- Dogecoin’s daily active addresses have soared, indicating strong on-chain activity and growing demand.

- Rising volumes and bullish liquidation data indicate continued momentum despite a slight decline in Open Interest.

Dogecoin [DOGE] has shown strong signs of breaking the falling wedge pattern, creating excitement among investors.

Priced at $0.127, up 4.96% in the past 24 hours at the time of writing, DOGE has caught the attention of traders.

However, the main question remains: can this bullish momentum push Dogecoin to the long-awaited $1.60?

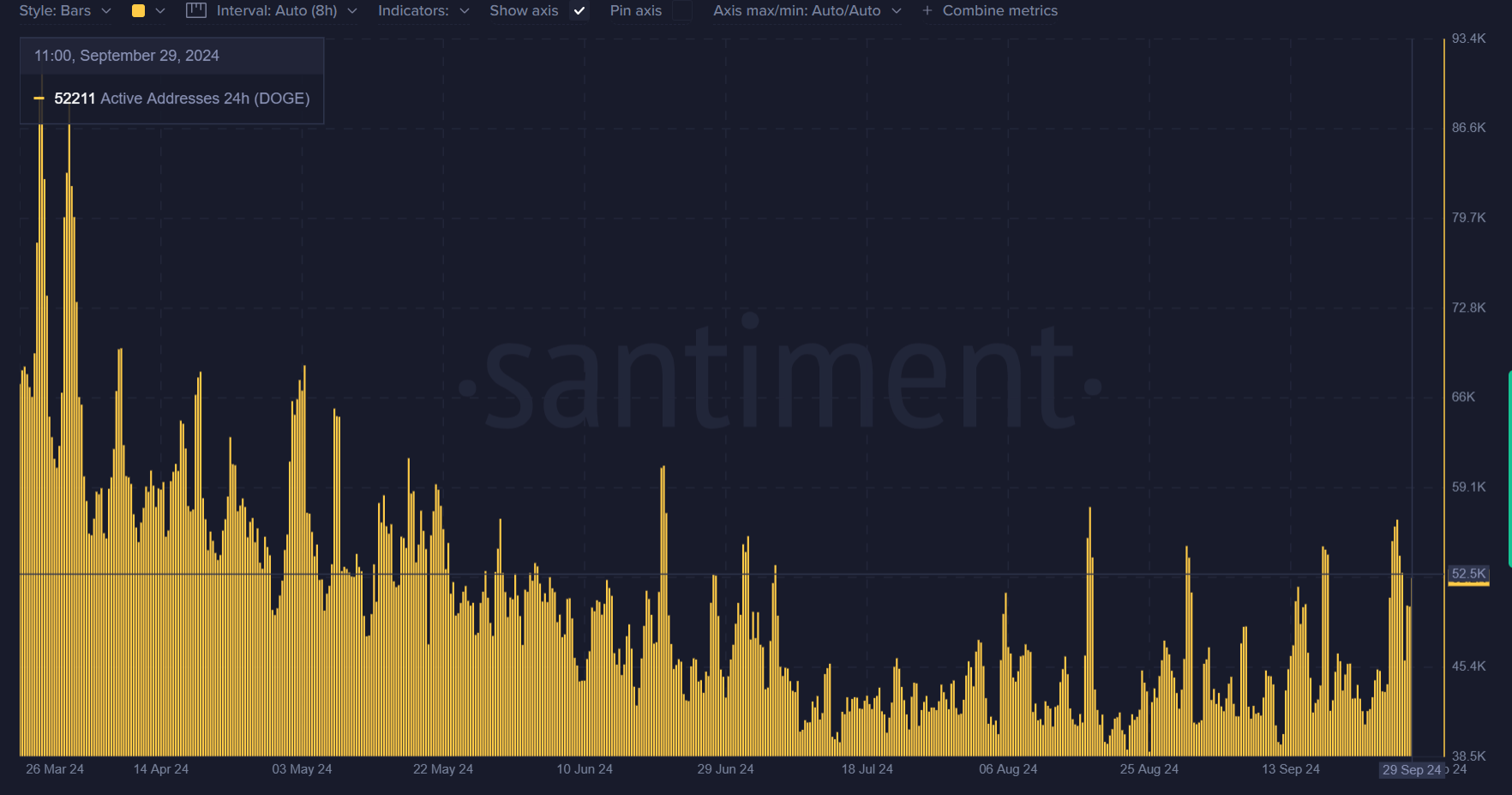

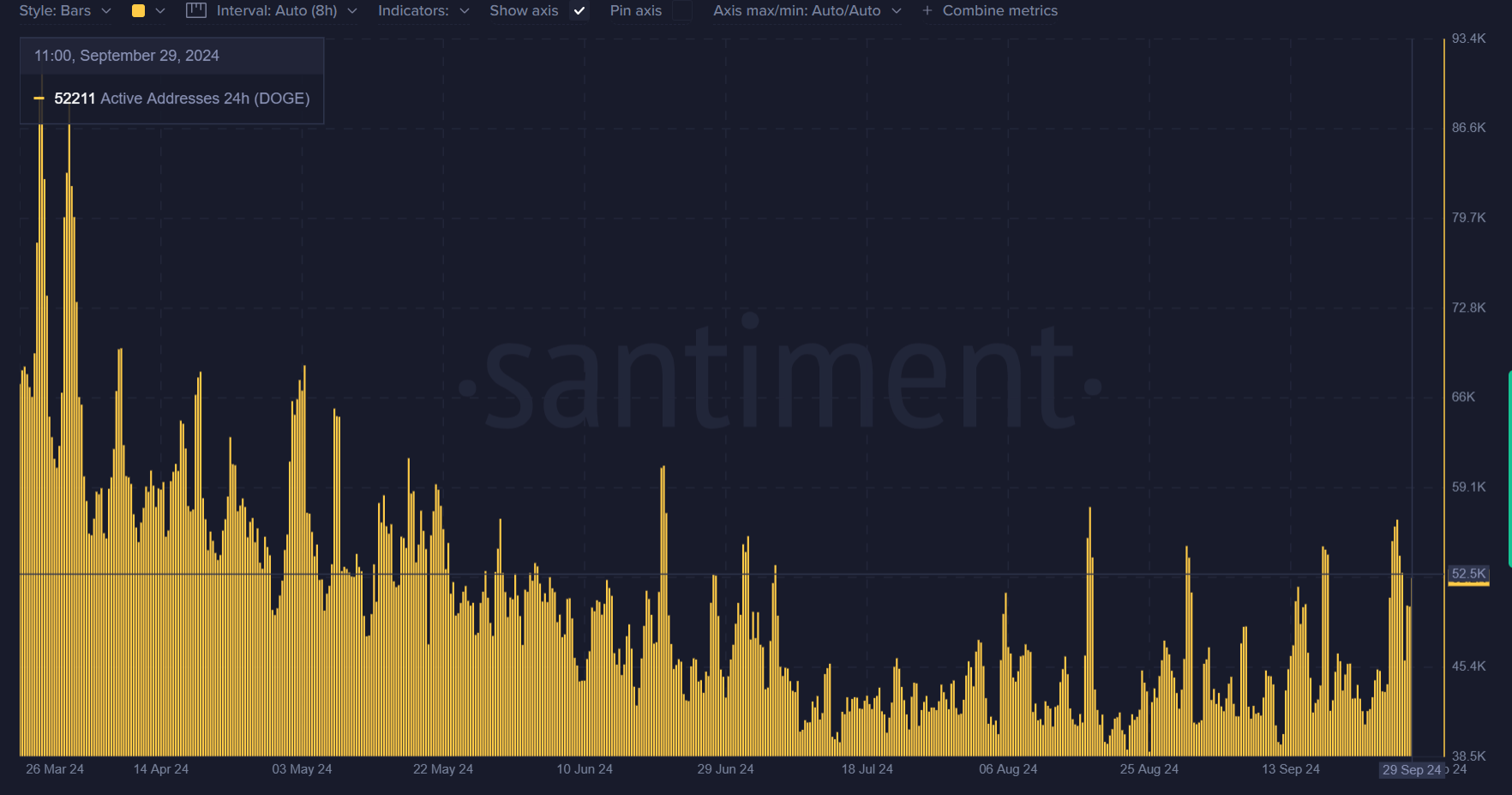

Increase in daily active addresses and volume

One of the most encouraging signs for Dogecoin’s potential upside is the recent increase in the number of daily active addresses. In the last 24 hours, at the time of writing, the number of active addresses has increased from 50,124 to 52,211.

This increase in networking activity reflects growing interest and participation from both private and institutional investors.

Therefore, this increase in the number of daily active addresses suggested underlying demand, which could drive Dogecoin’s price higher.

This greater involvement in the network created more confidence in the sustainability of the current rally.

Source: Santiment

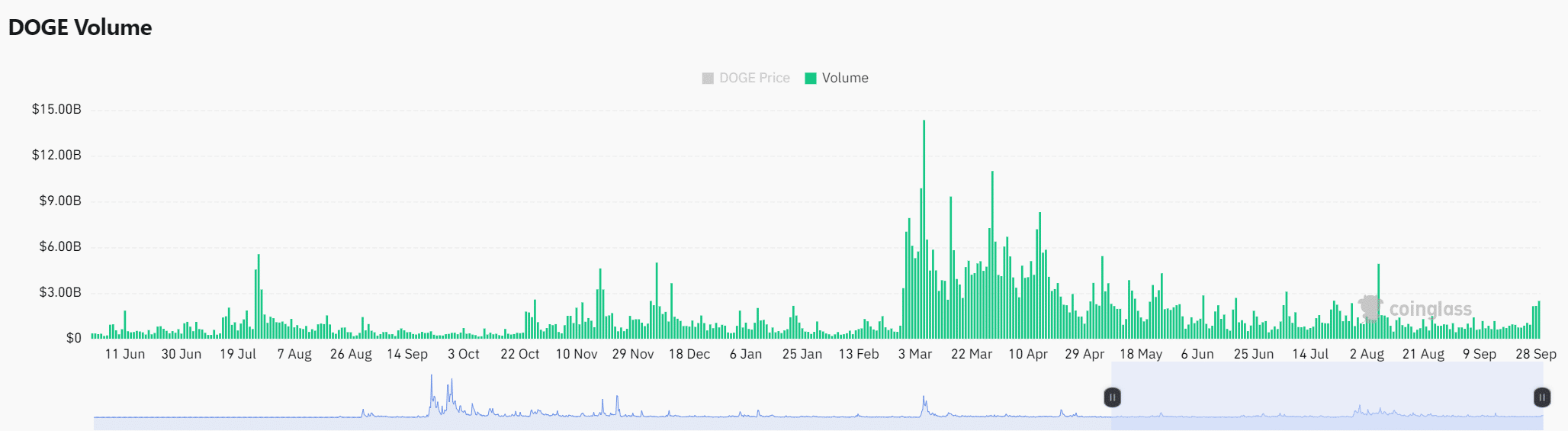

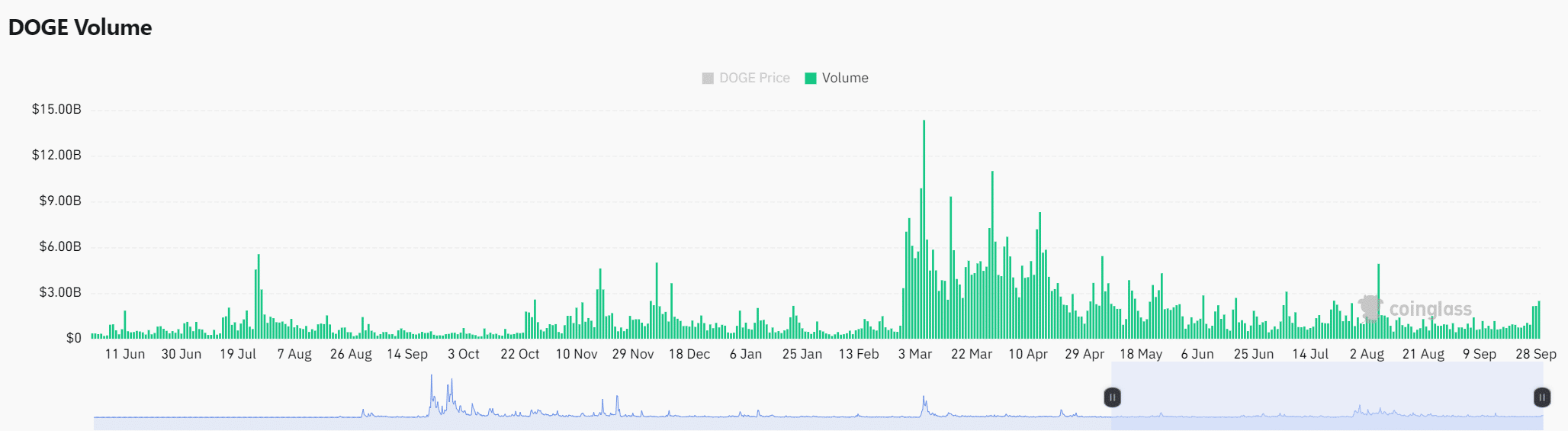

Furthermore, Dogecoin trading volume has increased, providing another bullish indicator. Over the past 24 hours, at the time of writing, volume rose to $2.07 billion, reflecting an increase of 0.35%.

Consequently, the higher volume indicates growing liquidity and interest in DOGE, which appears to support continued price growth. When volume rises along with price increases, it generally confirms the strength of the rally.

Therefore, if volume continues to rise, it could add further fuel to Dogecoin’s bullish trajectory towards its $1.60 target.

Source: Coinglass

Cautious signals despite rising volume

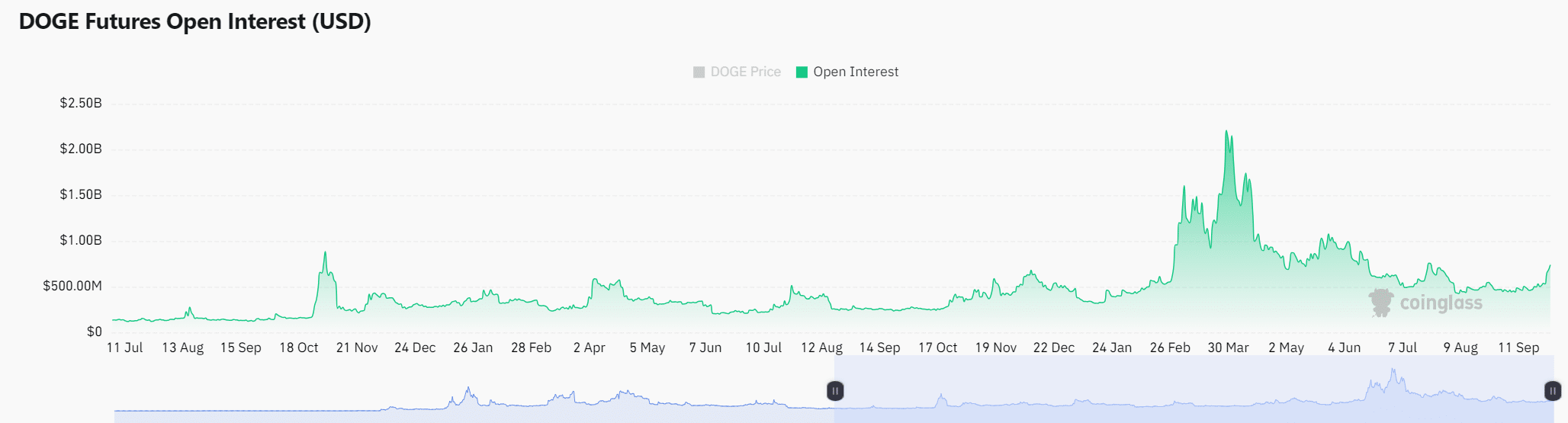

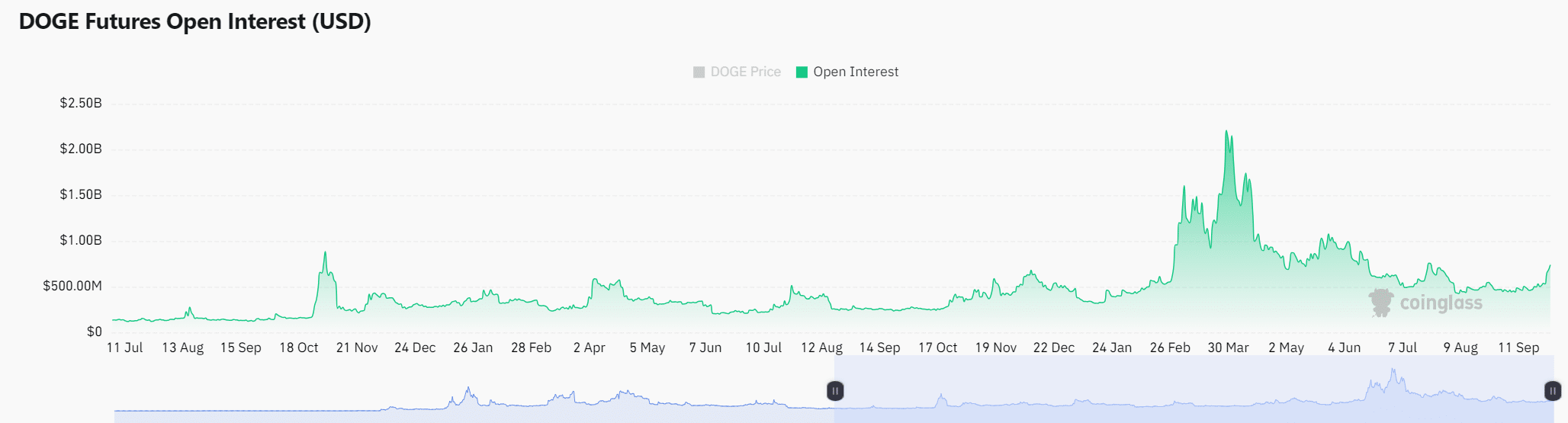

However, despite strong on-chain activity and increasing volume, Open Interest has fallen by 2.63% and now stands at $726.26 million.

This decline indicates that some traders have begun to unwind their positions, likely holding onto their gains or hedging against potential short-term volatility.

So while Dogecoin’s momentum appears strong, this drop in open interest introduces a warning sign.

Source: Coinglass

A bullish bias remains

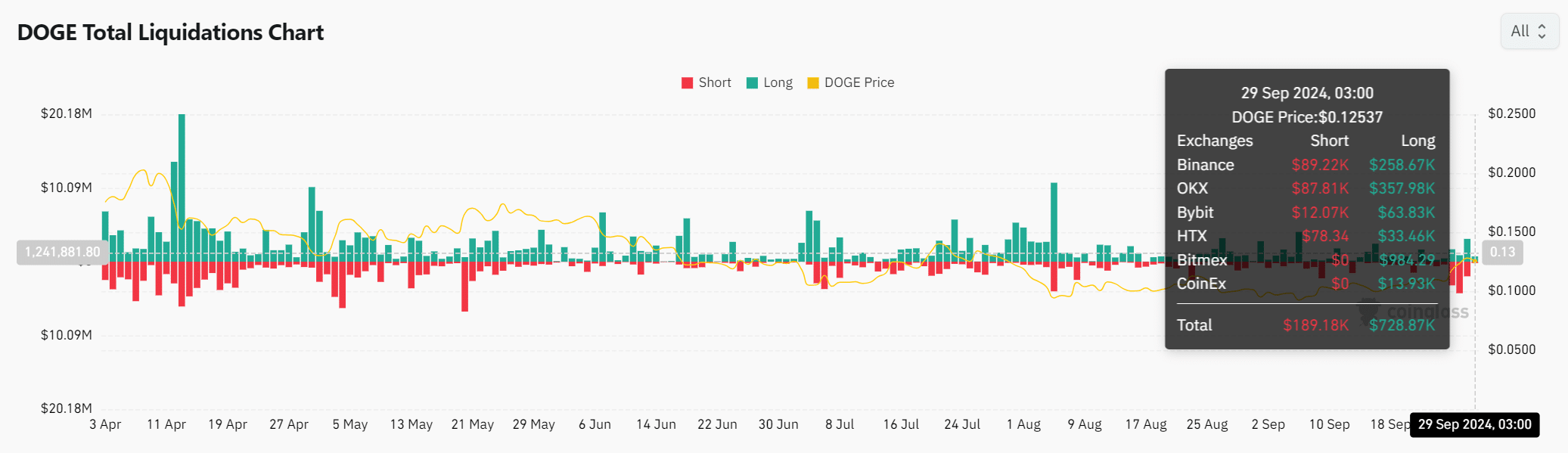

Furthermore, recent liquidation data shows a clear bullish bias. Liquidations of long positions totaled $728.87k, while short liquidations totaled only $189.18k.

This imbalance indicates that while some traders are taking profits, the majority remain optimistic about further price increases.

Therefore, as long as Dogecoin holds key support levels, this bullish sentiment may continue to push prices higher.

Source: Coinglass

Read Dogecoin [DOGE] Price forecast 2024-2025

Dogecoin’s breakout appears promising with rising daily active addresses, growing volume, and favorable liquidation data.

However, traders should keep a close eye on the decline in Open Interest to assess whether this momentum continues and pushes DOGE towards $1.60.