A leading crypto analytics firm says the industry’s biggest whales are loading up on dollar-pegged digital assets.

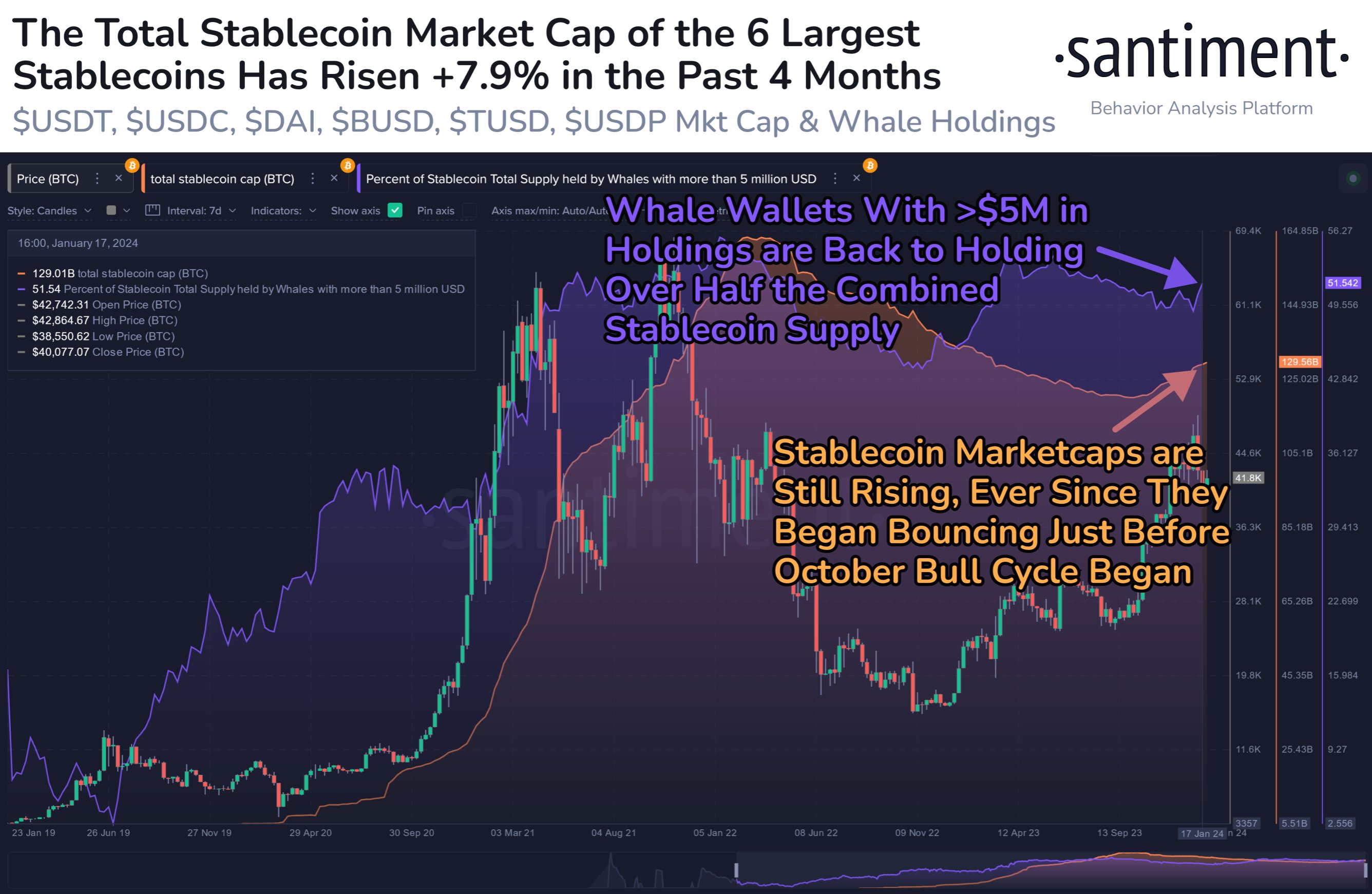

Santiment says on social media platform increased. four months.

The analytics firm also notes that the increase in the market cap of the dollar-pegged cryptocurrency comes as whales owning more than $5 million worth of digital assets gobble up massive amounts of stablecoins.

According to Santiment, the whales now own more than half of the combined supply of stablecoins.

The analytics firm emphasizes that the rise in stablecoin market caps has bullish implications for crypto, calling it a “necessary ingredient” for the markets to witness more rallies.

Taking a closer look at the activities of USDT owners, Santiment says that holders of the third-largest cryptocurrency by market capitalization are sending their dollar-pegged digital assets to exchanges. According to Santiment, USDT inflows to exchanges suggest that crypto markets are gearing up for more rallies.

“As the respective stocks of Bitcoin and Ethereum have continued to disappear from exchanges following the approval of the ETF (exchange-traded fund), an interesting development has been for Tether, with almost 4% of its available supply returning to the stock market within five weeks scholarships.

The increase in purchasing power means that the medium-term bull cycle of more than three months (starting in October) could still have some legs, especially with just 79 days until Bitcoin’s halving, which is estimated to happen on April 18 will take place.”

The Bitcoin halving is a highly anticipated event as it is a time when the issuance of new BTC to miners is halved.

At the time of writing, BTC is worth $43,439, up almost 3% in the past day.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3