Widely followed crypto analyst Justin Bennett mentioned yesterday’s Bitcoin (BTC) rebound hours before it happened.

Yesterday, Bennett told his 112,400 Twitter followers that a Bitcoin bounce could be imminent after a tough week for the crypto king.

“Good place for BTC so far, but maybe a bounce soon to flush some shorts.

Still a bunch of long liquidations for $24,000.

Let’s see.”

Hours later, Bennett predicted bounce took place, taking BTC from a 24-hour low of $24,936 to a 24-hour high of $25,746, a jump of more than 3%.

“And there’s the Bitcoin bounce.”

BTC is trading at $25,463 at the time of writing, up 3.4% in the past 24 hours and down 4.2% over the past week.

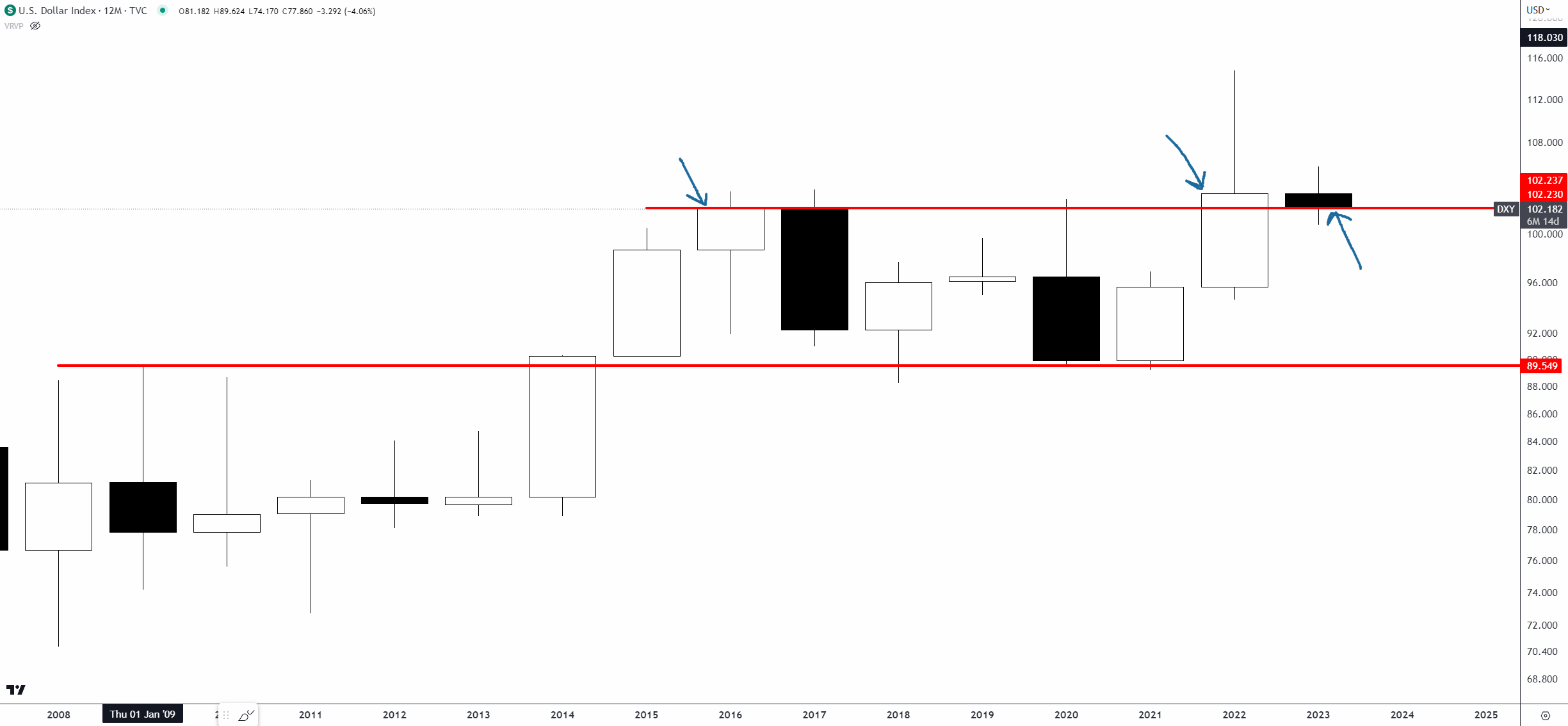

Despite his success in predicting BTC’s movement yesterday, so did the trader admits for possibly being wrong about its position on the US Dollar Index (DXY), a measure of the value of the US dollar against a basket of six major foreign currencies.

The DXY is a useful tool for investors and traders to track the strength of the US dollar against other major currencies. In general, a rising DXY indicates that the US dollar is strengthening, while a falling DXY indicates that the US dollar is weakening.

Says the trader of the DXY,

“My bullishness on the DXY may be misplaced.

And if I’m wrong, so be it.

But I can’t go bearish as the higher time frames hold this area.

My base case is still for a push to 109-110 later this year.

We will see.”

Earlier in the day, Bennett expressed his view that now is not the time to be bearish on the DXY.

“I’ve been saying it for months, but going bearish on the DXY while it’s above the 102.00 area is a mistake in my opinion.

If nothing else, a partial fill of last year’s fuse by 110 a.m. is still in the cards.

DXY 12 month time frame:”

The DXY is at 102.38 at the time of writing Market overview.

Don’t Miss Out – Subscribe to receive crypto email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Featured Image: Shutterstock/Ongky Ady Widyanto