- SOL rose 17.56% last week, with one analyst expecting a rally to $4,000

- Solana whales have also collected SOL tokens worth millions

The last four days, Solana [SOL] has registered a strong rise on the charts. During this period, the altcoin broke out of its $200 resistance. In fact, SOL climbed from a low of $187 to a high of $219 on the charts.

At the time of writing, Solana was trading at $216. This marked a 4.35% increase on the daily charts. This is on top of the altcoin’s weekly gain of 17.56%.

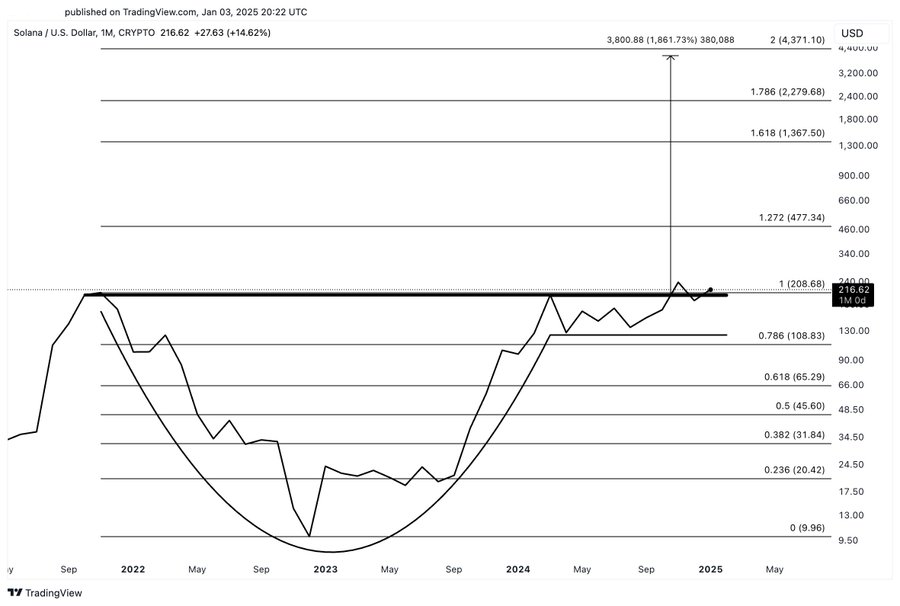

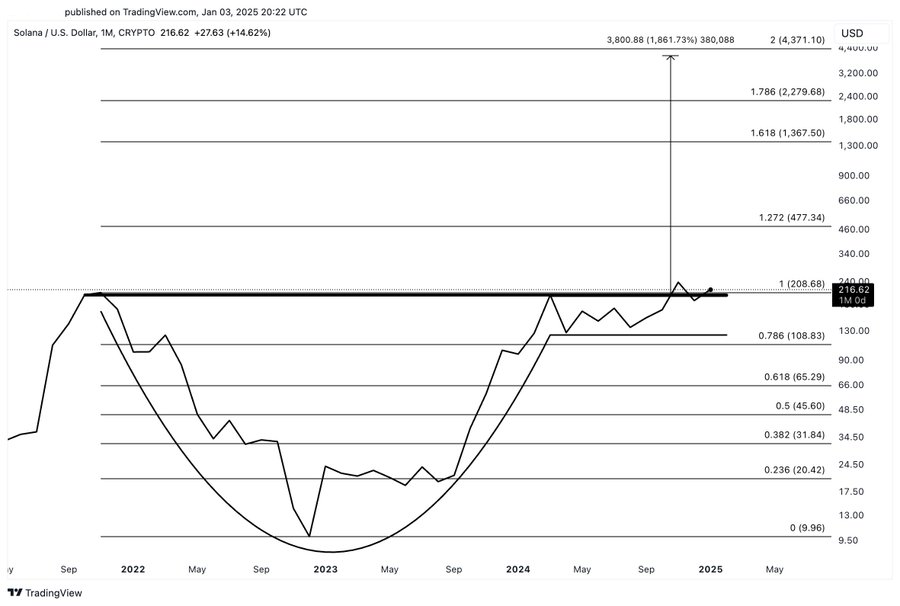

Needless to say, this price pump has left the Solana community eyeing a huge rally. For example, according to popular crypto analyst Ali Martinez, a potential rally to $4k is now possible, with Ali citing a cup-and-handle pattern on the charts.

Can Solana Rise to $4000?

In his analysis states Martinez stated that Solana is likely to form a cup-and-handle pattern and it could reach a high of $4,000.

Source: Ali on X

When a head and handle pattern forms, it means that buyers are regaining control after a period of consolidation and preparing for a breakout.

Typically, this pattern indicates a continuation of bullish momentum. Therefore, if this pattern were to eventually form, SOL could see an exponential rise to future levels.

What do SOL graphs say?

While the analysis shared by Ali seemed to offer a promising outlook, it is essential to determine what other statistics might suggest. For example, according to AMBCrypto analysis, Solana sees strong upside momentum amid a rise in buying pressure.

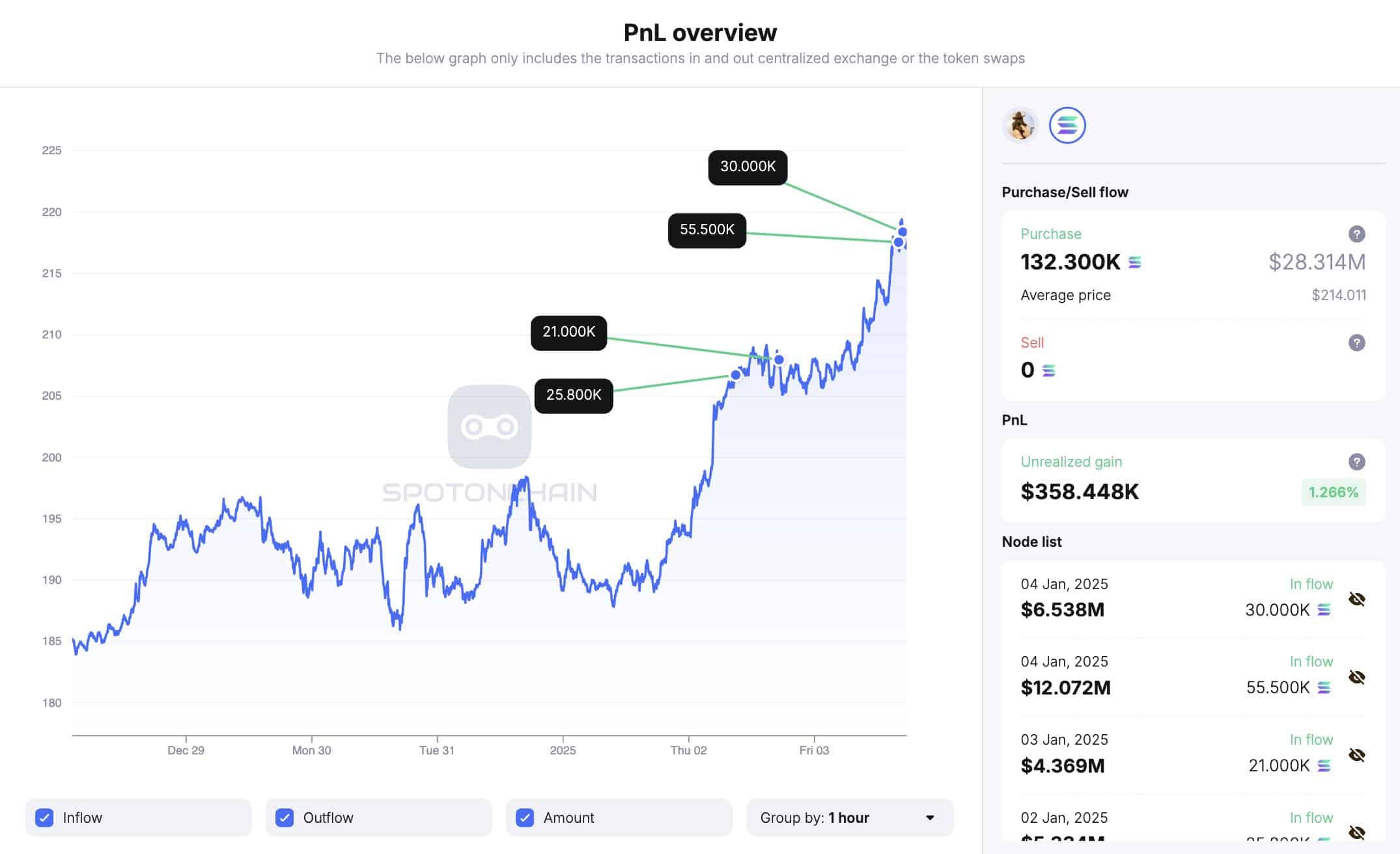

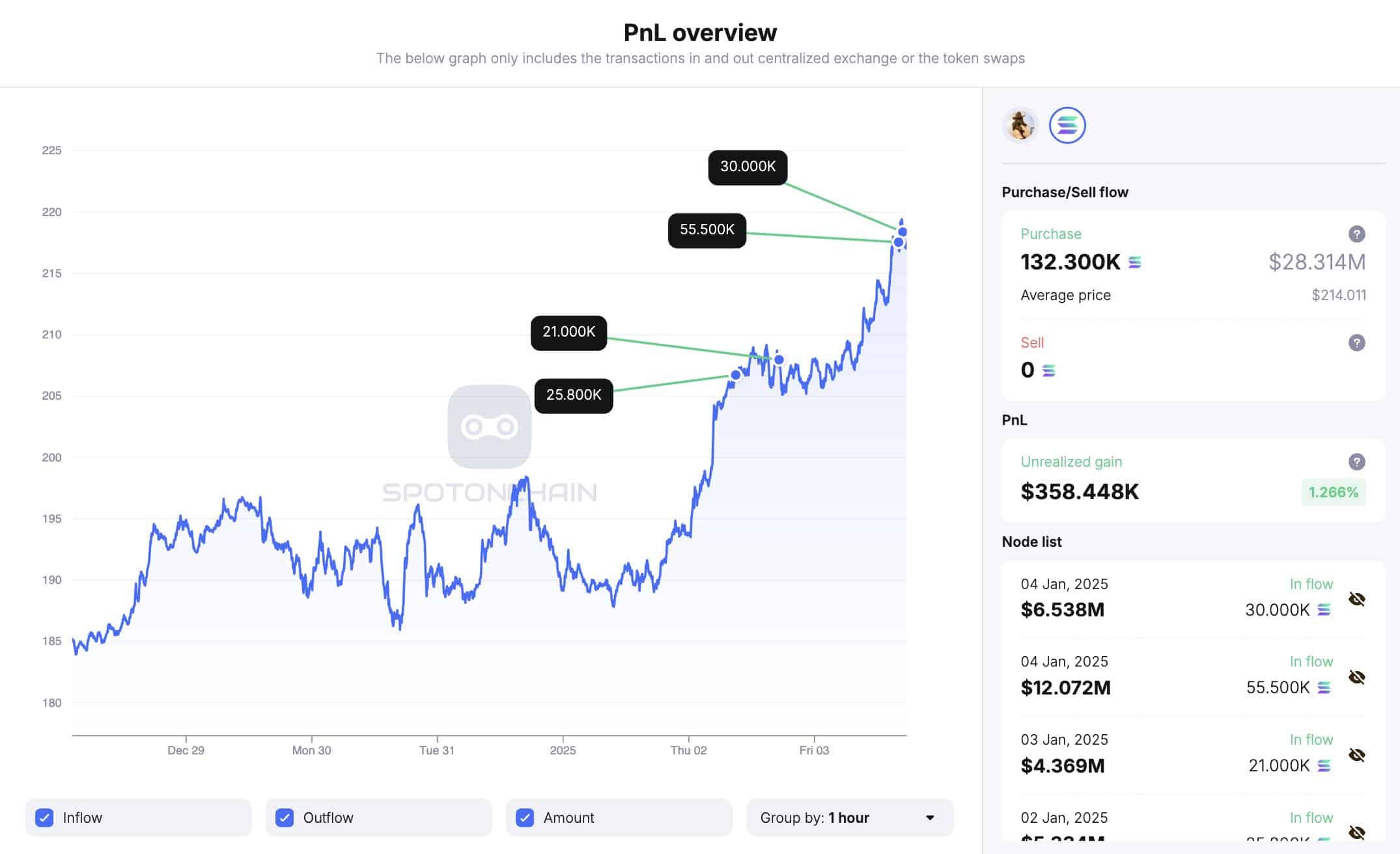

Source: Spotonchain

We can see this increase in purchasing activity from both retailers and whales. As such, whales have been actively collecting SOL in recent days. In fact, one whale has withdrawn 132,300 SOL tokens worth $28.31 million from Binance.

When whales start accumulating, it is a sign of bullish sentiment as they expect the price to continue rising on the charts.

Source: Coinglass

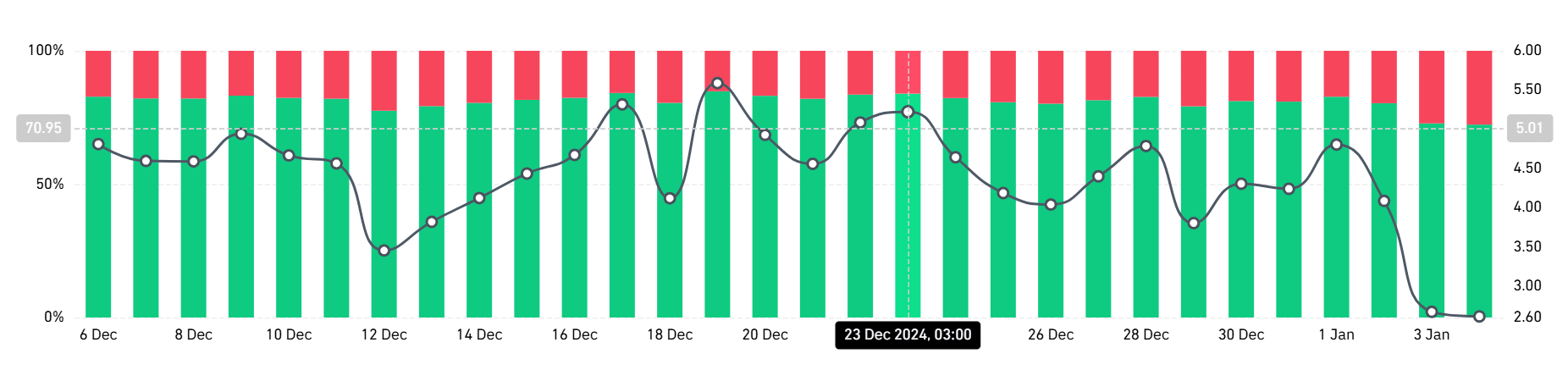

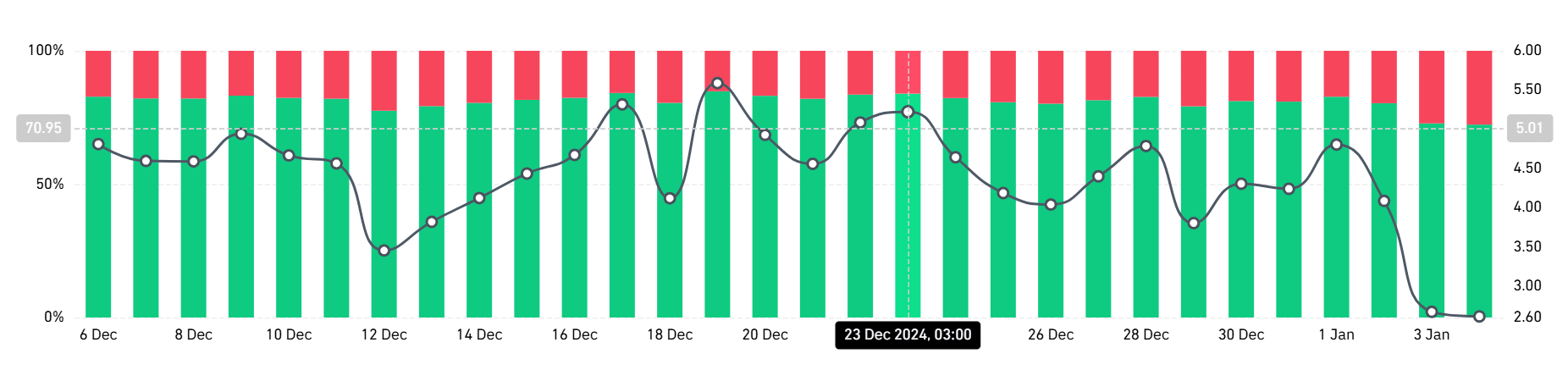

Moreover, the market’s bullishness can be further evidenced by the higher number of accounts taking long positions.

In fact, long/short accounts for SOL on Binance show that 72% of accounts have taken long positions. When longs dominate, it means more traders are bullish and expect the price to rise.

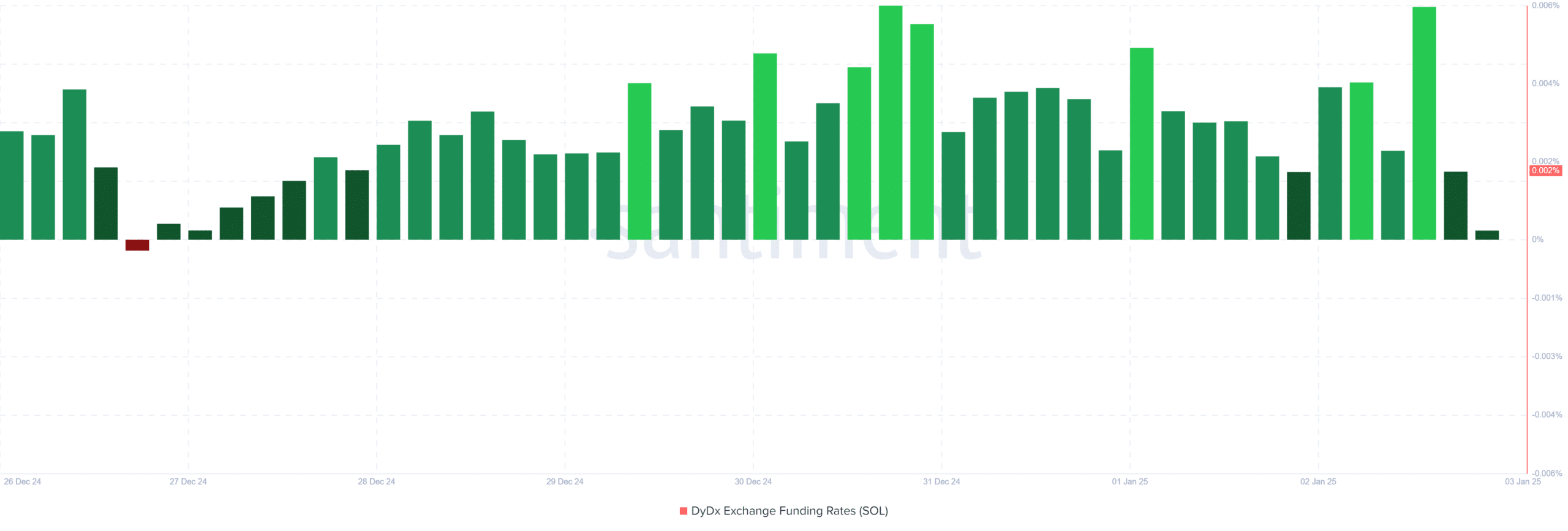

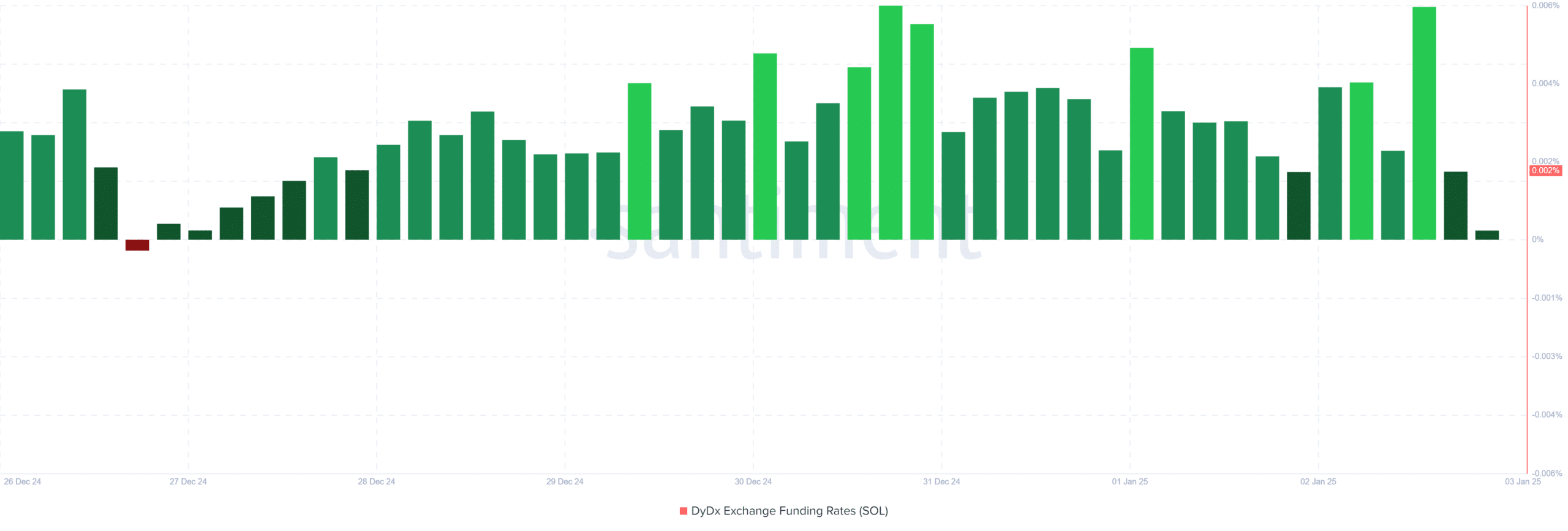

Source: Santiment

Finally, the increased demand for long positions can be further supported by a positive DyDx funding rate. When the DyDx funding rate is positive, it indicates a bullish market as investors are willing to pay a premium and hold their positions during market downturns.

Simply put, Solana is currently experiencing strong bullish sentiments among retailers and whales. These favorable market conditions position SOL for more gains on its price charts. Therefore, if the prevailing sentiment holds, SOL will attempt to reach the USD 228 resistance level. And a breakout from here will strengthen the altcoin for a move towards $245.

However, if sellers reenter the market, Solana will fall to $194. Therefore, a rally to $4,000 in the short term is far-fetched.