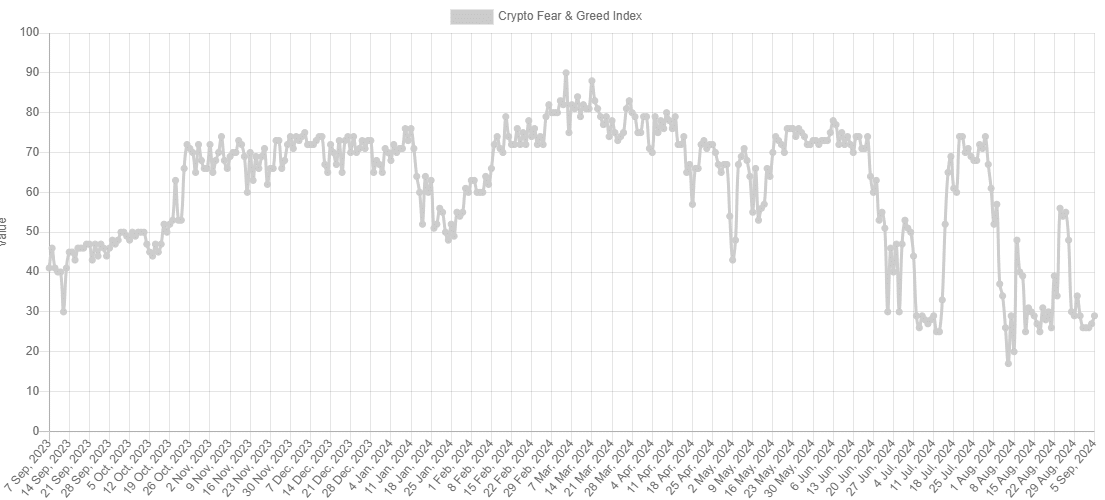

- The Fear and Greed Index reached a low not seen in a year.

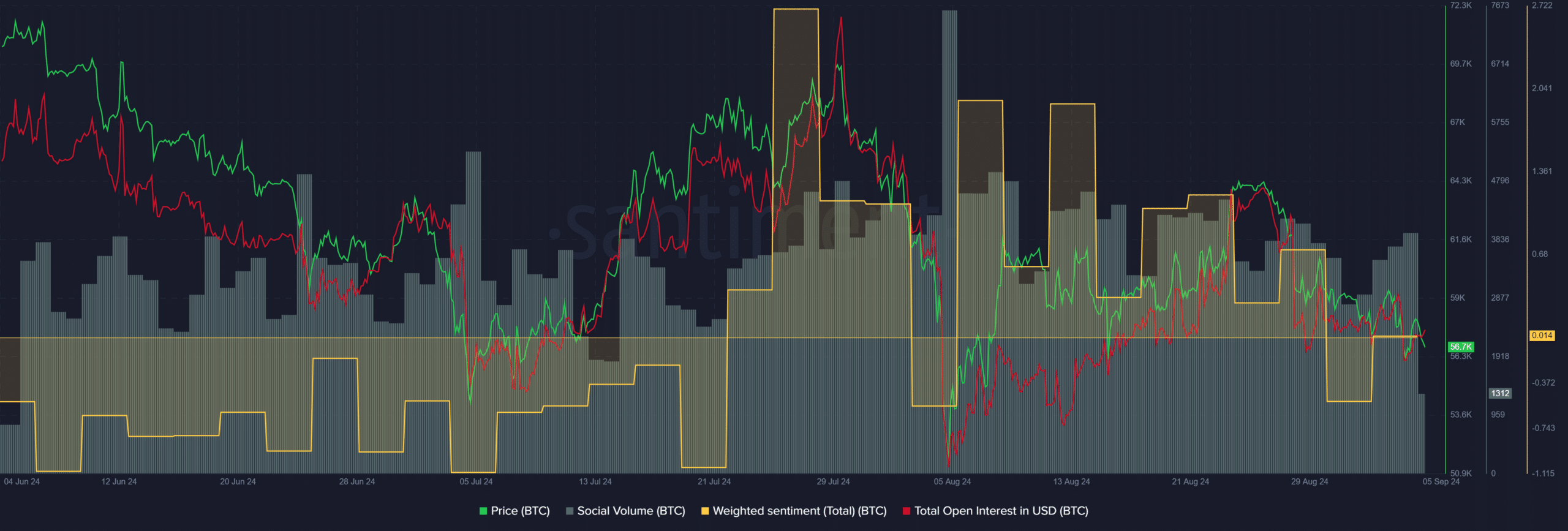

- The drop in social volume and positive engagement outlined the despondency in the market.

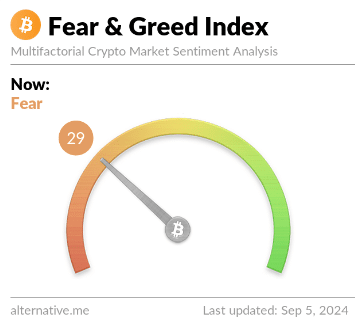

The Crypto Fear and Greed index stood at 29 at the time of writing.

It showed that there was fear in the market, but it was still better than the previous month, when heavy price corrections affected market-wide sentiment, worse than the recent drop below $60,000.

Source: Alternative.me

The overwhelmingly negative sentiment in the market led to a week-long, heavy deluge of outflow of Bitcoin [BTC] Spotting ETFs. On the other hand, El Salvador kept buying 1 BTC per day.

The weakest sentiment in a year

The Fear and Greed Index is a useful tool that gives investors an idea of when to buy and when to sell. Extreme fear readings are generally a good buying opportunity in crypto, while euphoric markets tend to mark price tops.

The index values are calculated based on Bitcoin’s behavior, as the king coin largely dictates the behavior of the crypto market. This includes volatility, market momentum and social media engagement.

The Crypto Fear and Greed Index was quite hopeful in May, but sentiment has deteriorated since then.

The promised bull run after the April halving did not take off immediately, but the continued downward trend since March has been a major concern for crypto investors.

In July and again in early August, index values reached lows below 30 not seen for a year.

At the time of writing, the value of 29 was also significantly low, but this could be a buying opportunity over the next six to twelve months.

Research into Bitcoin statistics

Read Bitcoin’s [BTC] Price forecast 2024-25

Bitcoin’s social volume has slowly declined over the past month. Weighted sentiment, which was positive when Bitcoin regained the $60,000 level in mid-August, has started to trend lower over the past three weeks.

The Open Interest also fell rapidly as BTC was rejected at the $64k resistance zone. Overall, market sentiment was bearish and those looking to buy were in the minority.