December sales of non-fungible tokens soared to $877 million, making it the second-best month of 2024.

Blockchain-based digital collectibles had a strong December, with sales of $877 million, making it the second-best month of 2024. This boost capped a wild year for the NFT market, which staged a sharp recovery in the final quarter.

Data from CryptoSlam shows that NFT sales for 2024 ended at $8.83 billion, surpassing 2023 sales by over $100 million. While the 1.1% growth may not seem huge, it underlines the market’s ability to bounce back after months of declining sales.

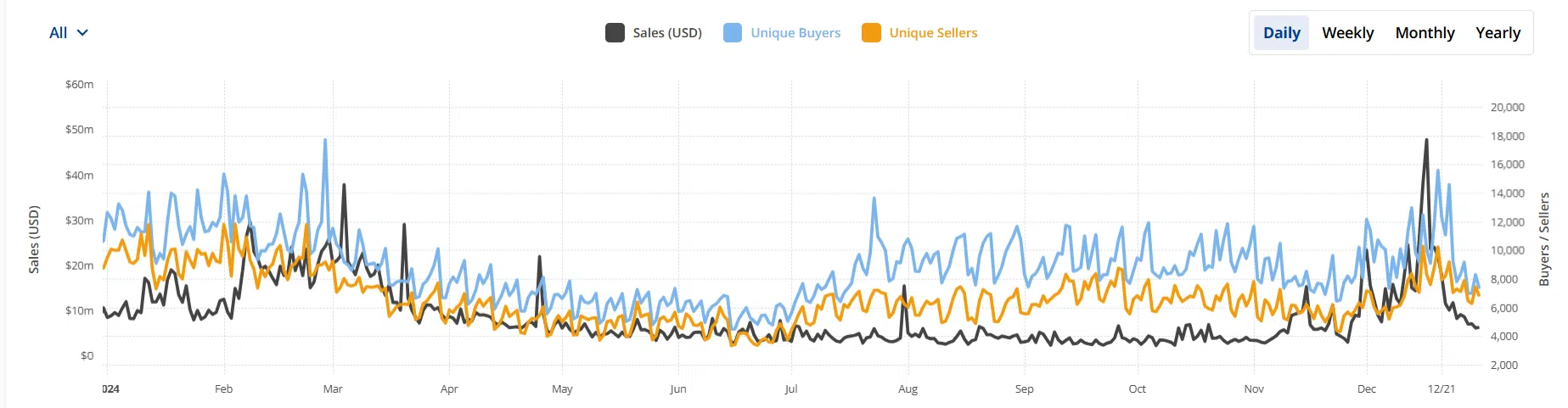

NFT sales in 2024 | Source: CryptoSlam

December stood out, thanks to Ethereum-based collections such as Pudgy Penguins, Azuki and Bored Ape Yacht Club, data shows. Ethereum NFTs led the month, bringing in $488.4 million of total sales, according to data from NFT Price Floor. Pudgy Penguins took the lead, with more than $285 million in merchandise volume, while other collections like Lil Pudgys and Azuki added a combined $222 million.

Commenting on crypto.news, Nicolás Lallement, co-founder of NFT Price Floor, noted that the NFT market had a “strong Q1 2024 for both Ordinals (Bitcoin) and Solana NFT collections,” further adding that a “repricing of Ethereum-based collections is long overdue.”

“As a trigger for that repricing, we have the current ‘token pegged to NFTs’ meta. Projects like Pudgy Penguins, Doodles, and Azuki have launched or announced plans for meme/L2 gov tokens, which have driven significant interest and repricing in blue-chip NFTs.”

Nicolas Lallement

Lallement points out that the price reprise “is not just driven by airdrops,” as many NFT holders “have shifted profits from speculative memecoin trades to long-term convictions, favoring quality collections.” He says the trend was “particularly noticeable on Ethereum, given that it is home to the most consolidated set of blue chip collections.”

“Looking ahead to 2025, I expect a trickle-down effect that will benefit the entire NFT ecosystem. It will likely start with collections related to airdrops, then expand to Ethereum-based blue-chip PFP collections, generative art (such as Art Blocks), and eventually include Solana and Bitcoin.”

Nicolas Lallement

The NFT market really rebounded in the fourth quarter. After a difficult third quarter, with sales of just $1.12 billion, sales skyrocketed 96% to reach $2.2 billion in the fourth quarter. November’s $562 million in sales helped set the stage for December’s nearly $1 billion show.

You might also like: Lifestyle app STEPN GO expands Adidas partnership with physical NFT sneakers

Industry experts attribute the rally to increasing confidence in the crypto market. For example, researchers at DappRadar noted that the rise in token prices likely fueled optimism, attracting new buyers to the space. DappRadar’s blockchain analyst Sara Gherghelas believes the difference “can be attributed to renewed trading activity in high-value collections, such as those from Yuga Labs, coupled with rising token prices.”

“Improved liquidity and greater engagement with top collections are driving confidence among collectors and investors, who now view NFTs not only as speculative assets, but also as cultural goods,” Sara Gherghelas wrote in a report.

Still far from its peak

Despite the year-end rally, total NFT sales in 2024 remain well below the market’s peak years. In 2021, NFTs generated $15.7 billion in sales, almost double this year’s figures. The following year was even more impressive, with sales of $23.7 billion.

Lallement believes that NFTs have a “unique position” as both risky speculative assets and status symbols. He explained that historically, during the later stages of a bull market, participants who have seen their wealth grow tend to shift their focus from speculative investments to status assets such as digital art and collectibles.

“This behavior stems from a desire to increase wealth and gain recognition within their community. For NFTs to return to their 2021-2022 highs, we likely need BTC to reach a significant price level (e.g. $150,000) and ETH to reach a new all-time high (several multiples from the previous one, perhaps around $10,000). .”

Nicolas Lallement

Once these milestones are achieved, Lallement expects a “rotation of capital from fungible tokens to select NFTs.” He believes that if market participants start reallocating profits to high-end collections, it could trigger a new wave of inflated valuations. “Strong token performance can rejuvenate investor confidence, create a wealth effect and reinvigorate the speculative and cultural appeal of NFTs as both investments and status artifacts,” he concluded, adding that this dynamic is likely to continue, allowing the NFT boom market will be strengthened. destroy nature alongside broader crypto trends.

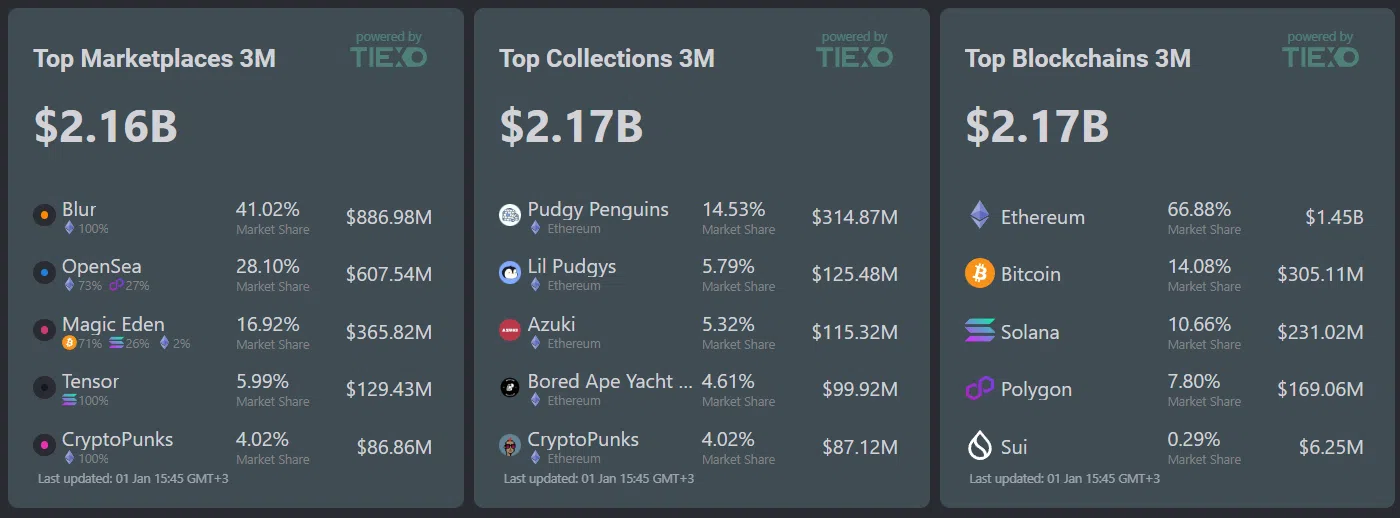

NFT activity in Q4 2024 | Source: Tiexo

Blur and OpenSea were the top marketplaces in the fourth quarter, accounting for nearly 70% of all NFT sales, according to data from NFT analytics platform Tiexo. Blur emerged as the leader with revenue of more than $885 million for the quarter, while OpenSea followed with $607 million. Magic Eden, which focuses on Solana NFTs, posted revenue of $365 million.

The variety of market activities shows that the NFT ecosystem is still maturing. As a result, no single platform or blockchain completely dominates. While Ethereum is still the all-time leader in NFT sales, Solana and Bitcoin are gradually gaining share.

The December rally has us wondering what’s next for NFTs. Will the momentum continue into 2025, or will it decline? We’ll likely find out soon, as analysts predict Bitcoin’s rally to peak in mid-2025, which could also impact the NFT market.

Read more: NFT Sales Rise 33% to $302 Million: Pudgy Penguins #4611 Goes for Nearly $494,000