- Bitcoin appeared to repeat its 2020 run, one analyst noted.

- BTC’s real price discovery run may have to wait until September 2024.

Bitcoin [BTC] hit an all-time high of $73,835 on March 14, according to Coinbase data. It has broken its previous ATH before the halving, which is expected to take place on the April 23. However, estimates vary from April 15 to April 23.

This did not happen in the previous cycle when BTC was trading at $9,000, just under half of its 2017 high of $19.9,000. This led to one analyst Theorizing that BTC could be experiencing an accelerated cycle, but the similarities persisted.

The idea of the pre-halving retrace

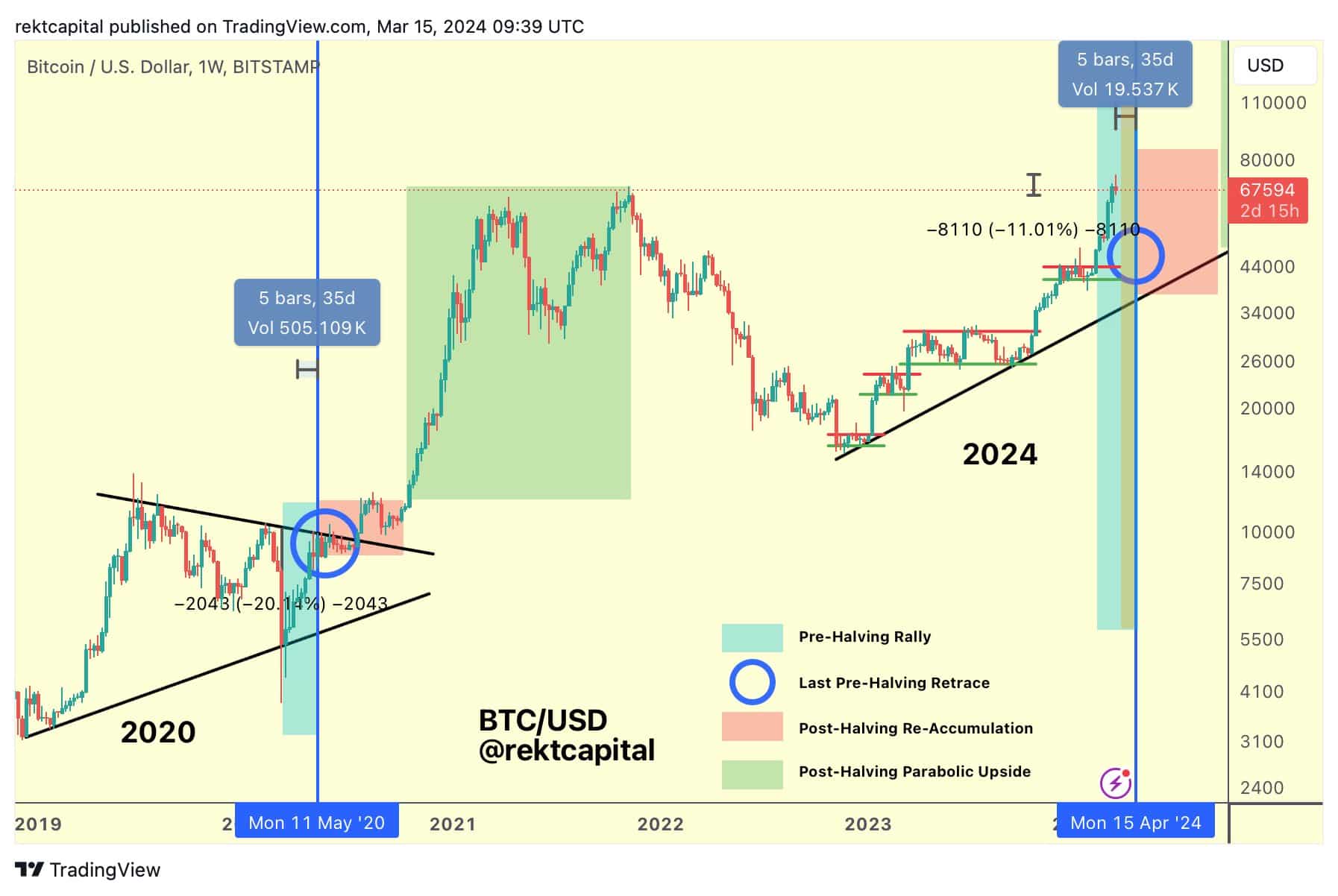

In a post on X (formerly Twitter), Rekt Capital explored the idea of how history keeps repeating itself. In 2020, BTC started to recover before the halving and entered a 35-day retracement. The analyst raised the idea that the same thing is happening again.

The pre-halving rally lasted eight weeks in 2020, while the retracement is expected to last another five weeks. Because of this, Bitcoin prices may not drop much, but rather find a support level and stay there for post-halving accumulation.

The chart highlighted that the parabolic bull run only started 23 weeks after the halving date. During the 2020 run, BTC quickly sought prices and continued to soar skyward until it reached $69,000 55 weeks later, or just over a year.

If April 15 turns out to be the halving date, then Bitcoin’s real bull run could begin 23 weeks later, on September 23, 2024. Again, this is based on the analyst’s perspective that history repeats itself.

How Deep Can the BTC Retracement Go?

Is your portfolio green? Check the BTC profit calculator

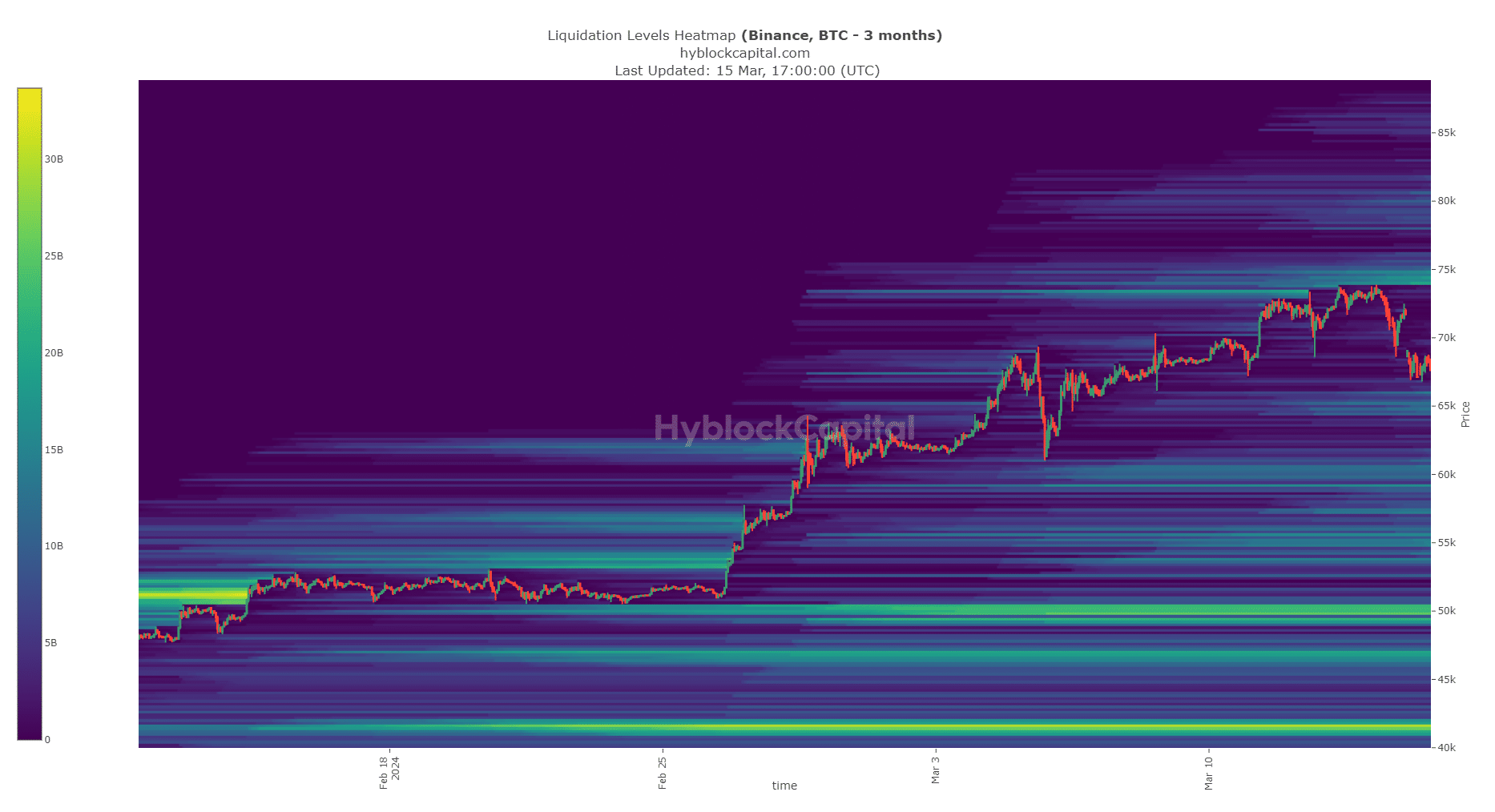

Since prices are attracted to liquidity, AMBCrypto decided to rely less on history and more on the heatmap of liquidation levels to understand where Bitcoin could take the next step. The $73.8k to $75k region is estimated to have multiple levels with liquidations worth $15 billion.

At the $74,000 level, there was $19 billion in estimated liquidations. In terms of support, the $64.6k-$65.8k had multiple liquidation levels worth $8 billion as estimated by Hyblock data. Therefore, it was likely that the current Bitcoin dip would stop at this support zone.