- Long-term holders trimming BTC positions, while traders are driving at the momentum in the short term.

- Despite the consolidation near $ 102k, Bullish sentiment holds.

After months of calm faith, long-term holders are finally starting to inspect their positions, such as traders in the short term ride a wave of profit that have been fueled by Bitcoin [BTC] golf.

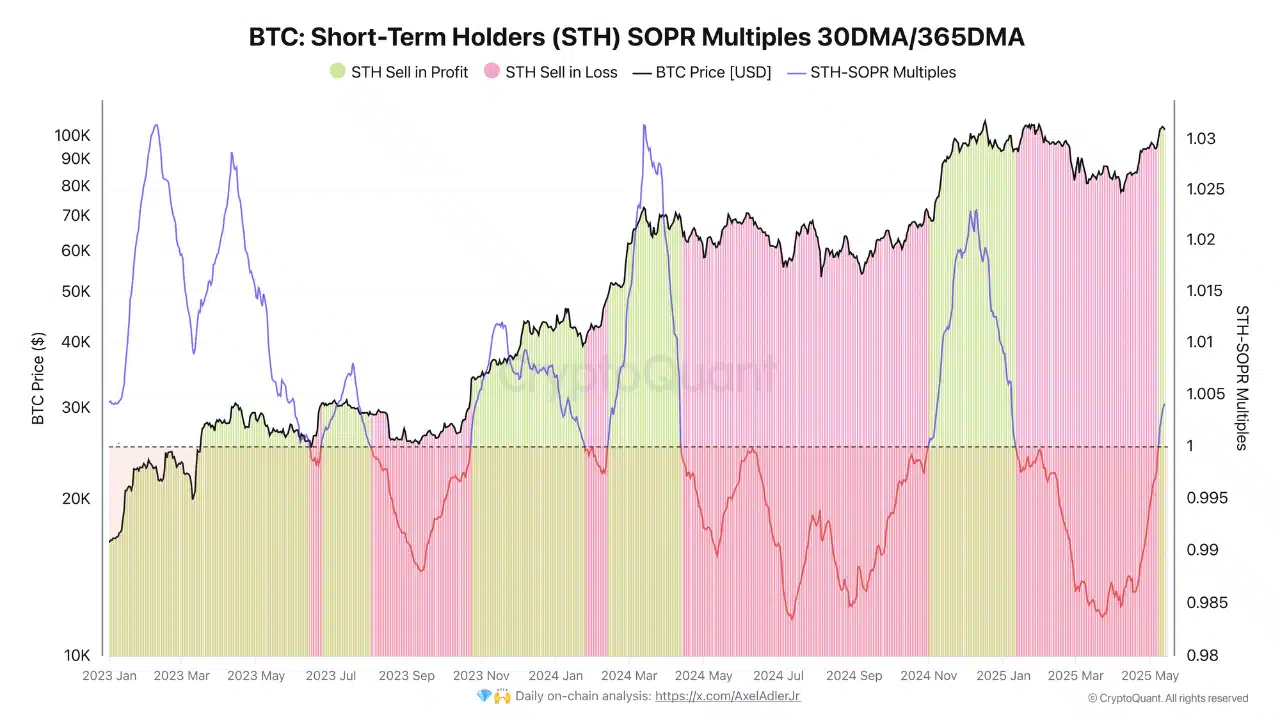

With BTC now over the $ 100k Mark, the market momentum cannot be denied. The expenses rise, StH Sopr remains above 1 and the wider mood feels Bullish. But growing profitable could soon test the resilience of the market.

Early signs of distribution

After one steady battery phase That saw the LTH Supply climbing of 13.66 million BTC in mid -March to a peak of 14.29 million BTC, the trend is quietly reversed.

Source: Glassnode

May has registered two consecutive falls in the long-term holder (LTH) Supply, in addition to an increase in LTH expenditure to 0.43-a significant increase.

These subtle shifts often identify approaching local tops, because experienced holders start to take a profit before wider market movements.

With Bitcoin, which is now being traded above $ 100k, these bends are close to close monitoring.