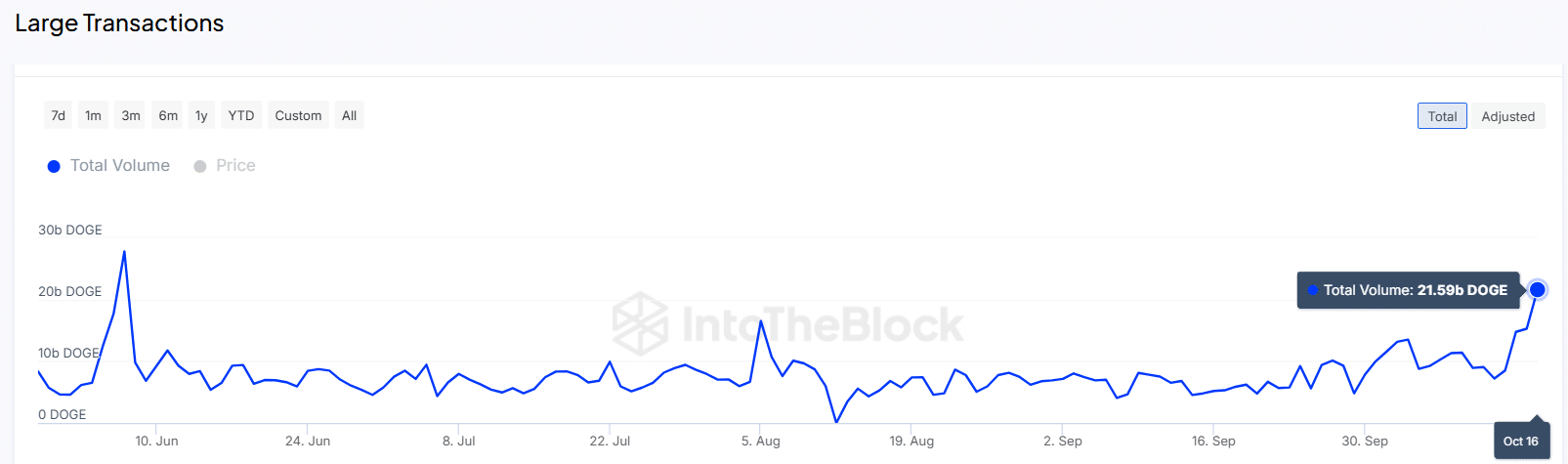

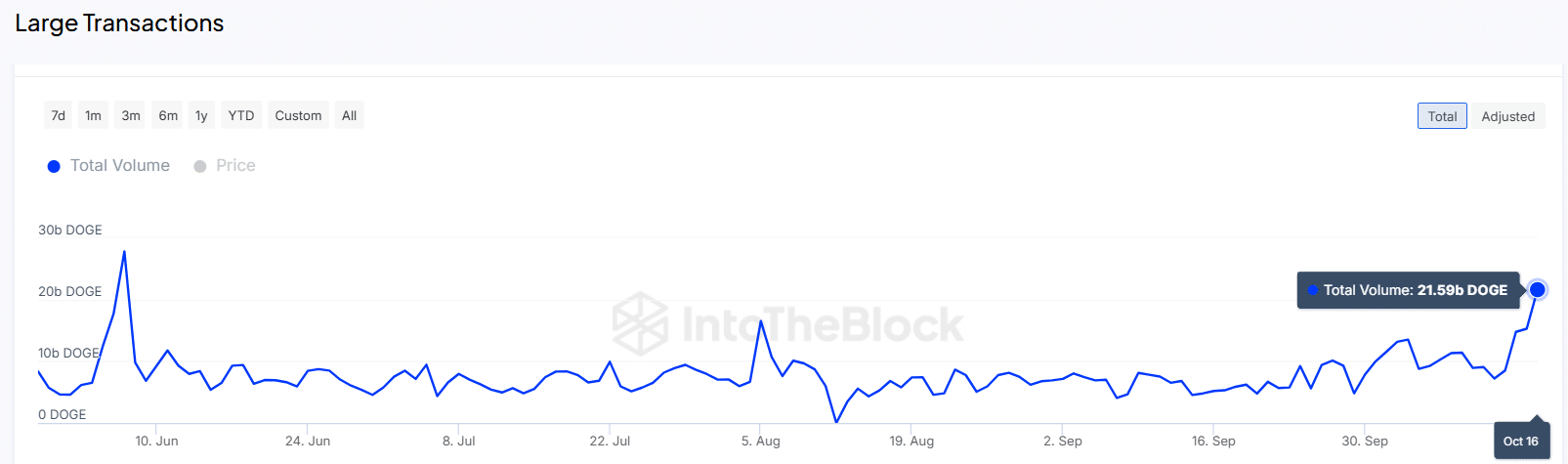

- Major Dogecoin transactions increased from 15.27 billion to 21 billion.

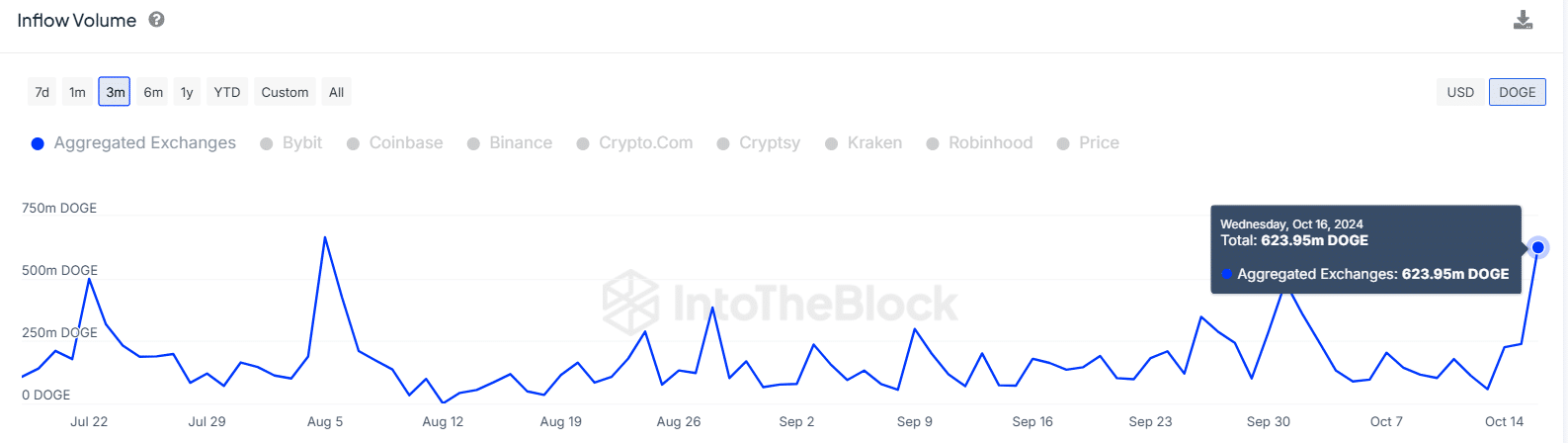

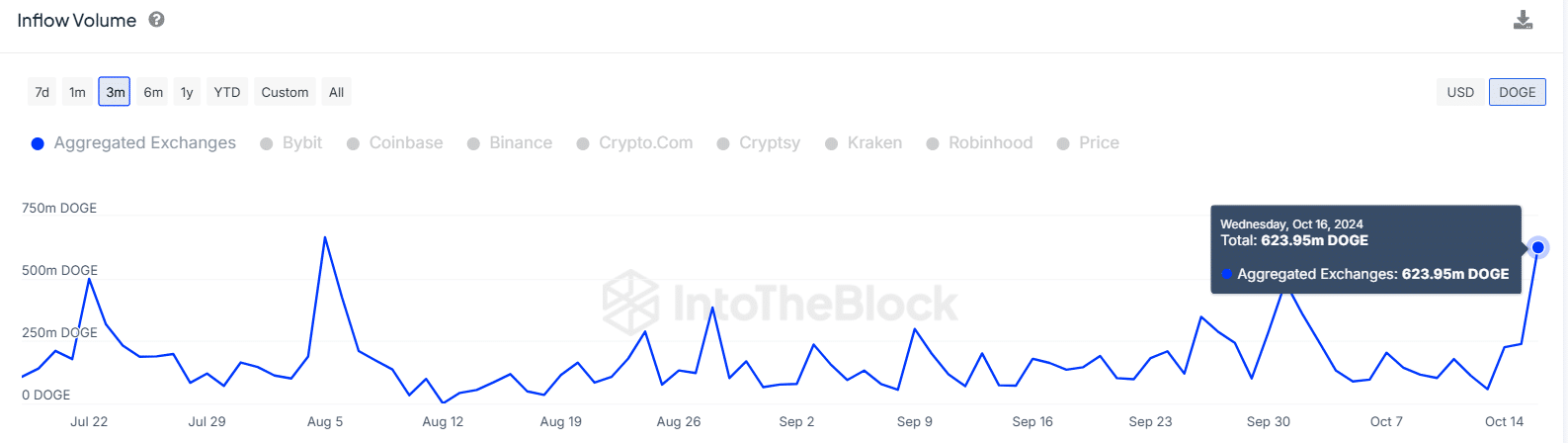

- Foreign exchange inflows also hit an eight-week high of over 623 million, which could increase selling pressure.

Dogecoin [DOGE]the largest memecoin by market capitalization, is one of the best performing cryptocurrencies among the top ten largest cryptos. Over the past seven days, DOGE is up 13% to trade at $0.12 at the time of writing.

Data from CoinMarketCap shows that these gains came from the growing interest in the meme coin, as trading volumes were up almost 60% at the time of writing.

Whales have likely contributed to the rising volumes, as large DOGE transactions jumped 40% to a four-month high of 21 billion tokens.

Source: IntoTheBlock

This spike shows that whale activity around DOGE is increasing, which could be a cause of the recent volatility. However, a closer look at the foreign exchange inflow data shows that this spike could also lead to selling pressure.

On October 16, more than 623 million DOGE tokens were sent to exchanges. This was the highest level of currency inflows in two months.

Source: IntoTheBlock

The spike in large trades and currency inflows suggests that DOGE is in a distribution phase where whales are making profits, which could weaken the uptrend.

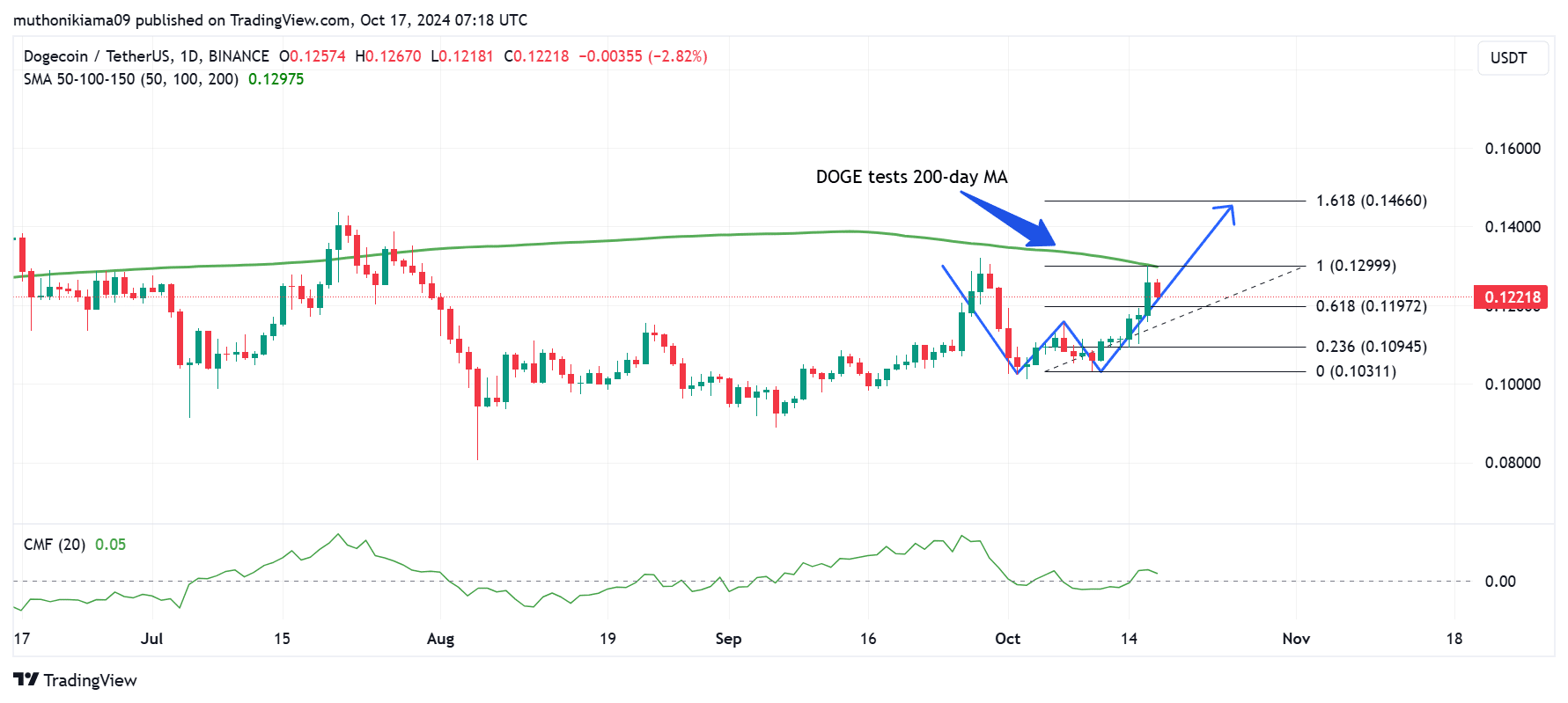

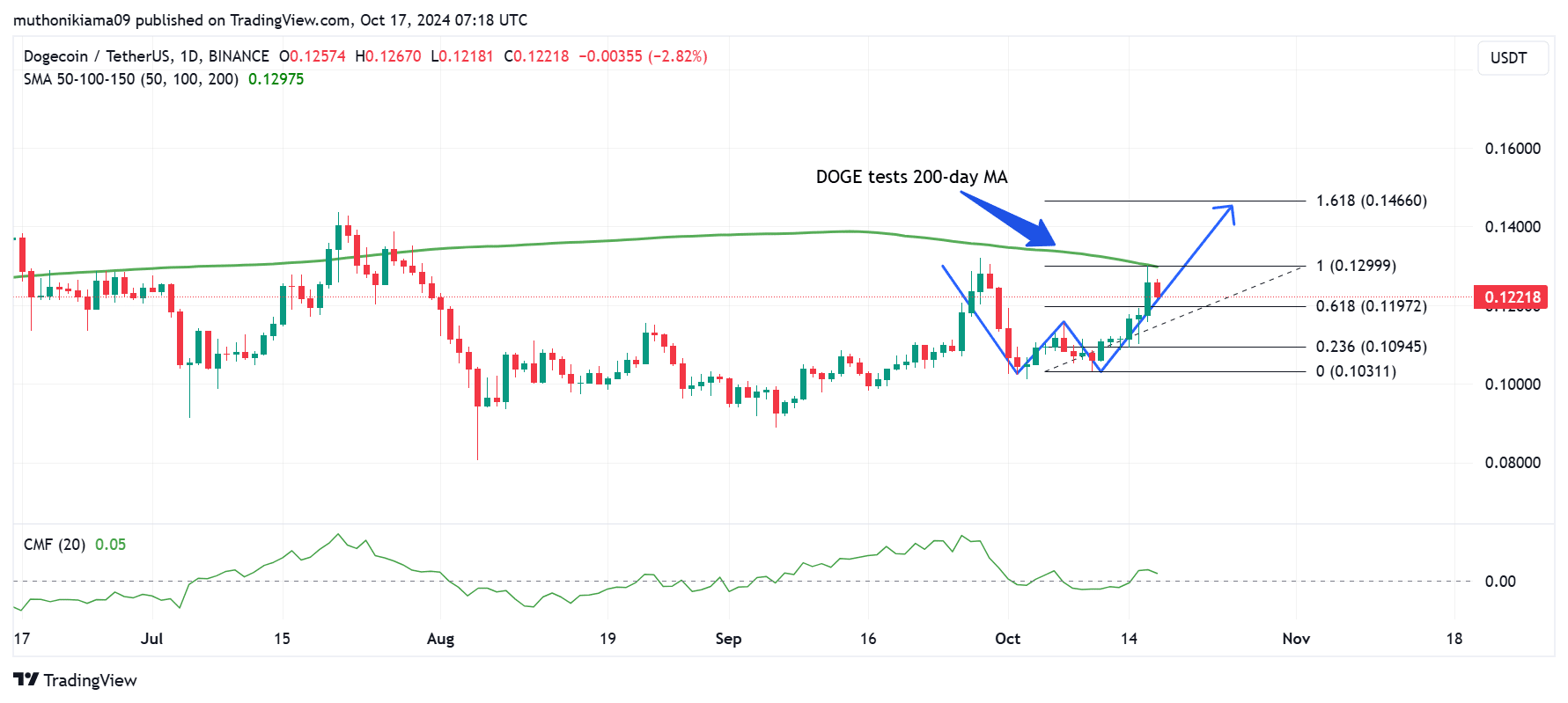

Dogecoin Price Analysis

A look at the daily chart shows that DOGE has completed a bullish W pattern. This is a bullish reversal pattern that indicates DOGE is resuming its uptrend, with the next price target at $0.146.

Source: Tradingview

However, for DOGE to make this breakout, resistance must move above the 200-day Simple Moving Average (SMA). Chaikin money flow is positive, showing that buyer pressure remains higher than selling pressure, which could support this breakout

If DOGE fails to reverse this resistance, it could fall to test support at the Fibonacci level of 0.236 ($0.109).

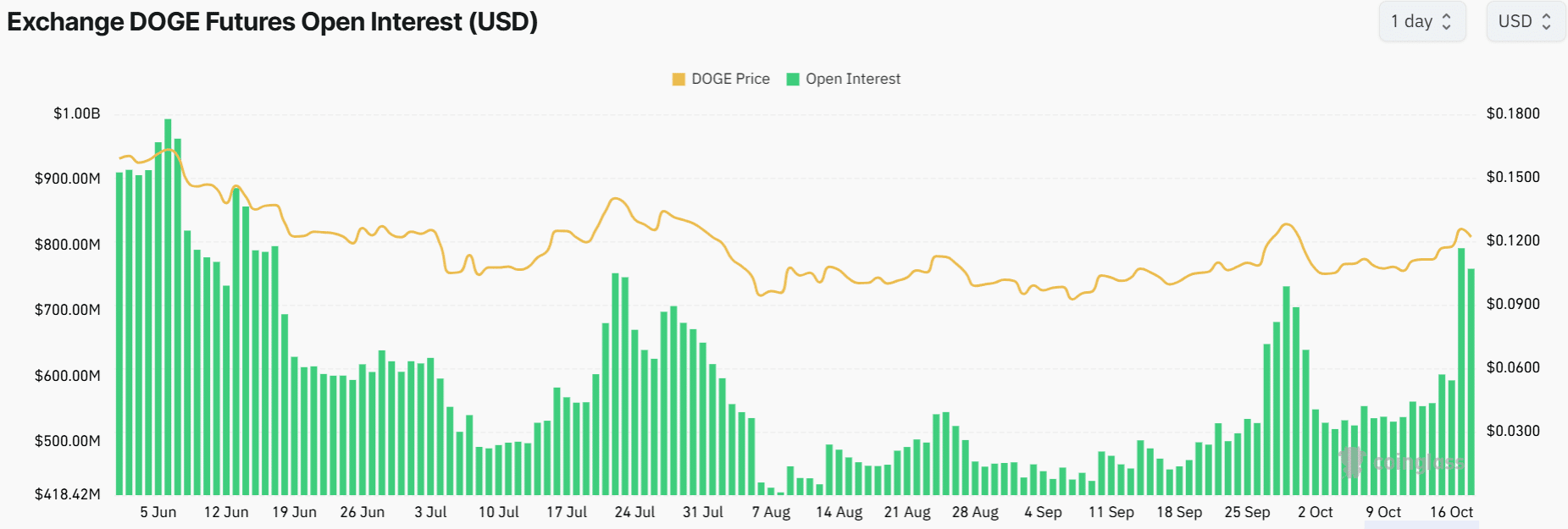

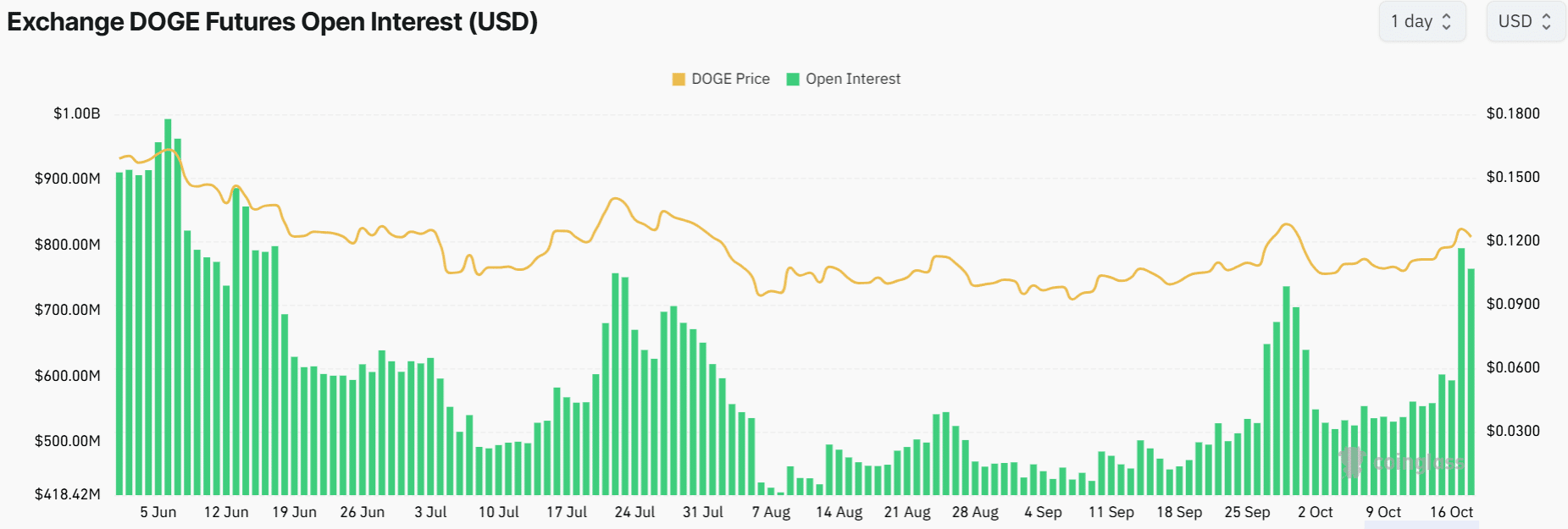

Dogecoin’s recent gains appear to be driven by a spike in open interest to a four-month high of $795 million at the time of writing. This increase shows that traders are opening new positions on DOGE.

Source: Coinglass

Considering that the long/short ratio has fallen from 1 to 0.86 at the time of writing, the spike could indicate that traders are starting to open short positions.

Realistic or not, here is DOGE’s market cap in BTC terms

Moreover, this increasing interest from futures traders in DOGE is not visible in the spot market. As AMBCrypto reported, the number of Dogecoin holders has increased decreased with more than 106,000 in the past week.

This indicates that the meme coin is in a distribution phase where traders are likely to book profits.