- Dogecoin miners hold their coins for long periods of time.

- DOGE appears poised for long-term gains.

Dogecoin [DOGE] continues to show strength, like other cryptocurrencies, as traders anticipate the historically bullish fourth quarter since the integration of blockchain technology into the financial markets.

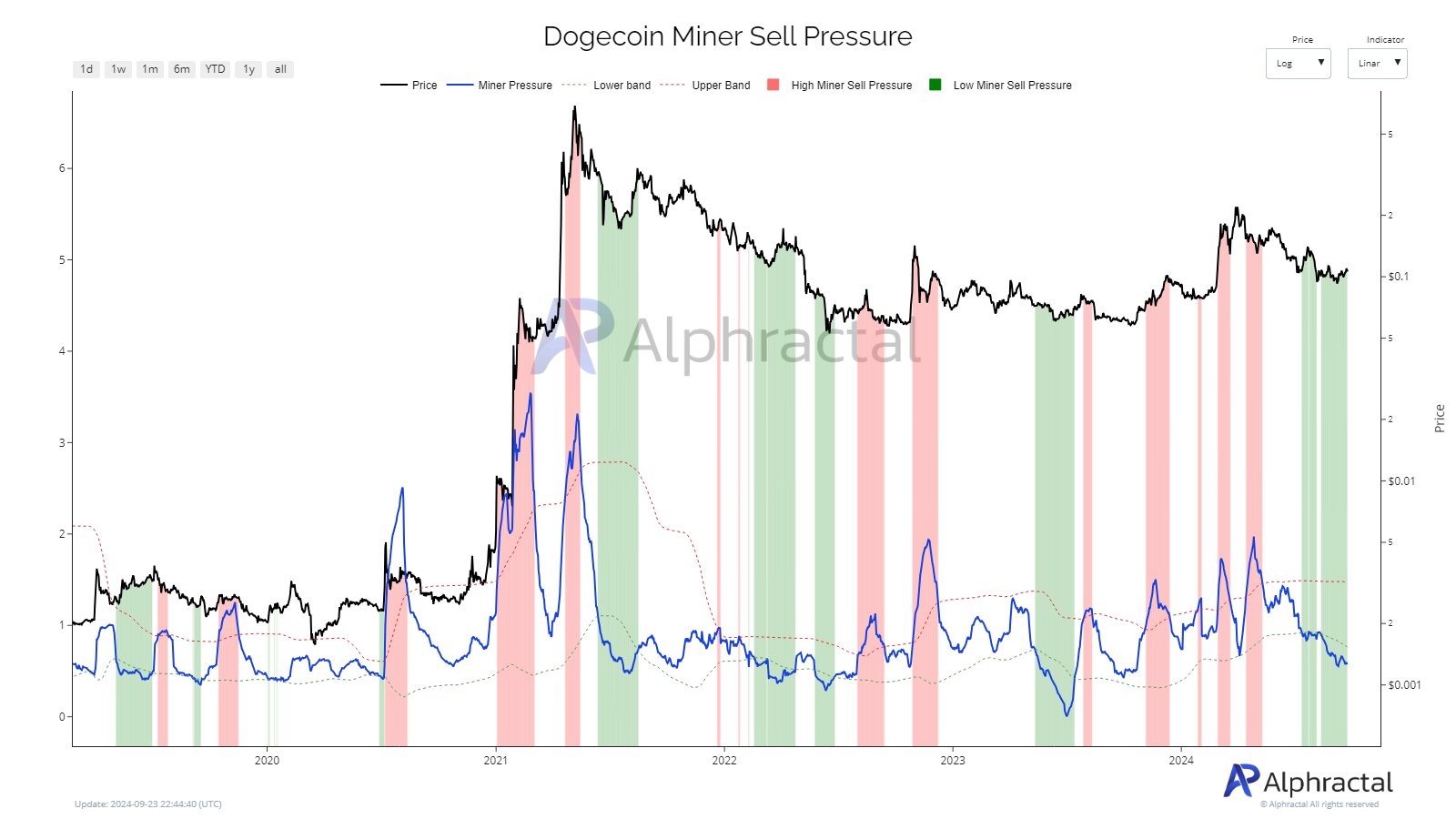

Dogecoin miners in particular seem to be playing the market intelligently, taking advantage of price spikes to sell their mined coins.

Sell signals are slow to emerge, indicating that miners are holding their DOGE for longer periods before selling.

This low selling pressure indicates that a price spike may be in the offing, as historical trends suggest that such quiet periods often precede a significant increase in the DOGE price.

Source: Alpharactal

Could DOGE be preparing for a price spike?

Dogecoin’s long-term prospects

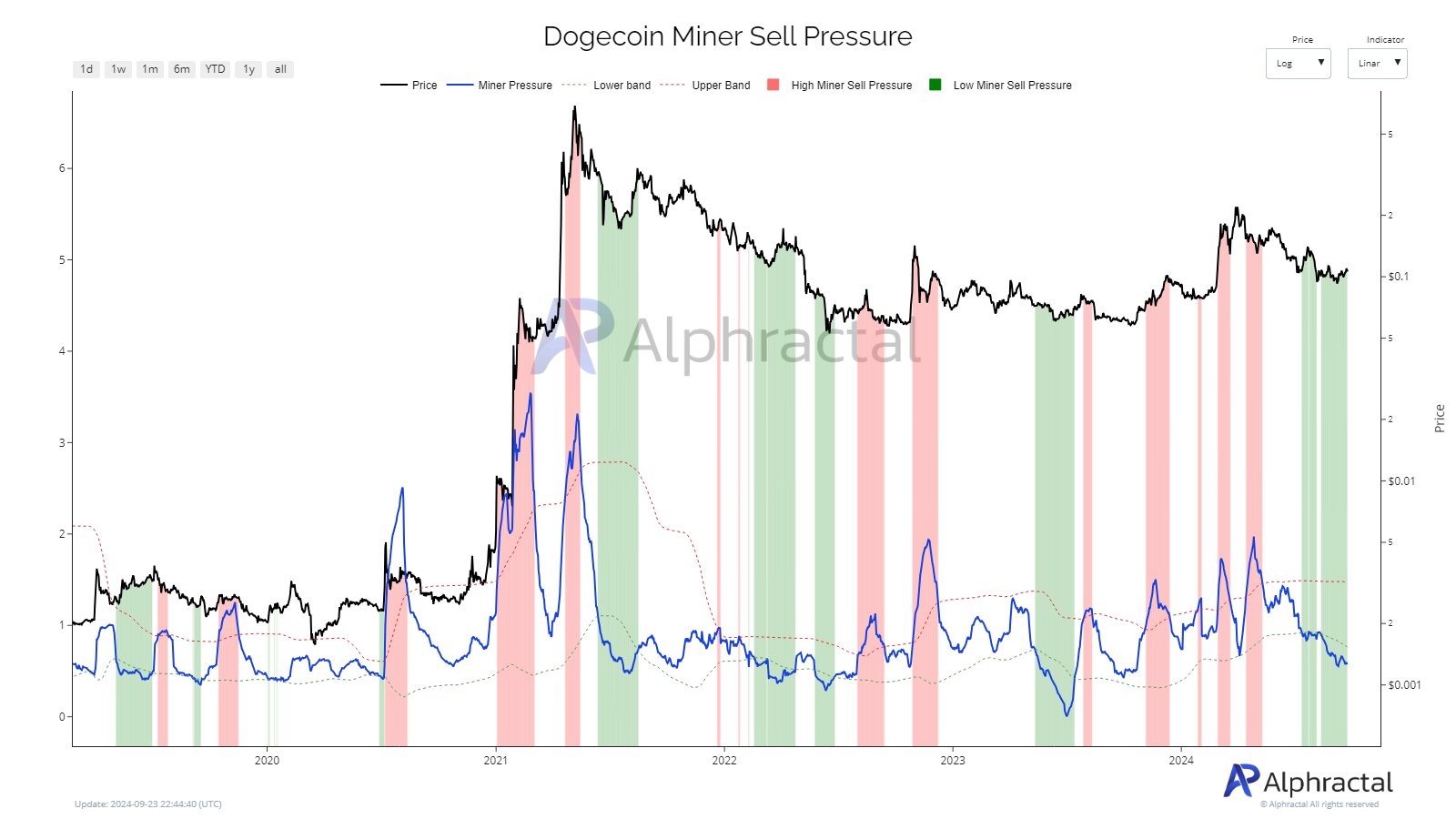

A closer look at Dogecoin’s weekly chart reveals that it may be entering a growth phase. This phase historically repeats itself in every crypto cycle. It typically lasts about 90 days and DOGE could reach major new highs.

The chart indicates three consecutive weeks of green candles, which supports the idea of DOGE price growth. If this trend continues, a conservative estimate suggests that DOGE could reach $0.15 by the end of 2024.

In a more optimistic scenario, if history repeats itself, DOGE could reach $0.5 by March 2025. By the end of that year, the price could even reach $0.75.

Source: TradingView

For long-term holders, this could be a favorable entry point as DOGE price is currently resting above a strong longer-term support level.

This upward trend further reinforces the idea that low selling pressure from Dogecoin miners could be the calm before the storm, indicating that a price spike is imminent.

Balance by companies that look good for whales

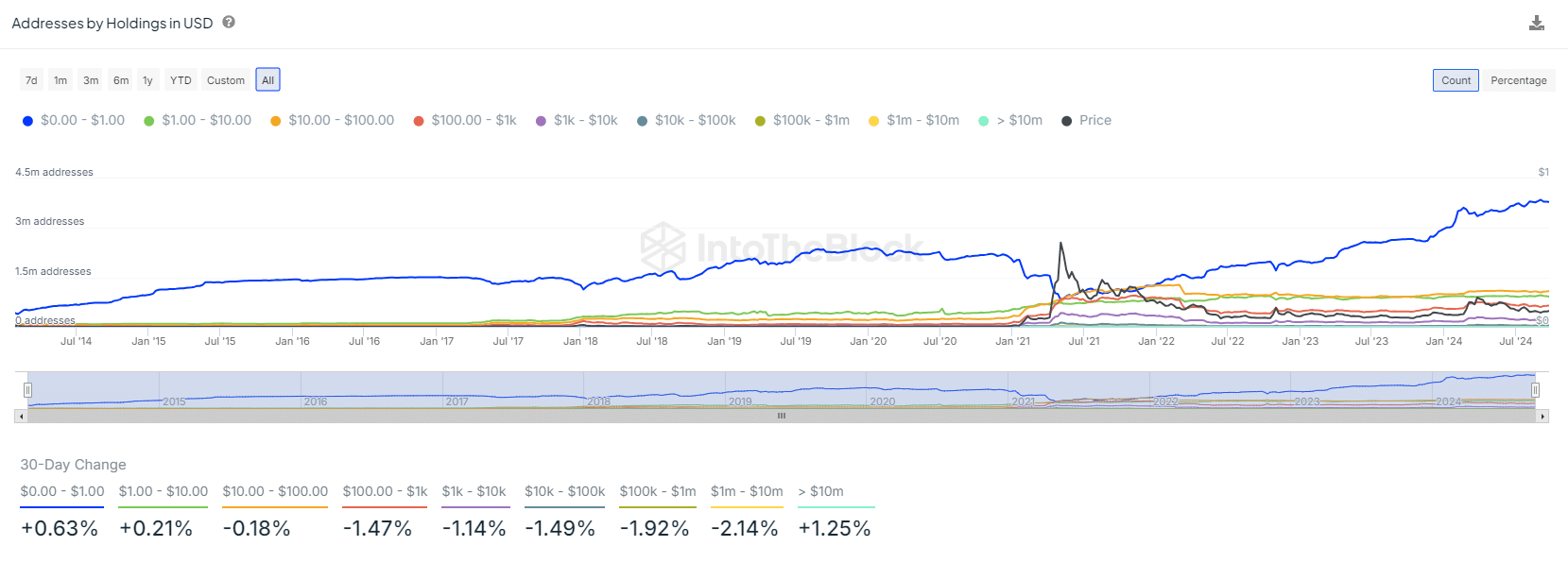

Dogecoin whales, who own more than $10 million in DOGE, increased their holdings by 1.25%. This increase in whale activity reinforces the bullish outlook for Dogecoin.

It suggests that key players are preparing for a possible price increase.

While other categories of DOGE holders have experienced a slight decline, this impact is minimal. Whales make up the majority of circulating DOGE, reducing the overall market weight of these declines.

However, traders should still approach DOGE with caution and ensure they have a clear strategy in mind before entering trades.

Source: IntoTheBlock

Key liquidation levels and price targets

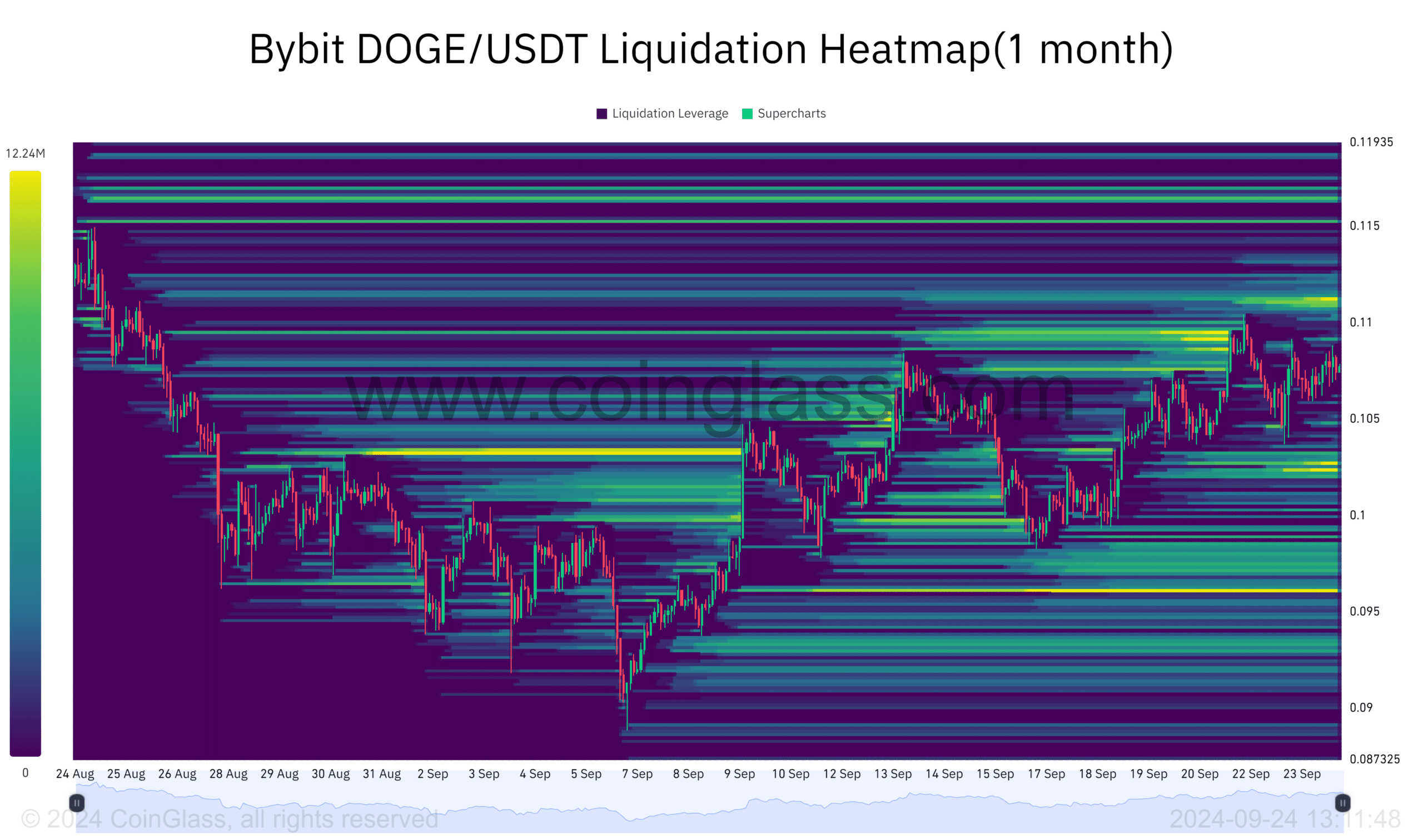

Another factor driving DOGE’s upward move is the significant concentration of liquidation levels above $0.11.

Some whales have placed approximately 30.93 billion DOGE in short positions in this zone, as a previous AMBCrypto analysis showed.

The easier these liquidation levels are exceeded, the higher the DOGE price can rise as more short positions are liquidated.

As DOGE approaches these levels, traders may see increased volatility, but if DOGE can break through, it could trigger a sharp rise.

Source: Coinglass

Read Dogecoins [DOGE] Price forecast 2024–2025

The price of Dogecoin looks set to rise as selling pressure remains low and whales continue to accumulate DOGE.

With the right timing and strategy, DOGE could be on the cusp of another price peak, driven by increasing whale activity and favorable market conditions.