- Dogecoin’s price fell 10%, approaching its lowest point since the fourth quarter of last year.

- Memecoins have a unique look that can help them thrive even in tough markets.

The recent crypto crash has wiped out the gains of memecoin from early 2025, and Dogecoin [DOGE] was no exception. A huge amount of 70 million DOGE tokens flooded into Binance, causing a series of red candlesticks.

But here’s a catch: With fear still gripping the market, the allure of high-risk, high-reward memecoins may still attract investors looking for quick, short-term profits.

Dogecoin is now showing some signs that point in that direction.

Be careful: history can repeat itself

Flashback to the week before Christmas 2024: the crypto market plummeted after the Fed ruled out rate cuts and sent Bitcoin [BTC] down 15% in just two weeks.

While altcoins followed suit, Dogecoin’s price took an unexpected turn.

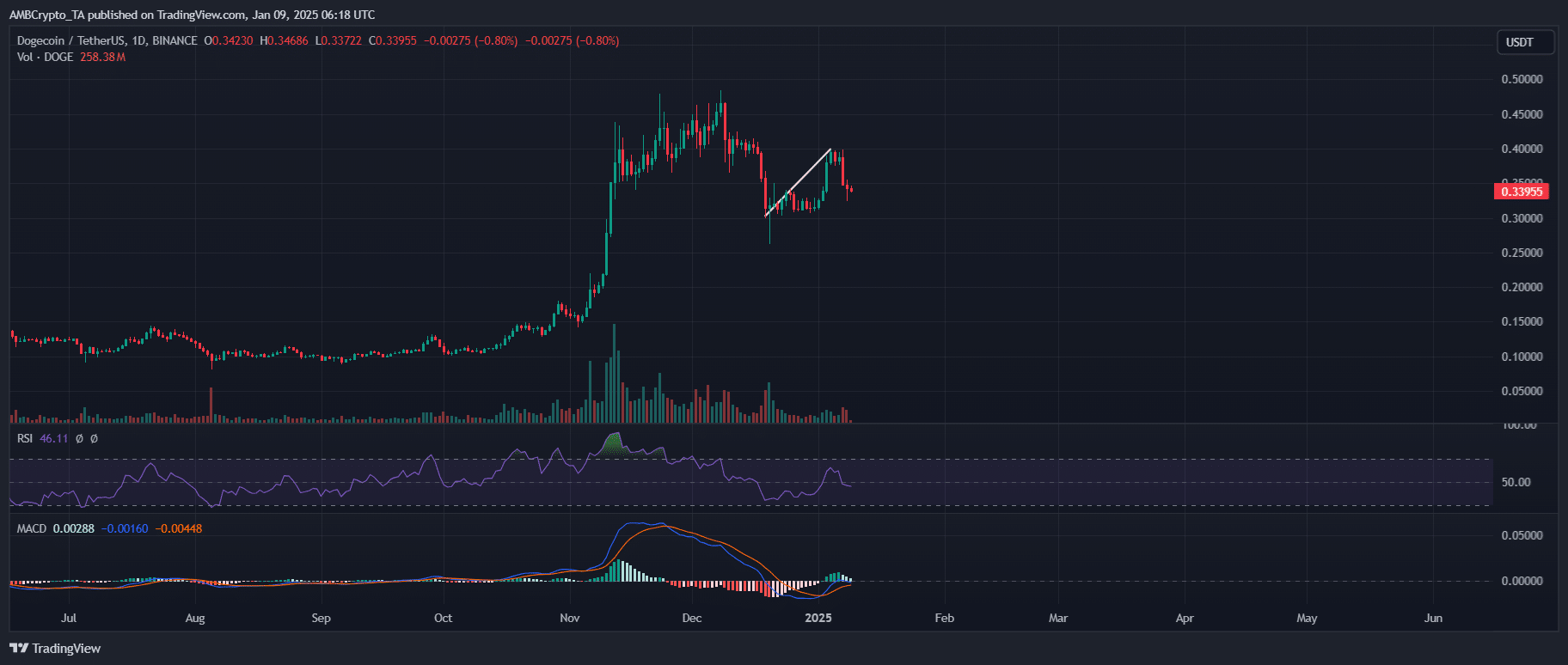

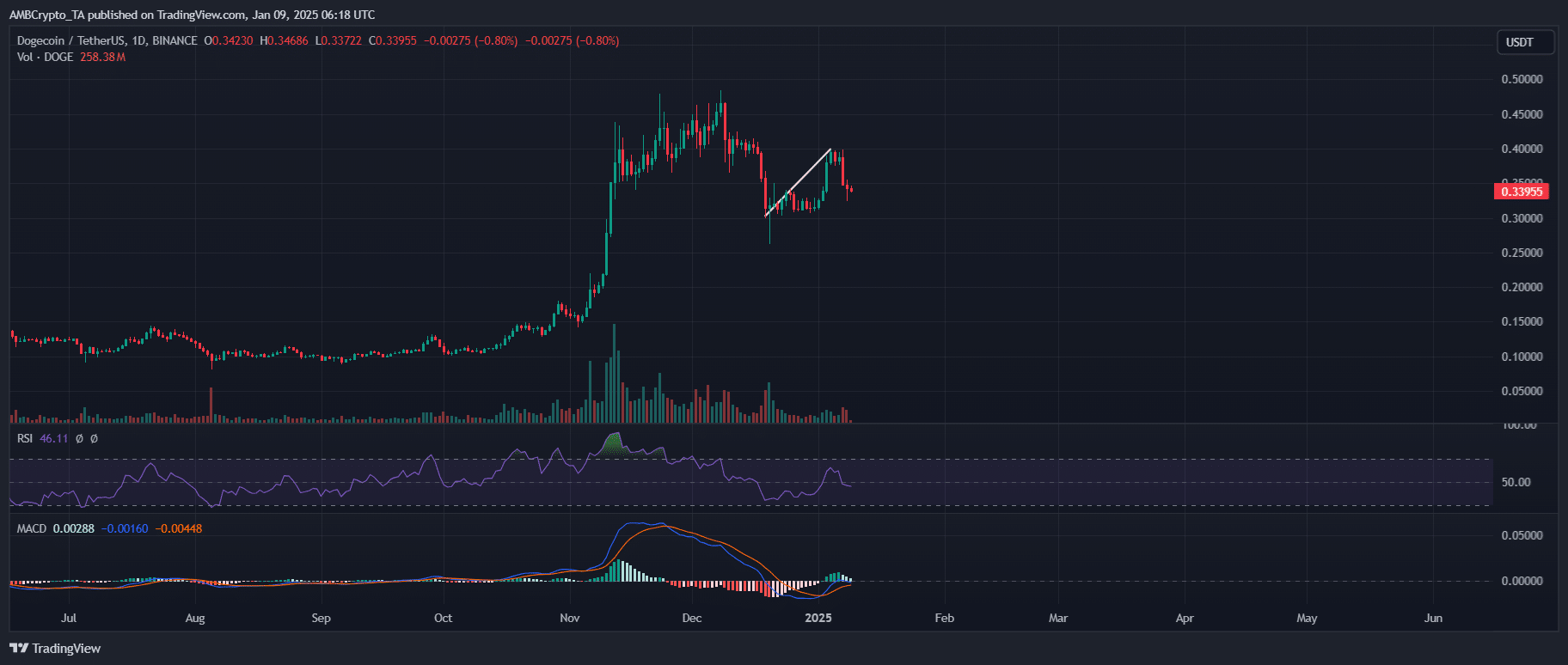

After hitting a yearly high of $0.48 in early December, DOGE plummeted to $0.30 in just two weeks. The DOGE/BTC pair turned red, signaling a shift of capital into other high-cap alts.

But just as the market crashed, DOGE made a strong recovery against Bitcoin, closing the first week of 2025 around $0.40. It was clear: investors flocked to memecoins in search of quick, short-term returns.

Source: TradingView

With Bitcoin down 8% after another Fed shock, the market sees a potential dip to $90,000. This could give DOGE another opportunity to raise capital, just like last time.

But even if history is on his side, it’s no guarantee. Still, from a psychological point of view, Dogecoin could have the edge.

After the heavy losses in the market, the reward of investing in BTC should outweigh the risk – and right now that doesn’t seem to be the case.

Given the 10% drop in Dogecoin’s price, both historical trends and the current market mood suggest that now may be the perfect time to start accumulating.

Let’s take a closer look at the data in the chain to see if it supports this theory.

The Dogecoin price has great potential

The inflow of $70 million in DOGE tokens to Binance matches the more than 10% decline over the past three days, wiping out early 2025 gains.

However, that 18% increase to $0.40 in the first week was driven by a massive 400% spike in whale accumulation.

This is a bullish sign, and as the volume indicators show upside potential and the MACD is still bullish, we could see another round of heavy accumulation in the coming days.

On the Futures side, Open Interest (OI) is down slightly by 1.29% to $3.43 billion, but long positions are still betting on a recovery. Meanwhile, most traders are short circuit DOGE – another potentially bullish signal.

If the whales jump in again, which seems very likely given the current setup, we could see a short squeeze that forces traders to buy back DOGE, potentially driving the price of Dogecoin even higher.

Read Dogecoins [DOGE] Price forecast 2025–2026

With historical trends, psychological factors, and volume metrics all pointing to accumulation, it is not too far-fetched to expect a rise in DOGE in the coming days.

However, to achieve this, the “risk factors” in the market must remain high, causing investors to turn to memecoins such as Dogecoin.