- Total assets under management for institutional crypto products rose 6.74% to $31.7 million.

- GBTC’s discount to the underlying Bitcoin fell to the lowest level in almost two years.

Optimism was well and truly back in the digital asset market in October. Analysts and traders interpreted the recent fake news-driven market rally as a “dress rehearsal” before the eventual adoption of spot Bitcoin. [BTC] exchange traded funds (ETF).

In response to the false alarm, the king rose to $35,000, its highest level since May 2022, according to data from CoinMarketCap. Overall, BTC has maintained its gains since the event. At the time of writing, BTC was exchanging hands at $34,000, with a gain of 26% since the beginning of the month.

The crypto market attracts institutional investors

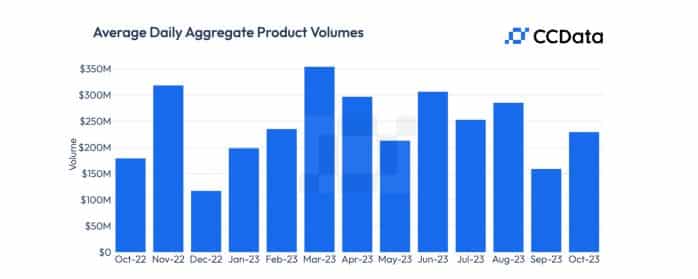

The positive sentiment started to impact trading activity. According to crypto market data provider CCDatathe average daily volume of digital asset investment products increased by as much as 44.3% to $230 million. This was the third highest monthly jump in volumes in 2023.

Source: CCData

Additionally, total assets under management (AUM) for institutional crypto products rose 6.74% to $31.7 million, breaking a two-month losing streak.

Source: CCData

The AUM is a measure of the flow of investors into and out of a fund and the market value of the underlying asset. The size of the AUM gives investors an idea of the investment company’s activities.

Most investors are attracted to funds with large assets under management simply because they have sufficient liquidity to meet any redemption pressures.

BTC-based products are growing, Ether is seeing investment decline

The jump in Bitcoin-based investment products witnessed an AUM increase of 11.1% to $23.2 billion. The jump extended their market dominance to 73.3%, up from 70.5% last month.

On the contrary, Ethereum [ETH]-based crypto products recorded a 5.45% decline in their assets under management to $6.35 billion. Due to the negative growth, the market share fell from 22.6% in September to 20%.

Surprisingly, the underperformance occurred in the month in which half a dozen Ether futures ETFs, including those from VanEck and ProShares, came to market.

While ETH disappointed, other altcoin-linked products witnessed a sharp jump in market value. Solana [SOL]–-based products were the biggest winners in October, with assets under management soaring by 74%.

Positive improvements in the ecosystem, which resulted in price gains, helped increase the market value of SOL-connected products. Indeed, SOL was the second highest gainer in the past 30 days, increasing its market value by a whopping 72%.

Source: CCData

The US and Canada are experiencing an increase in assets under management

The dominant North American institutional crypto market reaped the benefits of the bullish outlook. The US, home to some of the largest crypto asset managers, witnessed a 3.22% increase in assets under management to $24.5 billion. This increased the market share to an astonishing 77.3%.

Canada, another key market, saw $2.03 billion in assets under management in October. Canada in particular accounted for a 6.39% market share, the second highest after the US

Key European markets such as Germany recorded 16% growth in assets under management to almost $700 million.

Source: CCData

GBTC limits the discount to the underlying asset

Grayscale Investments, the world’s largest crypto asset manager, saw a 3.24% increase in assets under management to $23.1 billion in October.

Furthermore, the most popular product, Grayscale Bitcoin Trust (GBTC), has cut the discount on the underlying investments to the lowest level in almost two years.

Source: CCData

Typically, a decreasing discount between a trust’s shares and the net asset value (NAV) of its assets – in this example, Bitcoin – indicates that investors are optimistic about its prospects.

As indicated above, the discount to NAV in June was almost 45%. However, growing optimism about the conversion to a spot Bitcoin ETF, aided by recent court rulings, led to a sharp decline. The discount fell to 12.6% on October 18, the lowest since November 2021.

Please note that GBTC is the largest Bitcoin fund in the world with a market capitalization of over $17.8 billion. Grayscale is looking to convert the trust into a spot Bitcoin ETF due to the relative advantages the latter offers.

Is the party going ahead?

As things stood, the market seemed ready for a launch. Overall sentiment was bullish on the adoption of spot ETFs. While there has clearly been a change in sentiment in October, it will be interesting to see if the optimism continues into November.

The total market capitalization of all circulating cryptos rose to $1.26 trillion at the time of writing, marking a 20% increase from last month.

Source: CoinMarketCap