Arbitrum, a prominent Layer-2 (L2) scaling solution, has undergone remarkable development upward trajectory since launching its own token, ARB, in March 2023. The past 30 days saw a staggering 74% increase in ARB’s value, underscoring the market’s growing interest in the protocol.

Notably, Arbitrum’s daily decentralized exchange (DEX) volume has seen a significant increase, driving the protocol to surpass Ethereum (ETH) for the first time in this important metric.

This milestone highlights Arbitrum’s increasing adoption and recognition for its scalability within the decentralized finance (DeFi) ecosystem.

Arbitrum sets new DEX records

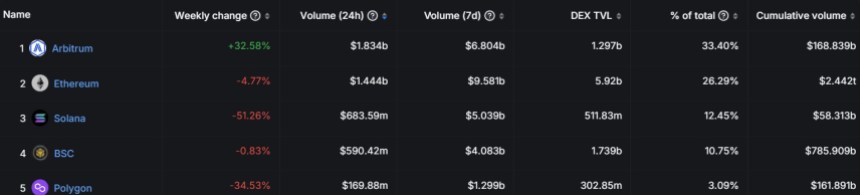

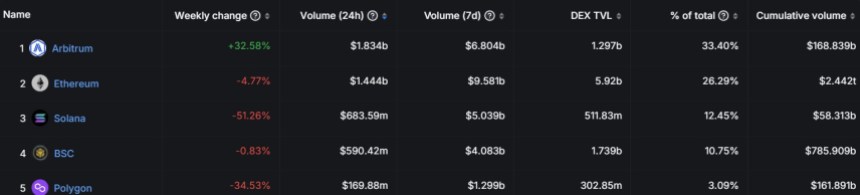

According to facts from DefiLlama, Arbitrum’s daily DEX volume reached an impressive $1.834 billion over the past 24 hours, surpassing Ethereum’s volume of $1.444 billion. Analyzing DefiLlama’s data, it becomes clear that Arbitrum’s growth extends beyond just daily DEX volume.

The weekly change in ARB’s value increased by 32.58%, demonstrating the token’s strong performance on the market. Furthermore, Arbitrum’s seven-day volume reached an impressive $6.804 billion, indicating robust trading activity on the protocol.

In terms of total value locked (TVL) in DEX, Arbitrum accounted for $1.297 billion, or 33.40% of total TVL. By comparison, Ethereum’s TVL was $5.92 billion, accounting for 26.29% of the total. This demonstrates Arbitrum’s growing prominence as users increasingly recognize its potential for efficient and secure decentralized trading.

ARB’s financial figures are rising

Furthermore, it demonstrates the growth of the protocol’s ecosystem, the token terminal facts shows that Arbitrum’s market capitalization (in circulation) increased by an impressive 83.84% to $2.56 billion.

The revenue generated of Arbitrum has also seen notable growth over the past 30 days, increasing 79.82% to $11.66 million.

Moreover, looking at the fully diluted market cap, Arbitrum has witnessed an identical increase of 83.84% to $20.07 billion.

Arbitrum’s year-over-year revenue has seen a significant increase, up 101.67% to $141.81 million. This figure represents the expected turnover for a full year based on the current situation monthly turnoverwhich underlines the continued growth of the protocol.

In terms of fees generated, Arbitrum’s 30-day figures are up 79.82% to $11.66 million, demonstrating the protocol’s ability to capture a significant portion of transaction fees within its ecosystem.

Year-over-year, fees increased 101.67% to $141.81 million, further confirming the protocol’s revenue growth and economic potential.

Nevertheless, the protocol’s native token, ARB, is trading at $1.8962, down more than 8% in the past 24 hours and below Thursday’s all-time high (ATH) of $2.11. Despite this pull backit is still up 36% over the past 14 days, demonstrating the token’s bullish momentum.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.