Bitcoin’s rise above $35,000 on October 24 and 25 surprised the crypto world as it signaled what could be the start of new bullish sentiment. Trading volumes for the world’s largest cryptocurrency reached their highest level since March, showing that interest in Bitcoin is once again exploding.

The entire crypto market saw an influx of money during the week, leading to an increase in market capitalization. Data from CoinGecko shows that the entire market cap increased from $1.184 trillion on Sunday, October 22nd to $1.312 trillion on Wednesday, October 25th. Most of these inflows went to Bitcoin, which saw its share of the cryptocurrency market rise from 49.58% to 51.47% during this period. same time period.

Chart of Coin gecko

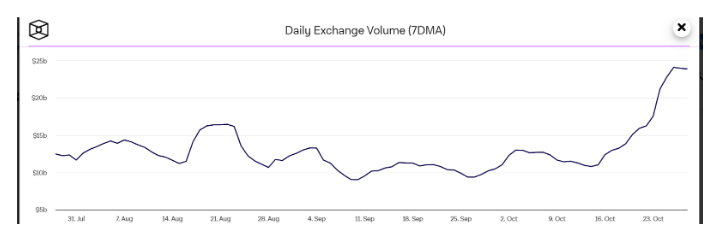

Daily crypto exchange volumes reach the highest level in 8 months

The recent surge in Bitcoin and cryptocurrency prices pushed Bitcoin’s daily trading volumes on crypto exchanges to their highest levels since March. According to According to The Block’s data dashboard, the seven-day moving average for spot trading volumes across multiple exchanges was $24.12 billion on Thursday and $23.98 billion on Friday, respectively. In comparison, Bitcoin trading volume on the exchanges on the first day of the month was $11.02 billion.

Chart from The Block

A similar metric from IntoTheBlock shows that Bitcoin transactions reached 1.4 million BTC as bulls looked to push Bitcoin to $35,000.

Chart from IntoTheBlock

Trading volumes are an important metric because higher volumes indicate greater interest and activity in a market. It means more people are actively buying and selling, leading to more liquidity and volatility.

Whale activity also increased during this period, as indicated by trackers on the chain. Whale transaction tracker Whale Alerts has shown several BTC transactions worth millions of dollars to and from crypto exchanges.

2,000 #BTC (USD 68,255,228) transferred from #Coinbase to unknown wallethttps://t.co/SdIJ87ZxNT

— Whale Alert (@whale_alert) October 26, 2023

2,000 #BTC (68,560,116 USD) transferred from unknown wallet to #Coinbasehttps://t.co/MJNn4HwswP

BTCUSD trading at $34,187 on the weekend chart: TradingView.com

— Whale Alert (@whale_alert) October 26, 2023

1,499 #BTC (51,276,429 USD) transferred from #Binance Unpleasant #Coinbenehttps://t.co/lVaDk8pYio

— Whale Alert (@whale_alert) October 27, 2023

What’s next? More Bitcoin movement?

Bitcoin has since formed a resistance level around $35,000 and is now trading within a range. At the time of writing, Bitcoin is trading at $34,150, still up 14.47% in a seven-day span. Although the price action appears to be moving sideways at the moment, there is still hope for continued momentum from the bulls to push BTC past $35,000 in the new week.

Matt Hougan, CEO of crypto index fund manager Bitwise, points to a further influx convert money to Bitcoin. Hougan makes this prediction on spot Bitcoin ETFs, projecting inflows of around $50 billion within the first five years of launch. Others like the crypto-financial services platform Matrixport has made more optimistic claims.

Dates of analytics platform mempool.space has shown a continued increase in activity on the BTC network. If the bulls maintain a strong push, we could see Bitcoin up to $45,000 in the early days of November.

Featured image from Shutterstock