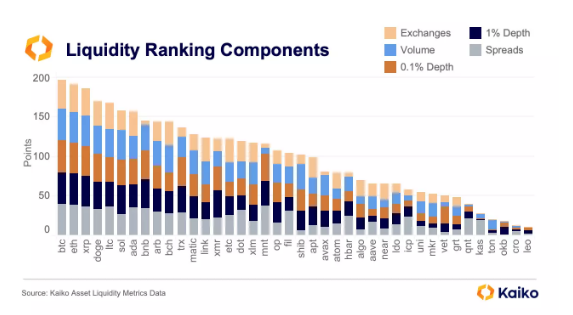

Kaiko, a blockchain analytics platform, conducted a study that revealed the complexity of the liquidity of the largest crypto assets, with some assets with lower market caps beating higher ones. According to his Liquidity ranking in the third quarterXRP and Dogecoin (DOGE) managed to beat Solana and Cardano in the liquidity rankings, falling behind only Bitcoin and Ethereum. There were also some surprising numbers in the rankings, such as BNB ranking 8th in liquidity, and Litecoin also outperforming.

Kaiko analysis highlights liquidity for crypto assets

The sheer number of crypto assets has always brought up the idea among investors to rank their valuation on some scale, with market capitalization being the most commonly applied. However, according to Kaiko, liquidity, along with other metrics such as volume and market depth, is a better way to measure the true value of a token, aside from market capitalization. This was best demonstrated by FTX’s token FTT, which had its market inflated and peaked at almost $10 billion, without having enough liquidity on the exchanges to support it.

According to the latest rankings Bitcoin took the top spot in terms of liquidity. This was not surprising as Bitcoin has always had a tight reign over the crypto industry since its inception. Ethereum followed in second place in terms of liquidity, repeating its position as king of the altcoins. However, Kaiko’s liquidity rankings started to diverge from the market capitalization in third position, with BNB massively underperforming and finishing in 8th place.

Instead of, XRP came in 4th place, beating Solana and Cardano (the Ethereum killers) on the inter-trader exchanges. XRP’s liquidity boost in the quarter was due to the asset gain clarity about the regulations in the U.S. Dogecoin came in at 5th place, despite being 10th in the market cap rankings, to solidify its position as the leader among meme coins. Litecoin came in at 5th place, completing the top five, despite being 18th in the market capitalization rankings.

Total crypto market cap at $1.59 trillion on the daily chart: TradingView.com

On the other hand, AVAX’s liquidity ranking fell 11 places compared to its market capitalization, while TON came in 37th despite ranking 9th by market capitalization during the quarter. ATOM, UNI, APT, TON, SHIB, OKB, LEO and CRO all fell more than five places as well.

What Does Liquidity Say About Dogecoin and Crypto Assets?

Kaiko’s measure of liquidity included the spread and average daily trading volume across exchanges. The analytics platform also included two different market depth levels; 0.1% for higher frequency traders and 1% for longer term holders.

In terms of trading volume, BTC came in first, while ETH and XRP followed suit. However, SOL beat DOGE in this area by about $2 billion in the quarter.

The bottom line is that greater liquidity often precedes greater longer-term success for cryptocurrencies. The fourth quarter of 2023 should tell a strong story in terms of crypto liquidity, as most cryptocurrencies recorded new yearly highs in terms of market capitalization.

Featured image from Shutterstock

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.