beginner

When it comes to exchanging value, two types of currencies come to mind: cryptocurrency and fiat currency. While both serve as mediums of exchange, they operate differently, have distinct underlying technologies, and are subject to varying levels of regulation. Understanding the similarities and differences between these two currencies is essential as they impact the way we manage our finances.

In this article, we will explore the differences between cryptocurrency and fiat currency, including their origins, use cases, and advantages and disadvantages. By the end of this article, you will have a better grasp of features intrinsic to these two types of currency and will be able to make an informed decision about which one is right for you.

Hi! I am Zifa, your guide in this fascinating exploration of the digital currency landscape. With over two years of intensive coverage in the cryptocurrency field, my passion lies in tracking the transformative influence of blockchain technology as it steadily permeates our everyday lives. Today, we return to the fundamentals, demystifying the complex world of crypto and comparing it to the familiar realm of fiat currency. Together, let’s embark on this journey of discovery and understanding.

What Is Fiat Currency?

Fiat currencies refer to government-issued currencies that are not backed by physical commodities such as gold or silver. The term “fiat” comes from the Latin phrase “let it be done,” meaning that the currency has value simply because the government declares it as legal tender.

Origins and Characteristics of Fiat Currency

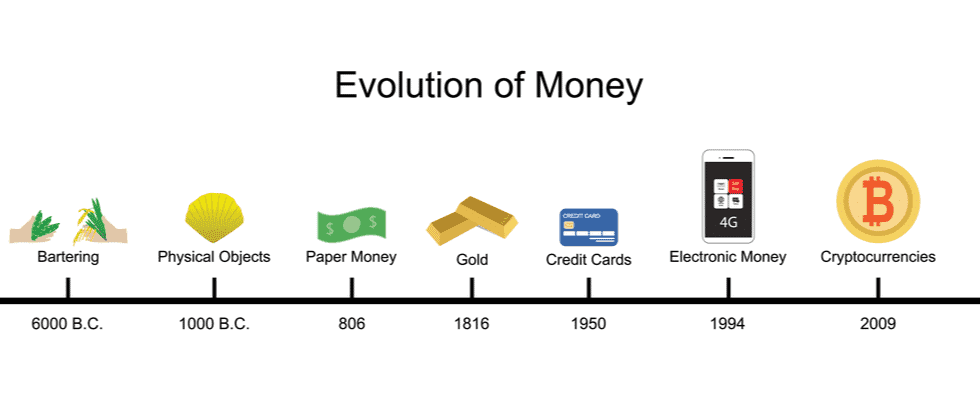

Fiat money has been in use for centuries, with the first widespread use of paper currency occurring in China during the 7th century. Today, most countries use fiat currency as their primary form of legal tender.

Unlike digital currencies, fiat currencies are controlled by central authorities such as central banks and government institutions. These authorities have the power to regulate the supply of currency and affect its value through monetary policy.

What Is Fiat Currency in Crypto?

In the context of cryptocurrency, fiat currency refers to traditional government-issued currency, like the US dollar or the euro, which can be used to purchase cryptocurrency. Many cryptocurrency exchanges allow users to trade fiat currencies for cryptocurrencies and vice versa.

Examples of Widely Accepted Global Fiat Currencies

Some of the most widely accepted fiat currencies in the world include the US dollar, euro, Japanese yen, and British pound. These currencies play a critical role in the global payment system, allowing for the exchange of goods and services across borders.

Why Is Digital Money Classified as Fiat Money?

Not all digital money is classified as fiat money. Digital fiat money refers to digital forms of government-issued currencies, like digital dollars or digital euros. These are overseen by a central bank and have the same value as their physical counterparts. However, cryptocurrencies, although digital, are not considered fiat because they are not issued or regulated by a central authority.

Potential Deficiencies of Fiat Currency

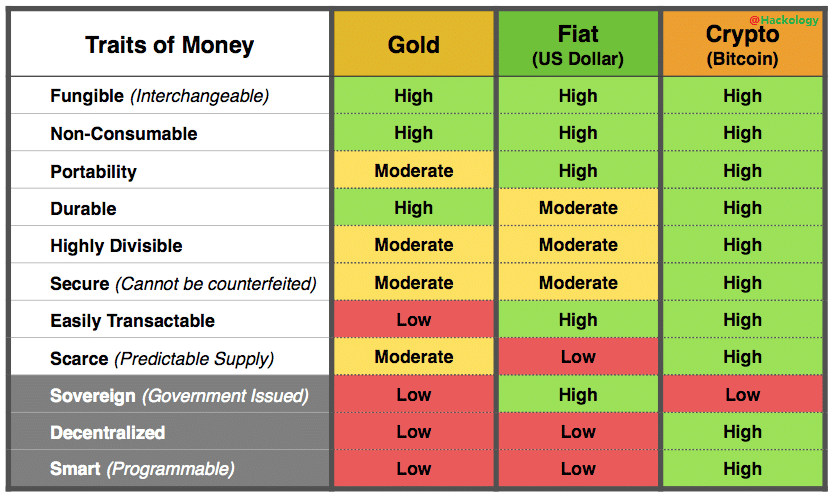

Despite its widespread use, fiat currency has some potential deficiencies. One of the main issues is its susceptibility to hyperinflation, where the value of the currency rapidly decreases due to an excessive increase in the money supply. In contrast, digital currencies like Bitcoin have a fixed supply, reducing the risk of hyperinflation.

Is Bitcoin Fiat Money?

No, Bitcoin is not considered fiat money. Fiat money is a type of currency issued by a government, and its value is derived from the trust that individuals and governments have that parties will accept that currency. In contrast, Bitcoin is a decentralized, digital currency that operates independently of a central bank.

What Is Cryptocurrency?

Cryptocurrencies are digital or virtual currencies that employ cryptography for security. Their decentralized nature sets them apart from traditional fiat currencies. This decentralization is facilitated by a technology known as the blockchain, which is essentially a distributed ledger enforced by a disparate network of computers, also known as nodes.

The Inception of Bitcoin and its Objectives

Cryptocurrencies were created as a response to the 2008 financial crisis with the goal of establishing a new financial system that is open, transparent, and free from the control of central banks. The first and most well-known cryptocurrency, Bitcoin, was introduced by an anonymous person (or group of people) using the pseudonym Satoshi Nakamoto in 2009. The premise of Bitcoin was to create a decentralized peer-to-peer electronic cash system that enables online payments to be sent directly from one party to another without going through a financial institution.

The Emergence of Altcoins: From Ethereum to Ripple

There are now more than 10,000 different cryptocurrencies that have been launched since the creation of Bitcoin, and these are typically referred to as altcoins (alternative coins). Some of the most well-known altcoins include Ethereum, Ripple’s XRP, Litecoin, and Bitcoin Cash. These digital assets offer varying features and functionalities. For instance, Ethereum is more than just a cryptocurrency; it’s a platform for creating decentralized applications (dApps) using smart contracts.

Functionality and Use Cases of Cryptocurrencies

Different cryptocurrencies serve different purposes. Bitcoin was created as an alternative to traditional money; nowadays, it is a digital medium of exchange. Ethereum, on the other hand, was developed as a platform that facilitates peer-to-peer contracts and applications via its own currency vehicle. Meanwhile, Ripple seeks to improve cross-border transactions by working with the existing financial system.

While the primary function of cryptocurrencies is generally to serve as a medium of exchange, many also have various other uses. Some, like Bitcoin, act mostly as a store of value, similar to gold, whereas others find application within their own blockchain ecosystems.

The rise of cryptocurrencies has been met with mixed reactions. Enthusiasts laud them as the future of finance, while skeptics worry about their volatility and lack of regulation. Nonetheless, their influence continues to grow, affecting sectors as diverse as finance, technology, law, and more.

Is Crypto Fiat?

No, cryptocurrencies are not considered fiat. While both are forms of currency, they operate under different systems. Fiat currency is issued by a government, and its value is based on the trust and confidence in that government. On the other hand, cryptocurrencies are decentralized, and their value is not determined by a central authority but by supply and demand dynamics in the market.

How Is Cryptocurrency Different from Government-Issued Currency?

Cryptocurrency differs from government-issued (fiat) currency in several ways. First, cryptocurrencies like Bitcoin operate on a decentralized system known as a blockchain, which is not controlled by any government or central authority. Second, the supply of cryptocurrencies is typically fixed, unlike fiat money which can be issued in varying amounts by central banks. Finally, transactions made with cryptocurrencies are usually anonymous and cannot easily be traced back to individuals, unlike transactions made with government-issued currency.

Monetary Policy

Monetary policy refers to the actions taken by a government or central bank to control the supply and availability of money in a country’s economy. Among other things, it influences currencies’ interest, exchange, and inflation rates. The government implements monetary policy to stabilize economic growth and control inflation and deflation in the economy.

In traditional fiat currency, monetary policy is controlled by the government through a central bank. The central bank uses tools such as open market operations and reserve requirements to manage the money supply and control inflation. They may also engage in Quantitative Easing, which involves increasing the money supply by buying government bonds or other financial assets.

However, devaluing a country’s currency through Quantitative Easing can have negative implications, such as increasing inflation and currency depreciation. It can also lead to a decrease in exports as a result of the higher relative price of goods in the country.

Cryptocurrencies operate on a different monetary policy system. Cryptocurrencies, such as Bitcoin and Ethereum, have a predetermined algorithm that controls the money supply. This algorithm prevents centralized control of the currency and ensures that its supply is finite, thereby reducing the potential for inflation.

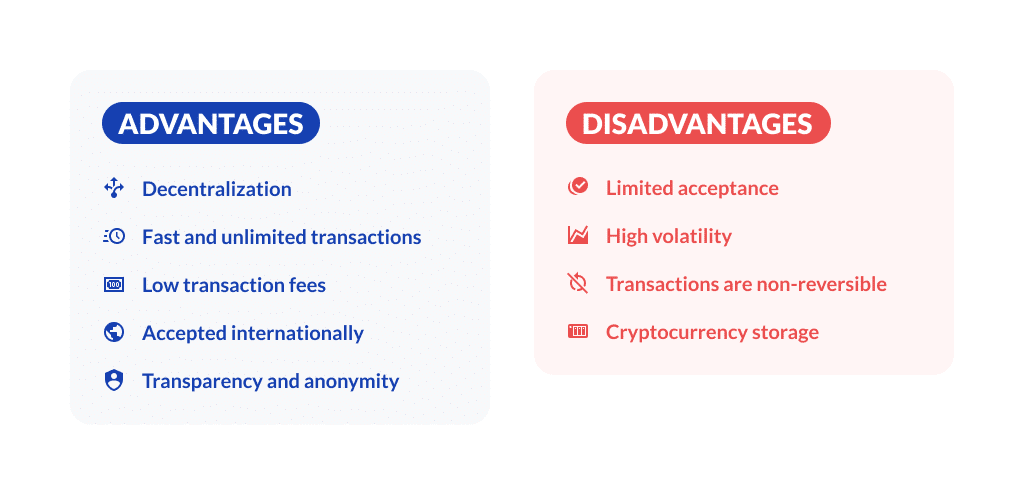

Advantages of Cryptocurrency

Cryptocurrencies have been making waves in the financial world. As a decentralized form of currency, they offer unique advantages that traditional fiat currencies cannot provide.

Cryptocurrencies are Pseudonymous

Cryptocurrencies are often referred to as being pseudonymous, which means that while a transaction can be traced to a specific blockchain address, the identity of the owner of that address is typically unknown. This is in contrast to fiat currency transactions, where a bank or financial institution can identify the sender and recipient of a transaction.

In cryptocurrency transactions, the use of a pseudonym, or “crypto alias,” allows users to conduct transactions without revealing their true identity. For example, if someone wants to send Bitcoin to another party, they can create a new Bitcoin address specifically for that transaction. This address is unique and only used for that one transaction. Besides, no personal information is required to create it.

While some cryptocurrencies, such as Bitcoin, have a public ledger that allows anyone to view all transactions on their blockchain network, the use of pseudonyms means that the identity of the individuals behind each transaction cannot easily be identified without additional information.

One example of a cryptocurrency designed for increased pseudonymity is Monero. Being privacy-oriented, it uses various techniques to provide its users with enhanced anonymity.

The advantages of pseudonymity in cryptocurrency transactions are clear: users can revel in greater privacy and protection from government or institutional surveillance. This is particularly relevant in countries where there is political unrest or economic instability or where citizens are subject to oppressive governments. The privacy and anonymity afforded by cryptocurrencies can help individuals to protect their wealth and conduct transactions without fear of retaliation.

Cryptocurrencies Are Secure

One of the major benefits of cryptocurrencies is their high level of security, which is achieved through blockchain technology.

Blockchain technology is a decentralized system that allows individuals to make secure transactions without the need for a central authority or intermediary. The use of mathematical algorithms and cryptography ensures that transactions cannot be tampered with.

One of the key ways in which blockchain technology ensures security is by providing transparency. All transactions are recorded on a public ledger that cannot be changed or altered. This means that anyone can view the history of a particular transaction, making it difficult for fraudsters to carry out illegal activities on the network.

The inability to reverse or alter transactions on the blockchain network reduces the risk of fraudulent activities like chargebacks. This feature makes cryptocurrencies a safer alternative to credit card payments, which are vulnerable to chargebacks and disputes.

We all know that in the increasingly digital world, the value of security cannot be overstated. Consumers and businesses alike are putting their trust in digital platforms to carry out financial transactions. With the high level of security granted by cryptocurrencies, individuals can be confident that their transactions are safe and sound and that their personal information is protected.

Cryptocurrency Transactions Are Fast

Cryptocurrency transactions have been identified as a faster and more efficient alternative to traditional fiat currency transactions. This is because cryptocurrency transactions can be processed and verified within minutes, unlike fiat currency transactions which could take days to be processed.

Fiat currency transactions often require intermediaries, such as banks or financial institutions, to facilitate the transaction process. These intermediaries have their own processing times and value date mechanism, which can cause delays in transactions. For instance, if a transaction is made on a Friday evening, the value date may not be displayed until the following week, leading to delays.

However, with the use of blockchain technology, cryptocurrency transactions bypass the involvement of intermediaries and the value date mechanism. The network of users validates and confirms each transaction in real time, ensuring immediate payment.

Cryptocurrency transactions can be made anytime, anywhere, without a financial institution. This makes them quicker, more efficient, and ideal for international payments.

Disadvantages of Crypto

While cryptocurrencies are packed with benefits, they come with a set of drawbacks too. It’s crucial to understand these downsides before investing in cryptocurrencies or using them as a medium of exchange.

Cryptocurrency Is Unregulated

Cryptocurrencies are often touted as decentralized currencies that are independent of government supervision and control. While this may seem like a positive attribute at first glance, the unregulated nature of the cryptocurrency market can actually pose significant challenges and risks.

One major issue with this lack of regulation is compliance with anti-money laundering requirements. Because cryptocurrencies are not linked to traditional financial institutions, authorities can struggle with tracking and monitoring transactions. Therefore, conducting illicit activities such as money laundering becomes easier. This has become a growing concern among regulators and governments, leading to increased scrutiny and proposed legislation aimed at bringing cryptocurrency transactions under greater supervision.

Crypto Is Highly Volatile

The main drawback of cryptocurrencies is volatility — their cost can seem erratic, and the value of your investments can also decrease or increase quickly. This means that if you’re relying on cryptocurrencies to pay for goods or services, you may need to find assets in traditional currencies if the value of a particular cryptocurrency falls significantly overnight. This could be particularly damaging for businesses that rely on cryptocurrency payments as it would create significant financial strain.

Historical data shows that fluctuations in currency markets can be both sudden and dramatic. Due to volatility, it is difficult to calculate the true worth of investments in digital currencies, which substantially increases associated risks — anyone trading cryptocurrencies has to do it at their own peril. To counteract this disadvantage, stablecoins emerged — these are usually backed by fiat currencies such as US dollars and highly regarded government bonds, thereby reducing the level of risk involved in using them.

Cryptocurrencies Are Not Universally Acknowledged

The lack of global acknowledgment presents several challenges for individuals and organizations who wish to use cryptocurrency as a primary payment method. For example, it can be difficult to find businesses or institutions that accept digital currencies as payment, which limits the practical usefulness and adoption of this alternative form of currency.

Advantages of Fiat Currency

While it may not have the same level of security and decentralization provided by cryptocurrencies, fiat currencies remain a reliable and widely accepted medium of exchange with many benefits. Read on to learn more.

Fiat Is Widely Accepted and Stable

Fiat money, also known as paper currency, has been the primary form of payment and store of value in most countries for decades. This is partly due to its wide acceptance and stability, making it an ideal medium of exchange and a reliable tool for businesses to plan and forecast.

One of the key reasons why fiat money has remained legal tender in most countries is its stability. Governments and central banks work tirelessly to maintain the stability of their national currencies by managing the supply and demand of money in the market. As a result, fiat money has evolved into a reliable and trusted store of value, enabling individuals and businesses to plan and make long-term financial decisions with confidence.

Moreover, the widespread acceptance of fiat currencies around the world has contributed to their usefulness as a medium of exchange. Unlike cryptocurrencies which are yet to gain this position, fiat money is widely accepted and recognized as a legal tender in most countries. This has made it an effective means of facilitating global trade, making cross-border transactions and traveling more convenient. Fiat currencies are often called ‘hard’ currencies as they are universally accepted as means of payment and are considered safe havens for investors and traders.

It is important to note that one of the key advantages of fiat currency is the extent of control that central banks have over it. Central banks are responsible for managing the monetary policy of their respective countries. This means that they can influence the supply and demand of money, interest rates, and credit supply to achieve various economic objectives. These objectives may include promoting economic growth, stabilizing prices, and controlling inflation. This level of control has made it possible for economies to achieve greater stability, predictability, and sustainability.

Disadvantages of Fiat Currency

Although fiat currency has been the primary form of payment for many countries, it is not without its disadvantages. From the influence of central authorities to the supply and demand of money, there are various areas where fiat currency falls short, and we will examine them in detail.

Contingent on Inflation

Inflation is a term often associated with economics, and it is something that can have a significant impact on the value of fiat currency. Simply put, inflation refers to the increase in prices of goods and services over a period of time.

The concept of inflation is particularly relevant to industries such as real estate, manufacturing, and hospitality, as they require significant cash investments. When inflation hits, the prices of goods and services in these industries can grow rapidly, making it difficult for businesses to maintain their profitability. This can lead to layoffs, closures, and other negative economic impacts.

Subject to Government Control

Fiat currencies are typically issued by governments and are subject to government control. This means that governments have the discretion to regulate the money supply and influence the value of the currency through monetary policy. They do this through mechanisms such as setting interest rates, minting new coins, and implementing quantitative easing policies. However, such discretion can be problematic since it can lead to increased inflation rates or stagnation in the economy.

Future of Crypto and Fiat Currency

As we move towards a more digital world, the future of currency is changing. Cryptocurrencies, with their decentralized, secure, and transparent nature, have taken the financial world by storm. On the other hand, fiat currencies have been the traditional medium of exchange for centuries and are still widely utilized.

What Would Happen If Cryptocurrency Replaces Fiat?

The potential outcomes of cryptocurrency replacing fiat currency are significant. It would mean that there would be no more physical banknotes, and payments would only be made using digital wallets. Transactions would be recorded in a decentralized database that is accessible to everyone. Cryptocurrency would be the sole medium of exchange, and traditional financial institutions would become obsolete.

If cryptocurrency replaces fiat currency, there could be a massive impact on global economic and financial stability. The main concern is that cryptocurrency is highly volatile and lacks regulation. This exposes users to high risk, which could lead to a financial crisis. Furthermore, the global adoption of cryptocurrency could shift the balance of power between nations because it would grant more influence to those who possess the most cryptocurrency.

The adoption of cryptocurrency would also have a direct impact on traditional banks. Banks would no longer be the only intermediaries in financial transactions as cryptocurrencies do not require banking services. This would threaten the existence of traditional financial institutions and disrupt established financial models.

While the prospect of cryptocurrency entirely replacing fiat currency has certain advantages, it also has its risks. One major risk is the possibility of too much power and influence being concentrated in the hands of a few. Furthermore, reliance on cryptocurrency could leave economies vulnerable to cyber attacks and technological failures.

The International Monetary Fund (IMF) has warned about the potential consequences of widespread adoption of cryptocurrencies. The IMF advises nations to approach the subject with caution and to ensure that regulatory frameworks are put in place. Regulation could help mitigate many of the risks associated with cryptocurrencies, such as money laundering and tax evasion.

Fiat Currency vs. Cryptocurrency: Final Thoughts

In conclusion, as we tread the path of financial evolution, the decision to accept fiat money or embrace cryptocurrency isn’t a binary one. The traditional money system, largely backed by the government and formed by traditional currency and commodity money, has been serving us for centuries and continues to be a dependable choice for most. Its intrinsic value lies in the trust and confidence we place in our governments and central banks.

However, the emergence of cryptocurrencies has opened new doors, challenging us to rethink our concepts of value, trust, and control in finance. While still volatile and perplexing for many, cryptocurrencies offer a compelling alternative to the traditional system, allowing for increased transparency, minimal reliance on central entities, and the potential for unprecedented financial innovation. As we move forward, the relationship between fiat currency and cryptocurrency will continue to shape and be shaped by our ever-evolving understanding of what money can and should be. Whether one chooses to stick with traditional currency or explore the vast crypto terrain, the key lies in understanding their fundamental differences and how each fits into one’s personal or business financial strategy.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.