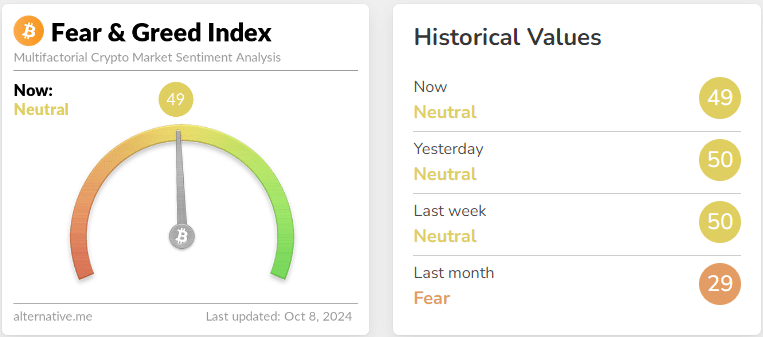

- The crypto Fear and Greed Index was not overloaded in either direction.

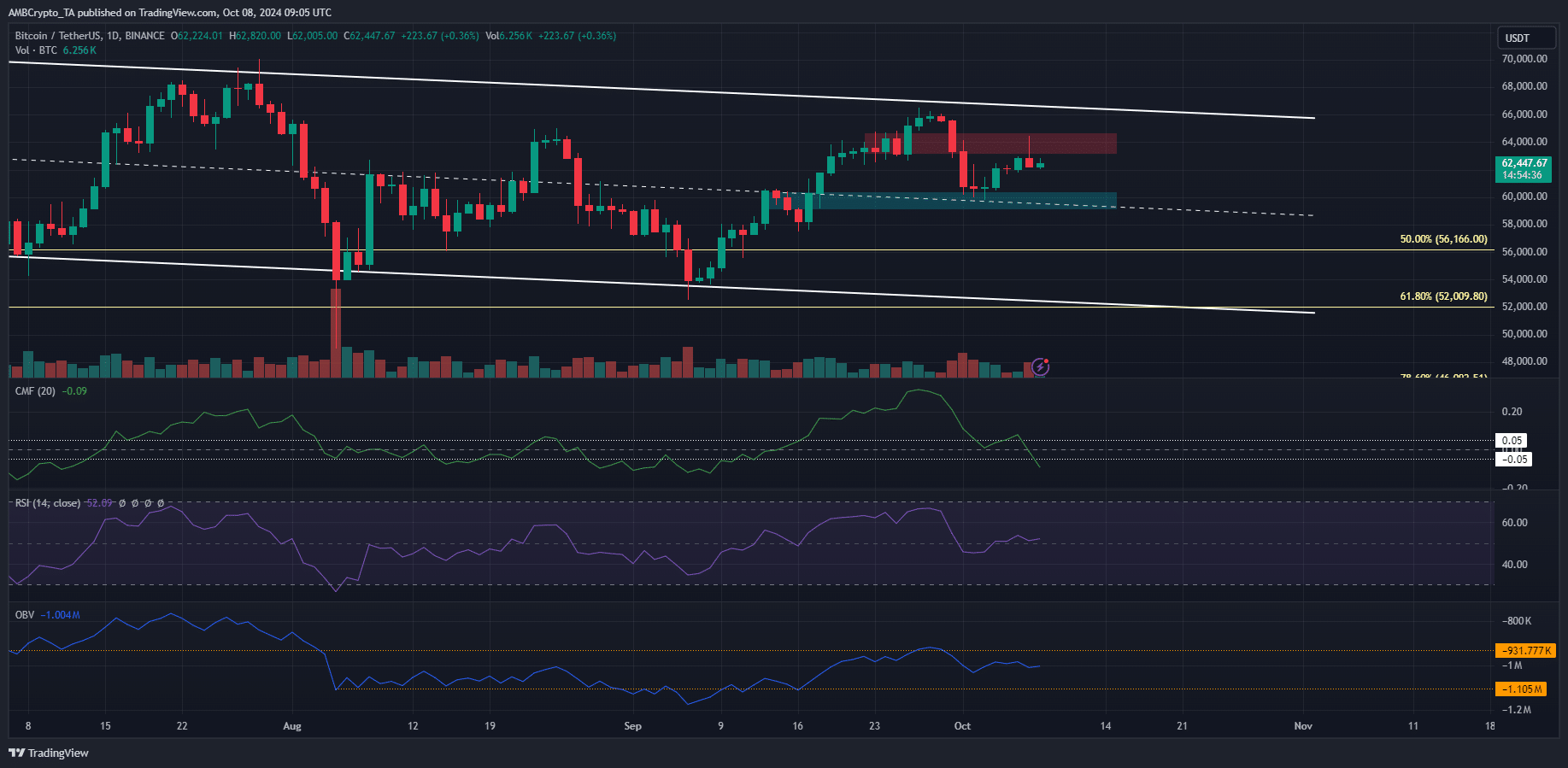

- The Tether Dominance chart has been trending upward since April – bulls wish this would change.

The crypto Fear and Greed Index showed that market sentiment was neutral at the time of writing, an improvement from the fearful outlook of early September.

The recent correction from $66.5,000 to $60,000 has not hurt market participants too much.

A recent AMBCrypto report outlined liquidation pockets around the price that could serve as potential magnet zones. The $66.2k zone is still a resistance area and another visit to this area could turn the bulls away.

On the other hand, a huge bullish move was possible based on historical trends.

Where is the crypto market sentiment?

The helpful Bitcoin Fear and Greed Index chart showed that sentiment was neutral. This was understandable given the price action over the past two weeks.

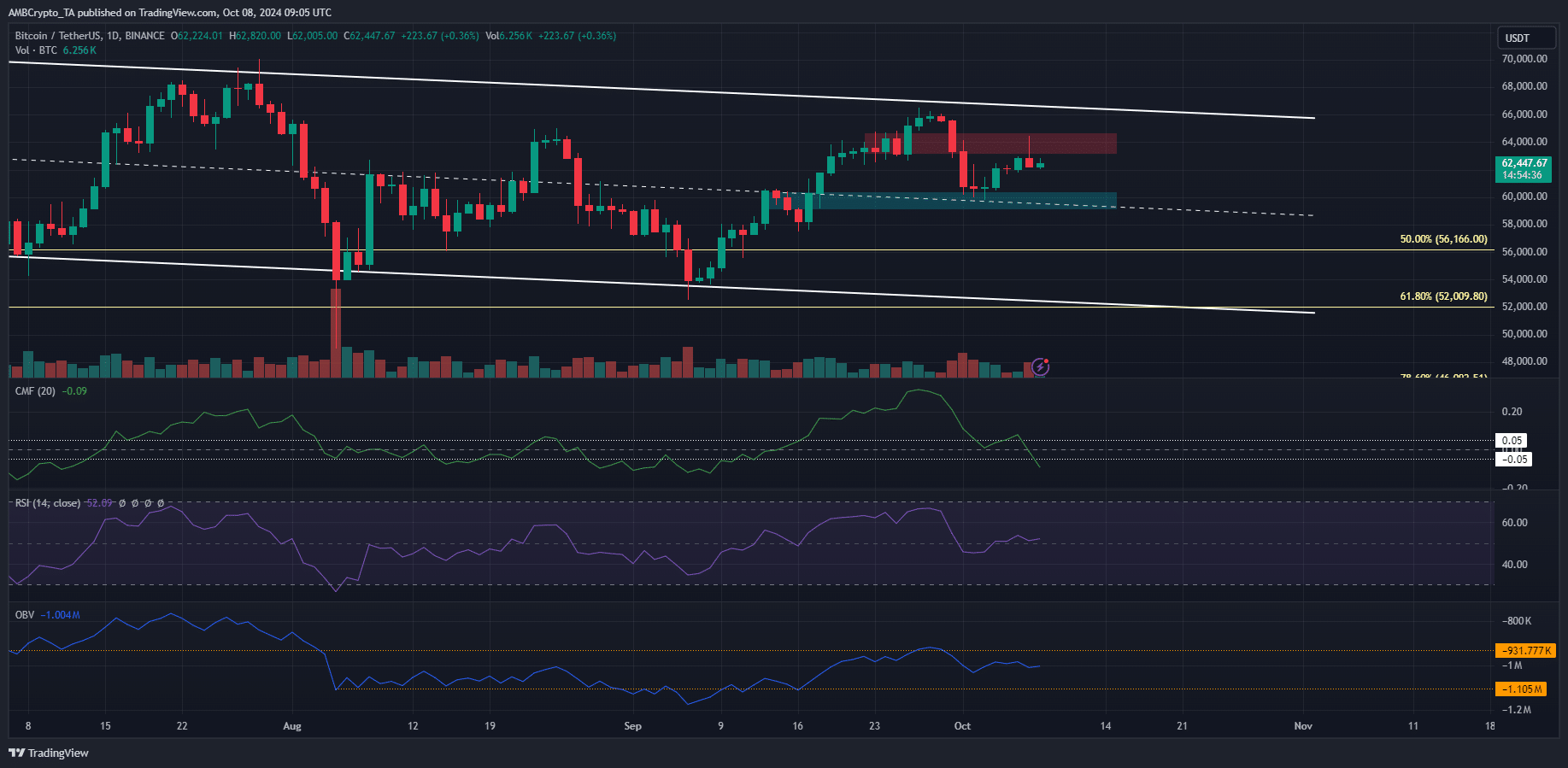

Source: BTC/USDT on TradingView

The descending channel (white) saw its center broken on September 18. A rally nearly reached channel highs but was rebuffed. Since then, the $64k zone has flipped to resistance.

The CMF stood at -0.09, indicating significant capital flow from the market and strong selling pressure. The OBV also indicated stable sales over the past two weeks, but has recovered slightly.

The RSI had a neutral view with a reading of 52.

A drop to $58k-$60k would provide a buying opportunity. A rise above $66k-$67k and a retest of the same level as support would also be an opportunity to go long. The latter scenario is likely to shift market sentiment toward greed.

Findings from the Tether chart for BTC trends

Source: USDT.D on TradingView

The Tether [USDT] The dominance trend is inversely proportional to the crypto market. An upward trend in this metric generally means the market is trending downward and investors are moving to stablecoins.

The 5.79% level is a resistance level and USDT.D could fall further in the coming days. A short-term Bitcoin rally is possible.

Is your portfolio green? Check out the BTC profit calculator

However, the statistic has been on an upward trend since March, as evidenced by the rising trend line.

Until it is broken, investors and swing traders in the crypto market should be conservative with their bullish objectives.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer