- The implementation of the Plato and Hertz hard forks helped reduce the risk of attacks on the BNB chain.

- A total of 126 incidents took place, resulting in losses of more than 43 million dollars.

There is a lot to be said about the crypto sector. But one thing that people cannot deny is the fact that the evolution of the ecosystem has given rise to unimaginable opportunities for both novices and experienced participants.

Among the pros, there’s also no denying that the industry has bad eggs who have made it their mission to dilute the good work of other players. So it’s almost impossible not to experience scams, hacks and carpet pulling here and there.

That brings us to the third quarter report (Q3), in which we assess BNB chain security performance.

But before we get into that, let’s first briefly explain what a rug pull is. A back pull occurs when a fraudulent developer hypes a cryptocurrency project, attracts investment, and later disappears with the money.

Such events have been one of the reasons that blocked the adoption rate of the crypto ecosystem. It is therefore important to evaluate what different chains are doing to reduce these recurring incidents.

Thanks to Hertz and Plato

As mentioned earlier, this article will focus on the BNB Smart Chain (BSC). The BNB Chain is the largest smart contract blockchain in terms of transaction volume and active users. This is because the chain is compatible with different protocols that want to build a smart contract applications.

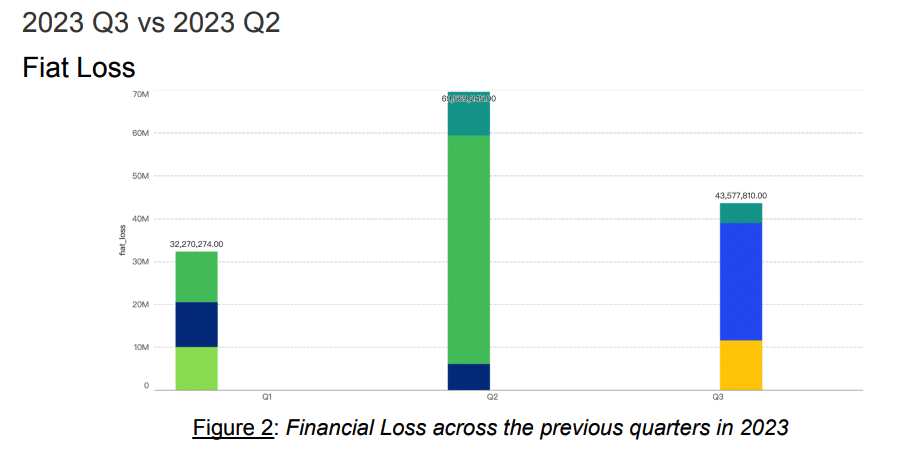

According to Q3 security report by blockchain companies AvengerDAO and HashThis has significantly reduced monetary losses through the BNB compared to 2022 figures. AMBCrypto’s review of the report revealed that there was a notable improvement between Q2 and Q3 2023.

Source: AvengerDAO and HashDit

Details from the above data showed that fiat losses in the second quarter amounted to a whopping $69.56 million. In the third quarter, the value dropped to $43.57 million. One of the reasons why losses decreased was due to a number of things that were set out in the protocol.

For example, in August the BNB chain went below two hard forks, namely the Plato and Hertz upgrade. A hard fork is a change in the protocol of a blockchain, bound by a software update.

Both Hertz and Plato were implemented to reduce the possibility of malicious attacks and increase BNB Chain’s compatibility with other Ethereum systems. [ETH] Virtual machines.

As a result, there was a 75% drop in the number of scams in the chain. Hacks also fell by 43%, with BNB Chain saying:

“This can be attributed to the fact that Web3 Security companies and sleuths in the chain keep a close eye on transactions. Therefore, hackers are deterred from being blackhat because they can be traced back to their real identity.”

Still top Year-To-Date

The report also showed that BNB Chain performed excellently compared to other chains. Take for example from all chains, Ethereum And Tron [TRX] together reported 70% of all fraud incidents.

BNB Chain, on the other hand, had 30% fewer incidents than Ethereum this quarter. However, for the entire year up to publication, the BNB Smart Chain accounted for the highest number of cases.

Source: AvengerDAO and HashDit

According to the report, most of the chain’s third-quarter losses occurred in September. This was followed by July and finally August. In total there were 126 incidents, of which 64.20% were scams and 35.71% were hacks.

MEV-related projects were the most attacked in the chain, followed by GameFi and Gambling projects. The report also took into account the top 10 hacks and scams that took place there. Some of these include a $6.2 million loss on CoinEx.

Source: AvengerDAO and HashDit

Realistic or not, here it is The market capitalization of BNB in terms of ETH

Another big one was the $17.8 million loss on Stake.com. Stake.com is a crypto gambling protocol that offers users the opportunity to bet on various games.

While there were others, the BNB Chain Core Development Team said it was working hard to ensure the reduction in hacks and scams continues. Speaking to AMBCrypto, the team agreed with the report, saying:

“Hashdit and AvengerDAO committees are at the forefront of crypto security and have seen a steady increase in users and integration with major ecosystem players. These reports contribute greatly to the Web3 ecosystem and the crypto community, providing users and developers with essential security knowledge to make informed decisions.”