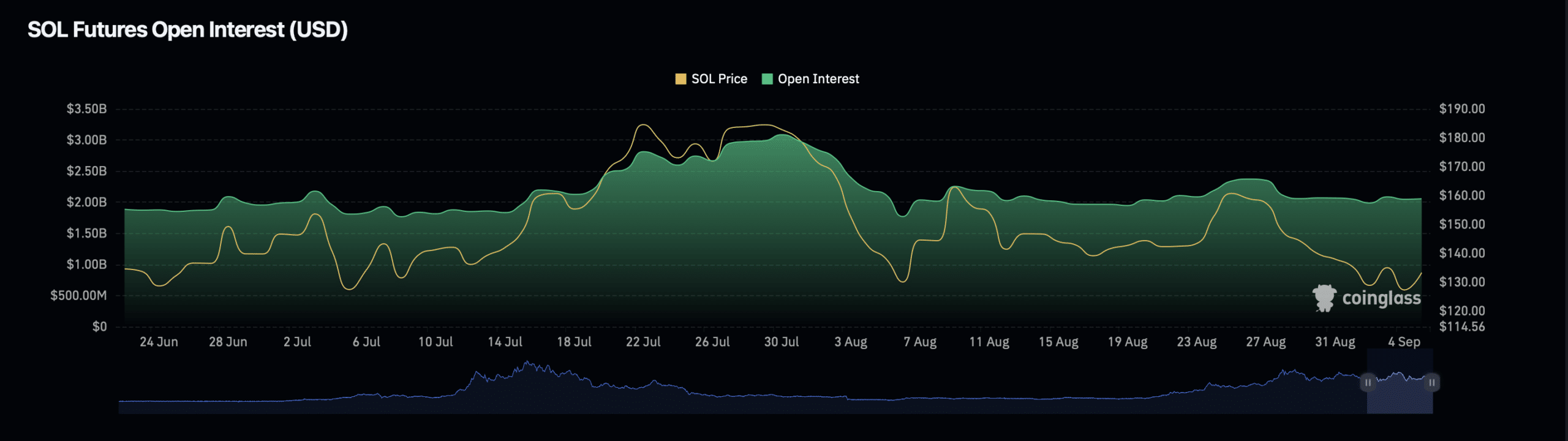

On the other hand, DOGS Open Interest – a measure of the total value of outstanding derivatives contracts – has shown a significant increase.

Facts from Coinglass revealed that the memecoin’s Open Interest increased by 13.84% to reach a valuation of $124.56 million.

Source: Coinglass

Read Dogs’ [DOGS] Price forecast 2024–2025

Furthermore, Open Interest increased by 28.41% and stood at $1.40 billion at the time of writing.

This increase in Open Interest suggested that traders were positioning themselves for potential price action, which could fuel further volatility in DOGS market performance.