TL; DR

Full story

It’s OK.

You can say it.

We are fully aware:

We get strangely excited about crypto integrations within legacy payment systems.

Why? Because crypto is currently (largely) building outside the existing system. That is, it does not fit well with the established infrastructure.

It’s hard to buy with a credit card, banks don’t like you moving money to exchanges, and you have to learn a lot of terminology when you get started.

(For example ‘gas costs’ = ‘transaction costs’ – why? No idea).

Glass half empty:

This separation of existing systems is a weak point for web3 & crypto.

Glass half full:

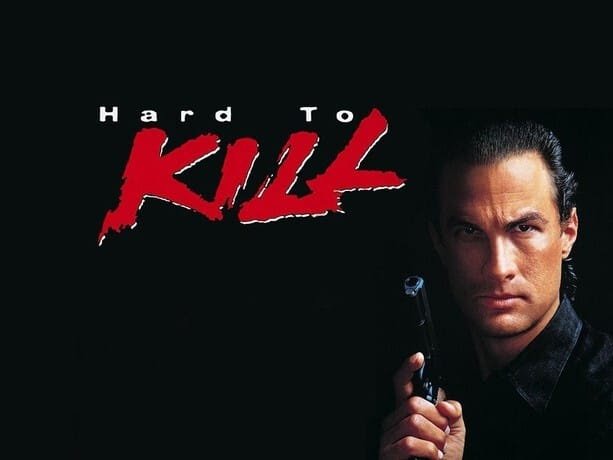

The more legacy systems rely on crypto, the harder it will be to kill them.

Hence our excitement about this latest development:

Mastercard joins US banking giants (including: Citi, JPMorgan and Wells Fargo) to develop distributed ledger technology for bank payments using tokenization.

Translation: banks want to start using/trusting crypto rails to process their payments.

Which means:

-

Crypto will become harder to kill.

-

(Theoretically) this should make buying crypto from your bank account MUCH easier.

-

This could very well spark a race to ‘tokenize everything’, because wherever there are tokenized assets to trade, there are fees to collect – and banks love collecting fees.

Very cool!