Este Artículo También Está Disponible and Español.

In a freshly shared four-hour graph of the DOGE/USDT trade savings on Binance, crypto analyst Carlos Garcia Tapia warns a potential disadvantage for Dogecoin as a weekend trade. “If bears break this pattern, it becomes ugly … Especially since the weekend comes,” warns Tapia.

Dogecoin price crash income?

His graphics posted Via X shows a rising wedge formation that encounters a confluence of resistance between $ 0.338 and $ 0.343, as well as a remarkable support zone in the $ 0.31 region.

The graph emphasizes higher lows (marked as “ll” on the graph) that forms the lower limit of a rising wedge. In the meantime, the overhead resistance (a rectangular zone around $ 0.338 – $ 0.343) has repeatedly closed up price movements. This wedge seems to compress a price promotion – often an arrangement for a considerable outbreak or breakdown.

A horizontal resistance zone around $ 0.34 stands out. The price of Doge has tried to have several short -term movements above this level, but failed to secure a confirmed outbreak, suggesting that sellers firmly defend that zone.

Related lecture

On the other hand, a green box of approximately $ 0.310 marks an area where buying interest is historically picked up. Below that level, the graph refers to a lower support marking near $ 0.262, which indicates a more substantial potential decrease if the wig pattern breaks down decisively.

The analyst points specifically to the coming weekend as a joker sign. Historically, lower trade volumes can aggravate volatility on Saturday and Sunday. If Dogecoin does not hold its rising trend line – firmly near $ 0.328– $ 0.330 – and the liquidity thinning, the price can quickly test the lower support around $ 0.310, or possibly slide to the $ 0.262 zone if the sales momentum accelerates.

Related lecture

Although an outbreak above $ 0.343 could invalidate this Bearish arrangement, Tapia’s warning nut underlines the meaning of a possible demolition of the wed formation. Weekend price promotion often differs from midweek patterns due to reduced participation, which means that a sharp movement in both directions could unfold faster than normal.

Doge must contain $ 0.31

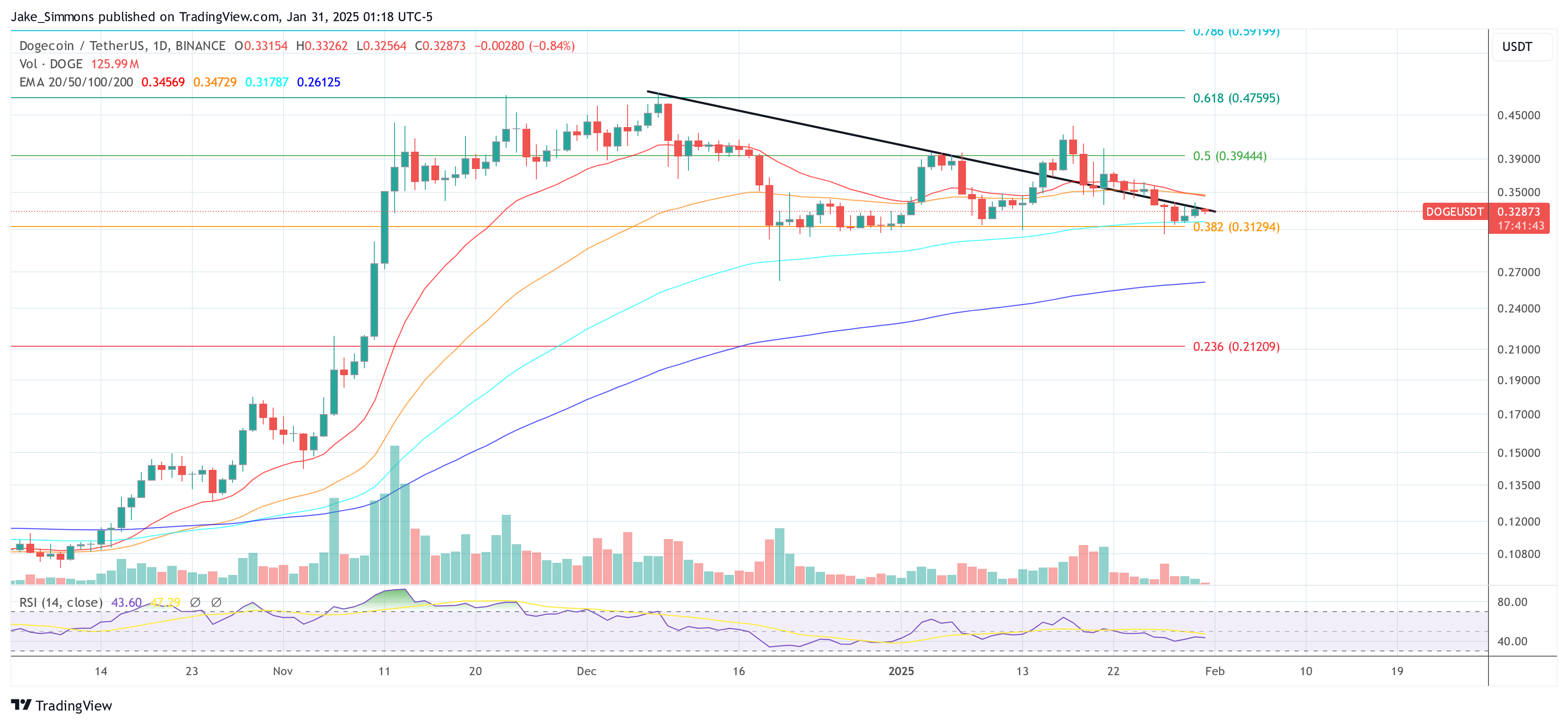

The daily graph supports Tapia’s position. There, Dogecoin (Doge) is under intensification of downward pressure while the price action hugs a persistent downward trend line. After reaching a local high in December, Doge has withdrawn from the most important exponential advancing averages (EMAs). The 20-day EMA (currently around $ 0.3457) and the 50-day EMA (near $ 0.3473) both have a lower curved, signaling of decreasing short-term momentum.

A glance at the graph reveals that Doge is now just above the 0.382 Fibonacci retracement level, calculated around $ 0.313. This FIB zone has supported the most crucial support since mid-December, but every decisive daily closure below can accelerate the sale. Traders keep a close eye on the 100-day EMA (about $ 0.3179), which is sandwiched just above this FIB level.

If the price cannot defend the area between $ 0.313 and $ 0.317, the eyes will turn to the 200-day EMA at around $ 0.2613 as a long-term critical support. If this level also breaks down, the 0.236 FIB could quickly become a reality for $ 0.212.

Featured image made with dall.e, graph of tradingview.com