This article is available in Spanish.

The broader crypto market experienced a major crash on December 9. While the Bitcoin price fell from $101,109 to $94,150, marking a decline of -7%, the altcoin market suffered significantly heavier losses. Ethereum was down as much as -12% at one point, XRP was down -22%, Solana was down -15%, Cardano was down -23%, Dogecoin was down -19%, and Shiba Inu was down -25%.

According to Coinglass factsMore than 562,000 traders were liquidated in the past 24 hours, with the total number of liquidations reaching $1.7 billion. The largest single liquidation order occurred on Binance in the ETHUSDT pair, worth $19.69 million. Of the total liquidations of $1.7 billion, $1.55 billion related to long positions.

Notably, Bitcoin’s leverage flush was relatively modest compared to that of altcoins, with $143 million of BTC longs liquidated. In contrast, ETH saw $219 million in liquidations, SOL $57 million, DOGE $86 million, XRP $53 million, and ADA $22 million.

Across the crypto market, this represented the largest debt wave since April 2021, when a record $10 billion in crypto futures liquidations occurred in a single day. This surpassed the previous record of $5.77 billion.

Related reading

After the flushout, Bitcoin and most altcoins have staged a sharp upward recovery, although they have yet to return to pre-crash levels. Over the past 24 hours, BTC continued to fall -2.4%, ETH -4.8%, XRP -9.6%, SOL -6.4%, and DOGE -8.4%.

What caused the crypto market crash?

According to crypto analyst ltrd (@ltrd_), the underlying dynamic is started with the increased selling pressure on Coinbase, where traders started selling aggressively almost an hour before the big cascade. Although the eventual plunge was caused by a chain reaction of liquidations, this prolonged selling in the spot markets was critical in pushing prices into zones where over-indebted traders had little choice but to retreat.

Overheated funding costs and rising open interest levels meant that once the first cracks appeared, highly leveraged positions had no chance of escape. “How can we tell that the market was overheated? It’s simple: the financing costs plus the increase in open interest. These two factors are driving the current market and indicate that people are over-indebted,” ltrd explains.

When the market finally collapsed, the effects were uneven. Bitcoin showed characteristics that were different from other instruments, and Ethereum showed encouraging signs of accumulation on the way down, indicating that a large buyer could have taken advantage of this opportunity.

Yet the truly astonishing developments happened with XRP on Coinbase, where, as ltrd put it: “You can see something crazy: the market effects for XRP on Coinbase are mind-boggling. Something absolutely strange happened. In a large, relatively mature market, we witnessed a cascade of large sell orders that caused the market to fall by more than 5%. We don’t know exactly what happened, but it is certainly unusual.” Ltd speculated that these huge and abnormal sell orders could have come from a major player forced to liquidate at any price.

Related reading

“It may be worth monitoring this situation in the coming days. Maybe a big player was forced to sell like there was no tomorrow,” he mused. The consequence of such an event, even in supposedly deeper markets, was a rapid crash that spilled over into perpetual swaps traded elsewhere, triggering further liquidations.

According to ltrd: “When something like this happens, it’s usually a cascade of unintentional commands. Market makers absorb this selling pressure and hedge it, creating signal propagation across the exchanges.” Even large-cap altcoins like XRP, which have market caps comparable to those of large US companies, still face liquidity constraints that become apparent under stress. “Relative to these market capitalizations, market liquidity is still poor,” he noted, explaining how this contributes to the perceived volatility and dramatic nature of such events.

When prices finally stabilized and started bouncing off their lows, ltrd highlighted how this pattern is common in overheated markets: “The next thing you always see in a hot market is a quick price turnaround from the low. There are a large number of liquidations, limited liquidity and still many players with profits looking to buy the dip. Let’s see who comes out on top.”

Macro analyst Alex Krüger placed the entire event in a broader perspective. ‘Nothing has changed. Expect prices to continue to rise,” he said, noting that future conditions, such as a pro-crypto US administration under Donald Trump, could create a more constructive backdrop for digital assets.

Although Krüger raised the possibility of more leverage flushes in the coming months, he viewed these events as a normalizing force. “Today was an important flush-out. Especially for altcoins. Very normal in warm markets with a lot of debt. This is how crypto baptizes newcomers and keeps crypto natives disciplined,” Krüger said, adding: “Never fun to get caught in a leverage flush for long. But that’s what this is. Funding back to baseline across the board. This time also alts. Expect a few more in the coming months.”

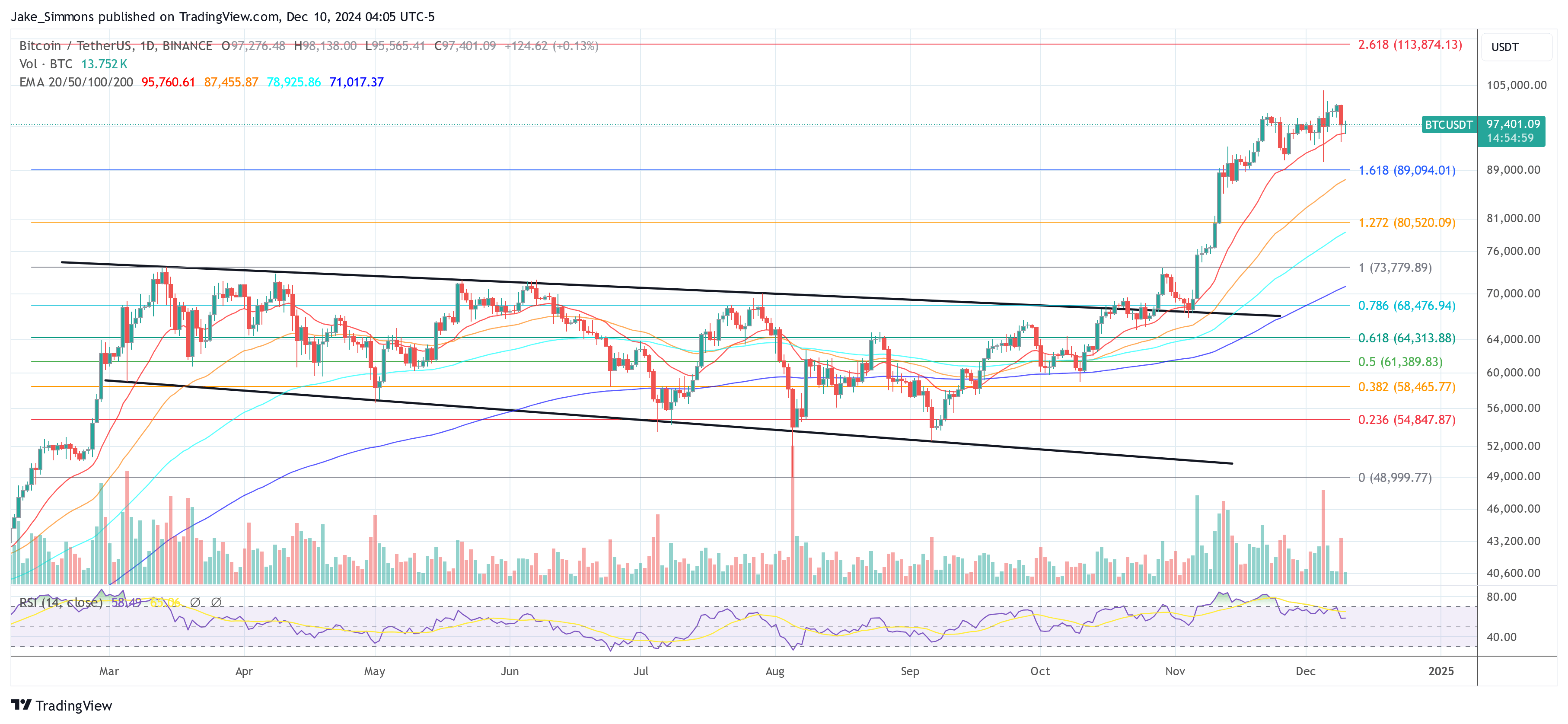

At the time of writing, Bitcoin was trading at $97,401.

Featured image from Shutterstock, chart from TradingView.com