- Bitcoin has hit a new all-time high, pushing crypto to $3.2 trillion today.

- Major liquidations affected traders, while macroeconomic factors provided optimism.

Although the performance of crypto today has seen a notable increase in appreciation, a slight decline has also been recorded.

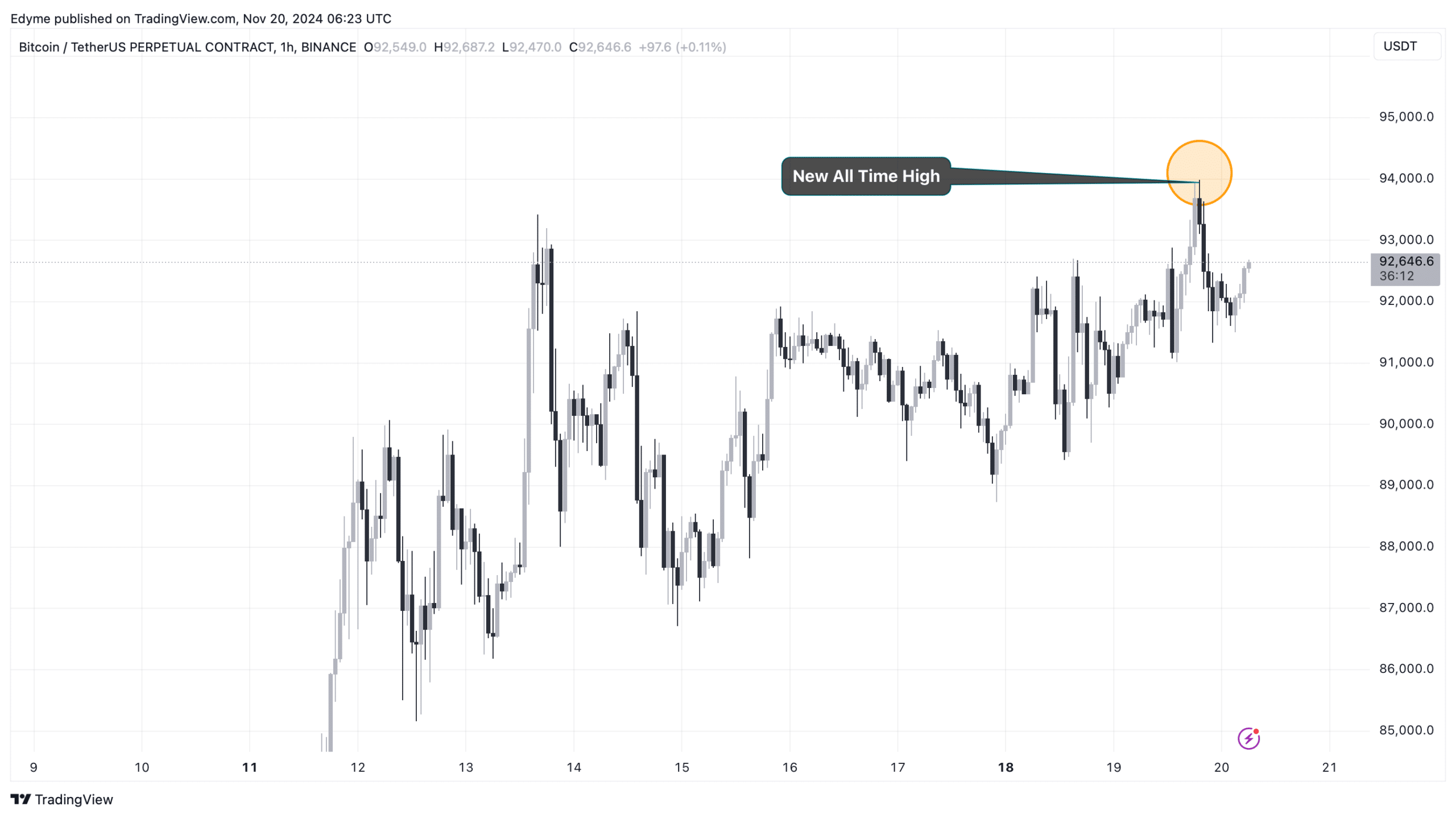

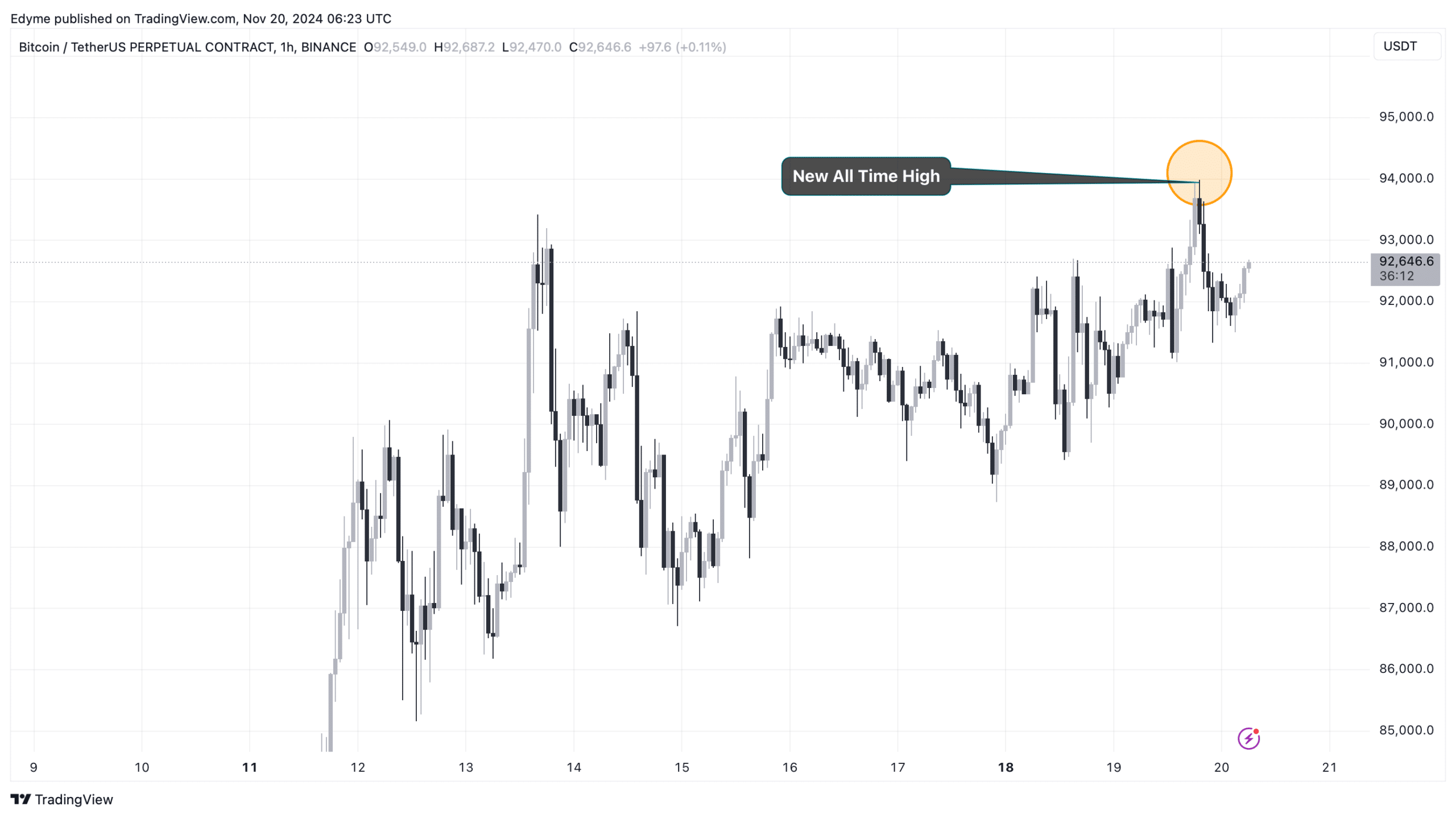

Coin gecko facts showed that the global crypto market soared to a value of $3.227 trillion earlier today as Bitcoin hit a new all-time high of $94,000.

However, at the time of writing, this valuation had since fallen 1.7% to remain at $3.21 trillion at the time of writing.

Of the other factors that have led to this push in the global crypto market today, Bitcoin itself is the most extraordinary.

As previously mentioned, BTC, the largest cryptocurrency asset by market capitalization, has recorded a new ATH, bringing its 7-day performance to a gain of 5.9%.

Source: TradingView

At the time of writing, Bitcoin was trading at a price of $92,460 over the past day, up 1%. The continued rise in BTC’s price now brings it closer to a market cap of $2 trillion.

For context, as of today, the asset’s market cap has a valuation of $1.8 trillion, which still makes the asset one of the largest assets in the world.

Meanwhile, BTC’s daily trading volume has also seen a notable increase in valuation, from less than $50 billion earlier this week to currently $77.11 billion.

Market impact and liquidations in crypto today

While the performance of crypto today has been generally positive, it has not been beneficial to all participants.

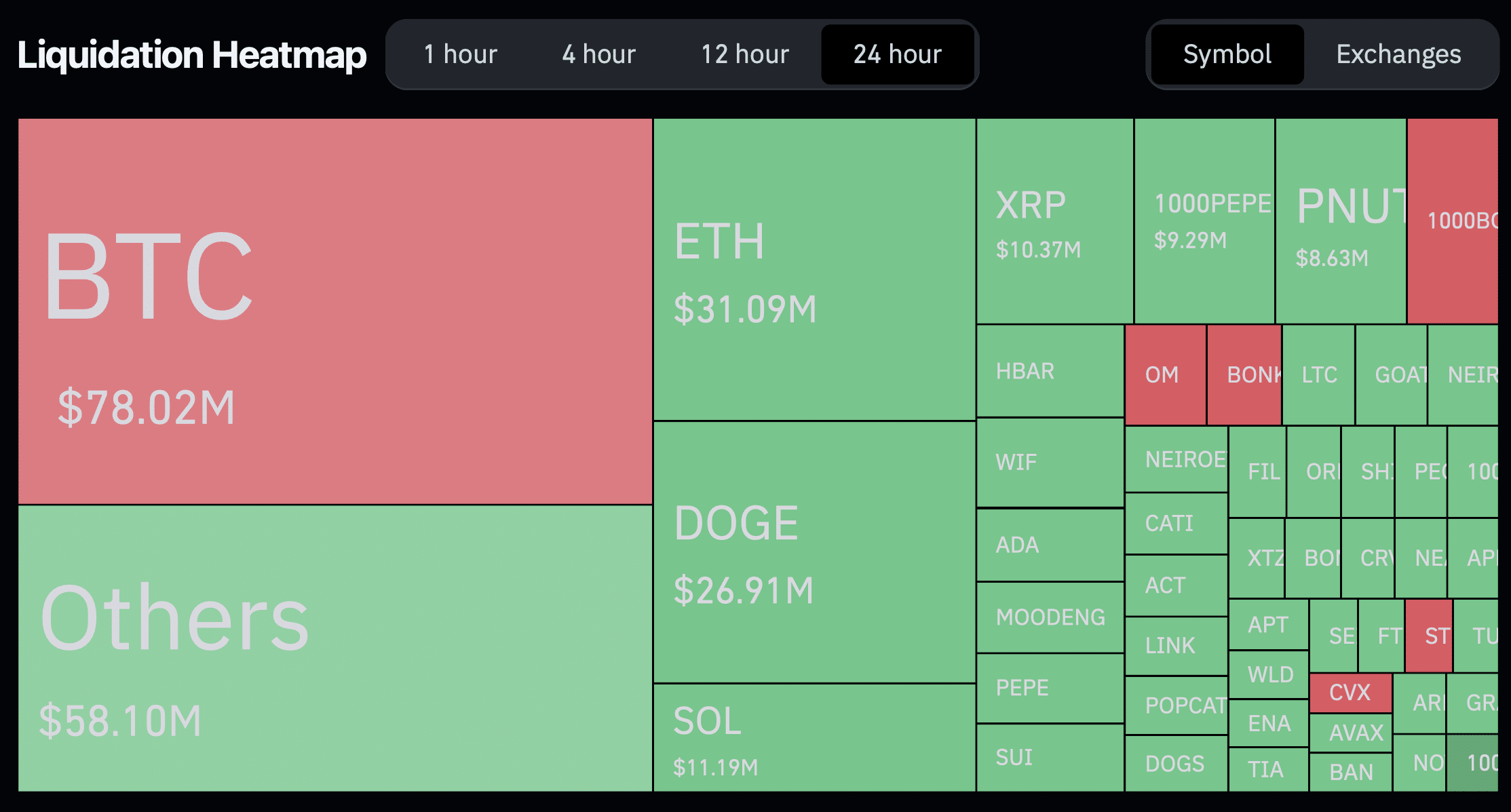

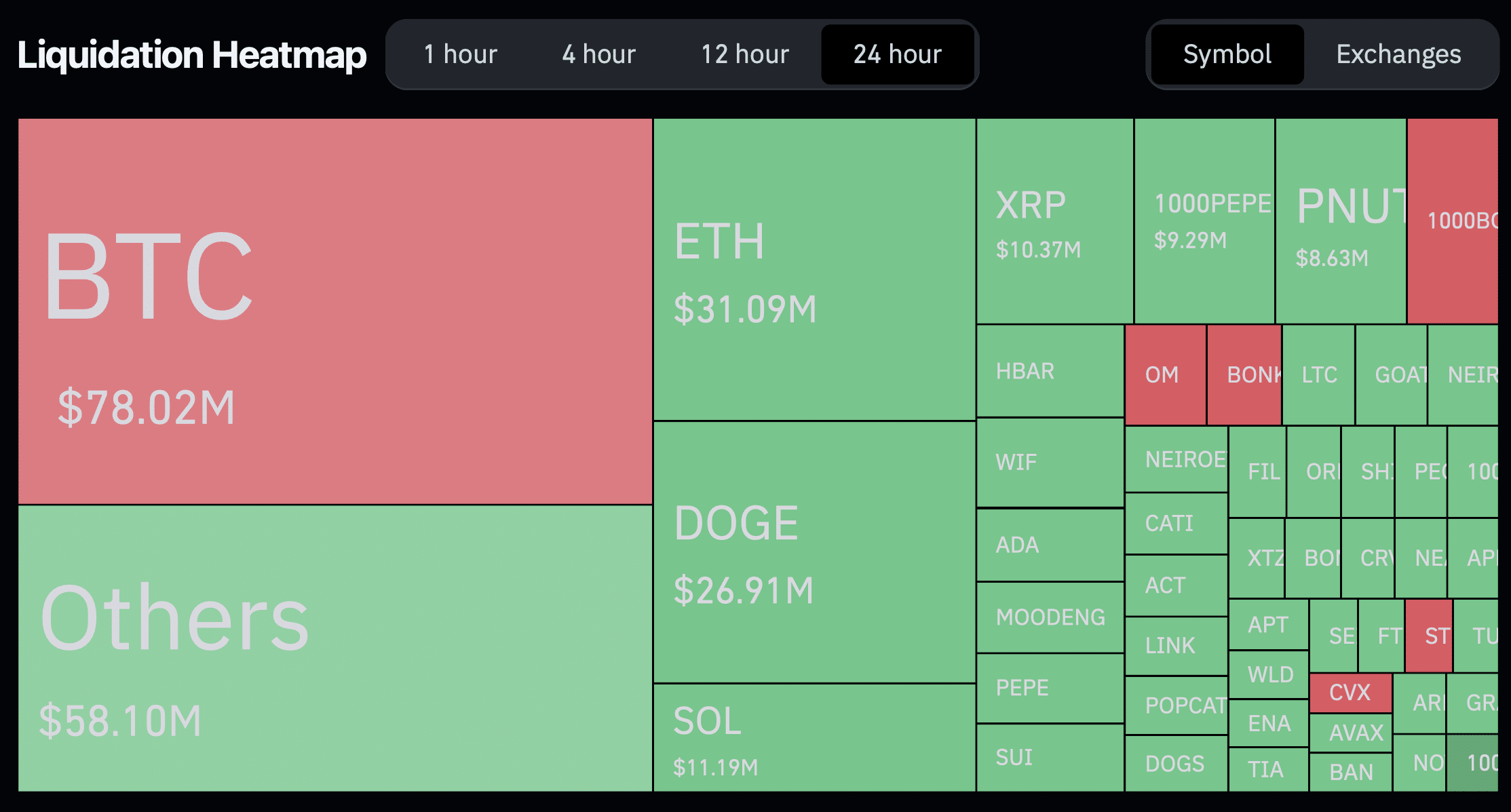

Facts from Coinglass indicated that 119,717 traders faced liquidation in the last 24 hours, with a total value of approximately $317.33 million.

Liquidation occurs when a trader’s position is forcibly closed by an exchange due to insufficient funds to maintain a leveraged position.

This often happens during high market volatility when prices move against the position a trader has taken.

Source: Coinglass

Of the total liquidations, $78 million was attributed to Bitcoin, with short traders bearing the brunt, accounting for $47 million.

However, long traders were not completely spared, contributing $31 million to Bitcoin’s total liquidations.

This trend expanded to other cryptocurrencies, where major assets such as Ethereum were present [ETH] saw more long positions being liquidated.

Such liquidations suggest that while Bitcoin’s rise has been a peak, not all assets in the market have seen parallel gains.

Despite the challenges some faced, certain cryptocurrencies managed to perform well. Cardano [ADA] recorded an increase of 4.8%, while Pepe [PEPE] and Bonk [BONK] saw gains of 1.1% and 12.5% respectively.

Macroeconomic factors

Several macroeconomic factors have contributed to crypto’s performance today.

Remarkably, MicroStrategyled by Michael Saylor, made its largest Bitcoin acquisition to date, buy almost 52,000 BTC valued at more than $4.6 billion.

Such high-profile acquisitions often boost market confidence, cementing Bitcoin’s status as a major asset.

Moreover, interest in crypto got a boost today from Rumble, a competitor of YouTube.

The platform’s CEO hinted that he would explore the possibility Add Bitcoin to Rumble’s Balance Sheetwhich could further stimulate mainstream adoption.

At the end of the third quarter, Rumble held $131 million in cash and cash equivalents, highlighting its ability to make significant cryptocurrency investments.

Despite widespread optimism, analysts have called for caution. Cypress Demanincor, a market analyst at X (formerly Twitter), shared insights on the broader crypto market chart, warning:

“A break below the $3-$2.9 trillion threshold and a daily close below would likely signal a shift, potentially leading to profit-taking and a ‘risk-off’ pullback or correction from this latest bullish move. ”