Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

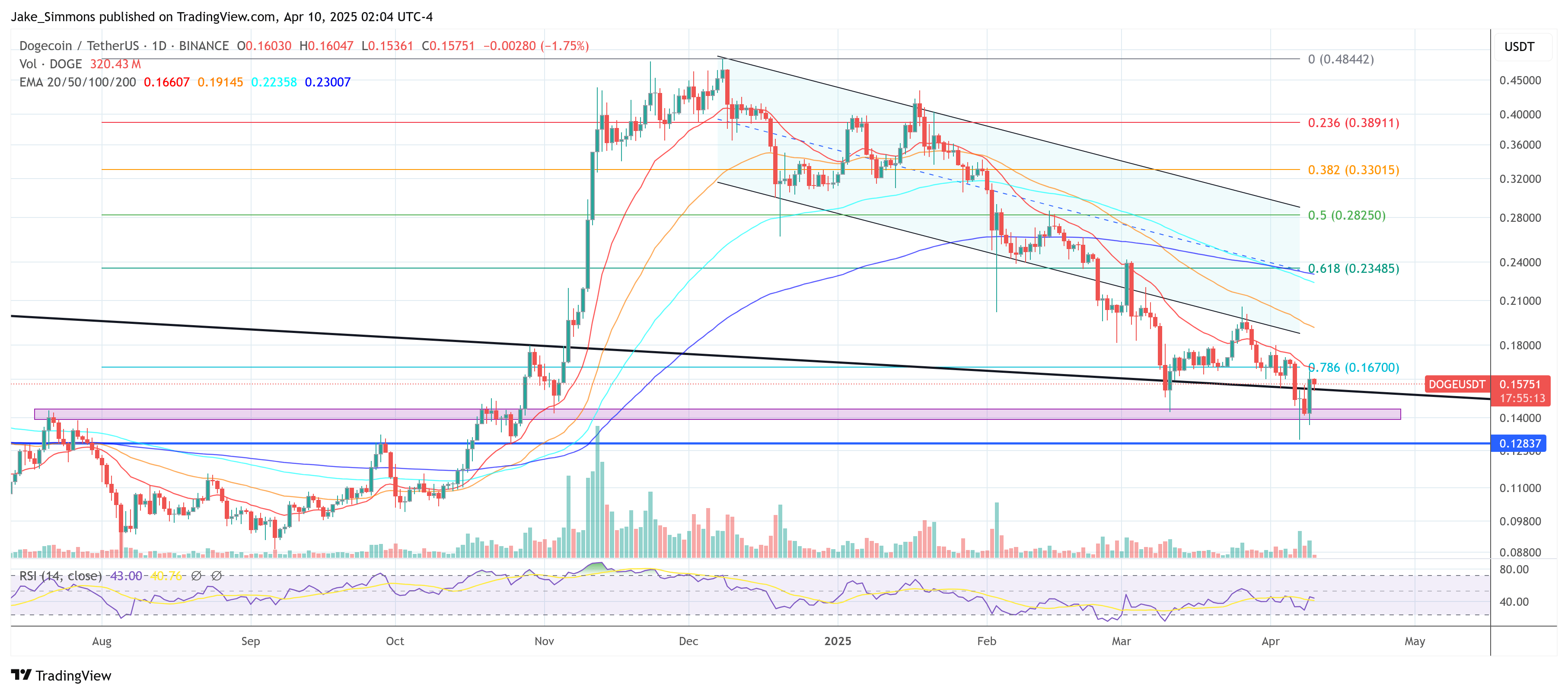

The momentum of Dogecoin is dramatically shifted after macro -economic developments and a series of strong technical signals, according to Crypto -Chartist Kevin (@kev_capital_ta). Yesterday, the broader cryptomarkt rose after President Donald Trump has announced a 90-day break for rates for 75 countries, while China’s rates were increased to 125%.

Bullish Momentum for Dogecoin

The news sent Bitcoin above the $ 80,000 threshold and catapulted various large altcoins, including Dogecoin, higher. “Daily bullish divergence on Dogecoin that starts playing here,” Kevin writes In his last update, although he warns that “macro news this clearly has the most to do, but the graphs gave us hints in advance that the chance was not guaranteed, but there.”

In the hours after the announcement of the rate, Dogecoin gathered by around 13%, so that the signs of a bullish divergence Kevin marked two days earlier for the first time. “Dogecoin came down again to test the lines of the bull market structure in the sand” and somehow it was, although it was neatly broke neatly earlier in the day, the daily candle could recover slightly above this level of support, “he explained.

Related lecture

Kevin noted that the parallel between the bullish divergence of Dogecoin and that of Bitcoin on the daily period of time, which suggests that renewed optimism for doge can be partially bound to the leading cryptocurrency -above his own crucial support.

Kevin’s Outlook is rooted in a multi-week assessment of the technical attitude of Dogecoin. At the end of March he pointed to a “weekly demand candle” and the “last line of the bullmarkt support”. He emphasized how crucial it remains for Dogecoin to keep above 0.139.

Doge price objectives

He also described the potential benefit of Dogecoin as “phenomenal” compared to the risk of losing that $ 0.139 threshold for multiple weekly closures. The Fibonacci retracement and expansion levels of the graph suggest potential technical goals for Dogecoin that remain relevant to traders looking for directional signals.

Related lecture

These levels start with the 0.236 on $ 0.09038, the 0.382 at $ 0.13827, the 0.5 on $ 0.19039, the 0.618 to $ 0.26216, the 0.65 by $ 0.28529 and the 0.70 at $ 0.3310. Higher up, the 0.786 reads $ 0.41339, the 0.88 is $ 0.54210, the 1.0 level marks $ 0.73839 and the 1,0866 is $ 0.93377.

Further on the expansion side is the 1,272 at $ 1,54348 and the 1,414 appears at $ 2,26813. The analyst underlined that “as long as BTC owns these levels and does not lose $ 70K, I am absolutely fond of this place on doge”, and emphasize how the wider market could form along these technical markers of Dogecoin.

In the coming days, however, will reveal whether Dogecoin can build on at the momentum that arises in the midst of the rate-related market dumping and or the worn expression “The trend is your friend” will keep Dogecoin enthusiasts in a bullish mindset.

At the time of the press, Doge traded at $ 0.15751.

Featured image made with dall.e, graph of tradingview.com