Former Goldman Sachs CEO Raoul Pal says digital assets will outpace tech stocks as a major catalyst begins to emerge.

The CEO of Real Vision tells According to his million followers on social media platform X, dollar liquidity is ultimately the driving force behind risky assets like stocks and crypto.

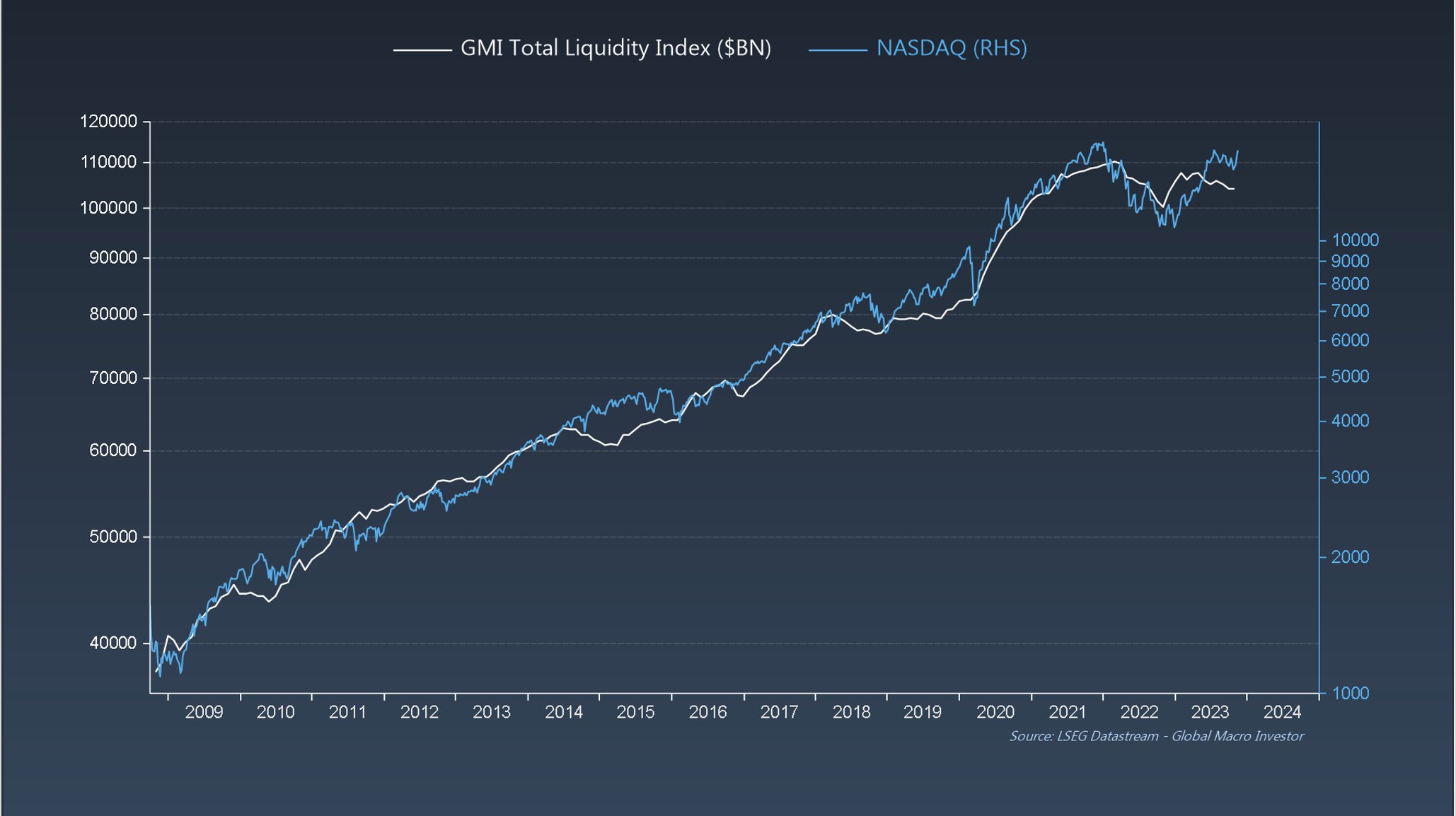

He shares a chart showing that the Nasdaq index has been moving virtually in line with liquidity for more than a decade, and is still in a strong, intact uptrend.

“And liquidity is what drives assets…

Our job is to back the fastest horses (the secular trending assets).

Technology (the Exponential Age):”

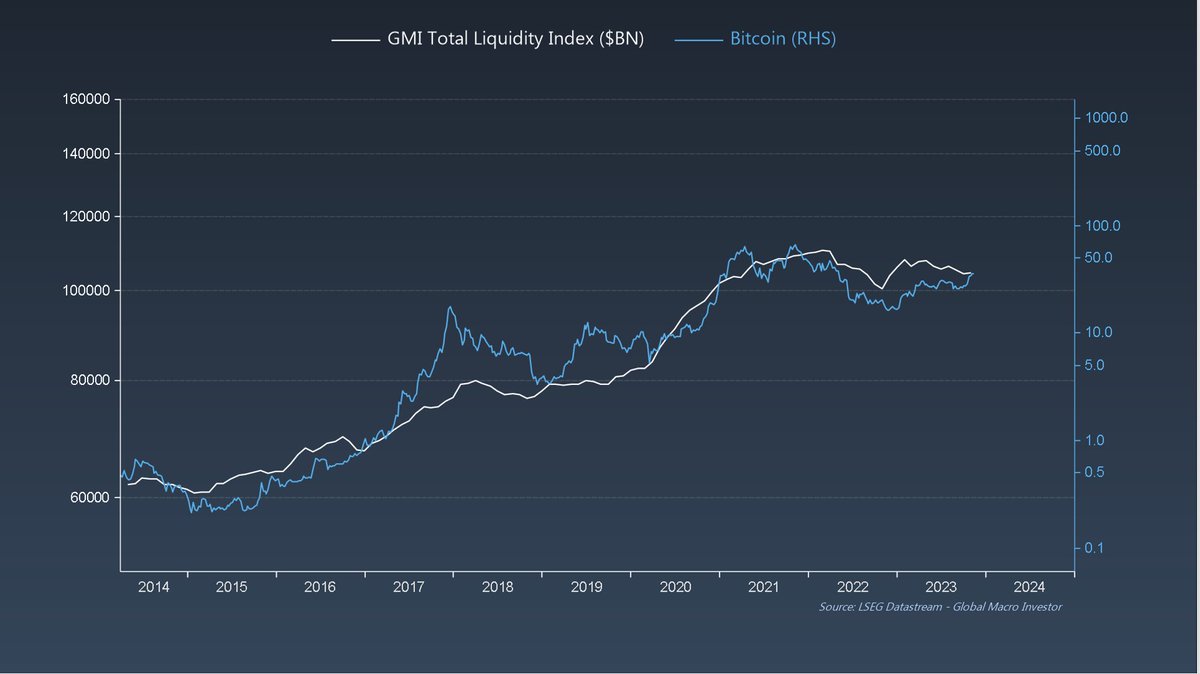

Crypto is no different than the Nasdaq, according to another chart shared by Pal.

“And Crypto (the super-sized black hole):”

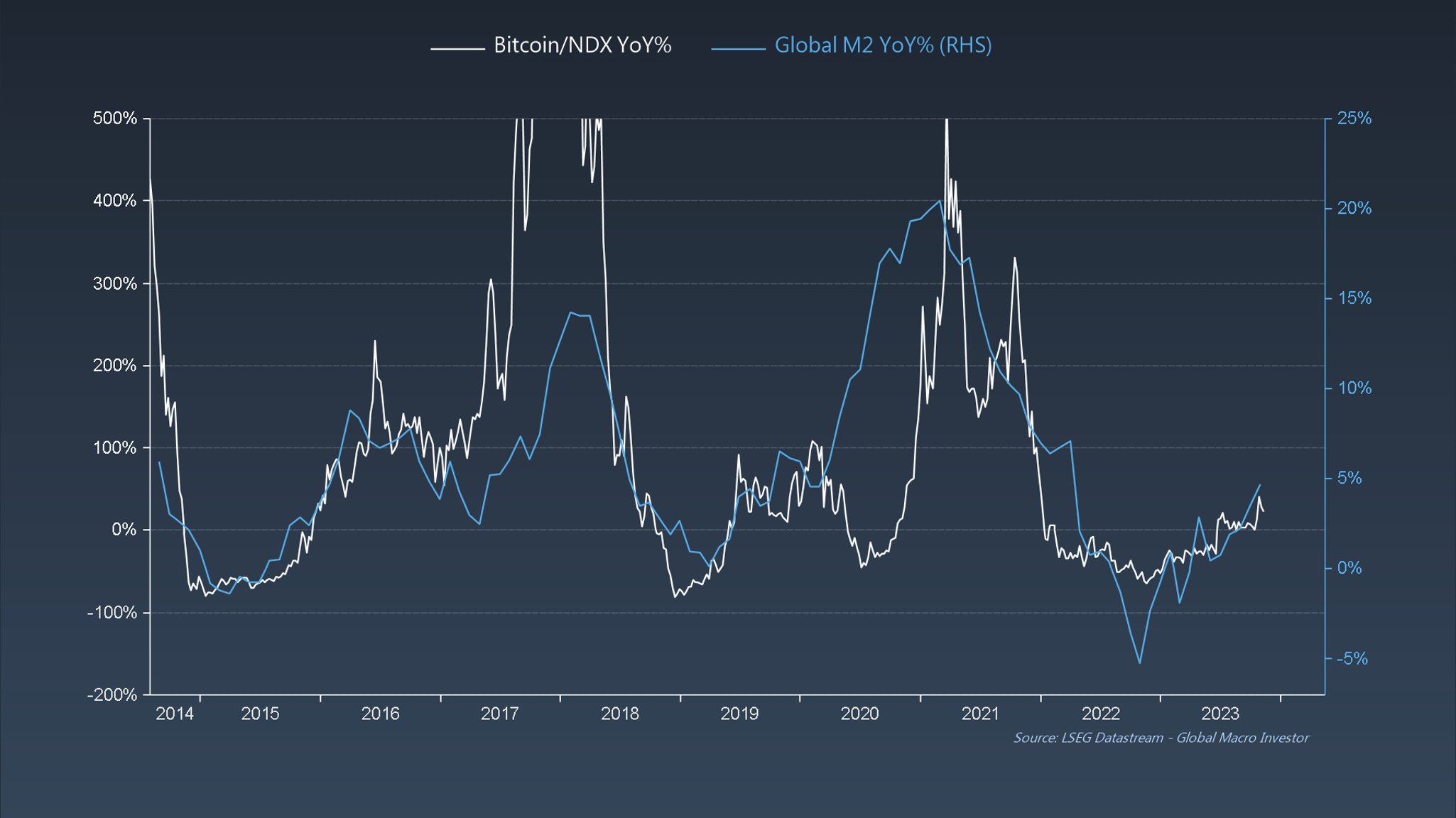

The macro guru emphasizes that crypto is often the faster horse when global liquidity starts to pick up.

“But crypto is vastly outperforming tech as the liquidity cycle turns positive…”

Pal is also optimistic about the development of altcoins, but notes that picking and choosing smaller altcoin projects can be extremely difficult and risky.

In a newsletter earlier this month, the macro investor said Ethereum (ETH) rival Solana (SOL) recently entered an uptrend after breaking a classic bullish pattern.

“SOL broke out of its inverse head-and-shoulders situation last month and is now up more than 475% year-to-date. This was one of our core transactions at GMI (Global Macro Investor) this year and it worked out very well.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: ClipDrop