- The outbreak of Solana seemed more than justified because it had recovered dominance in important statistics

- Review came on the heels of a rapid rebound of recent market FUD

Solana [SOL] This week has taken an important step and rose by more than 20% to reach $ 130. This upward momentum placed Sol prior to many cryptocurrencies with high caps, which quickly recovered from the recent FUD that grabbed the market.

In particular the relative power of Solana against Ethereum [ETH] became increasingly clear, with the SOL/ETH couple overpowering its early February resistance.

Support for this outperformance, Solana’s Defi -income The cumulative total of Ethereum of all time surpassed, with $ 2.56 billion in lifelong costs compared to ETHs $ 2.27 billion.

All in all, with increasing income, a rising SOL/ETH ratio and unparalleled transaction transport, the outbreak of Solana can be well deserved. But can the bulls grab the moment?

Solana’s Q1 struggles – A look back

Solana finished Q1 with a drawing of more than 30%, which pursues most large caps colleagues. In fact, the weakness was not limited to only its price action, it also expanded to structural statistics.

SOL in particular has loses its $ 100 billion market dop threshold, which slipped behind Binance Coin [BNB] around the sixth Crypto activa.

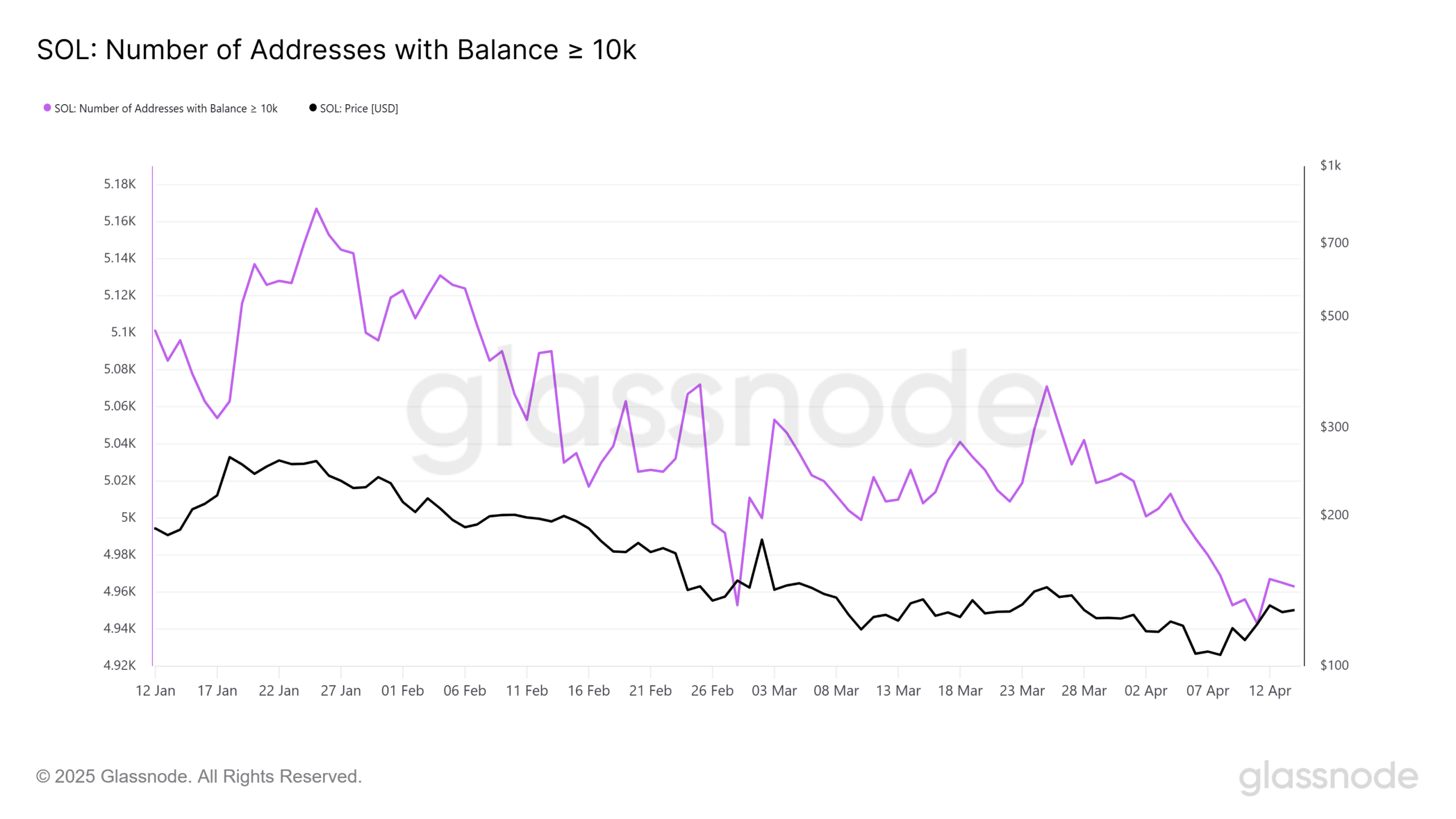

Moreover, flowing on chains showed that millions of sol tokens were not stuck, which activated an overhang of the stock. This coincided with an aggressive whale distribution patterns, so that the balance decided to tilted to the dominance on the sales side.

Source: Glassnode

In short, Q1 marked a period of persistent structural settlement for SOL, with bearish liquidity dynamics that overwhelms signs of bullish absorption.

A trend removal is now crucial to validate the patience of both short and long-term holders (Hodlers) who navigated through this Fud Fud cycle of high volatility.

Solana’s dynamics on chains, with Total value locked (TVL) Spiking to a high of April of $ 8.54 billion, seemed to point out a potential turning point on the press.

Months of patience finally about to bear fruit?

With Solana who recovers his earlier dominance on both technical and on-chains fronts, speculation mounts around a potential outbreak. Although the set -up may be increasingly constructive, a decisive movement still requires validation.

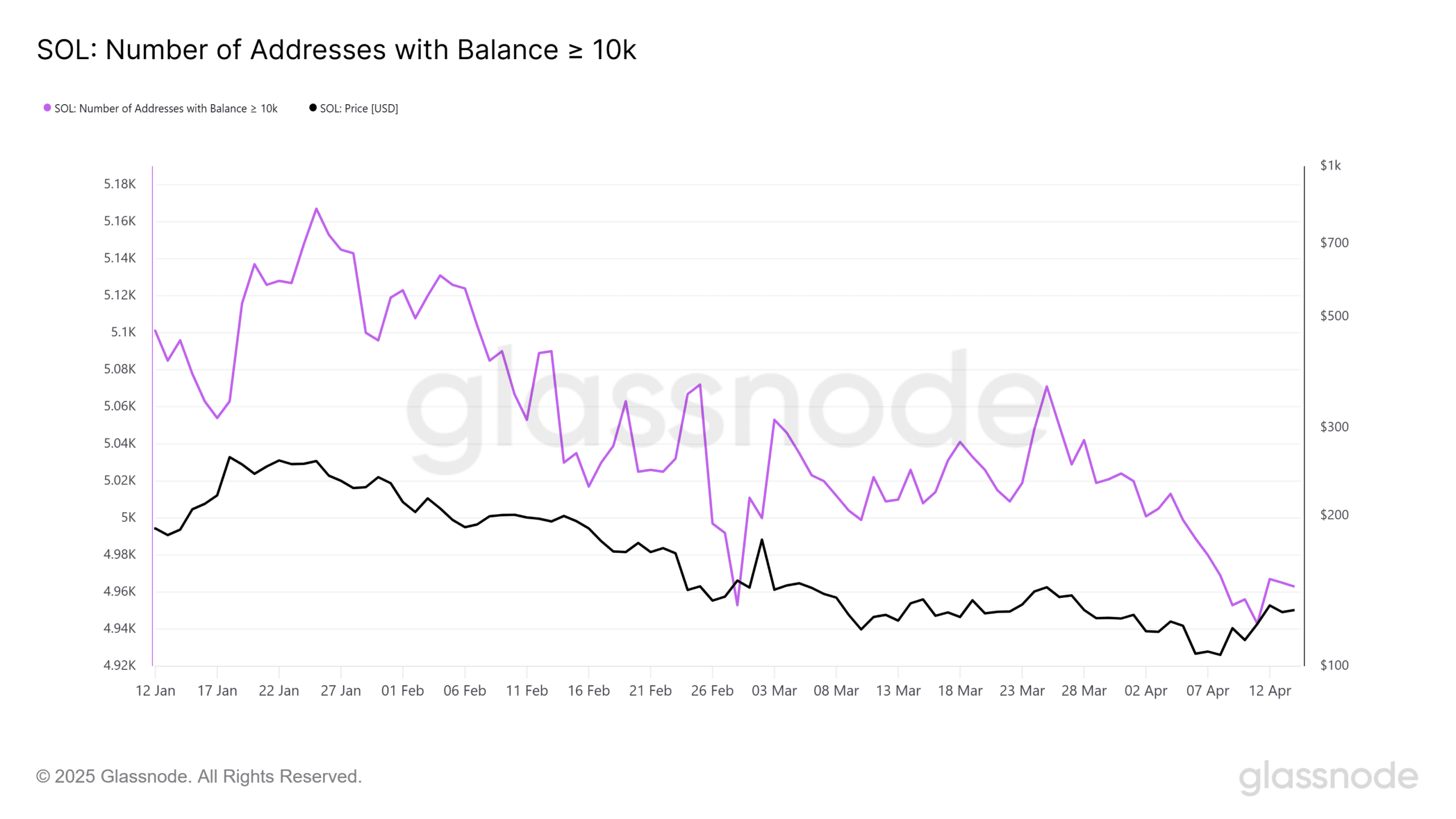

It is remarkable that the change of Solana Hodler Net Position was firmly in a positive area. This indicated persistent net inflow in long-term portfolios.

In fact, the trend of market time meant the longest accumulation line in more than six months – as a result of the rising conviction in the Macro story of Solana.

Source: Glassnode

Historically, such structural accumulative phases are tailored to cyclical soils, often prior impulse rallies. However, unlike earlier cycles, the divergence between long -term accumulation and stores in the retail trade is remarkable.

Specifically, New address Creation fell to a low point of six months. This reflected modest grassroots -participation.

In fact, Solana can undergo a phase of structural travel, whereby the price action in the short term will probably remain accessible. Until the activation of the retail trade is resumed.

Until that time, holders in the long term will continue to wear the weight of the market in the market-with their patience will probably be confronted with further tests.