- Bitcoin breaks the downward trend channel.

- The average leverage delta of Bitcoin’s top traders falls below 2.

Bitcoin [BTC] continues to gain momentum as crypto markets show signs of recovery from the recent recession.

Within the hourly time frame, BTC has finally broken out of the downward parallel channel, which has been persisting since late July 2024. The reach lasted more than 50 days.

The BTC/USDT price action has shown that this could be a potential turning point for Bitcoin with a by-the-book retest. The price action formed from higher highs and higher lows as it neared the breakout resistance.

Typically, when markets consolidate for extended periods, a parabolic run often follows. This could give BTC a target of $75,000, which could surpass its all-time high.

Source: TradingView

A rally towards this critical zone is feasible if market conditions remain favorable as BTC has reclaimed the $62,000 level and is now targeting $65,000 before potentially reaching $75,000 in Q4 2024 or early Q1 from 2025.

Could this uptrend push BTC to $75,000 by the end of the year? Let’s explore the possibilities.

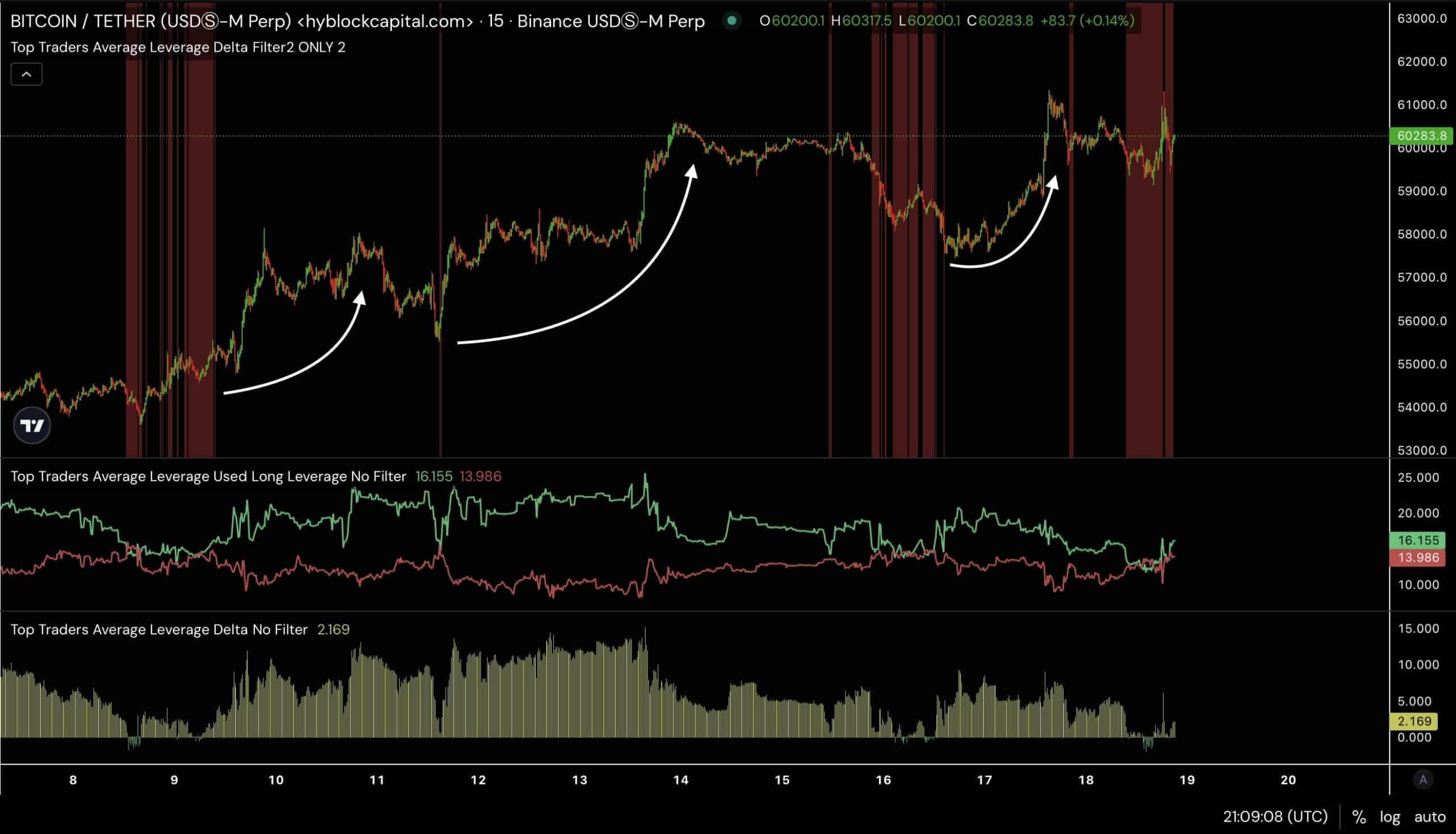

Average Leverage Delta Signals from Top Traders…

Historically, an uptrend has often followed when the top traders’ average leverage delta fell below +2, as happened recently before rising to 2.169.

This adds even more confidence that a BTC rally may have begun. The leverage delta for BTC currently stands at +0.49, indicating that the leverage of both longs and shorts is almost equal.

The drop in the top traders’ average leverage delta supports the idea that BTC/USDT’s breakout from the downtrend channel could signal the start of a bull run.

Source: Hyblock Capital

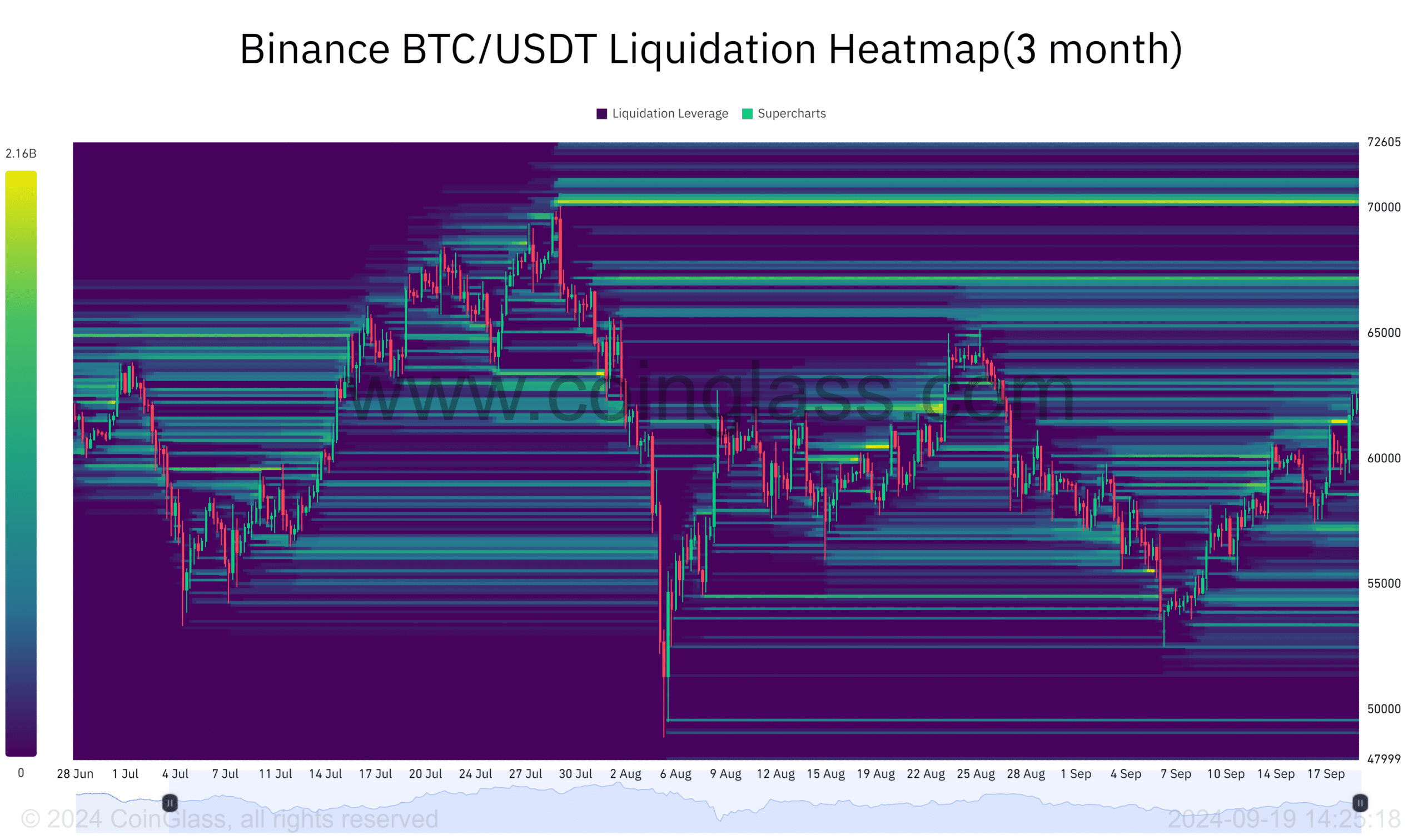

BTC liquidation heatmap

Furthermore, Bitcoin’s price often moves towards zones of high liquidity. Traders liquidated about $179.70 million in the futures markets as BTC reached $61,498.

This liquidation could fuel further upside as the price focuses on liquidity at higher levels.

A significant liquidity cluster of $730.49 million is also present at the $70182 price level, with another $1.3 billion at $67250.

Source: Coinglass

BTC could climb higher to reach these liquidity levels, further fueling upside momentum and potentially reaching the $75,000 target.

The average Bitcoin cycle

Furthermore, the average Bitcoin cycle historically starts 170 days after the halving and peaks 480 days afterward.

Currently, BTC is 151 days post-halving, meaning it is less than 20 days away from the historic start of a post-halving rally.

This cycle pattern adds a new layer of confidence to the potential rally towards $75,000, while the top traders’ average delta indicates a bull run.

Read Bitcoin’s [BTC] Price forecast 2024-25

Source:

The crypto market seems poised for a positive move, driven by technical signals and liquidity patterns, which indicate that Bitcoin is poised for higher gains.