- At the time of writing, the crypto market was still talking about ‘HEBBERG’, despite concerns about the elections

- Prediction sites favored a Trump victory, with options traders eyeing their targets of $60,000, $70,000 and $80,000

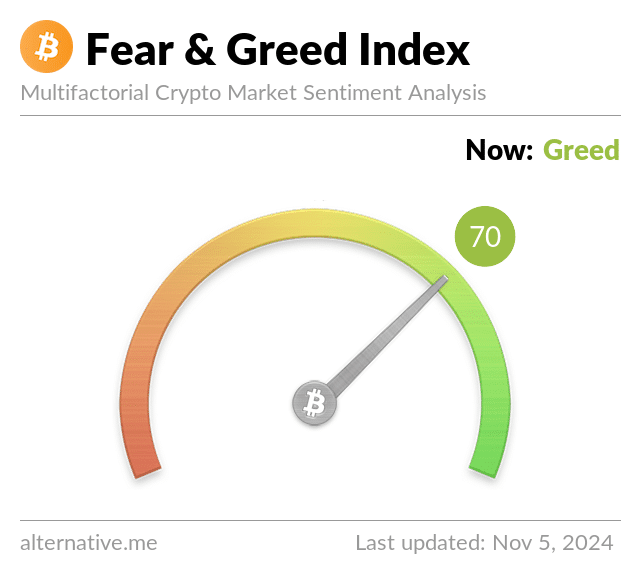

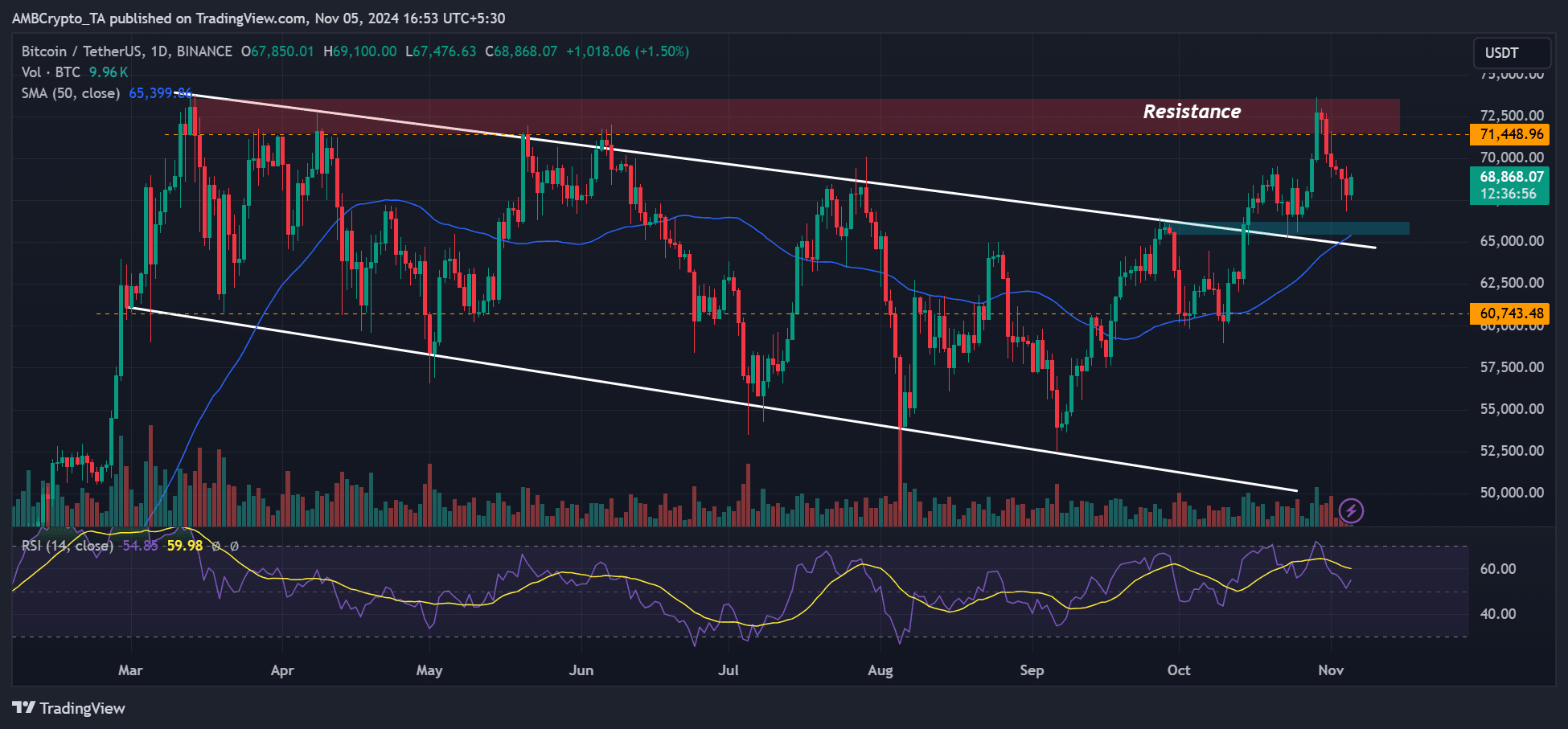

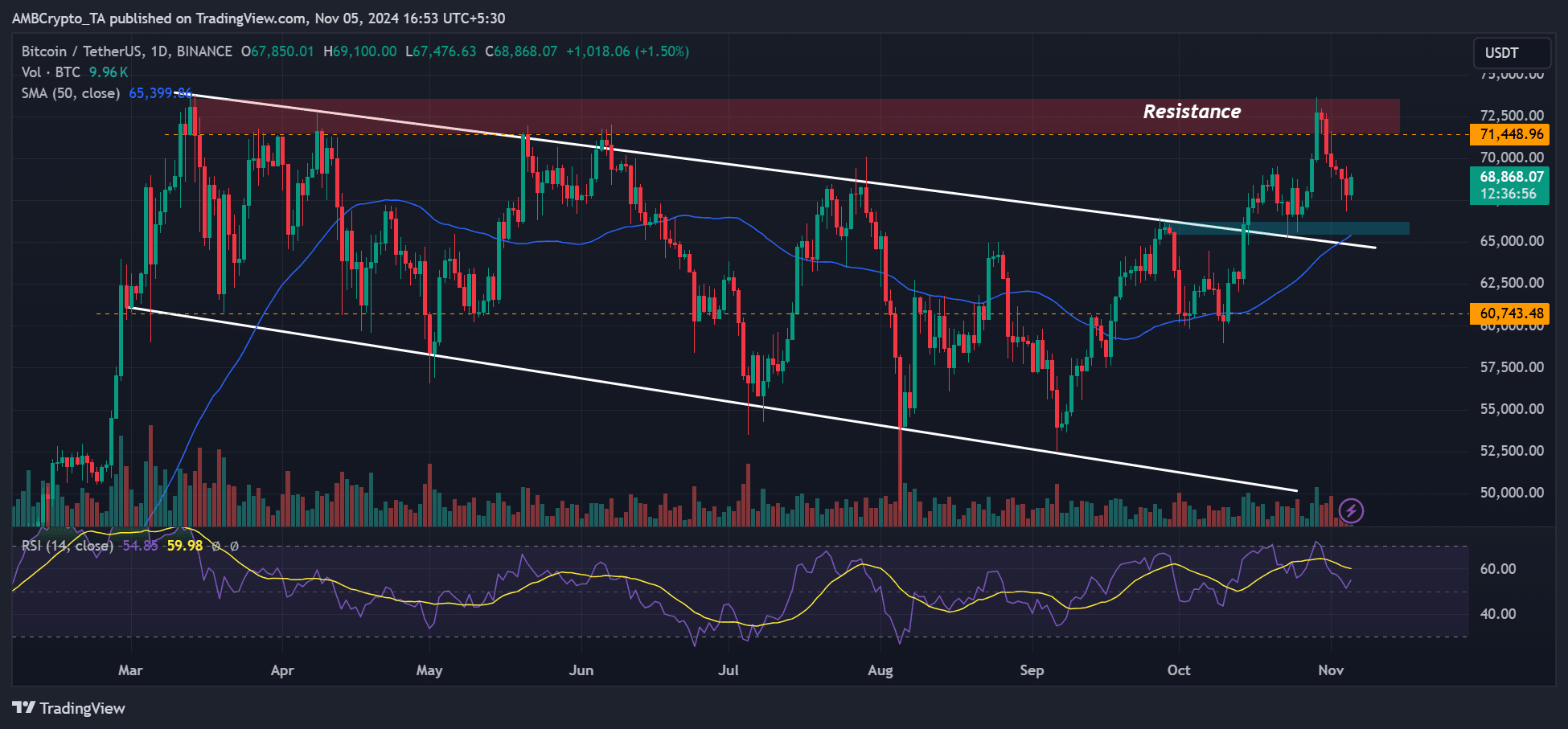

There is incredible fear in the market as Election Day approaches in the United States. However, despite Bitcoins [BTC] recent pullback from near its all-time high (ATH) to $68k, the Crypto Fear and Greed Index is still flashing ‘Greed’. At the time of writing it was at 70.

Source: Alternative.me

Bitcoin speculators remain positive

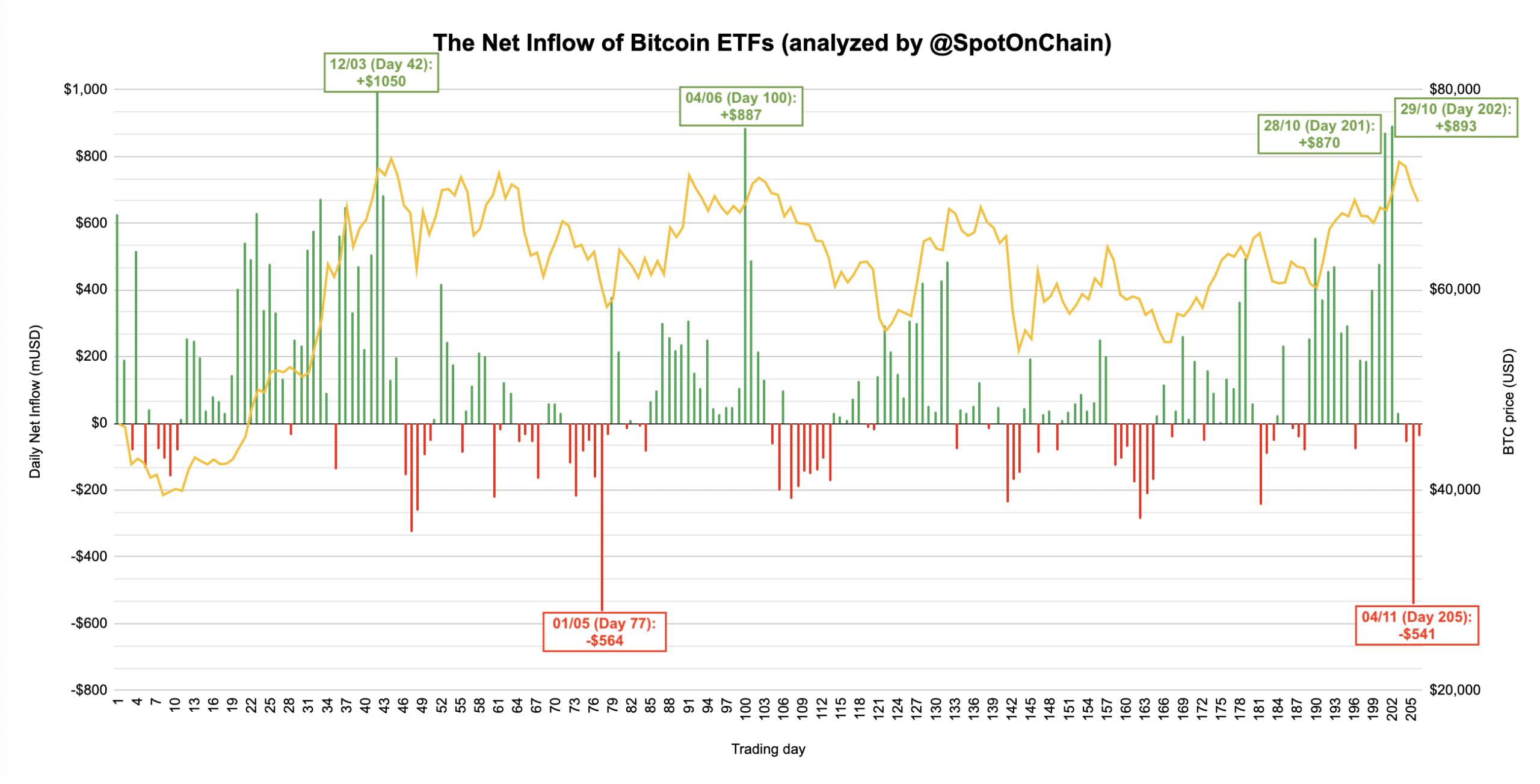

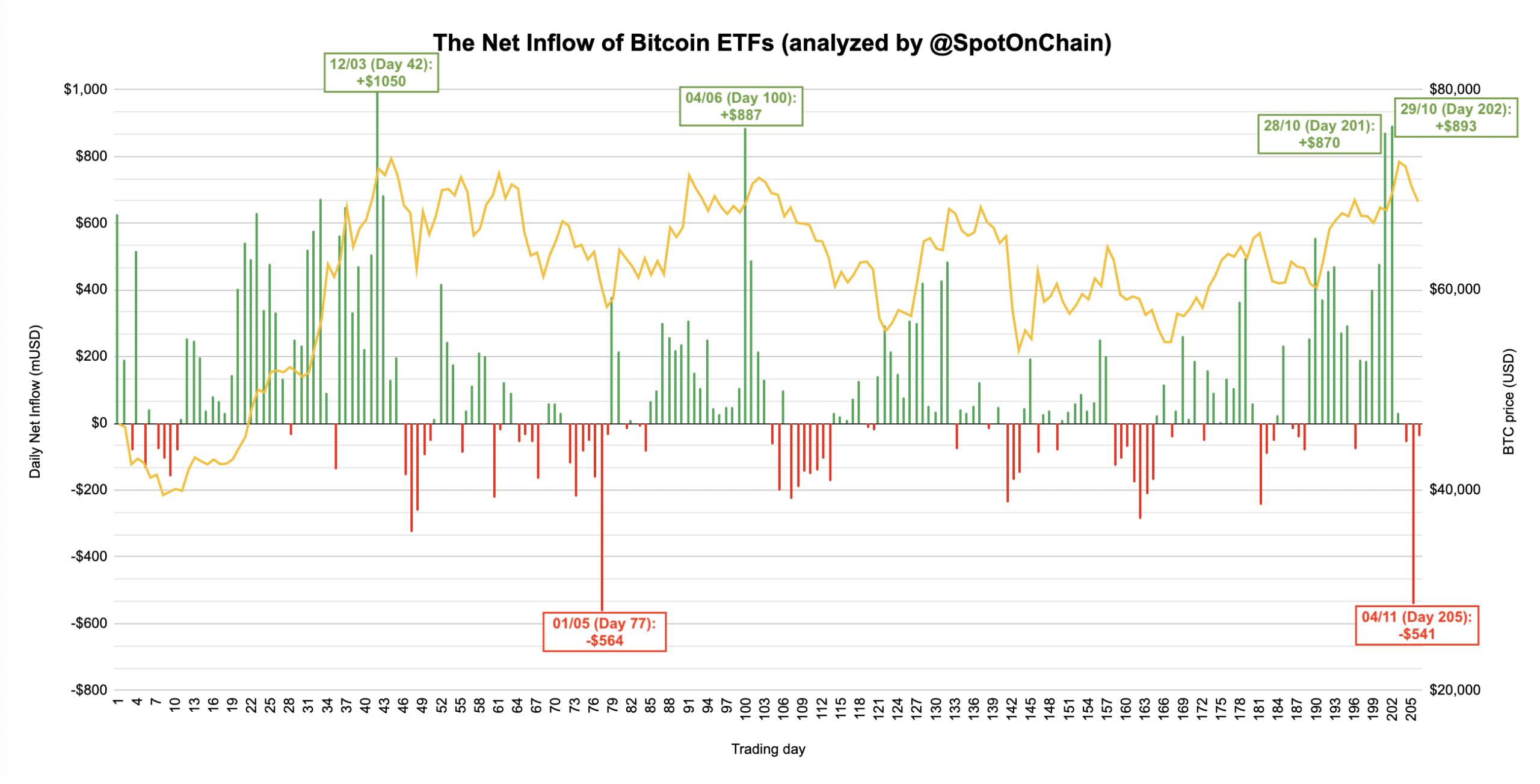

Even Monday’s risk-off move on US Spot BTC ETFs hasn’t deterred BTC speculators. The products saw cumulative daily net outflows of $541 million, led by 21Shares (ARKB) and Bitwise’s BITB.

According to Spot On Chain, Monday’s sale was the second-largest daily outflow for these products. This reflected a broader market de-risking of US equities ahead of Election Day.

Source: Spot On Chain

Maybe Trump’s pipe on prediction sites and top election models was partly responsible for the confidence in the BTC and crypto markets.

However, it is worth noting that crypto trading firm QCP Capital warned that the market has understated the potential risks following the election or even Harris’ likely victory.

Part of the company’s election commentary read,

“The crypto market is currently priced +/-3.5% in BTC spot movement on election night itself. Still, traders may be underestimating post-election risk: the current lack of volatility premium beyond the November 8 expiration suggests that markets expect a quick resolution, potentially underestimating potential delays or contentious outcomes.”

The company anticipated erratic BTC price swings as polls rolled in. Amberdata, in turn, predicted that price swings could be $6k-$8k in either direction.

It added that a Harris win could push BTC to $60,000, while a Trump win could trigger a new ATH for BTC ($75,000/$77,000).

That said, the options market saw this weekend large funds favor bullish results with upside targets of $70,000 – $85,000.

The latest Deribit facts revealed that offshore markets had expected $72,000 to $75,000 targets on Monday, based on the massive call-buy (upside expectation) from the European and Asian markets. Part of the update read:

“Oversized T-1 Option flows jack IV higher. APAC-Euro flow: 1.5k Nov 72+75k purchased calls. At the US Open, when BTC peaked at 69.3k, Nov 29 bought 60k Put x1k funded by Nov 29 80k Call, and Nov 15 64k Put bought 1.5k.”

The increase in interest in put options (downside bets), with an eye on $60,000, also reflected Amberdata’s objectives if Harris were to win the election.

Furthermore, it appears that no matter who wins, options traders expect BTC to remain above $60,000. On the price charts, $65,000 will remain an important level to watch if the decline continues.

Source: BTCUSDT, TradingView