- Bitcoin whale may face liquidation of $28 million WBTC.

- The price action shows that the price will continue to fall.

Bitcoins [BTC] the recent price action continued to frustrate traders as uncertainty loomed over the ‘king of crypto’.

While other cryptocurrencies faced similar declines, BTC was particularly affected by the whale activity.

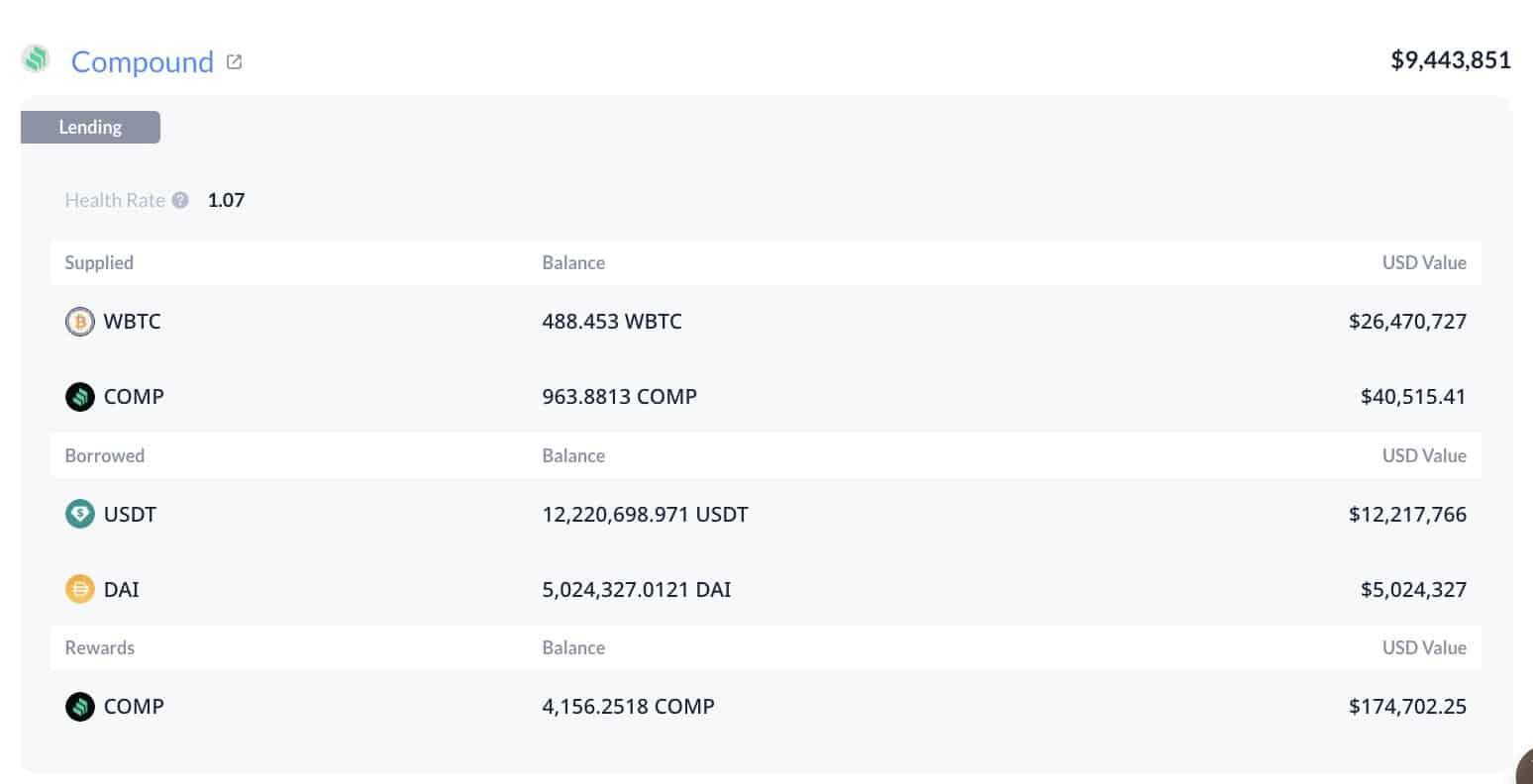

One Prominent Whale Risks Liquidation of 488.45 WBTC, Worth $28 Million, on Compound [COMP]with a health percentage of 1.07 and a liquidation price of $50,429.

This whale was liquidated three times during the 2022 crash, for a total of 74,426 cWBTC worth $32.82 million. Current liquidation orders below $50,429 could drive the Bitcoin price to this level.

Source: Lookonchain

More BTC levels need to be liquidated

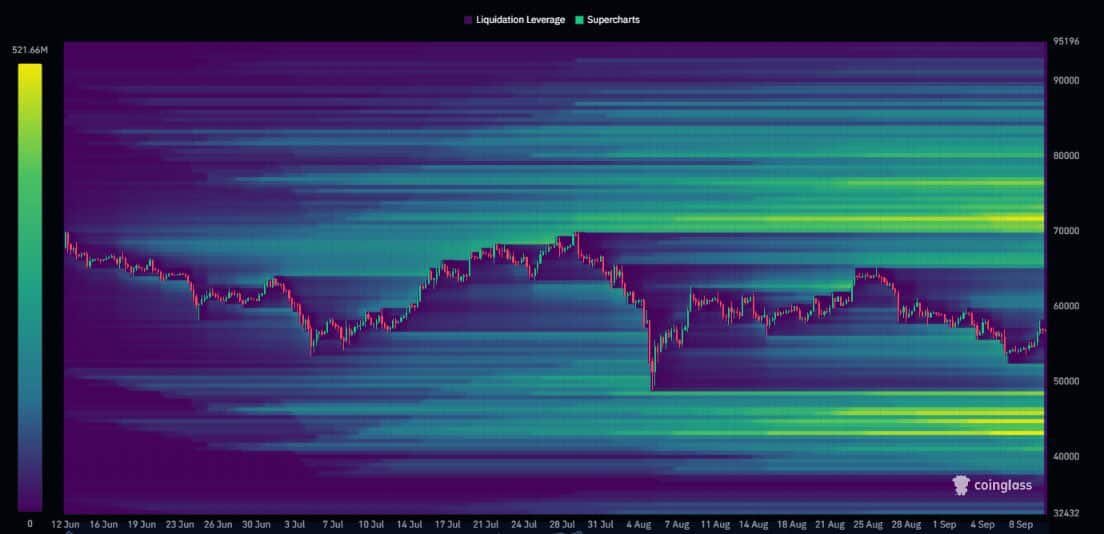

The broader Bitcoin market is at risk of further liquidation. Notably, sell-side liquidations are expected to total $1.07 billion around $50,000, with an additional $500 million expected below $55,000.

A three-month heatmap revealed high liquidity levels on both sides of the market, with long liquidations around $45,000 and short liquidations around $72,000.

Traders should avoid leveraged positions as the market can move sharply in either direction to exploit liquidity.

Source: Coinglass

After rejecting the $60,000 level, Bitcoin’s price may fall further, potentially pushing liquidity below $50,000 before a reversal to the upside occurs.

What’s next for BTC?

Within a four-hour window, Bitcoin has repeatedly failed to move above the 200-day exponential moving average (EMA) in recent weeks.

This suggested that BTC could face additional downside pressure. Prices are often attracted by liquidity above or below key levels.

Whether BTC is trading above or below its moving averages provides insight into the strength or weakness of the market.

Bulls need to claw back these moving averages to spark an upswing, but sentiment indicates that the price could fall further as more liquidity is concentrated at the psychological $50,000 level.

Source: TradingView

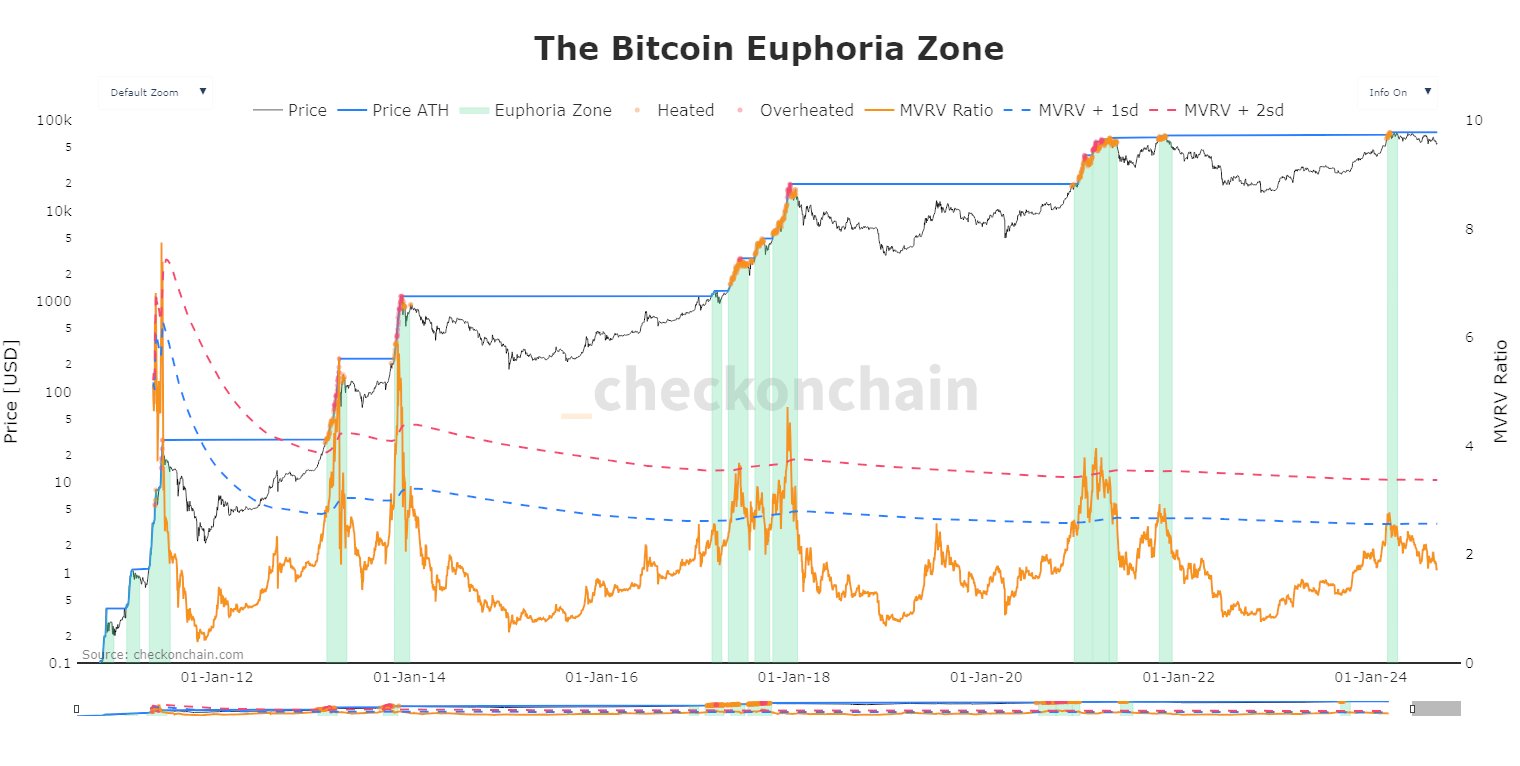

History shows a return to an equilibrium zone

Historically, Bitcoin has tended to return to an equilibrium zone, which offers potential for future price growth.

The Euphoria Zone metric suggests that the previous cycle’s ATH typically becomes the low for the next rally.

Other metrics, such as the market value to realized value ratio (MVRV), show that BTC is heading towards an equilibrium zone, a critical level where the price has historically bounced off.

Source: Checkonchain

Although Bitcoin has not yet reached these levels, analysts predict that BTC could fall below $50,000, gather liquidity and then rise to new highs, possibly in late Q4 2024 or early Q1 2025.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Bitcoin’s price action and ongoing liquidations point to potential volatility in the near future. As liquidity builds below key levels, BTC could fall further before a substantial recovery occurs.

However, if Bitcoin follows historical patterns, it will likely rebound, paving the way for higher price appreciation as liquidity increases.