- Spot market demand is leading Bitcoin’s upward momentum.

- BTC is down 2.46% in the past 24 hours.

The past month has Bitcoin [BTC] has experienced a continued uptrend and reached a new ATH of $108268.

This upward trend has led key stakeholders to deliberate on the factors underlying this. To this extent, CryptoQuant analysts have cited growing demand in the spot market as the main factor pushing up BTC prices.

Demand on the Bitcoin spot market is skyrocketing

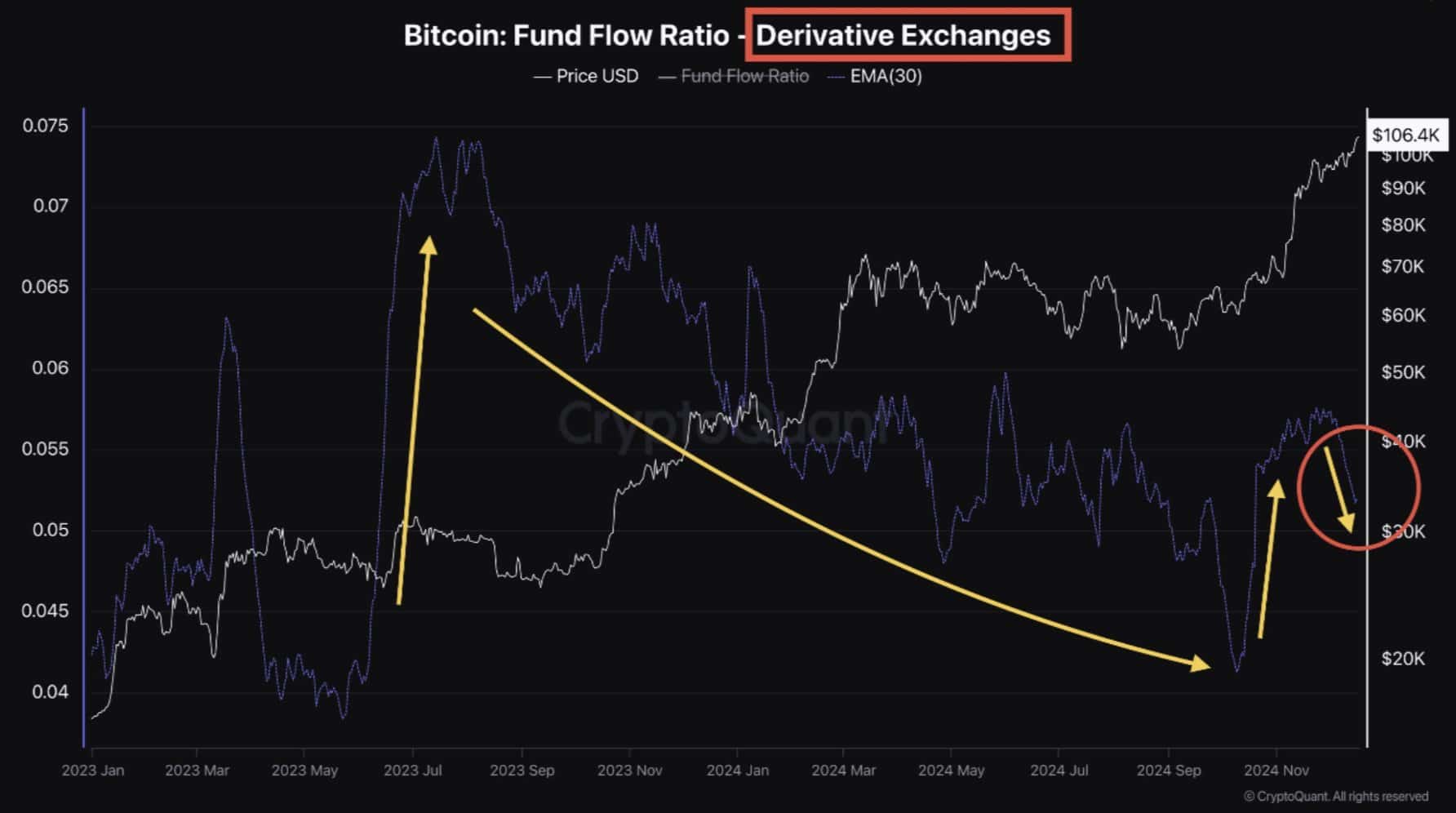

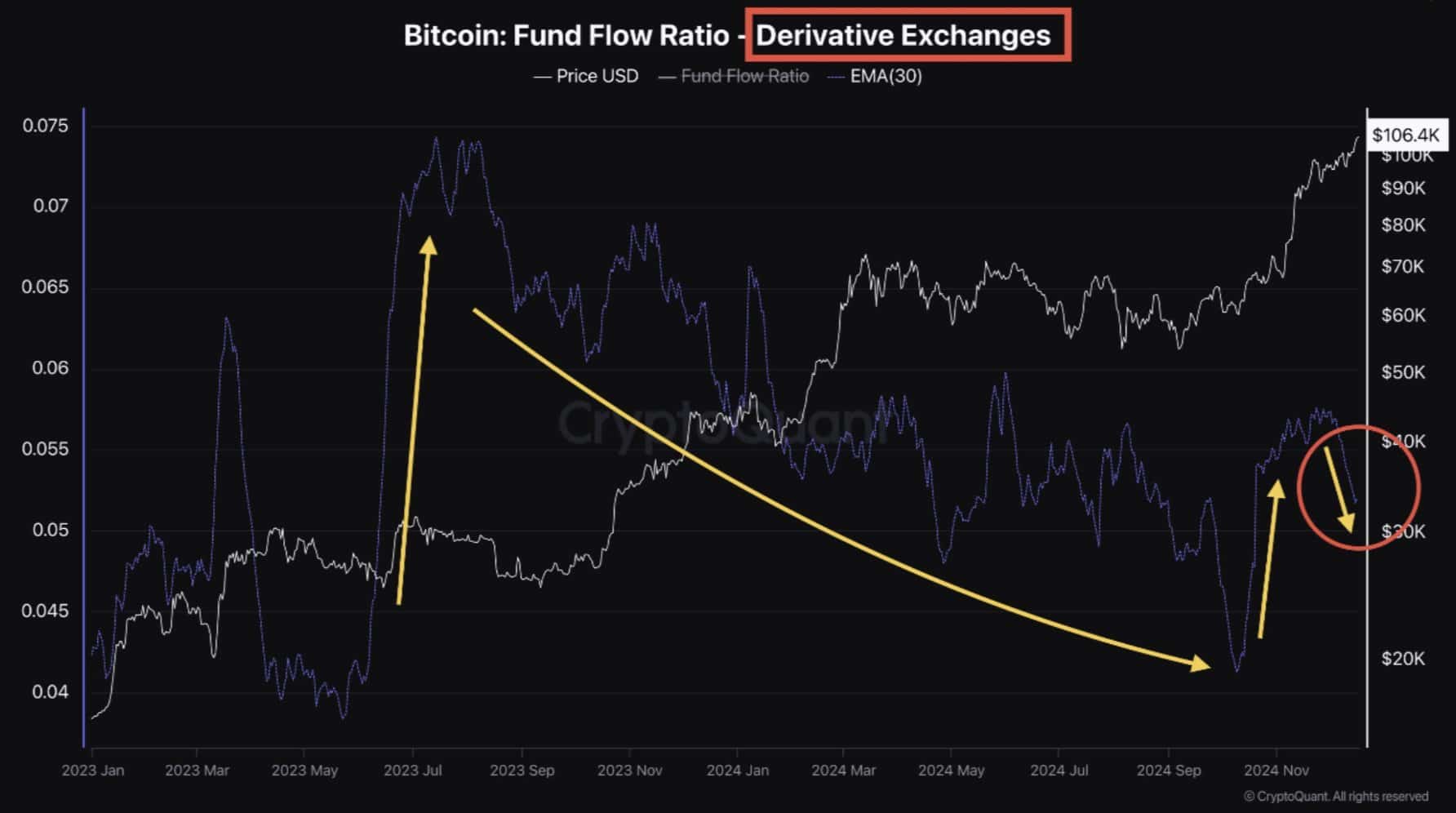

In his analysis states Avocado on a chain stated that Bitcoin’s bull cycle is either driven by the futures market or the spot market.

As such, the 2023 bull run was driven by the Futures market, followed by a spike in spot market activity, pushing prices higher.

Source: CryptoQuant

However, the spot and futures market experienced a prolonged decline from March 2024 to September. In October 2024, Bitcoin saw a surge in trading volumes for both markets, which has since driven prices to new ATH.

While demand in the futures market has declined over the past month, demand in the spot market continues to increase.

This increase in demand in the spot market indicates that the speculative glut in the futures market is cooling, while buying pressure in the spot market is gaining momentum.

Therefore, the futures markets will continue to experience a cycle of liquidations and overheating, which will result in BTC price growth. As such, this price movement will stimulate further capital inflows into the spot market.

Often, a surge in demand in the spot market pushes the price of an asset higher due to increased buying pressure.

Impact on BTC

Usually, an increase in purchasing pressure leads to higher prices. However, Bitcoin has experienced a market correction in the past day.

In fact, at the time of writing, Bitcoin was trading at $103825, down 2.46% on the daily charts. Despite the dip, the market is continuously experiencing higher demand, especially on the spot market.

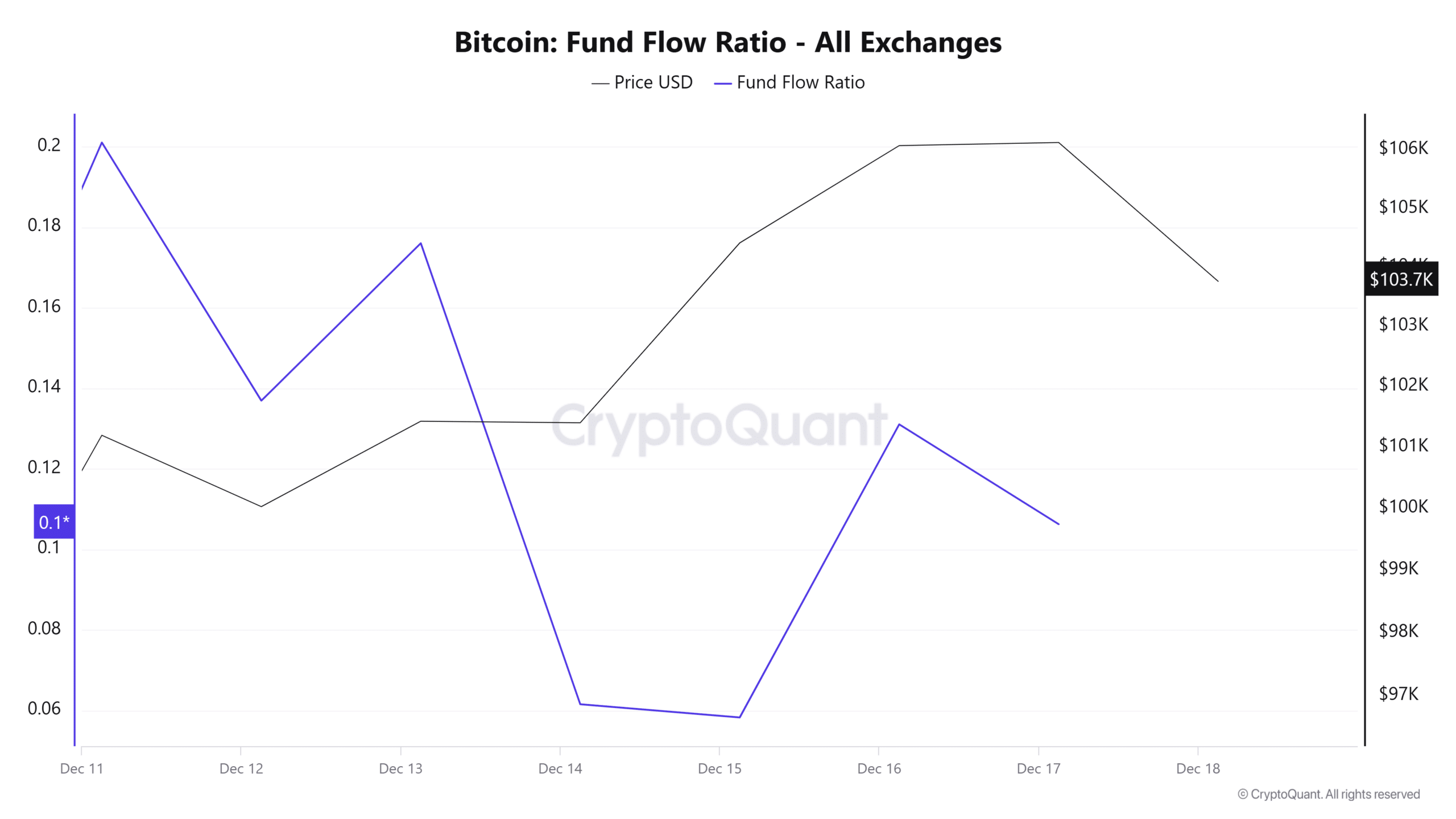

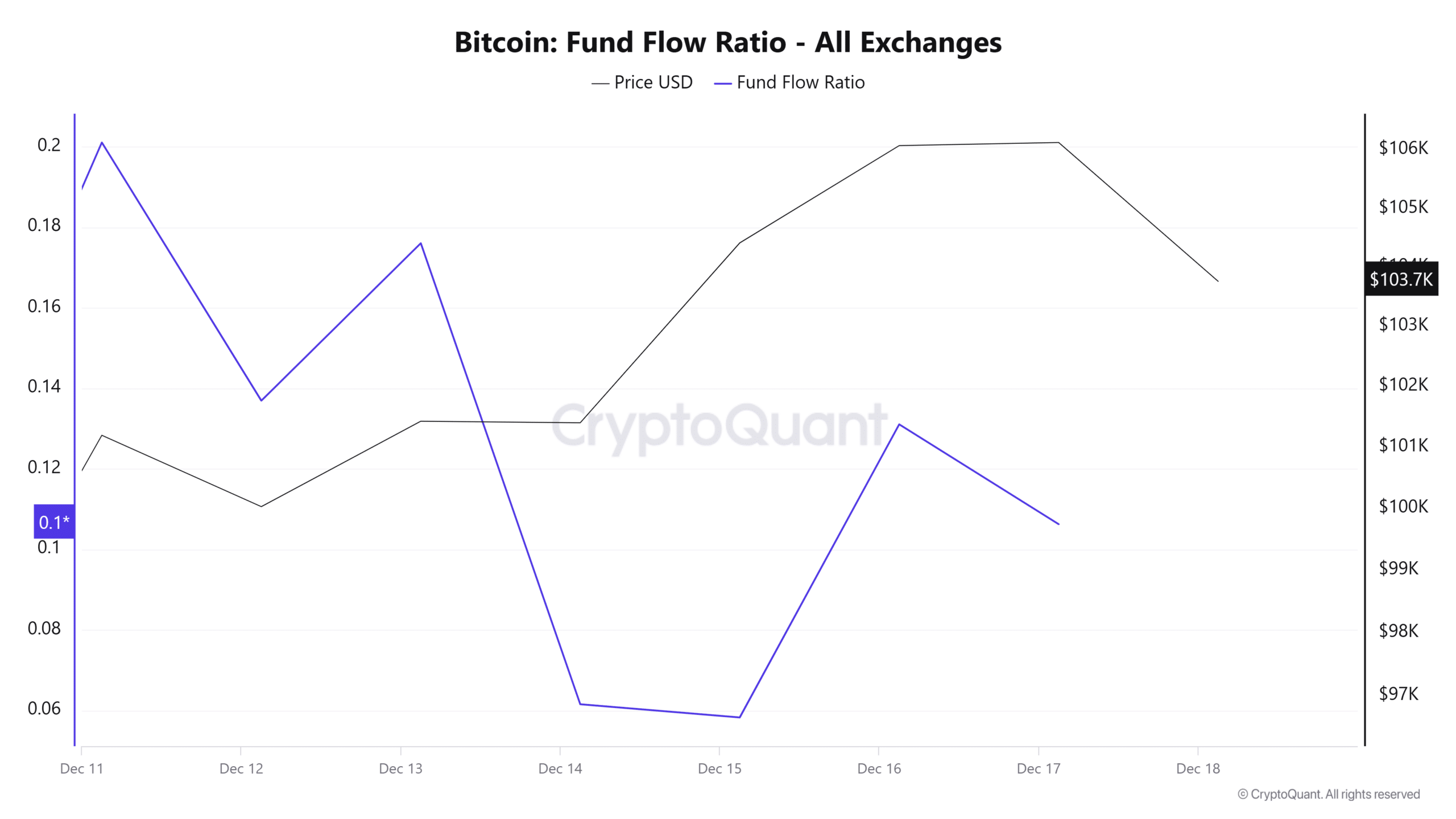

Source: CryptoQuant

This increase in demand in the spot market is reflected in the decrease in the fund flow ratio. Specifically, users withdraw money from exchanges and keep it in private wallets.

This is a bullish signal indicating reduced exchange rate activity, which correlates with long-term market confidence.

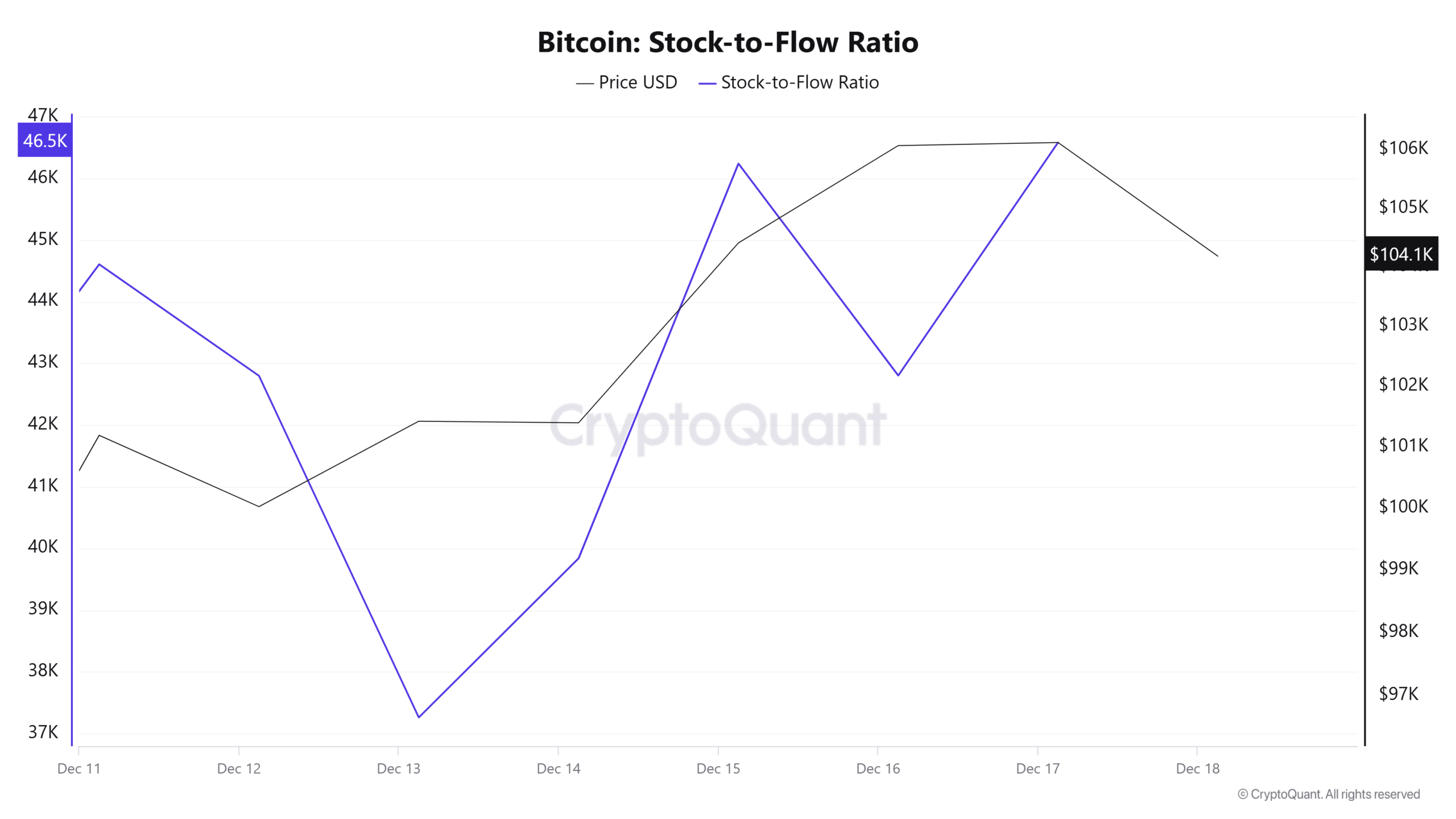

Source: CryptoQuant

Furthermore, Bitcoin’s stock-to-flow ratio has increased to 46.5k after falling to 37k. A rise in the SFR indicates a peak in BTC scarcity.

This shows that the supply of the assets is decreasing while the demand is increasing. When demand rises amid increasing scarcity, it causes a supply crunch, causing prices to rise.

Read Bitcoin Price Prediction 2024-2025

Simply put, an increase in demand in Bitcoin’s spot market positions the crypto for more gains on the price charts through higher buying pressure. If this demand continues, prices will continue to rise.

If so, we could see BTC regain $106,000 and head towards a new high. If the previous day’s correction continues, the King Coin will then drop to $102630 before another uptrend takes place.