Many had speculated that the rally in the crypto market would decline after the Spot Bitcoin ETF rumors faded. However, that hasn’t been the case, and a recent revelation from a prominent crypto analyst suggests that the two largest cryptocurrencies by market capitalization, Bitcoin and ethercould continue to show an upward trend.

New liquidity coming to the market could boost Bitcoin and Ethereum

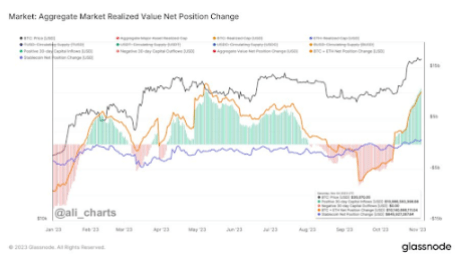

In a after Shared on his X (formerly Twitter) platform, Crypto analyst Ali Martinez revealed that the crypto market has seen nearly $10.97 billion in revenue positive capital inflow, which represents this year’s highest level. According to him, this influx of capital into crypto could potentially mean that investors are heavily bullish on these assets.

Source: X

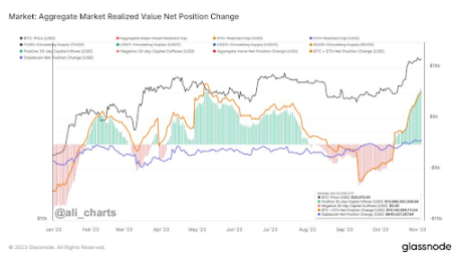

Meanwhile, there are also further indications that the market, and especially Bitcoin, could see a rise inflow of new money in the coming days, as Martinez mentioned in a subsequent one after that more than 700,000 new BTC addresses were created on November 4. The analyst believes that such an event is an important milestone as Bitcoin’s network growth is one of the best price predictors.

Source: X

It is uncertain what could be behind this influx and the renewed interest in the crypto market. However, some believe it could be institutional investors taking positions ahead of a possible approval of the upcoming Discover Bitcoin ETF filings from the Securities and Exchange Commission.

Others believe that the Bitcoin Halving could contribute to this to the revival of the price of Bitcoin and by extension the crypto market. Historically, Bitcoin has made significant gains in the period leading up to the halving. The next halving is expected to take place in April 2024.

Whatever the reason, there is no doubt that the influx of new money into the ecosystem is a positive development. A specific crypto analyst had ever noticed that many altcoins have been lukewarm due to the lack of liquidity in the market and that they could pick up again once there is renewed interest in the market.

Institutional interest coming from abroad

According to a Bloomberg reportHong Kong’s financial regulator, the Securities and finance commission (SFC) is considering allowing the launch of exchange-traded funds (ETFs) that would allow investors to invest directly in the cryptocurrency itself (spot trading).

This development comes in the middle of The reluctance of the American SEC to approve current affairs Discover Bitcoin ETF applications, which could give US investors direct exposure to the flagship cryptocurrency, Bitcoin.

This once again emphasizes the stark contrast between treatment that the crypto industry has received abroad and in the United States. However, the positive approach from regulators abroad is commendable as the crypto industry continues to see interest from such regions.

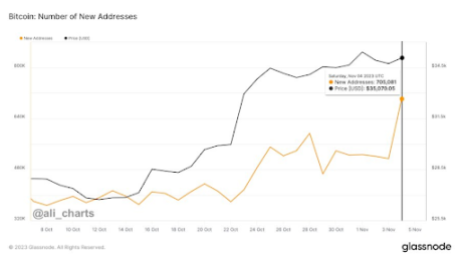

BTC bulls try to reclaim $35,000 | Source: BTCUSD on Tradingview.com

Featured image from iStock, chart from Tradingview.com