This article is available in Spanish.

In a new technical analysis published on X, says crypto analyst Dark Defender (@DefendDark). project a very bullish future for the XRP price. He uses Elliott Wave Theory to suggest a potential rise to $18.22 in what he expects to be the third wave of a major bullish cycle. This analysis is supported by a detailed overview of XRP price movements, key support levels and technical indicators on the weekly chart.

Why XRP Price Is Poised to Reach $18

The Elliott Wave Theory states that market prices unfold in specific patterns, known as waves. According to this theory, a typical cycle includes five waves, with waves 1, 3 and 5 being impulsive waves moving in the direction of the general trend, and waves 2 and 4 being corrective waves moving against it. The third wave is often the most dynamic and achieves the greatest price distance.

Related reading

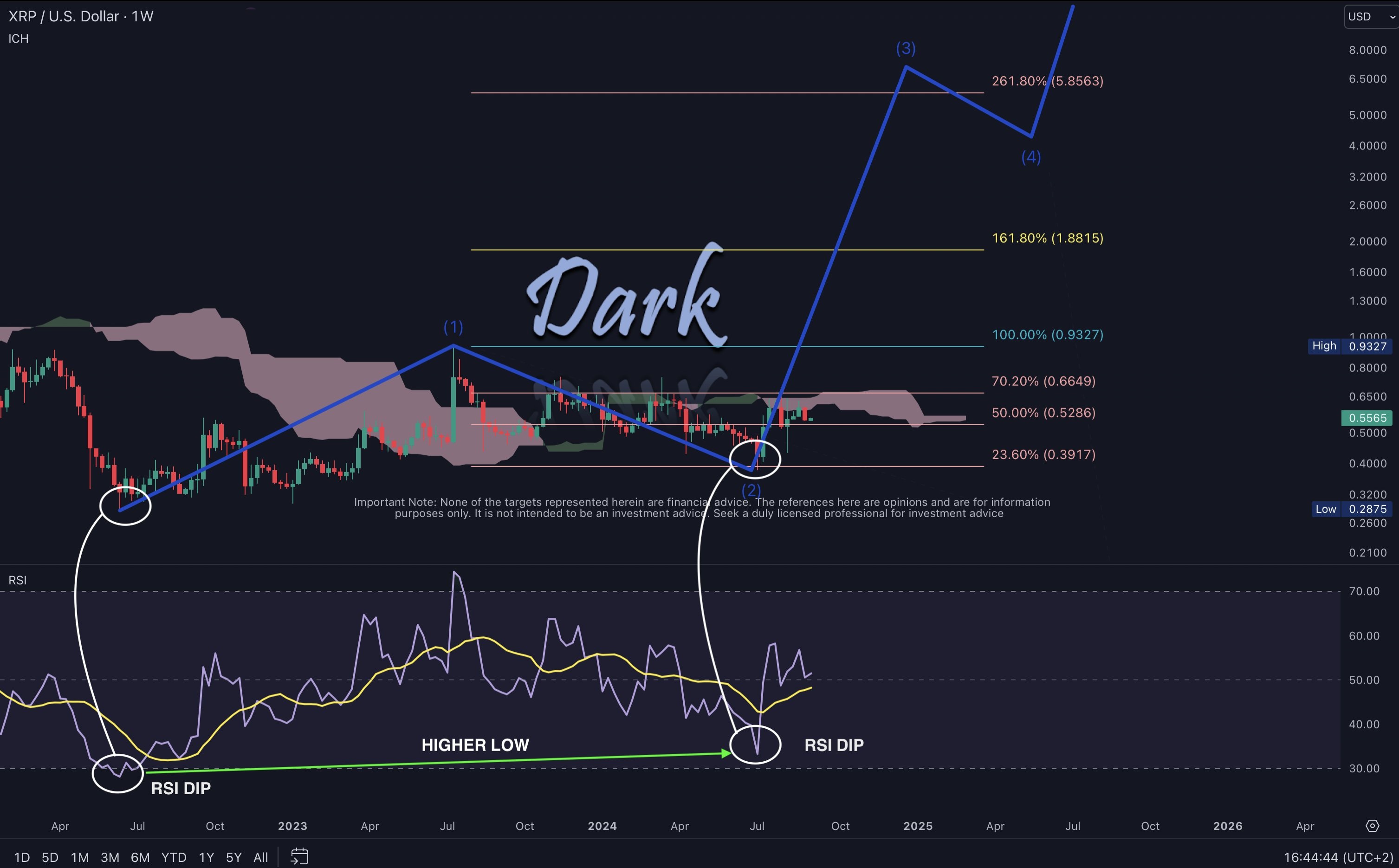

When analyzing the XRP chart, Dark Defender points out that XRP has completed its first and second waves. The first wave had a significant upward trend. XRP rose to $0.93 in July 2023, followed by a downward correction in the second wave, which is typical of Elliott Wave formations. The second wave took the XRP price below $0.39 in July 2024, marking the bottom.

The consolidation phase between $0.6649 and $0.3917 ended the correction phase and paved the way for the expected third wave. Notably, the transition to wave 3 corresponds to a ‘higher low’ formation on the RSI.

A higher low on the RSI during a corrective wave (wave 2) indicates underlying strength and typically precedes a strong upward move, indicating that the price has maintained higher relative lows despite the correction. This formation is seen by Dark Defender as a bullish signal, reinforcing the potential onset of wave 3.

Dark Defender’s analysis includes critical Fibonacci extension levels that serve as potential targets and resistance levels in the bull run. The Fibonacci retracement level of 23.60% at $0.3917 and the 50.00% at $0.5286 served as significant support during the correction phase. With the XRP price currently trading around $0.56, the next price target is $0.6649 (70.20%).

Related reading

These levels are crucial as they represent intermediate resistances that XRP has faced and must be surpassed to confirm the bullish trend. The $0.6649 level is identified by the crypto analyst as particularly significant and marks the upper limit of previous consolidation.

“It has been a long time since XRP consolidated between $0.6649 and $0.3917. In the weekly time frame, the RSI dips paralleled the price declines. There is a weekly RSI golden cross. We have consistently emphasized the importance of the $0.6649 level. This level, located above the weekly Ichimoku clouds, is a crucial marker that must be in place before the run,” Dark Defender explains via X.

As the price progresses, the 100.00% Fibonacci level at $0.9327 represents a full recovery and a doubling from some of the lowest recent prices, setting a foundation for the next impulse wave. The extended Fibonacci levels of 161.80% and 261.80%, which equate to $1.8815 and $5.8563 respectively, are higher bullish targets that can be achieved in a strong market upswing.

The ultimate price target for wave 3, represented by the 361.80% level at $18.22, would mark an extraordinary upside, reminiscent of the dramatic gains seen in the 2017 crypto bull market. “We are having a deja vu of 2017 by being weeks ahead of the XRP bull run. If a similar run occurs, $18.22 (NFA), the 361.80% Fibonacci level, is expected to be the wave 3 target high. It will be great to see this all come through,” concludes Dark Defender.

At the time of writing, XRP was trading at $0.5672.

Featured image created with DALL.E, chart from TradingView.com