- BTC retested $66k after better-than-expected August inflation data

- An update in the US labor market could determine the next market direction

Bitcoin [BTC] rose to test $66,000 again on Friday, following a softer reading of the US Fed’s favorite inflation data: the Core PCE Index (Personal Consumption Expenditure). This index tracks US inflation without the noise of food and energy price fluctuations.

August’s Core PCE Index came in better than expected, up 2.6% year-over-year (YoY). This was contrary to market expectations of 2.7%.

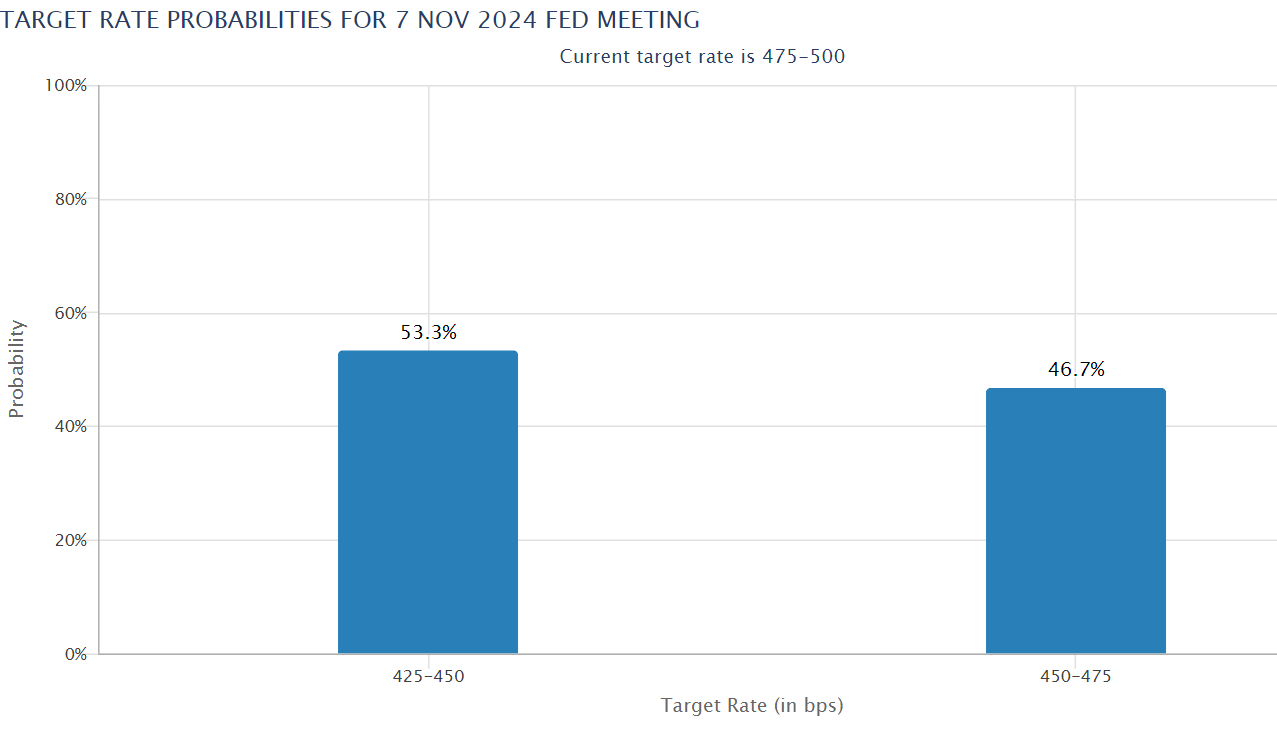

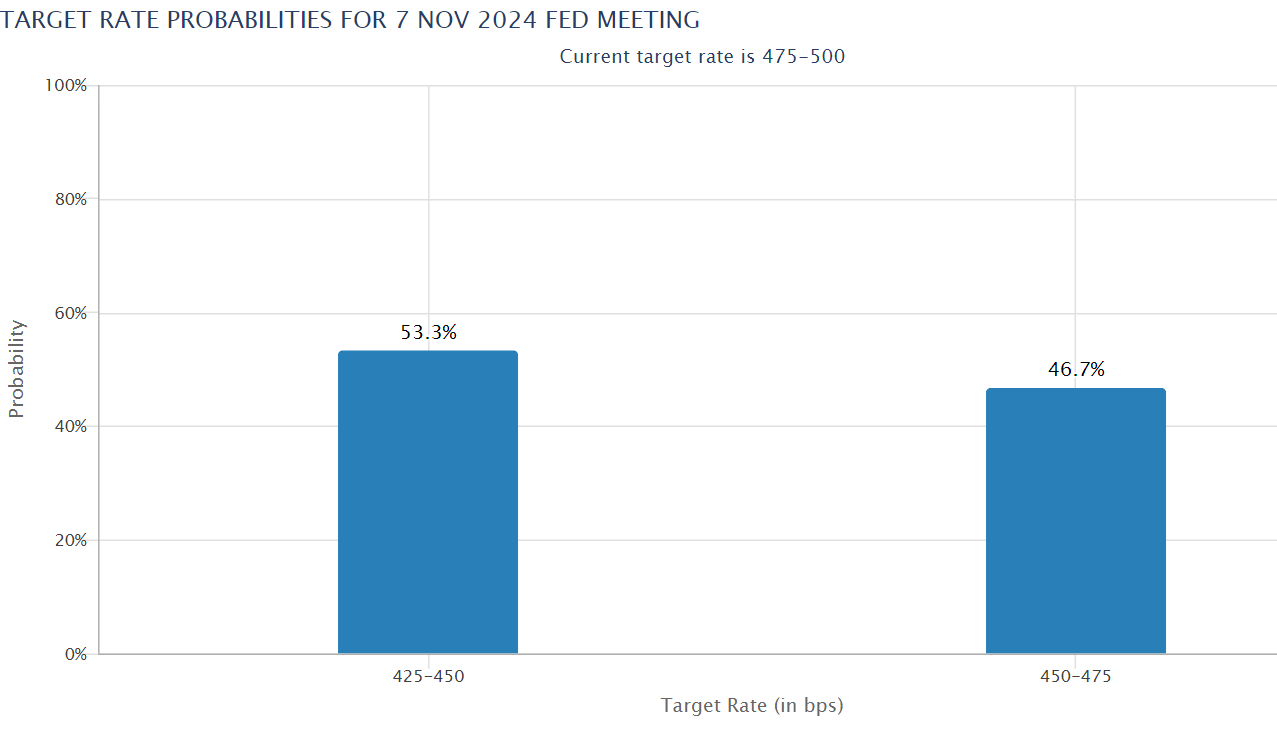

Low inflation rates stimulated markets as speculators charged higher prices chances of another 50 basis points (bp) Fed rate cut in November.

Source: CME FedWatch

Next market catalyst

The low inflation rates meant that the Fed would now focus on the status of the US labor market, especially the unemployment rate, in adjusting the pace of interest rate cuts accordingly.

Ergo, upcoming updates from the US labor sector will influence the market’s next direction, trading firm QCP Capital noted.

Part of the company’s weekend briefing on September 28 read,

“As we head into next week, the main focus will be on the upcoming labor market indicators, including JOLTs, ADP and the U.S. unemployment rate.”

The key updates what you should pay attention to are the JOLTs (Job Openings and Labor Turnover Survey) and the employment situation scheduled for November 1 and 4. QCP Capital projected the potential market impact of the updates, adding:

“Strong performance on these measures could strengthen the case for a 50 basis point cut in November, further boosting risk assets.”

If that is the case, BTC could move even higher towards $70,000 after the recent shift in bullish market structure. Especially after it reclaims the 200-day MA (Moving Average).

Source: Daan Crypto/X

The launch could also benefit Ethereum [ETH]. ETH has even outperformed BTC since the Fed pivot.

Thus, an additional macroeconomic tailwind could extend ETH’s remarkable recovery on the charts. According to market analyst Benjamin Cowen, ETH could even rise to the psychological level of $3000.

Source: Cowen/X

That said, top digital assets saw renewed demand from US investors. This week, US BTC ETFs saw inflows of $1.11 billion, the largest weekly inflows since July 19.

Similar, but limited, investor interest was also observed in ETH ETFs. The products attracted an inflow of $84.6 million, the largest weekly demand since August 9. If the trend continues, the price targets of $3,000 per ETH and $70,000 per BTC could be achievable.