A closely watched crypto analyst says Bitcoin (BTC) could see a sharp decline if it fails to hold a crucial support zone.

In a new strategy session, crypto trader Ali Martinez tells his 110,700 followers on social media platform

“A surge in selling pressure that pushes Bitcoin below $92,000 could spell trouble. Crossing this level opens the door to a steep decline, with little support until $74,000.”

The trader’s chart – which uses UTXO Realized Price Distribution (URPD), a metric that analyzes the distribution of BTC’s realized price based on the amount of Bitcoin left after transactions – shows a huge gap between $92,000 and $74,000. According to Martinez, this is Bitcoin’s “free fall” territory.

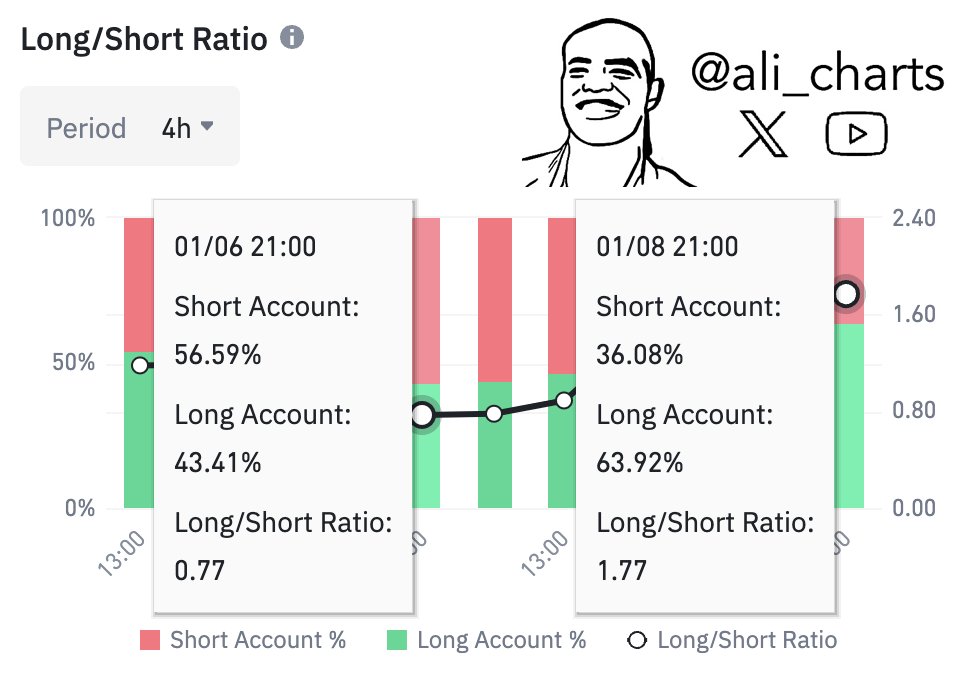

The analyst continues remark that when the top crypto assets reached a price of $102,000 per market peak, the majority of traders on Binance started shorting the assets. However, now that the price has fallen again to $93,000, investors are doing the opposite.

“On January 6, with Bitcoin at $102,000, 56.59% of traders on Binance were shorting. What followed was a 10% [drop]causing BTC to drop to $93,000 today. But now 63.92% of traders on Binance are going long.”

The key digital asset is trading at $93,918 at the time of writing, down 1.3% in the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney