- Crypto traders are careful prior to Trump’s rate announcement, uncertain about the impact of the market.

- Despite the V1 -then, experts predict that Bitcoin could test $ 100,000 as rates and stabilize policy measures.

Bitcoin [BTC] Is holding above $ 84k while traders adopt a cautious “wait-and-see” attitude prior to the long-awaited Liberation D rate announcement by President Trump.

With global markets that are removing for potential turbulence, crypto investors with uncertainty continue to struggle. Will the new rates ignite new volatility, or will they open the door for new opportunities?

Crypto traders in the ‘wait-and-see’ mode

Presto research analyst MIN JUNG said,

“The market is currently in a wait -and -see mode, because the details of the rates still have to be announced.”

The announcement of new rates on 2 April, called “Liberation Day”, is expected to make significant changes to American trade relationships. However, the exact impact on the cryptomarket remains unclear.

Traders weigh the potential consequences of these rates, which can cause a chain reaction in world trade.

“Some investors believe that the impact can be less serious than initially feared, and consider the recent dip as a potential ‘buy the dip’ opportunity …”

Jung went further,

“However, many traders still choose to stay on the sidelines until there is more clarity.”

Worst Q1 for Bitcoin since 2018

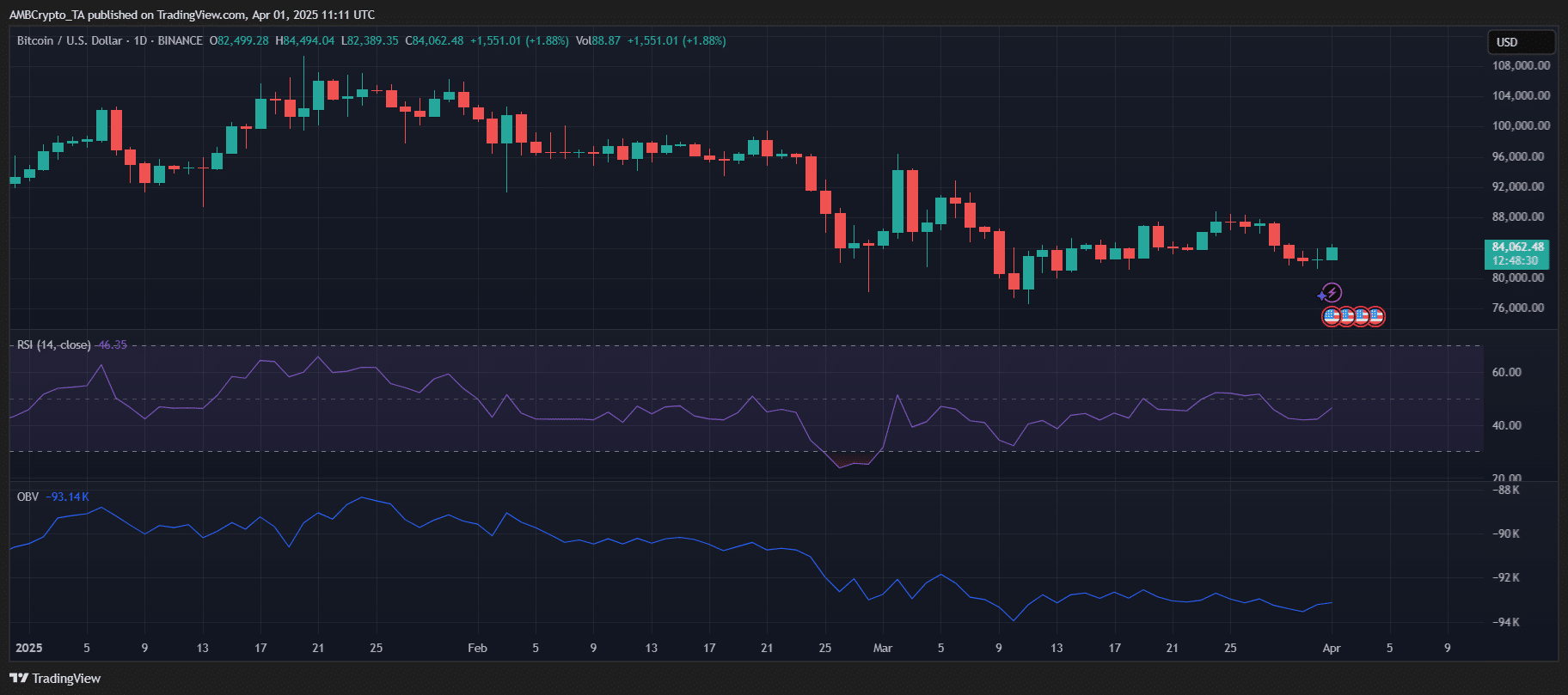

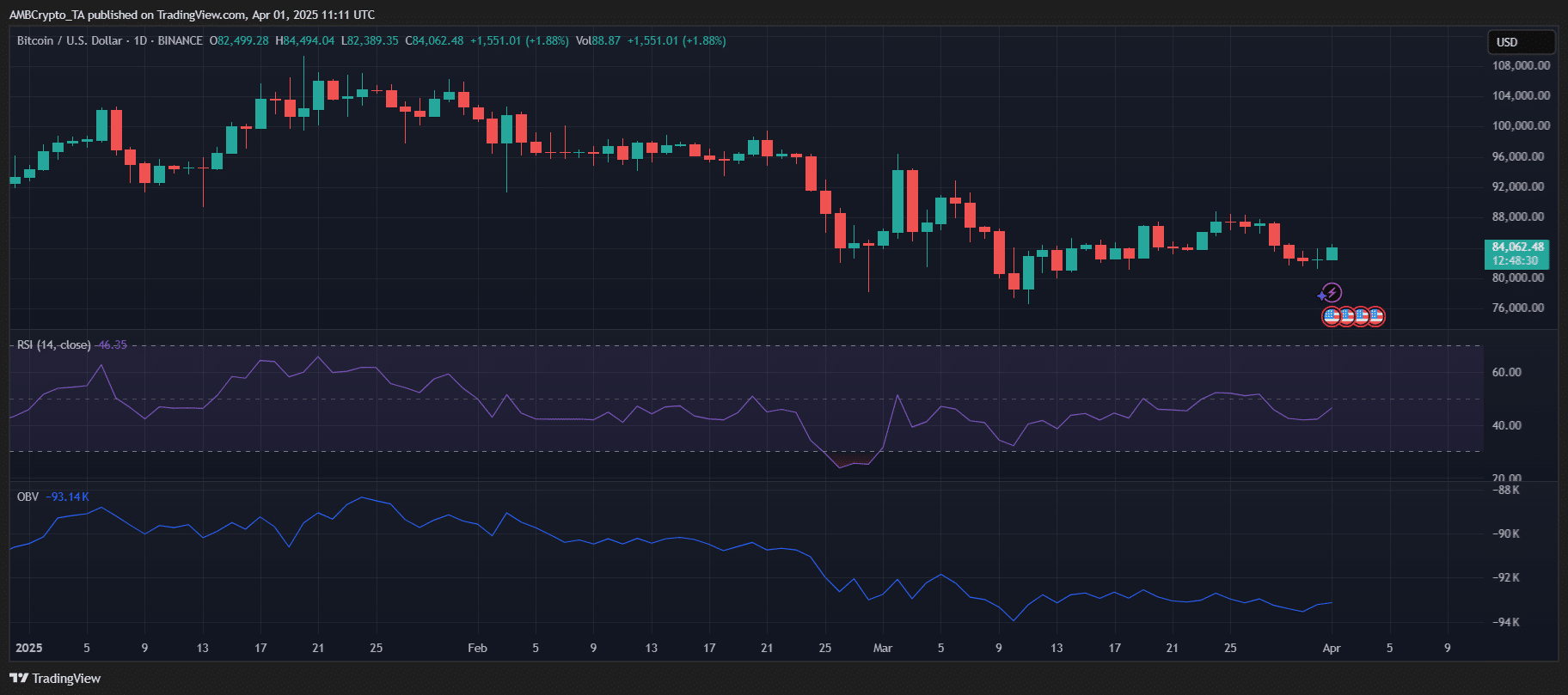

The first quarter of 2025 was a turbulent for Bitcoin. After peaking over $ 108,000 in January, BTC had a sharp decrease up to less than $ 80,000 last month.

This decrease was in line with the response from the wider market to Trump’s rate announcements and global economic uncertainty.

Source: TradingView

After November the market followed a classic “Buy the rumor, sell the news” pattern. Investors initially expected Trump’s pro-Crypto attitude at the beginning of 2025 to manage a bull market.

However, the implementation of rates has introduced unexpected volatility, which shifts the trajectory of the market and the expected bullish momentum is filled in.

The performance of Bitcoin Q1 2025 marked the worst since 2018, with a decrease of 11.82%.

Look forward

Despite the recent decline, experts remain optimistic about Bitcoin’s long -term provision.

Although policy changes Time costs to fully unfold, the expected momentum of institutional adoption is seen as an important engine, with pro-Crypto policy of the current administration that plays a crucial role.

However, the effects of this policy are probably gradual.

The Bitcoin prize is expected to test the $ 100,000 in the coming months, with a potential recovery in the second quarter of the year.

If the Federal Reserve lowers the rates and the administration provides clarity about its tariff position, Bitcoin could see another rally, possibly by breaking through resistance to $ 88k.

That said, risks continue to exist and the market reaction will depend on the details of the announcement of the rate, so that investors are waiting for further clarity about the economic landscape.