- 2024 was a pivotal year for Bitcoin, with the same setting the stage to tackle 2025’s volatility

- Stablecoins are rising like the new gold, leading a financial revolution as the anti-dollar coalition grows

2024 has been a wild ride for cryptos. Inflation skyrocketed, traditional markets were rocked by global drama, and more and more people started looking at crypto as their financial ‘Plan B’.

The so-called “Trump pump” gave Bitcoin the opportunity to prove itself as digital gold, and it did not disappoint. As we look ahead to 2025, the crypto world is holding its breath and wondering what’s next. Speculation is rife, but the stakes are even higher.

The crypto market remains tangled in the economic thread

It’s no coincidence: Bitcoin rose on the back of triple-digit YTD growth, climbing the charts to $108,000 before returning to $98,334 at the time of writing. In fact, the year could end four times stronger then gold.

Why? Every fourth year is a well-known bullish trend for Bitcoin, creating momentum that will continue for years to come, fueled by a mix of internal and external factors. As it should be, BTC once again lived up to its reputation.

However, the crypto market remains closely linked to external forces. Investor sentiment continues to be largely driven by macroeconomic trends, which dictate their ‘risk appetite’ – a reality that became even more apparent as the year drew to a close.

When the FOMC took a cautious stance on economic data and hinted at increasing volatility, the crypto market took a hit. In just three days, the market cap dropped from an ATH of $3.77 trillion to $3.13 trillion – a steep drop of 17%.

Meanwhile, the US dollar rose to a three-year high. The impact wasn’t limited to Bitcoin alone: major currencies like the Japanese yen also struggled, hitting a five-month low on the charts.

Clearly, the Fed’s single announcement caused ripple effects across global markets, directly or indirectly impacting cryptocurrency demand. However, a deeper look at the numbers revealed a huge shift in market behavior.

Bitcoin breaks its usual trend

In June 2022, there was a post-pandemic inflation spike of over 9%, with the Fed raising rates and Bitcoin entering its harshest cycle. At the time, the crypto was stuck between $20,000 and $25,000 on the charts.

This year, however, the reactions were different.

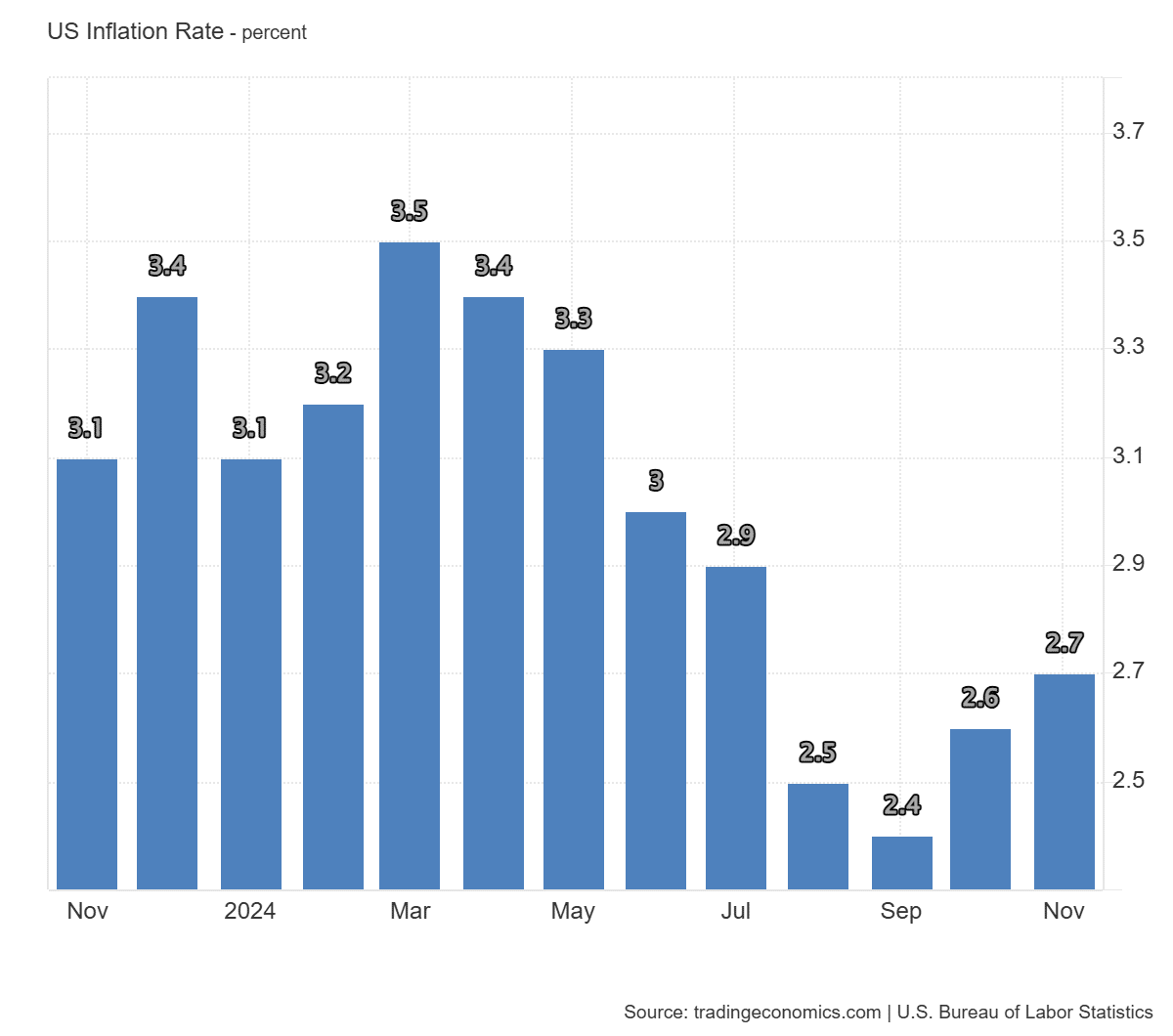

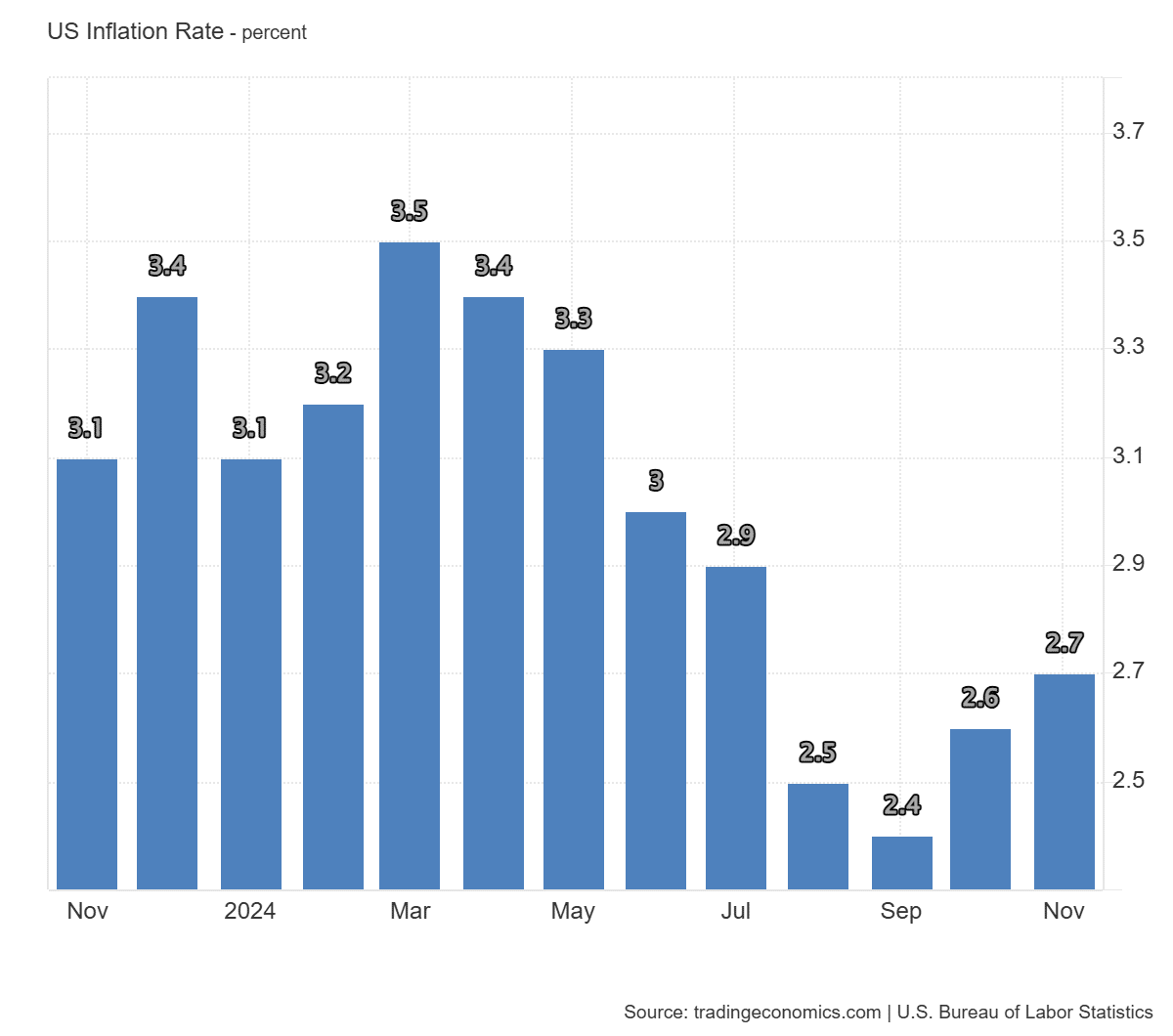

Source: Trade Economics

Even as inflation hit an annual high of 3.5% in March, driven by rising oil prices, Bitcoin didn’t budge. Instead, the price rose to a new all-time high of $73,000.

What’s even more impressive is how Bitcoin has far surpassed traditional assets. With YTD growth of almost 140%, BTC has done just that leaving other major indexes such as Gold (+27%), the S&P 500 (+33%) and NASDAQ (+33%) in the dust.

In a year marked by skyrocketing war supplies costs, broken supply chains, political chaos and escalating trade sanctions, Bitcoin remained steadfast.

But why does this matter? During times of economic pressure, investors typically withdraw from ‘risky’ assets. Capital is flowing into banks as people seek safety in savings and higher borrowing costs eat into liquidity, pushing investors into traditional assets with guaranteed returns.

And yet, despite tightening household budgets and general market uncertainty, Bitcoin has emerged as a “safe haven,” living up to its reputation as “digital gold.” This marks a crucial shift for BTC and means that 2025 could be a gamechanger.

So is this the start of something new?

Undoubtedly, Bitcoin’s dominance over traditional assets, especially gold – the age-old safe haven – has paved the way for a new era in global investing.

With a pro-crypto administration at the helm and Bitcoin reserves gaining mainstream attention, BTC’s power appears to be here to stay. However, the road ahead is far from smooth.

Renewed Chinese tariffs, tax cuts and tighter government spending could prompt the Federal Reserve to keep interest rates high, which would challenge both the markets – and Bitcoin.

The driving factor? Inflation. Although these policies aim to increase domestic dependence, they entail economic risks that could spread across global markets.

Read Bitcoin’s [BTC] Price forecast 2025-26

As these challenges unfold, Bitcoin’s resilience will come under renewed scrutiny, and the dominance of the US dollar will be at stake. It’s clear that the shifts we’ve seen this year are far from ordinary. They have been groundbreaking and paved the way for Bitcoin to tackle the coming volatility.

Meanwhile, stablecoins are carving out their own niche. Tether (USDT), the largest dollar-pegged stablecoin, reached an all-time high capitalization of $140 billion.

With practical use cases, it also challenges traditional fiat currencies. An example – In October 2024, Tether enabled the shipment of 670,000 barrels of crude oil from the Middle East worth $45 million.

As stablecoins continue to gain traction as an inflation hedge and alternative to traditional fiat, the anti-dollar movement becomes stronger. This could mark the beginning of a new financial era – one in which Bitcoin and stablecoins take the lead.